1,400-Point Sensex Jump, Nifty At 23,800+: 5 Factors Fueling The Indian Stock Market's Rise

Table of Contents

Positive Global Sentiment and FPI Inflows

Positive global cues have significantly impacted the Indian market, fueling the recent Sensex surge and Nifty rally. This positive global market sentiment is largely attributed to increased Foreign Portfolio Investment (FPI) flows.

- Increased FPI Inflows: Foreign institutional investors (FIIs) have been pouring money into the Indian stock market, injecting significant liquidity and driving up stock prices.

- Easing Inflation Concerns in the US: The easing of inflation concerns in the US, a major global economy, has boosted investor confidence worldwide, leading to increased investment in emerging markets like India.

- Positive Corporate Earnings Reports Globally: Strong corporate earnings reports from major global companies have also contributed to a positive global outlook, encouraging further investment in India.

The influx of FPI inflows, coupled with the positive global market sentiment, has played a crucial role in the recent Sensex and Nifty gains. This demonstrates the interconnectedness of global and domestic market forces.

Robust Domestic Economic Data

Strong domestic economic indicators have further bolstered market optimism and contributed to the impressive market rally. Positive data points paint a picture of a healthy and growing Indian economy.

- Robust GDP Growth: India's GDP growth continues to demonstrate resilience, exceeding expectations and signaling a strong economic foundation.

- Healthy Consumption Figures: Strong domestic consumption figures indicate a healthy consumer spending environment, fueling economic activity and business growth.

- Improved Industrial Production: Improved industrial production numbers reflect increased manufacturing activity and a positive outlook for the industrial sector.

- Government Initiatives: Government initiatives focused on infrastructure development and tax reforms have boosted investor confidence in the long-term growth prospects of the Indian economy.

These positive domestic economic indicators signal a strong and stable economy, attracting further investment and supporting the recent Sensex and Nifty gains.

Strong Corporate Earnings

Positive corporate earnings reports across various sectors have played a significant role in boosting market sentiment and driving up stock valuations. Many companies have reported exceeding expectations, reflecting a healthy business environment.

- Strong Performance Across Sectors: Companies across diverse sectors have showcased strong performance, indicating broad-based economic strength.

- Improved Profitability: Improved profitability and strong future growth prospects have boosted investor confidence and led to increased demand for stocks.

- Exceeded Expectations: Numerous companies have reported earnings that exceeded analysts' expectations, further enhancing investor sentiment.

The strong corporate earnings highlight the underlying strength of the Indian economy and contribute to the bullish sentiment driving the recent Sensex and Nifty rally.

Easing Inflation Concerns

Easing inflation concerns, both globally and domestically, have had a positive impact on the Indian stock market. Lower inflation rates reduce uncertainty and encourage investment.

- Decline in Inflation Rates: The recent decline in inflation rates, both in India and globally, has provided relief to investors concerned about rising prices.

- RBI Monetary Policy: The Reserve Bank of India (RBI)'s effective monetary policy decisions in managing inflation have helped stabilize the market and improve investor confidence.

- Impact on Interest Rates: The easing of inflation has also led to a more stable interest rate environment, making borrowing more affordable for businesses and consumers.

The easing of inflation concerns has removed a significant headwind for the market, contributing to the recent Sensex and Nifty gains.

Increased Retail Investor Participation

The growing participation of retail investors in the Indian stock market has also played a role in the recent rally. Increased participation boosts market liquidity and can drive up stock prices.

- Rise in Demat Accounts: A significant increase in the number of Demat accounts reflects a surge in the number of individual investors entering the stock market.

- Increased Trading Activity: Higher trading volumes indicate increased retail investor activity and participation in the market.

- Impact on Market Liquidity: The increased participation of retail investors has improved market liquidity, making it easier for buyers and sellers to transact.

This influx of new retail investors is injecting fresh capital into the market, increasing trading volumes, and contributing to the overall market momentum.

Conclusion

The remarkable 1,400-point Sensex jump and Nifty surpassing 23,800 is a result of a confluence of factors, including positive global sentiment, robust domestic economic data, strong corporate earnings, easing inflation concerns, and increased retail investor participation. Understanding these interwoven elements is vital for investors to navigate the market effectively. Stay informed about these key factors influencing the Indian stock market to make informed investment decisions. Continue tracking the Sensex and Nifty performance and analyze the ongoing impact of these factors on future market trends. Learn more about investing in the Indian stock market and capitalize on its potential for growth.

