11% Drop In Three Days: Amsterdam Stock Exchange In Freefall?

Table of Contents

Analyzing the 11% Drop: Unpacking the Causes

The sudden 11% drop in the AEX index demands a thorough examination of contributing factors. Several interconnected elements likely played a role in this sharp decline.

Possible Macroeconomic Factors

Global macroeconomic headwinds significantly impacted the AEX.

- Inflationary Pressures: Persistent high inflation across Europe and globally eroded investor confidence, leading to a risk-off sentiment. Concerns about central bank responses to inflation further fueled market uncertainty.

- Interest Rate Hikes: Aggressive interest rate hikes by major central banks, including the European Central Bank, increased borrowing costs for businesses, dampening economic growth prospects and impacting stock valuations.

- Recession Fears: Growing concerns about a potential recession in major economies, including the Eurozone, negatively impacted investor sentiment, prompting a sell-off in riskier assets.

Geopolitical Influences

Geopolitical instability further exacerbated the situation.

- The War in Ukraine: The ongoing conflict in Ukraine continues to create significant economic uncertainty, impacting energy prices and supply chains globally. This uncertainty contributed to risk aversion in the markets.

- International Tensions: Rising geopolitical tensions in other regions also added to the overall sense of uncertainty and risk aversion, prompting investors to seek safety in less volatile assets.

Sector-Specific Downturns

The decline wasn't uniform across all sectors.

- Energy Sector Volatility: Fluctuations in energy prices, heavily influenced by the war in Ukraine, significantly impacted energy companies listed on the AEX.

- Technology Sector Correction: The technology sector experienced a correction, reflecting broader concerns about valuations and growth prospects in the sector.

- Key Company Performance: Several major companies listed on the AEX experienced significant drops in their share prices, further contributing to the overall market decline. For example, [insert example of a major company and its performance].

Investor Sentiment and Market Psychology

The sharp drop reflects a confluence of factors impacting investor sentiment.

Panic Selling

The speed and magnitude of the decline suggest a significant element of panic selling. As prices fell, investors rushed to sell their holdings, further accelerating the downward spiral.

Investor Confidence

Negative news and the rapid market downturn significantly eroded investor confidence in the Dutch economy and the outlook for Dutch companies. This loss of confidence fueled further selling pressure.

Algorithmic Trading

Algorithmic trading, which uses computer programs to execute trades based on pre-defined rules, likely amplified the market's downward momentum. These algorithms can react quickly to price changes, potentially exacerbating sell-offs.

Short-Term and Long-Term Implications for the AEX

The 11% drop has significant short-term and long-term implications.

Short-Term Outlook

The short-term outlook for the AEX remains uncertain. A period of consolidation or further declines is possible, depending on global and domestic economic developments.

Long-Term Impact

The long-term impact will depend on several factors, including the resolution of geopolitical uncertainties, the effectiveness of government interventions, and the pace of economic recovery. A prolonged period of low investor confidence could hinder economic growth in the Netherlands.

Government Response

The Dutch government may implement measures to stabilize the market and support businesses. These measures could include fiscal stimulus or regulatory changes.

Comparison with Other Major Stock Exchanges

The AEX's performance mirrors similar trends observed in other major European stock exchanges during this period. Many markets experienced increased volatility and declines, reflecting a broader global economic slowdown and uncertainty. A comparative analysis with indices like the FTSE 100 (UK) or the DAX (Germany) would reveal similar patterns and offer a broader context for understanding the AEX's performance.

Conclusion: Navigating the Amsterdam Stock Exchange Volatility

The 11% drop in the Amsterdam Stock Exchange highlights the inherent volatility of the stock market and the importance of understanding the complex interplay of macroeconomic, geopolitical, and psychological factors. The decline underscores the need for careful risk management and diversification in investment strategies. While the short-term outlook remains uncertain, investors should focus on long-term investment horizons and adapt their strategies based on evolving market conditions. Stay informed about Amsterdam Stock Exchange analysis, AEX market trends, and global economic developments to make informed decisions. Develop robust risk management strategies and consider diversifying your portfolio to mitigate potential losses. Understanding stock market investing and actively monitoring AEX market trends is crucial for navigating this volatile environment.

