$5000 Personal Loans For Bad Credit: No Credit Check Options

Table of Contents

Understanding Bad Credit and Loan Options

A bad credit score, generally considered below 670, can significantly impact your ability to secure a loan. Lenders view borrowers with low credit scores as higher risk, leading to higher interest rates or loan denials. Understanding the types of loans available for bad credit is crucial.

-

Secured vs. Unsecured Loans: Secured loans require collateral (like a car or savings account) to back the loan, reducing the lender's risk. Unsecured loans, such as many personal loans, don't require collateral but typically come with higher interest rates for those with bad credit. A $5000 secured loan might be easier to obtain than an unsecured one.

-

Hard vs. Soft Credit Checks: A hard credit check impacts your credit score, potentially lowering it further. A soft credit check, often used for pre-qualification, doesn't affect your score. Ideally, you want to explore options with soft credit checks initially.

-

Key Considerations:

- Check your credit report: Before applying for any loan, review your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) to identify any errors and understand your creditworthiness.

- Consider credit repair: If you have time before needing the loan, work on improving your credit score. Paying down debt and consistently paying bills on time can improve your chances of approval.

- Understand APR and interest rates: The Annual Percentage Rate (APR) represents the total cost of borrowing, including interest and fees. Bad credit loans often have higher APRs than loans for those with excellent credit. Compare APRs carefully before committing to a loan.

Finding $5000 Personal Loans with Bad Credit: No Credit Check Alternatives

While "no credit check" loans exist, they usually come with extremely high interest rates and should be considered a last resort. Let's explore several options:

Payday Loans

Payday loans are short-term, high-interest loans typically due on your next payday. They often involve a high APR and can create a debt cycle if not repaid promptly.

- How they work: You borrow a small amount, typically repaid in full with fees on your next payday.

- Risks: Extremely high interest rates and fees can lead to significant debt. Multiple payday loans can quickly spiral out of control.

- Responsible Borrowing: Only consider a payday loan if absolutely necessary and if you're confident you can repay the full amount on time.

Installment Loans

Installment loans offer a more manageable repayment plan compared to payday loans. You borrow a larger sum and repay it in fixed monthly installments over a longer period.

- How they work: Fixed monthly payments make budgeting easier.

- Comparison: Installment loans often have lower APRs than payday loans, despite still being higher than loans for those with good credit.

- Multiple Lender Comparison: Compare offers from multiple lenders to find the best interest rate and terms.

Loans from Credit Unions

Credit unions often offer more lenient loan terms than traditional banks, especially for borrowers with bad credit.

- Advantages: Credit unions are member-owned, potentially offering lower interest rates and more personalized service.

- Membership: You'll typically need to meet membership requirements, but this can be easier than qualifying for a loan from a traditional bank.

- Lower Rates: Credit unions sometimes offer more competitive interest rates.

Online Lenders Specializing in Bad Credit

Several online lenders cater specifically to borrowers with poor credit history. However, carefully research the lender’s reputation before applying.

- Advantages: Convenience and often a faster application process.

- Disadvantages: Higher interest rates compared to loans for those with good credit are common.

- Importance of Research: Always check online reviews and ensure the lender is legitimate before providing any personal information. Compare interest rates and fees across multiple platforms.

Tips for Securing a $5000 Personal Loan with Bad Credit

Improve Your Credit Score

Even if you need a loan immediately, improving your credit score is a long-term strategy for better financial health.

- Dispute errors: Check your credit reports and dispute any inaccurate information.

- Reduce debt: Lowering your credit utilization ratio (the amount of credit you use compared to your total available credit) is a significant factor.

Gather Necessary Documents

Having all the necessary documentation prepared beforehand streamlines the application process.

- Required Documents: Proof of income (pay stubs, tax returns), government-issued photo ID, bank statements.

Shop Around for the Best Rates

Don't settle for the first offer you receive. Compare loan offers from multiple lenders to find the best interest rate and terms.

- Online Comparison Tools: Use online comparison tools to efficiently compare rates and terms from various lenders.

Conclusion

Obtaining a $5000 personal loan with bad credit requires careful planning and research. By understanding the different loan options, comparing offers from multiple lenders, and improving your credit score whenever possible, you can significantly increase your chances of securing the funding you need. Remember to borrow responsibly and always read the terms and conditions carefully before signing any loan agreement. Start your search for a $5000 personal loan today and find the financial solution that works best for your circumstances. Don't hesitate to explore your options for a $5000 personal loan for bad credit – your financial future is within reach!