Featured Posts

-

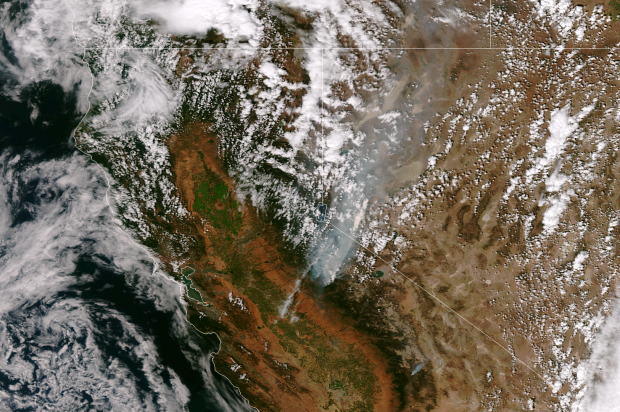

La Wildfires List Of Celebrities Whose Homes Were Damaged Or Destroyed

May 09, 2025

La Wildfires List Of Celebrities Whose Homes Were Damaged Or Destroyed

May 09, 2025 -

Leading Bitcoin Experts Gather In Seoul Bitcoin 2025

May 09, 2025

Leading Bitcoin Experts Gather In Seoul Bitcoin 2025

May 09, 2025 -

Attorney Generals Fentanyl Display A Deeper Look

May 09, 2025

Attorney Generals Fentanyl Display A Deeper Look

May 09, 2025 -

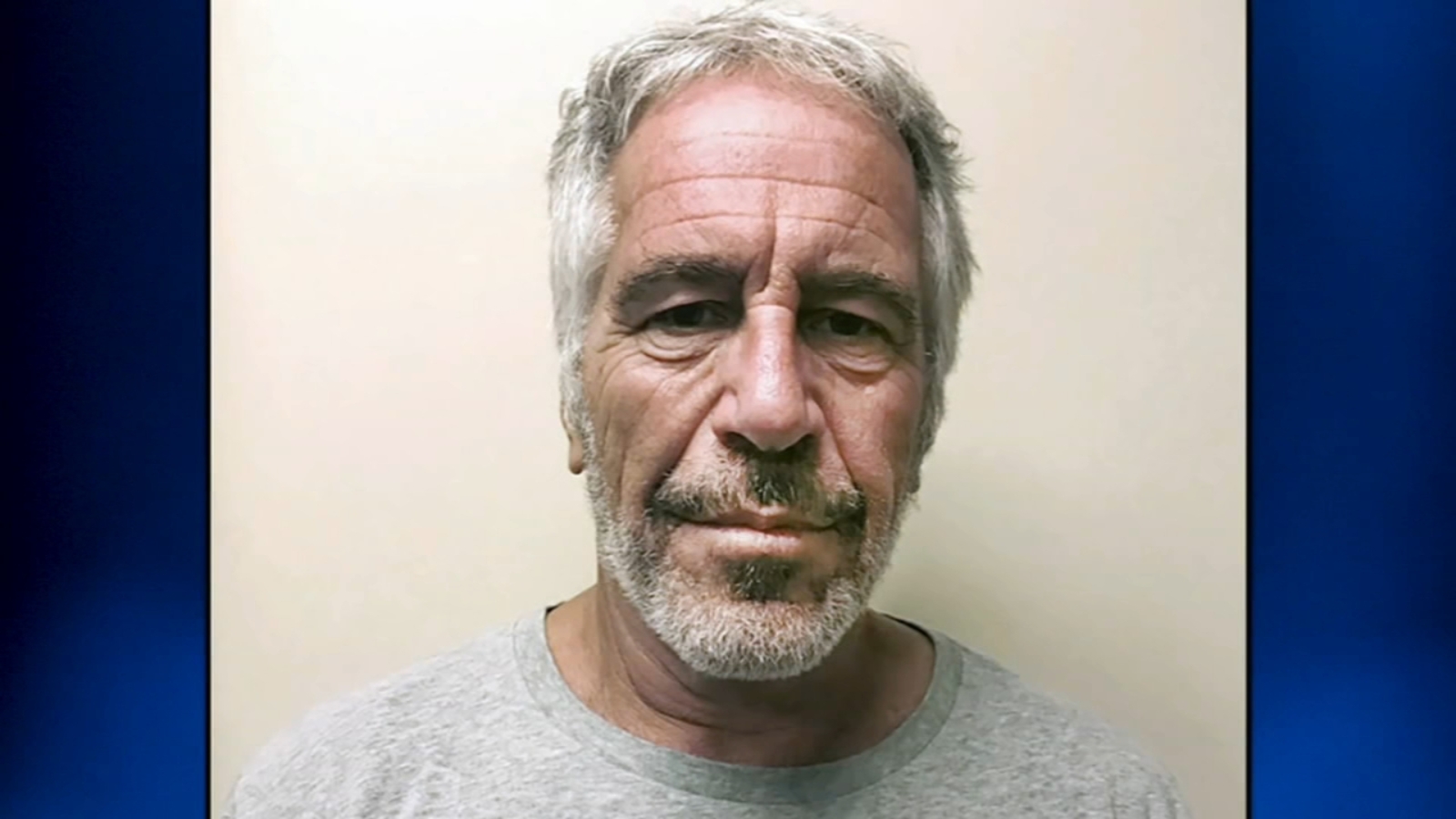

Should We Vote To Release The Jeffrey Epstein Files A Look At Ag Pam Bondis Decision

May 09, 2025

Should We Vote To Release The Jeffrey Epstein Files A Look At Ag Pam Bondis Decision

