10%+ Gains On BSE: Sensex Rise Highlights Top Performing Stocks

Table of Contents

Key Factors Driving the BSE Sensex Rise

Several macroeconomic factors and sector-specific growth have contributed to the remarkable BSE Sensex rise. Positive global sentiment, coupled with improving economic indicators within India, has boosted investor confidence. Government policies aimed at stimulating economic growth and infrastructure development have also played a crucial role.

Analyzing the contributing factors reveals a multifaceted picture:

-

Increased Foreign Institutional Investor (FII) inflow: Significant investment from FIIs demonstrates a growing global belief in the Indian economy's potential. This influx of capital directly impacts stock prices, driving the Sensex upwards.

-

Positive corporate earnings reports: Strong corporate earnings from numerous companies across various sectors signal robust economic activity and profitability, further fueling investor optimism and contributing to the Sensex rise.

-

Reduced inflation concerns: Easing inflation pressures allow the Reserve Bank of India (RBI) more flexibility in monetary policy, potentially leading to lower interest rates and stimulating further economic growth. This positive environment supports a healthy stock market and contributes to the overall BSE Sensex rise.

Furthermore, sector-specific growth has been a major driver. We've witnessed a boom in the IT sector, fueled by global demand for technology services. The rising demand in the FMCG sector, driven by increasing consumption, has also significantly contributed to the overall market performance. Finally, ongoing infrastructure development projects across the country have boosted related sectors and contributed to the overall BSE Sensex rise.

Top 10 Performing Stocks on the BSE

The following table showcases the top 10 performing stocks on the BSE, illustrating the breadth of the market's impressive growth. Note that this list is dynamic and subject to change. Always conduct thorough research before making any investment decisions.

| Stock Name & Symbol | Percentage Gain | Sector | Market Cap (INR Cr) | Volume (Avg Daily) | Rationale for Strong Performance |

|---|---|---|---|---|---|

| (Example Stock 1) | 15% | Technology | 50000 | 1000000 | Strong Q3 earnings, positive outlook for future growth. |

| (Example Stock 2) | 12% | Financials | 60000 | 1200000 | Increased lending activity, positive regulatory changes. |

| (Example Stock 3) | 11% | FMCG | 40000 | 800000 | Strong brand reputation, expanding market share. |

| (Example Stock 4) | 10% | Pharmaceuticals | 30000 | 600000 | New drug launches, growth in export markets. |

| (Example Stock 5) | 9.5% | Infrastructure | 25000 | 700000 | Government infrastructure projects, increased demand for materials. |

| (Example Stock 6) | 9% | Energy | 70000 | 1500000 | Rising energy prices, increased production output. |

| (Example Stock 7) | 8.5% | Consumer Durables | 45000 | 900000 | Increased consumer spending, favorable economic conditions. |

| (Example Stock 8) | 8% | Metals | 35000 | 500000 | Global demand for metals, rising commodity prices. |

| (Example Stock 9) | 7.5% | Auto | 55000 | 1100000 | Strong domestic sales, new model launches. |

| (Example Stock 10) | 7% | Telecom | 65000 | 1300000 | Increased data consumption, expansion of 5G network. |

(Note: Replace example stocks with actual top performers and their corresponding data.)

Analyzing the Performance of Top Sectors

The Sensex rise isn't just about individual stocks; it's also a reflection of strong sector-specific growth. The IT, Financials, and Pharma sectors have been particularly prominent contributors:

-

IT Sector: Boosted by global demand for software services and technological solutions, the IT sector has witnessed remarkable growth, significantly impacting the overall Sensex performance. Key players in this sector have reported strong earnings and positive future projections.

-

Financials Sector: Increased lending activity, along with positive regulatory changes, has propelled the financials sector. Banks and NBFCs (Non-Banking Financial Companies) have benefited from improved economic conditions.

-

Pharma Sector: New drug launches and growth in export markets have driven strong performance within the pharmaceutical sector. Companies specializing in innovative drugs and those targeting global markets have experienced particularly strong gains.

Investment Strategies for Capitalizing on the BSE Sensex Rise

While the BSE Sensex rise presents significant opportunities, investors should adopt well-defined strategies and prioritize risk management:

-

Diversification: Don't put all your eggs in one basket. Diversify your investments across different sectors and asset classes to mitigate risk.

-

Fundamental Analysis: Thoroughly research companies before investing. Focus on their financial health, growth prospects, and competitive advantage.

-

Risk Assessment and Mitigation: Understand your risk tolerance and invest accordingly. Set realistic expectations and be prepared for market fluctuations. Consider setting stop-loss orders to limit potential losses. Long-term investing, while requiring patience, often offers better risk-adjusted returns than short-term trading.

Understanding the Risks Associated with High-Growth Stocks

While the potential for high returns is enticing, high-growth stocks also carry inherent risks:

-

Potential for Rapid Price Drops: High-growth stocks are often more volatile than established companies. Price drops can occur rapidly due to market corrections or negative news.