Featured Posts

-

Man Utd Amorim Snubs Garnacho Liverpool Next

May 28, 2025

Man Utd Amorim Snubs Garnacho Liverpool Next

May 28, 2025 -

Marlins Win Against Nationals Back To Even

May 28, 2025

Marlins Win Against Nationals Back To Even

May 28, 2025 -

Develop Voice Assistants With Open Ai New Tools Unveiled At 2024 Event

May 28, 2025

Develop Voice Assistants With Open Ai New Tools Unveiled At 2024 Event

May 28, 2025 -

Etf Investing Soars A Deep Dive Into Recent Market Trends

May 28, 2025

Etf Investing Soars A Deep Dive Into Recent Market Trends

May 28, 2025 -

Securing A Tribal Loan With Bad Credit A Direct Lender Guide

May 28, 2025

Securing A Tribal Loan With Bad Credit A Direct Lender Guide

May 28, 2025

Latest Posts

-

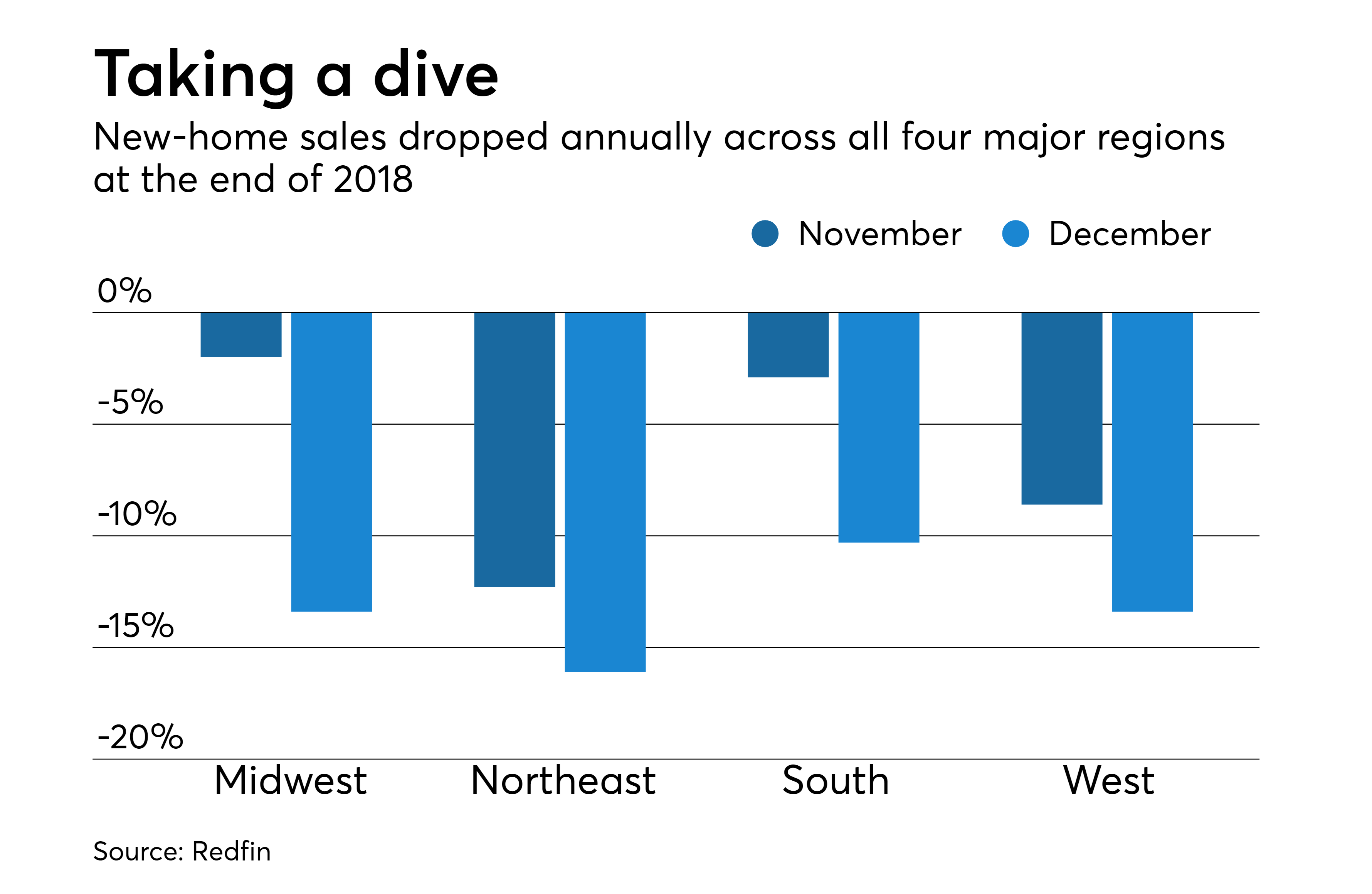

Home Sales Plummet Crisis Levels Hit Sagging Market

May 30, 2025

Home Sales Plummet Crisis Levels Hit Sagging Market

May 30, 2025 -

Alcaraz Earns Monte Carlo Masters Final Berth Wins Against Davidovich Fokina

May 30, 2025

Alcaraz Earns Monte Carlo Masters Final Berth Wins Against Davidovich Fokina

May 30, 2025 -

Bells Ai Fabric A Major Investment In Six B C Data Centres

May 30, 2025

Bells Ai Fabric A Major Investment In Six B C Data Centres

May 30, 2025 -

Davidovich Fokina Falls To Alcaraz In Monte Carlo Masters Semi Final

May 30, 2025

Davidovich Fokina Falls To Alcaraz In Monte Carlo Masters Semi Final

May 30, 2025 -

British Columbia To Host Six New Bell Ai Data Centres

May 30, 2025

British Columbia To Host Six New Bell Ai Data Centres

May 30, 2025