7% Stock Market Plunge In Amsterdam: Intensifying Trade War Concerns

Table of Contents

H2: The Severity of the Amsterdam Stock Market Drop

H3: Unprecedented Fall in the AEX Index: On [Insert Date], the Amsterdam Stock Exchange (AEX) experienced a shocking 7% plunge, marking one of the most significant single-day drops in its history. This dramatic fall saw the AEX index plummet by [Insert Point Drop] points, closing at [Insert Closing Value]. This unprecedented decline significantly surpassed previous market corrections observed in recent years, exceeding the [Insert Percentage]% drop during [Insert Previous Market Event] and highlighting the severity of the current situation.

- Specific numbers illustrating the magnitude of the loss: The AEX index closed at [Insert Closing Value], representing a [Insert Percentage]% decrease from its previous closing value and a [Insert Point Drop] point drop. This translates to billions of euros wiped off the market capitalization of listed companies.

- Comparison to previous market drops in Amsterdam and other major European markets: The severity of this drop is significantly higher than the average daily fluctuation observed in the AEX index over the past [Insert Time Period], surpassing even the volatility seen during the [Insert Previous Significant Market Event]. European markets, such as the DAX (Germany) and CAC 40 (France), also experienced significant declines, but not to the same extent as Amsterdam.

- Mention of specific companies heavily impacted by the fall: Several key players in the Dutch economy, including [Insert Examples of Companies and Sectors Affected], experienced substantial losses, reflecting the broad-based nature of the market downturn.

Keywords: AEX index, Amsterdam stock exchange, market decline, percentage change, historical lows, market capitalization.

H2: The Role of the Intensifying Trade War

H3: Global Trade Tensions and Their Impact: The Amsterdam stock market plunge is inextricably linked to the escalating global trade war. The recent [Insert Specific Trade Policy or Event, e.g., imposition of new tariffs, threat of sanctions] has significantly impacted investor confidence and fueled uncertainty regarding the future trajectory of global trade. This uncertainty is particularly acute for the Netherlands, a nation heavily reliant on international trade.

- Explanation of relevant trade tariffs or sanctions impacting Dutch businesses: The [Insert Specific Trade Policy] directly impacts Dutch exports of [Insert Example Products/Sectors], leading to reduced competitiveness and potentially impacting company profitability.

- Discussion of supply chain disruptions and their impact on Dutch companies: Disruptions to global supply chains due to the trade war are placing additional strain on Dutch businesses, impacting production and potentially leading to delays and increased costs.

- Analysis of investor sentiment regarding the trade war's future trajectory: The ongoing uncertainty surrounding the future of the trade war has significantly dampened investor sentiment, prompting a sell-off in the Amsterdam stock market as investors seek to protect their assets from further potential losses.

Keywords: Trade war, global trade, tariffs, sanctions, supply chain disruption, investor sentiment, economic uncertainty, geopolitical risk.

H2: Impact on Dutch and European Economies

H3: Ripple Effects Across Sectors: The 7% stock market plunge in Amsterdam has far-reaching implications that extend beyond the financial markets. The ripple effects are likely to be felt across various sectors of the Dutch and wider European economies.

- Potential impact on employment in affected sectors: The decline in market value and potential reduction in business activity could lead to job losses in affected sectors, particularly those heavily reliant on exports and international trade.

- Effects on consumer confidence and spending: The market downturn may negatively impact consumer confidence, leading to decreased spending and potentially slowing economic growth.

- Analysis of the potential for a broader European economic slowdown: The Amsterdam market decline serves as a warning sign for the broader European economy, highlighting the potential for a more significant slowdown if the trade war continues to escalate.

Keywords: Dutch economy, European economy, economic impact, consumer confidence, recession risk, unemployment, economic growth.

H2: Strategies for Investors During Market Volatility

H3: Navigating Uncertain Times: The current market volatility necessitates a cautious and strategic approach for investors. Successfully navigating this uncertainty requires careful planning and diversification.

- Recommendations for diversifying investments: Diversifying investment portfolios across different asset classes and geographies is crucial to mitigate risk and reduce exposure to market fluctuations.

- Strategies for risk mitigation: Implementing risk mitigation strategies, such as hedging or using stop-loss orders, can help to limit potential losses during periods of market instability.

