3 Financial Mistakes Women Often Make And How To Overcome Them

Table of Contents

Underestimating the Importance of Retirement Planning

Securing a comfortable retirement is a crucial aspect of financial security, yet many women underestimate its importance. This often leads to a significant gender retirement gap.

The Gender Retirement Gap

The disparity in retirement savings between men and women is alarming. Several factors contribute to this gap:

- Lower average salaries: Women, on average, earn less than men for comparable work, leaving them with less disposable income to save for retirement.

- Career breaks for childcare: Many women take time off from their careers to raise children, impacting their earning potential and overall retirement savings.

- Longer life expectancy: Women tend to live longer than men, meaning their retirement savings need to last longer, requiring a larger nest egg.

These factors significantly impact retirement savings. Starting early is crucial to mitigating the impact. Maximize your retirement contributions by:

- Utilizing employer matching: Take full advantage of any employer matching programs offered through your 401(k) or other retirement plans. This is essentially free money!

- Investing in tax-advantaged accounts: Contribute to tax-advantaged accounts like 401(k)s and IRAs to reduce your tax burden and increase your savings.

Strategies for Closing the Gap

Closing the gender retirement gap requires proactive planning and smart strategies:

- Budgeting and saving strategies: Create a realistic budget to identify areas where you can cut expenses and increase your savings.

- Investing in diverse assets: Diversify your investment portfolio to manage risk and potentially increase returns. Consider a mix of stocks, bonds, and other assets.

- Seeking professional financial advice: A financial advisor specializing in women's financial planning can provide personalized guidance and support.

Understanding different investment strategies and the importance of diversification is key. A financial advisor can help you navigate these complex aspects of investing and tailor a plan to your specific needs and risk tolerance.

Neglecting to Build an Emergency Fund

Life throws curveballs. Unexpected expenses can quickly derail even the most carefully planned finances. A significant financial mistake many women make is neglecting to build an adequate emergency fund.

The Vulnerability of Inadequate Savings

Without a robust emergency fund, you become highly vulnerable to financial hardship:

- Job loss: Unemployment can leave you without income, making it difficult to meet your financial obligations.

- Unexpected medical expenses: Medical emergencies can be incredibly costly, even with health insurance.

- Home repairs: Unexpected home repairs can quickly drain your savings.

Ideally, you should aim to save 3-6 months of living expenses in an emergency fund. Consider these savings vehicles:

- High-yield savings accounts: Offer higher interest rates than traditional savings accounts.

- Money market accounts: Provide a balance between safety and liquidity.

Creating a Realistic Emergency Fund Plan

Building an emergency fund requires discipline and planning:

- Setting realistic savings goals: Start small and gradually increase your savings over time.

- Automating savings: Set up automatic transfers from your checking account to your savings account each month.

- Tracking progress: Monitor your savings progress regularly to stay motivated.

Utilize budgeting apps and tools to track your spending and identify areas where you can cut expenses to free up money for savings.

Ignoring or Underestimating Debt Management

High-interest debt can be crippling, impacting your credit score and hindering your financial progress. Many women ignore or underestimate the importance of effective debt management.

The High Cost of High-Interest Debt

High-interest debt, such as credit card debt and payday loans, can quickly spiral out of control:

- High interest rates: These rates can significantly increase the total amount you owe.

- Accumulating debt: Paying only the minimum payment can lead to accumulating debt over time.

- Impacting credit score: High debt levels can negatively affect your credit score, making it harder to obtain loans or credit in the future.

Consider these debt repayment methods:

- Snowball method: Pay off your smallest debts first for a sense of accomplishment.

- Avalanche method: Prioritize debts with the highest interest rates to save money in the long run.

Effective Debt Management Strategies

Tackling debt requires a strategic approach:

- Creating a debt repayment plan: Develop a realistic plan to pay off your debts systematically.

- Negotiating with creditors: Contact your creditors to explore options for lowering your interest rates or payment amounts.

- Building good credit: Pay your bills on time and maintain a low credit utilization ratio to improve your credit score.

Remember, budgeting and tracking spending are crucial for successful debt management. Seek professional help from a credit counselor if you’re struggling to manage your debt.

Conclusion

We've discussed three common financial mistakes women often make: underestimating retirement planning, neglecting emergency funds, and ignoring or underestimating debt management. These mistakes can have significant long-term consequences for your financial security. The key takeaways are the importance of proactive financial planning, consistent budgeting, regular saving, and effective debt management.

Start planning your financial future today! Take charge of your finances and avoid common financial pitfalls for women. Create a budget, research investment options suited to your risk tolerance, and consider seeking advice from a financial advisor specializing in women's financial planning. Don't let these common financial mistakes for women hold you back from achieving your financial goals. Start building a brighter financial future for yourself!

