AAPL Stock: Analysis Of Upcoming Price Levels

Table of Contents

Analyzing Current Market Conditions and Their Impact on AAPL

The current economic climate significantly influences AAPL stock. High inflation and rising interest rates generally impact the tech sector, potentially slowing consumer spending and impacting Apple's sales. However, Apple's robust ecosystem and loyal customer base provide a degree of insulation.

Recent Apple product releases, such as the iPhone 14 series and the Apple Watch Series 8, have generally been well-received, although sales figures may be impacted by broader economic headwinds. Competitive pressures from Samsung in the smartphone market and Google in the software and services space remain significant factors. We must also consider Apple's resilience and ability to innovate.

- Impact of supply chain issues: While supply chain disruptions have eased, lingering effects could still impact production and, consequently, the AAPL stock price.

- Influence of consumer confidence: Decreased consumer confidence due to economic uncertainty may lead to lower demand for Apple products, influencing the stock's valuation.

- Analysis of analyst ratings and price targets: Monitoring analyst ratings and price targets provides valuable insight into market sentiment and expectations regarding AAPL's future performance. A consensus of positive outlooks generally suggests a bullish sentiment, while a divergence signals uncertainty.

Technical Analysis of AAPL Stock Charts

Technical analysis of AAPL stock charts offers another perspective on potential price movements. By examining key indicators like moving averages (e.g., 50-day and 200-day), Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), we can identify potential trends and turning points.

Chart patterns, such as support and resistance levels, are crucial for predicting price movements. A breakout above a significant resistance level often signals a bullish trend, while a breakdown below support suggests a bearish outlook.

- Identification of key support and resistance levels: Identifying these levels helps predict potential price reversals or continuations of existing trends. These levels often represent psychological barriers for traders.

- Analysis of trendlines and their implications: Upward-sloping trendlines suggest a bullish trend, while downward-sloping lines indicate bearish pressure. Breaks above or below these lines can signal significant shifts in momentum.

- Discussion of potential breakout scenarios: A breakout above a resistance level can indicate a significant price increase, while a breakdown below support suggests a potential decline. Volume confirms these breakouts.

Fundamental Analysis of Apple's Financial Health

Analyzing Apple's financial statements—income statement, balance sheet, and cash flow statement—is crucial for understanding its underlying financial health and future prospects. Key metrics to consider include revenue growth, profit margins, debt levels, and return on equity (ROE).

Apple's diverse revenue streams, encompassing iPhones, services, wearables, and more, provide a level of resilience against downturns in specific product categories. The company’s consistent innovation and strong brand loyalty contribute to its long-term competitive advantage.

- Evaluation of Apple's revenue streams and their diversification: The diversification of Apple's revenue streams mitigates risk associated with reliance on a single product category.

- Assessment of Apple's innovation pipeline and future product launches: Apple's ongoing investment in R&D and its pipeline of innovative products influence long-term growth prospects.

- Analysis of Apple's debt-to-equity ratio and financial stability: A strong balance sheet with low debt indicates financial stability and a greater ability to weather economic downturns.

Potential AAPL Stock Price Levels and Scenarios

Based on the combined analysis of market conditions, technical indicators, and Apple's fundamentals, we can outline potential price scenarios for AAPL stock. A bullish scenario suggests continued growth driven by strong product demand and economic recovery. A bearish scenario anticipates a price decline due to economic headwinds or negative news. A neutral scenario reflects a period of consolidation before a potential directional move.

- Short-term price targets (within the next 3-6 months): This timeframe is heavily influenced by short-term market sentiment and news events.

- Mid-term price targets (within the next 12-18 months): Mid-term projections account for broader economic trends and product release cycles.

- Long-term price targets (beyond 2 years): Long-term projections depend on sustained innovation, market share gains, and overall economic growth.

- Risk factors impacting the projections: These include unexpected economic downturns, increased competition, and negative regulatory changes.

Conclusion: Making Informed Decisions about AAPL Stock

Analyzing "AAPL stock" requires a comprehensive approach combining market analysis, technical indicators, and fundamental assessments. While this article offers potential scenarios for AAPL stock price levels, it's crucial to remember that these are predictions, not guarantees. Various factors could influence actual outcomes.

