$900 Million Tariff Projection Triggers Apple Stock Sell-Off

Table of Contents

The $900 Million Tariff Projection: A Deep Dive

The source of the alarming $900 million tariff projection stems from [Insert Source Here – e.g., a specific government announcement, analyst report, etc.]. This figure represents the estimated cost increase Apple faces due to newly imposed or increased tariffs on various products imported into [Insert Target Country/Region Here – e.g., the United States]. The specific products affected by this Apple tariff include a range of devices vital to their revenue stream.

- Specific Tariffs and Impact: The tariffs are not uniform across all Apple products. For example, iPhones might face a [Insert Percentage]% tariff increase, while iPads could see a [Insert Percentage]% increase, and Macs a [Insert Percentage]%. These varying rates significantly impact profitability calculations for each product line.

- Price Increases for Consumers: The inevitable consequence of these tariffs is a likely increase in prices for consumers. This could significantly affect demand, particularly in price-sensitive markets. The extent of the price increases will depend on Apple's pricing strategy and its ability to absorb some of the increased costs.

- Countries/Regions Impacted: The tariffs primarily affect Apple products imported into [Insert Target Country/Region Here]. This geographic limitation means some markets will be more heavily affected than others, creating complexities in global supply chain management for Apple.

Market Reaction and Apple Stock Performance

The news of the $900 million tariff projection immediately impacted Apple's stock price. Within [Insert Timeframe – e.g., hours, days], Apple's stock experienced a [Insert Percentage]% drop, wiping out [Insert Dollar Amount] in market capitalization. This dramatic Apple stock sell-off reflected investor anxieties about the potential long-term effects of increased costs and reduced profitability.

- Trading Volume: The volume of Apple stock traded during the sell-off was significantly higher than average, indicating considerable investor activity and a flight from the stock.

- Analyst Reactions: Analysts responded with a range of predictions, some expressing cautious optimism about Apple's ability to mitigate the impact, while others voiced more pessimistic forecasts, highlighting the potential for reduced earnings and decreased market share.

- Comparison to Other Tech Companies: The Apple stock sell-off wasn't entirely isolated. While the impact of the Apple tariff was a significant driver, other tech companies also experienced declines, reflecting broader market anxieties. However, the magnitude of Apple's drop was considerably larger, suggesting a more specific sensitivity to the tariff news.

Potential Long-Term Implications for Apple

The $900 million tariff projection poses several long-term challenges for Apple. The most immediate concern is the impact on profitability and revenue. The increased costs could eat into profit margins, potentially requiring price adjustments that could further decrease sales volume. The long-term implications for Apple are far-reaching.

- Mitigation Strategies: Apple may explore several strategies to offset the tariff impact. These could include shifting some production to countries outside of the targeted region to avoid tariffs, adjusting product pricing, and focusing on higher-margin products to compensate for losses on others.

- Supply Chain Disruptions: The increased costs and potential production shifts could disrupt Apple's finely-tuned supply chain, introducing delays and potentially causing shortages.

- Impact on Consumer Demand: Higher prices due to tariffs could significantly reduce consumer demand, particularly in price-sensitive markets. This could lead to reduced sales and a decline in Apple's market share.

Alternative Explanations for the Apple Stock Sell-Off

While the $900 million Apple tariff played a major role in the stock sell-off, it's important to consider other contributing factors. The timing of this news coincided with several broader economic trends that may have influenced investor sentiment.

- Macroeconomic Factors: Overall market trends, inflation concerns, and rising interest rates could have contributed to a general risk-off sentiment among investors, impacting Apple stock along with others.

- Apple-Specific News: Any negative news or reports concerning Apple's products, performance, or legal issues unrelated to tariffs could have further exacerbated the sell-off.

- Investor Sentiment and Speculation: Investor sentiment and speculation often play a significant role in stock market fluctuations. Negative expectations about Apple's future performance, independent of the tariffs, could have amplified the sell-off.

Conclusion: Understanding the Apple Stock Sell-Off and Looking Ahead

The $900 million tariff projection significantly contributed to the dramatic Apple stock sell-off. The market reacted swiftly, reflecting concerns about the impact on Apple's profitability and future growth. While the tariff is a major factor, macroeconomic conditions and other Apple-specific news likely played a role as well. Apple's long-term response, including its strategies to mitigate the impact of these tariffs, will be crucial in determining the final consequences of this event. Stay tuned for further updates on the evolving situation regarding the Apple stock sell-off and the ongoing impact of these tariffs. Understanding the dynamics of the $900 million tariff projection and its influence on Apple's future is crucial for investors and consumers alike.