Featured Posts

-

Jellystone Pinata Smashling Leads Teletoon S Spring Streaming Slate

May 22, 2025

Jellystone Pinata Smashling Leads Teletoon S Spring Streaming Slate

May 22, 2025 -

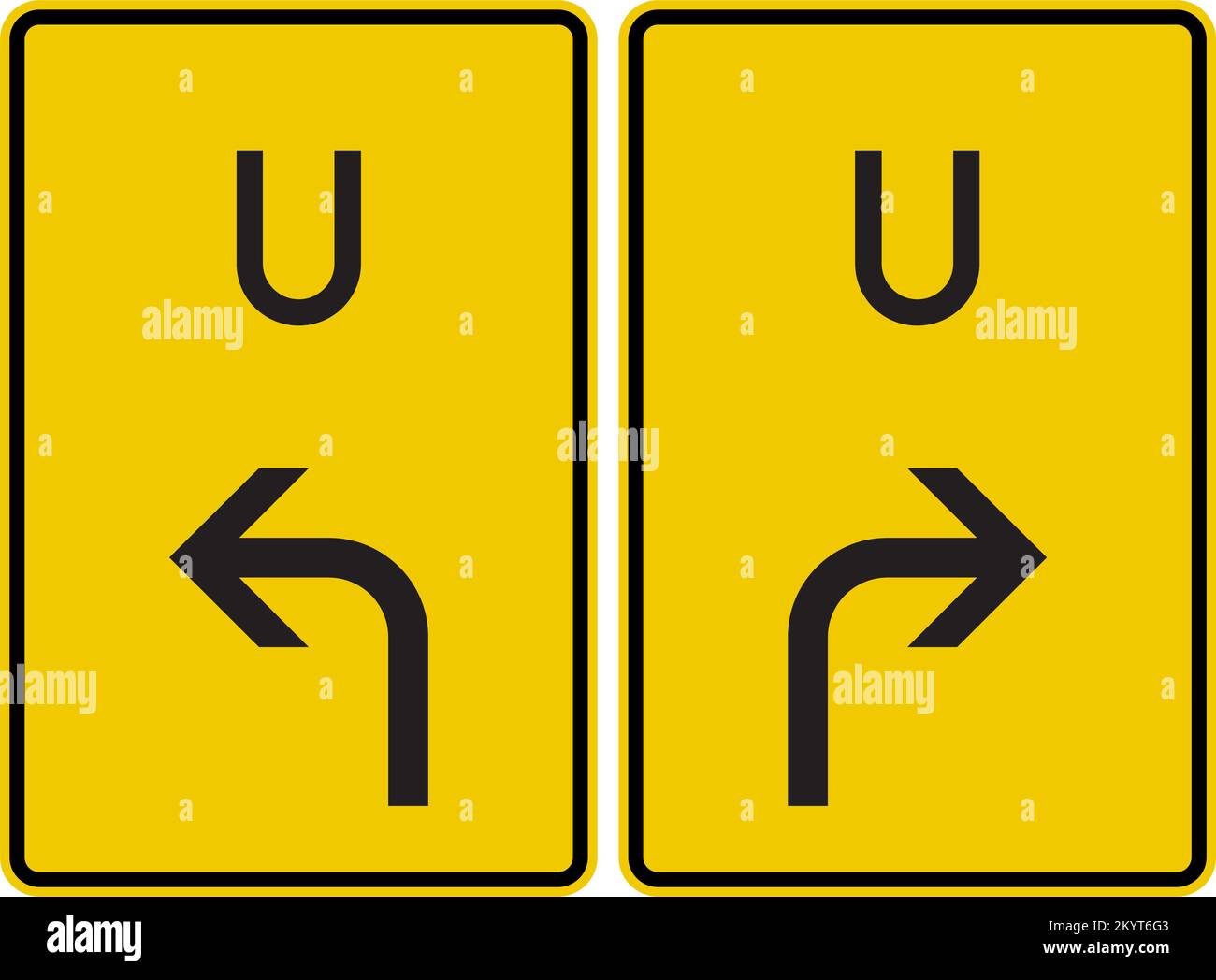

Route 15 Accident On Ramp Closure And Detour Information

May 22, 2025

Route 15 Accident On Ramp Closure And Detour Information

May 22, 2025 -

Succession Planning The Rising Trend Among High Net Worth Individuals

May 22, 2025

Succession Planning The Rising Trend Among High Net Worth Individuals

May 22, 2025 -

Penn Relays 2024 Allentown Boys Achieve Record Breaking 4x100m Run

May 22, 2025

Penn Relays 2024 Allentown Boys Achieve Record Breaking 4x100m Run

May 22, 2025 -

Wtt Star Contender Chennai Oh Jun Sung Secures The Win

May 22, 2025

Wtt Star Contender Chennai Oh Jun Sung Secures The Win

May 22, 2025

Latest Posts

-

Council Addressing Fewer Send Cases Raised By Mps

May 23, 2025

Council Addressing Fewer Send Cases Raised By Mps

May 23, 2025 -

This Morning Host Cat Deeley Shows Off Figure In Black Swimsuit

May 23, 2025

This Morning Host Cat Deeley Shows Off Figure In Black Swimsuit

May 23, 2025 -

Cat Deeley Enjoys This Morning Break In Chic Black Swimsuit

May 23, 2025

Cat Deeley Enjoys This Morning Break In Chic Black Swimsuit

May 23, 2025 -

Cat Deeleys Holiday Style Black Swimsuit And Relaxation

May 23, 2025

Cat Deeleys Holiday Style Black Swimsuit And Relaxation

May 23, 2025 -

Cat Deeleys Stunning Black Swimsuit A This Morning Break

May 23, 2025

Cat Deeleys Stunning Black Swimsuit A This Morning Break

May 23, 2025