Featured Posts

-

Escape To The Country Financing Your Rural Dream

May 24, 2025

Escape To The Country Financing Your Rural Dream

May 24, 2025 -

The Kyle And Teddi Dog Walking Incident A Heated Dispute

May 24, 2025

The Kyle And Teddi Dog Walking Incident A Heated Dispute

May 24, 2025 -

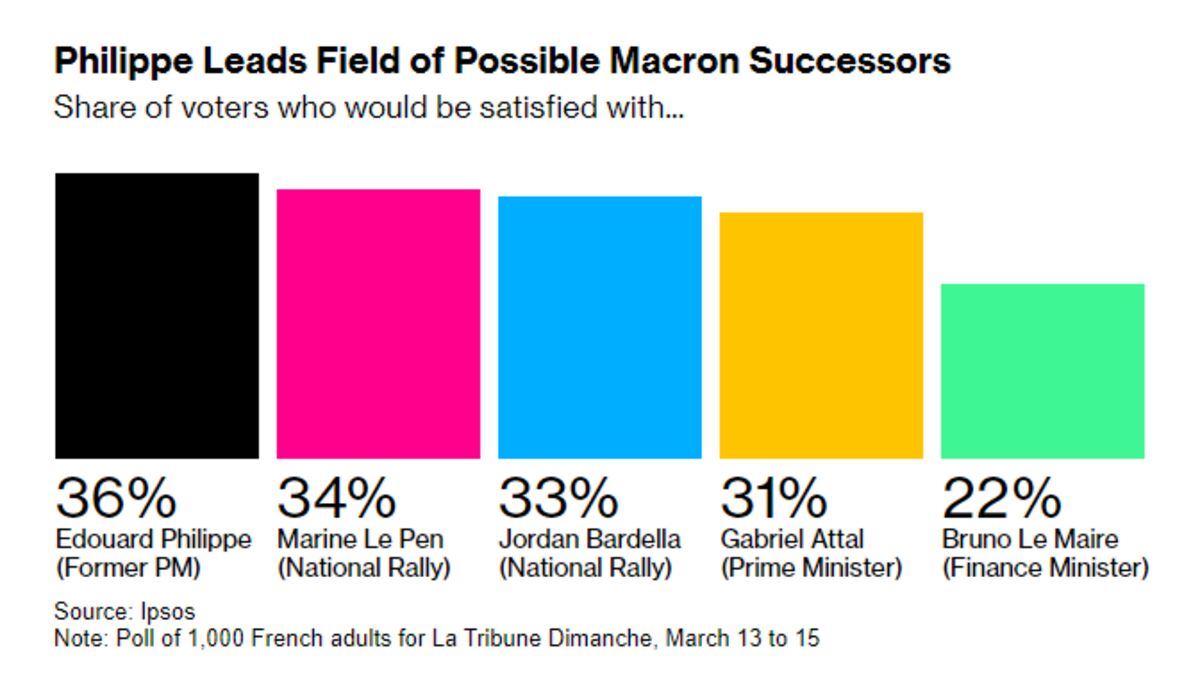

Macrons Policies A Former French Pms Perspective On Disagreements

May 24, 2025

Macrons Policies A Former French Pms Perspective On Disagreements

May 24, 2025 -

Conchita Wurst And Jj To Perform At Eurovision Village 2025

May 24, 2025

Conchita Wurst And Jj To Perform At Eurovision Village 2025

May 24, 2025 -

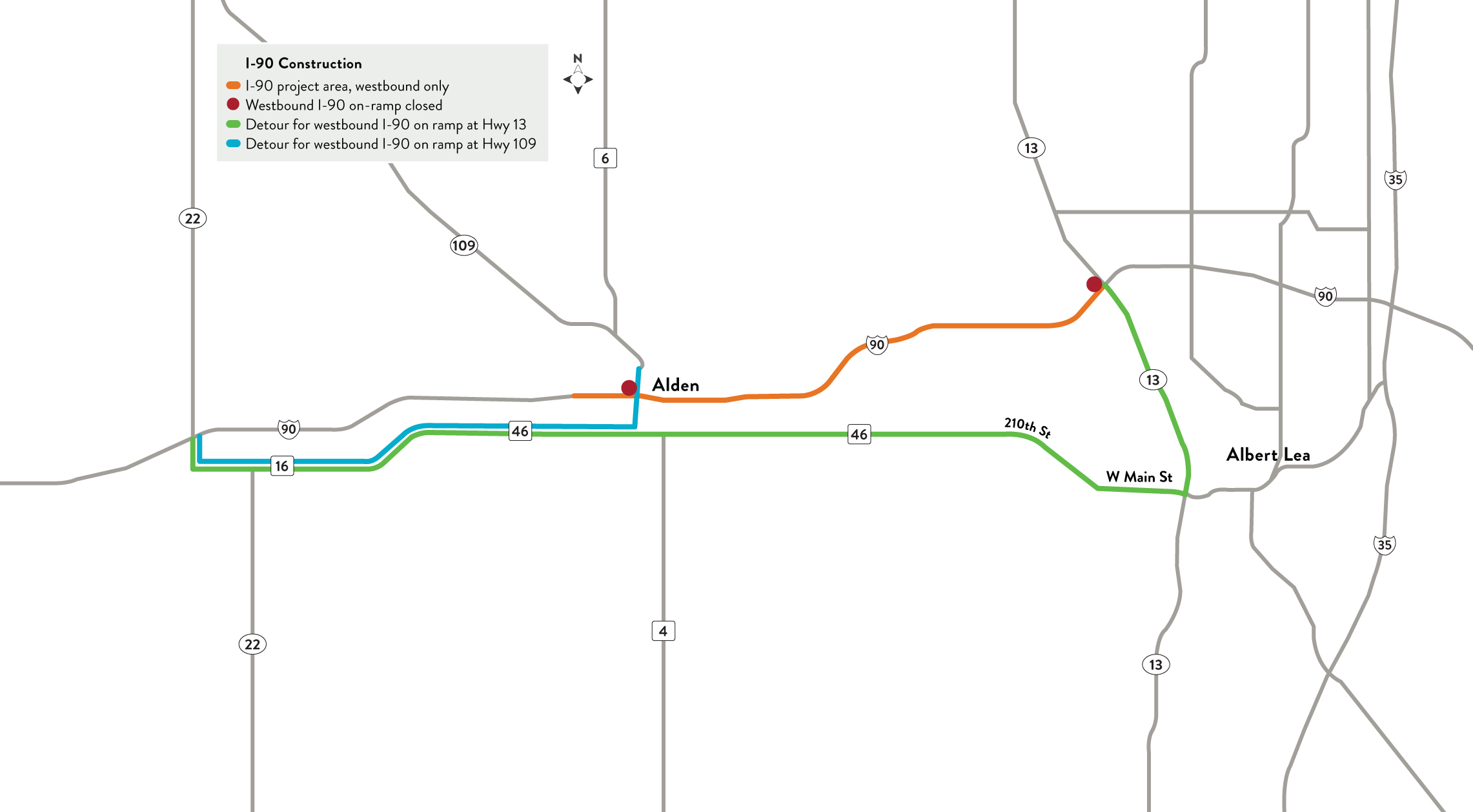

M62 Westbound Resurfacing Road Closure Manchester To Warrington

May 24, 2025

M62 Westbound Resurfacing Road Closure Manchester To Warrington

May 24, 2025

Latest Posts

-

Debate Reignited Sean Penn Questions Dylan Farrows Claims Against Woody Allen

May 24, 2025

Debate Reignited Sean Penn Questions Dylan Farrows Claims Against Woody Allen

May 24, 2025 -

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 24, 2025

The Sean Penn Woody Allen Dylan Farrow Controversy A Closer Look

May 24, 2025 -

Sean Penns Comments On Dylan Farrows Accusations Against Woody Allen

May 24, 2025

Sean Penns Comments On Dylan Farrows Accusations Against Woody Allen

May 24, 2025 -

Understanding Frank Sinatras Four Marriages And Relationships

May 24, 2025

Understanding Frank Sinatras Four Marriages And Relationships

May 24, 2025 -

Woody Allen Sexual Assault Accusations Sean Penn Expresses Doubts

May 24, 2025

Woody Allen Sexual Assault Accusations Sean Penn Expresses Doubts

May 24, 2025