Before making any investment decisions, thorough research and consideration of your personal risk tolerance are essential. Continue monitoring "AAPL stock" and its price levels, and consider further research into "Apple stock forecast" and "AAPL stock predictions." Remember, a diversified investment strategy is always recommended to mitigate risk.

Featured Posts

-

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

The Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025 -

Us Tariff Pause Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025

Us Tariff Pause Sends Euronext Amsterdam Stocks Soaring 8

May 24, 2025 -

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025 -

13 Vuotias F1 Lupaus Taemae Nimi Kannattaa Muistaa Ferrari Kiinnitti Nuoren Kuljettajan

May 24, 2025

13 Vuotias F1 Lupaus Taemae Nimi Kannattaa Muistaa Ferrari Kiinnitti Nuoren Kuljettajan

May 24, 2025 -

Massachusetts Gun Trafficking Ring Busted 18 Brazilians Charged 100 Firearms Seized

May 24, 2025

Massachusetts Gun Trafficking Ring Busted 18 Brazilians Charged 100 Firearms Seized

May 24, 2025

Latest Posts

-

Italys New Citizenship Law Claiming Rights Through Great Grandparents

May 24, 2025

Italys New Citizenship Law Claiming Rights Through Great Grandparents

May 24, 2025 -

Successfully Negotiating A Best And Final Job Offer Tips And Strategies

May 24, 2025

Successfully Negotiating A Best And Final Job Offer Tips And Strategies

May 24, 2025 -

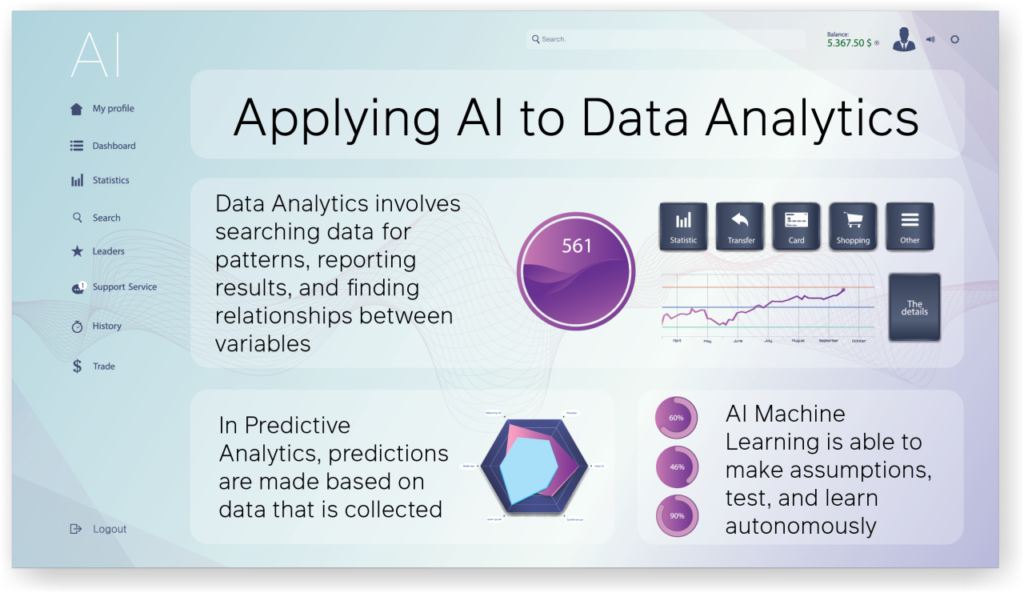

Podcast Production Revolutionized Ais Role In Analyzing Repetitive Data

May 24, 2025

Podcast Production Revolutionized Ais Role In Analyzing Repetitive Data

May 24, 2025 -

The Trump Tax Bill Key Amendments And House Vote Outcome

May 24, 2025

The Trump Tax Bill Key Amendments And House Vote Outcome

May 24, 2025 -

The Future Of Ai Hardware Open Ai And Jony Ives Potential Collaboration

May 24, 2025

The Future Of Ai Hardware Open Ai And Jony Ives Potential Collaboration

May 24, 2025