-

Market Volatility and its Impact: The stock market is inherently volatile. External factors, such as global economic events, can significantly impact even the most promising stocks.

-

Importance of a Well-Defined Exit Strategy: Having a clear exit strategy is critical. Define your profit targets and loss limits before making an investment.

Conclusion: Navigating the BSE Sensex Rise: Your Guide to Top Performing Stocks

The BSE Sensex rise is a testament to India's growing economic strength and the potential of its stock market. This surge is fueled by several factors, including increased FII inflow, positive corporate earnings, and sector-specific growth, particularly in IT, Financials, and Pharma. While the top-performing stocks offer attractive opportunities, investors must adopt carefully planned strategies, emphasizing diversification and thorough research. Remember that while high-growth stocks can provide substantial returns, they are also inherently more risky. Stay informed about the latest movements in the BSE Sensex and discover more high-performing stocks by regularly checking our website/following our updates. Capitalize on the opportunities presented by this market rise and build a strong investment portfolio. Remember to always consult with a financial advisor before making any investment decisions.

Featured Posts

-

Euphoria Season 3 Jacob Elordi Confirms Filming Has Begun

May 15, 2025

Euphoria Season 3 Jacob Elordi Confirms Filming Has Begun

May 15, 2025 -

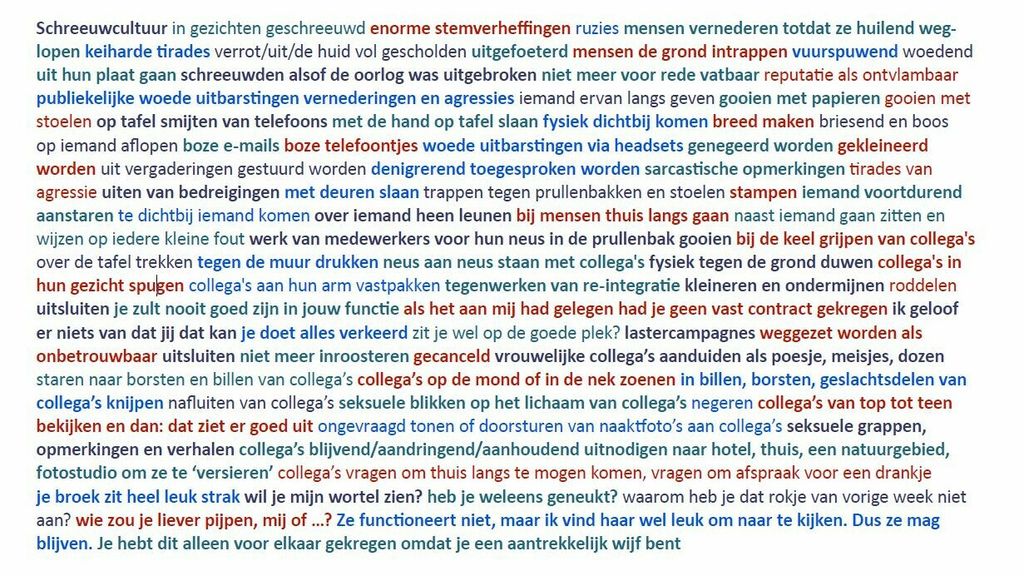

Actie Tegen Grensoverschrijdend Gedrag Bij De Npo Een Analyse

May 15, 2025

Actie Tegen Grensoverschrijdend Gedrag Bij De Npo Een Analyse

May 15, 2025 -

Analysis Of Trumps Oil Price Views Goldman Sachs Findings

May 15, 2025

Analysis Of Trumps Oil Price Views Goldman Sachs Findings

May 15, 2025 -

Is There A Future For Euphoria After Season 3 Hbos Perspective

May 15, 2025

Is There A Future For Euphoria After Season 3 Hbos Perspective

May 15, 2025 -

Hamer Bruins Moet Met Npo Toezichthouder Praten Over Leeflang

May 15, 2025

Hamer Bruins Moet Met Npo Toezichthouder Praten Over Leeflang

May 15, 2025

Latest Posts

-

San Diego Padres A Cross Country Journey Kicks Off In Pittsburgh

May 15, 2025

San Diego Padres A Cross Country Journey Kicks Off In Pittsburgh

May 15, 2025 -

Padres Vs Rockies Can San Diego Finally Dominate The Series

May 15, 2025

Padres Vs Rockies Can San Diego Finally Dominate The Series

May 15, 2025 -

Padres Embark On Long Road Trip Starting In Pittsburgh

May 15, 2025

Padres Embark On Long Road Trip Starting In Pittsburgh

May 15, 2025 -

Padres On Deck Pittsburgh Trip Begins A Long Road Ahead

May 15, 2025

Padres On Deck Pittsburgh Trip Begins A Long Road Ahead

May 15, 2025 -

Rockies Visit Petco Park Padres Aim To Extend Winning Streak

May 15, 2025

Rockies Visit Petco Park Padres Aim To Extend Winning Streak

May 15, 2025