- Importance of long-term investment planning: Maintaining a long-term investment horizon and focusing on fundamental analysis rather than short-term market fluctuations is essential for weathering market volatility.

Keywords: Investment strategies, risk management, portfolio diversification, long-term investment, market volatility, financial planning, hedging, stop-loss orders.

3. Conclusion:

The 7% plunge in the Amsterdam stock market underscores the significant impact of the intensifying global trade war on even robust economies. The unprecedented fall in the AEX index highlights the interconnectedness of global markets and the need for investors to carefully analyze their risk exposure. The potential economic consequences extend beyond the immediate market impact, affecting employment, consumer confidence, and potentially leading to a broader European economic slowdown. Investors must adapt their strategies, focusing on diversification, risk mitigation, and long-term planning to navigate these uncertain times.

Call to Action: Stay informed about the evolving situation regarding the Amsterdam stock market and the global trade war. Regularly monitor market trends and adjust your investment strategies accordingly to mitigate potential risks associated with the Amsterdam stock market and other global market fluctuations. Consider consulting a financial advisor for personalized guidance on navigating this period of uncertainty.

Featured Posts

-

Solve The Nyt Mini Crossword March 12 2025 Answers And Hints

May 24, 2025

Solve The Nyt Mini Crossword March 12 2025 Answers And Hints

May 24, 2025 -

Emergency Services Respond To M56 Car Overturn Casualty On Motorway

May 24, 2025

Emergency Services Respond To M56 Car Overturn Casualty On Motorway

May 24, 2025 -

Konchita Vurst Neyniyat Pt Sled Triumfa Na Evroviziya

May 24, 2025

Konchita Vurst Neyniyat Pt Sled Triumfa Na Evroviziya

May 24, 2025 -

Bestechung An Der Uni Duisburg Essen Umfang Des Skandals Und Gestaendnis Einer Mitarbeiterin

May 24, 2025

Bestechung An Der Uni Duisburg Essen Umfang Des Skandals Und Gestaendnis Einer Mitarbeiterin

May 24, 2025 -

Massachusetts Gun Trafficking Ring Busted 18 Brazilians Charged 100 Firearms Seized

May 24, 2025

Massachusetts Gun Trafficking Ring Busted 18 Brazilians Charged 100 Firearms Seized