May 09, 2025 -

Mc Cann Family Home Polish Madeleine And Acquaintance Reject Guilt

May 09, 2025

Mc Cann Family Home Polish Madeleine And Acquaintance Reject Guilt

May 09, 2025

Latest Posts

-

Transgender Rights The Bangkok Post Highlights Increasing Calls For Change

May 10, 2025

Transgender Rights The Bangkok Post Highlights Increasing Calls For Change

May 10, 2025 -

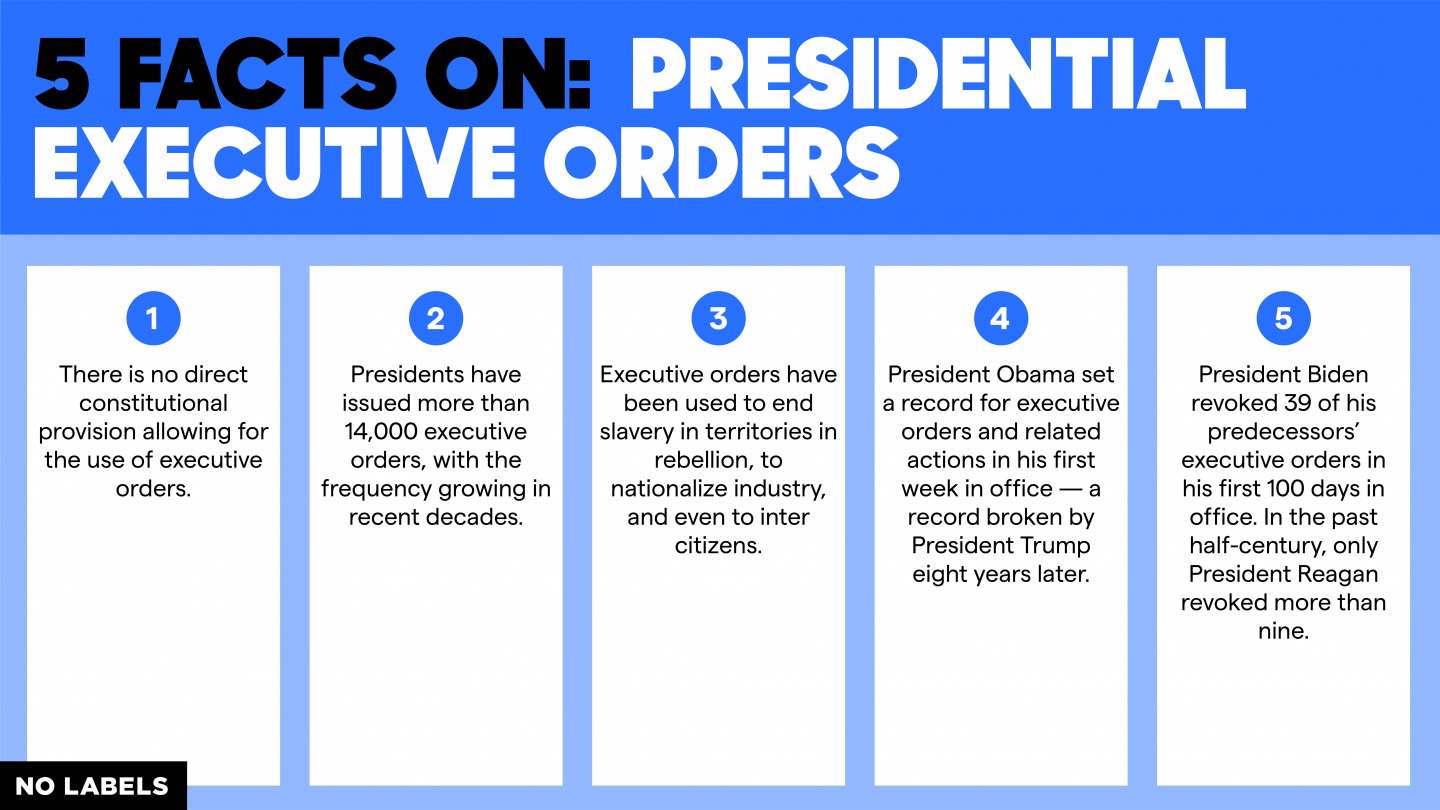

Transgender Community Impact Of Trumps Executive Orders On Healthcare And Rights

May 10, 2025

Transgender Community Impact Of Trumps Executive Orders On Healthcare And Rights

May 10, 2025 -

Bangkok Post Reports Surge In Advocacy For Transgender Equality

May 10, 2025

Bangkok Post Reports Surge In Advocacy For Transgender Equality

May 10, 2025 -

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025

The Impact Of Trumps Executive Orders On The Transgender Community A Call For Stories

May 10, 2025 -

Calls For Transgender Equality In Thailand Intensify A Bangkok Post Analysis

May 10, 2025

Calls For Transgender Equality In Thailand Intensify A Bangkok Post Analysis

May 10, 2025