$584 Million: Dubai Holding Expands REIT Initial Public Offering

Table of Contents

Dubai Holding's REIT IPO Expansion: A Detailed Look

The expansion of the Dubai Holding REIT IPO from its initial size to a substantial $584 million reflects a surge in investor demand and confidence in Dubai's real estate market. This increased offering size provides a wider range of investment opportunities for a broader pool of investors, both large and small. The decision to expand highlights positive market conditions and a strong belief in the long-term potential of Dubai's property sector.

- Original IPO size: [Insert Original Size if available. Otherwise, use a placeholder like "Initially announced at a smaller figure,"]

- Expanded IPO size: $584 million

- Key dates and milestones: [Insert key dates, including the opening and closing dates for the IPO. If unavailable, use placeholders like "Offering period to be announced shortly."]

- Expected returns and investment potential: [Include details about projected returns, emphasizing the potential for both capital appreciation and dividend income. If unavailable, use cautious phrasing, such as "Investors can expect a competitive return based on the strong performance of the underlying assets."]

- Target investor demographics: [Describe the target investor profile, including high-net-worth individuals, institutional investors, and potentially retail investors.]

Impact on Dubai's Real Estate Market

The expanded Dubai Holding REIT IPO is poised to significantly impact Dubai's already vibrant real estate market. The injection of significant capital through this offering will create increased liquidity, potentially stimulating further development and construction projects. This increased activity will have a ripple effect, impacting property values and attracting further foreign direct investment into the emirate.

- Increased liquidity in the market: The IPO will inject significant capital into the market, making it easier for buyers and sellers to transact.

- Potential for increased property development: The influx of capital can lead to the development of new residential and commercial properties, boosting the overall supply.

- Attraction of further foreign investment: The success of the expanded IPO will signal confidence in Dubai's real estate market, encouraging further investment from international sources.

- Impact on existing REITs in Dubai: The expanded offering could potentially increase competition among existing REITs in Dubai, potentially leading to greater innovation and improved offerings for investors.

Attractiveness of the Dubai Holding REIT for Investors

The Dubai Holding REIT offers several compelling advantages for investors seeking exposure to Dubai's dynamic real estate market. The potential for strong returns, driven by both capital appreciation and steady dividend yields, makes it an attractive proposition. The REIT structure also offers benefits in terms of diversification and reduced risk compared to direct property investment.

- Projected dividend yield: [Insert projected dividend yield if available. If unavailable, state something along the lines of "A competitive dividend yield is expected, providing a regular income stream for investors."]

- Portfolio diversification opportunities: The REIT offers diversification across a range of high-quality properties in various sectors, reducing overall portfolio risk.

- Potential for capital appreciation: Dubai's robust real estate market presents significant potential for capital appreciation over the long term.

- Risk factors and mitigation strategies: While all investments carry risk, investors should carefully assess the risks associated with this investment and consider their risk tolerance. [Mention risk mitigation strategies if known].

- Comparison with other REITs in the region: [Compare Dubai Holding REIT with other prominent REITs in the UAE, highlighting its unique selling points and competitive advantages.]

Competitive Landscape of the UAE REIT Market

Dubai Holding's REIT is entering a competitive but growing UAE REIT market. While there are established players, Dubai Holding's size, portfolio quality, and the backing of a reputable developer like Dubai Holding provide a significant competitive edge. The future outlook for the REIT is positive, considering the long-term growth potential of Dubai's real estate sector and the increasing demand for REIT investments in the region. Analysis of market share and future growth projections will be key to monitoring the REIT's performance against its competitors.

Conclusion

The $584 million expansion of Dubai Holding's REIT IPO represents a landmark moment for Dubai's real estate market. This significant increase demonstrates substantial investor confidence and positions the REIT for significant growth. The investment opportunities presented are compelling, offering the potential for strong returns through both dividend income and capital appreciation. The REIT's diversified portfolio and the strength of Dubai's real estate market contribute to a positive outlook.

Invest in the future of Dubai's real estate with the expanded Dubai Holding REIT IPO – learn more today! [Insert link to relevant resources, if available]

Featured Posts

-

Angely I Restorany Biznes Evgeniya Plyuschenko Ilya Averbukha I Tatyany Navki

May 20, 2025

Angely I Restorany Biznes Evgeniya Plyuschenko Ilya Averbukha I Tatyany Navki

May 20, 2025 -

Determined Germany Faces Italy In Crucial World Cup Quarterfinal

May 20, 2025

Determined Germany Faces Italy In Crucial World Cup Quarterfinal

May 20, 2025 -

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt

May 20, 2025

Ajatha Krysty Fy Esr Aldhkae Alastnaey Imkanyat Jdydt

May 20, 2025 -

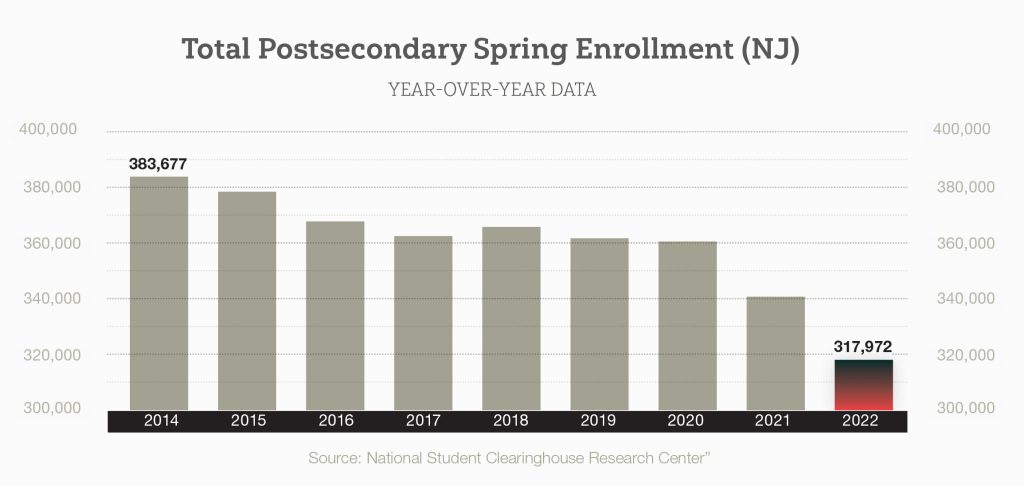

Facing Hard Times College Towns And The Struggle With Enrollment Decline

May 20, 2025

Facing Hard Times College Towns And The Struggle With Enrollment Decline

May 20, 2025 -

Bortaseger Mot Malta Inleder Jacob Friis Nya Era

May 20, 2025

Bortaseger Mot Malta Inleder Jacob Friis Nya Era

May 20, 2025