May 24, 2025

Latest Posts

-

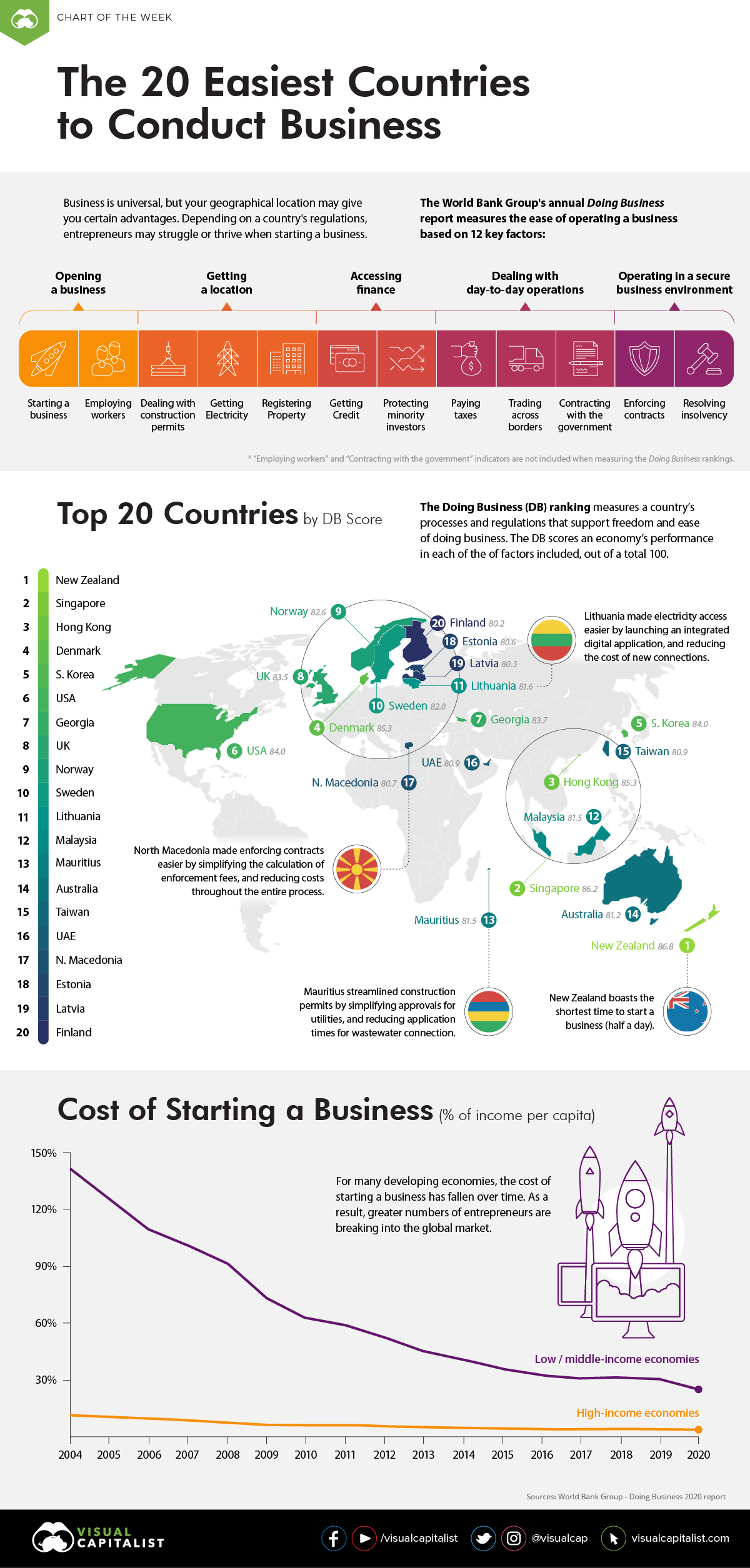

The Countrys Booming Business Regions A Location Guide

May 24, 2025

The Countrys Booming Business Regions A Location Guide

May 24, 2025 -

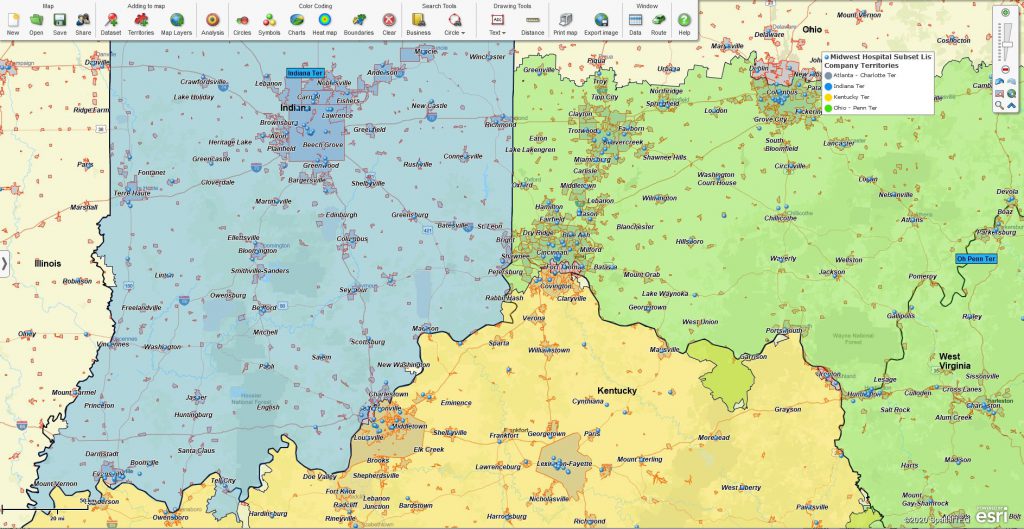

Where To Invest A Map Of The Countrys Rising Business Centers

May 24, 2025

Where To Invest A Map Of The Countrys Rising Business Centers

May 24, 2025 -

Identifying And Analyzing The Countrys Fastest Growing Business Locations

May 24, 2025

Identifying And Analyzing The Countrys Fastest Growing Business Locations

May 24, 2025 -

Mapping The Countrys Newest Business Hotspots

May 24, 2025

Mapping The Countrys Newest Business Hotspots

May 24, 2025 -

Global Forest Loss Wildfires Exacerbate The Problem

May 24, 2025

Global Forest Loss Wildfires Exacerbate The Problem

May 24, 2025