Featured Posts

-

The M62 Relief Road And Bury An Examination Of A Proposed Route

May 25, 2025

The M62 Relief Road And Bury An Examination Of A Proposed Route

May 25, 2025 -

Analyzing Jordan Bardellas Chances In The Upcoming French Elections

May 25, 2025

Analyzing Jordan Bardellas Chances In The Upcoming French Elections

May 25, 2025 -

Porsche 956 Nin Tavan Asintisinda Sergilenmesinin Nedenleri

May 25, 2025

Porsche 956 Nin Tavan Asintisinda Sergilenmesinin Nedenleri

May 25, 2025 -

The Sean Penn Woody Allen Relationship A Case Study In Me Too Controversy

May 25, 2025

The Sean Penn Woody Allen Relationship A Case Study In Me Too Controversy

May 25, 2025 -

Kering Reports Sales Dip Demnas Gucci Debut In September

May 25, 2025

Kering Reports Sales Dip Demnas Gucci Debut In September

May 25, 2025

Latest Posts

-

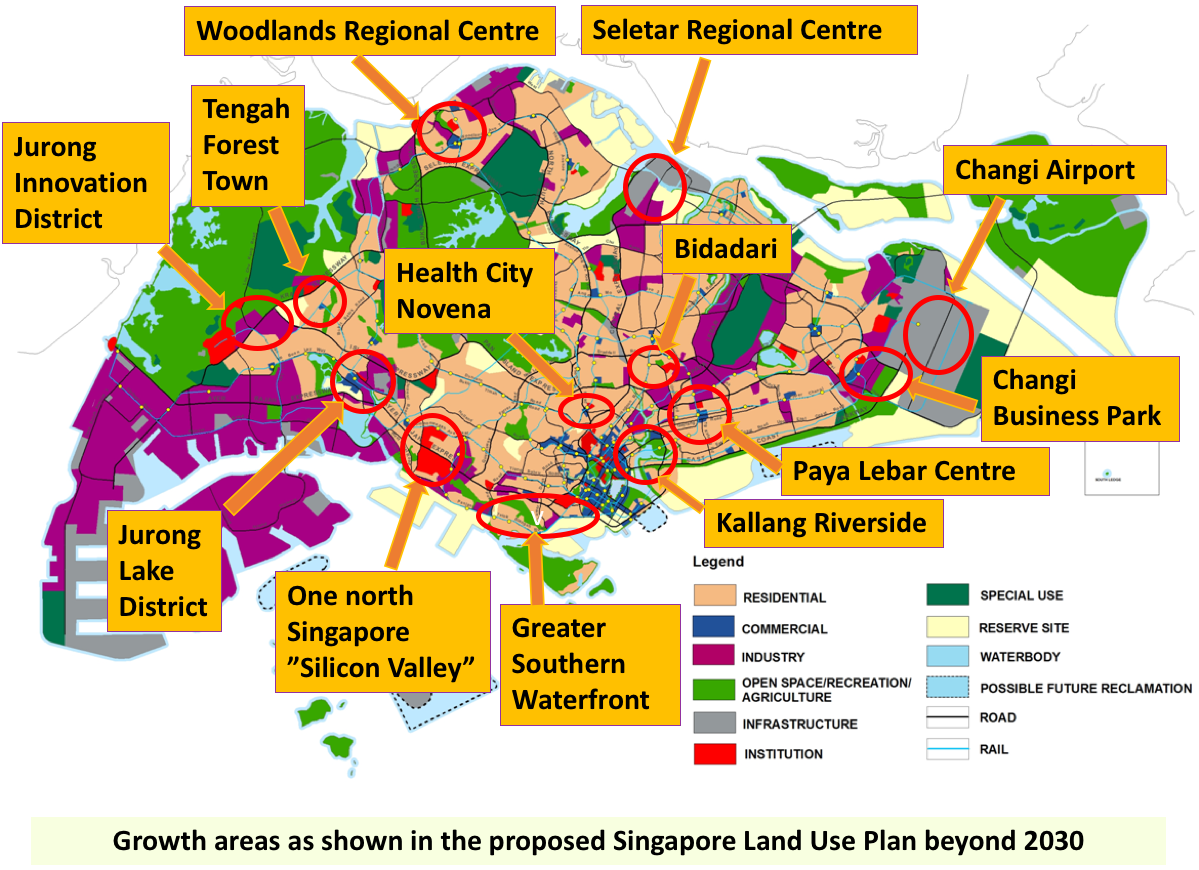

Exploring The Countrys Business Hotspots Opportunities And Challenges

May 25, 2025

Exploring The Countrys Business Hotspots Opportunities And Challenges

May 25, 2025 -

The Countrys Evolving Business Map Key Growth Areas

May 25, 2025

The Countrys Evolving Business Map Key Growth Areas

May 25, 2025 -

Where To Invest A Comprehensive Guide To The Countrys Best Business Locations

May 25, 2025

Where To Invest A Comprehensive Guide To The Countrys Best Business Locations

May 25, 2025 -

Understanding The Countrys Emerging Business Landscapes

May 25, 2025

Understanding The Countrys Emerging Business Landscapes

May 25, 2025 -

Investing In The Future Identifying Promising Business Locations Nationwide

May 25, 2025

Investing In The Future Identifying Promising Business Locations Nationwide

May 25, 2025