Action Required: Important HMRC Messages Regarding Your Child Benefit

Table of Contents

Understanding HMRC Child Benefit Communication Methods

HMRC uses several methods to contact claimants about their Child Benefit. It's vital to recognize legitimate communications to avoid scams. They typically communicate via:

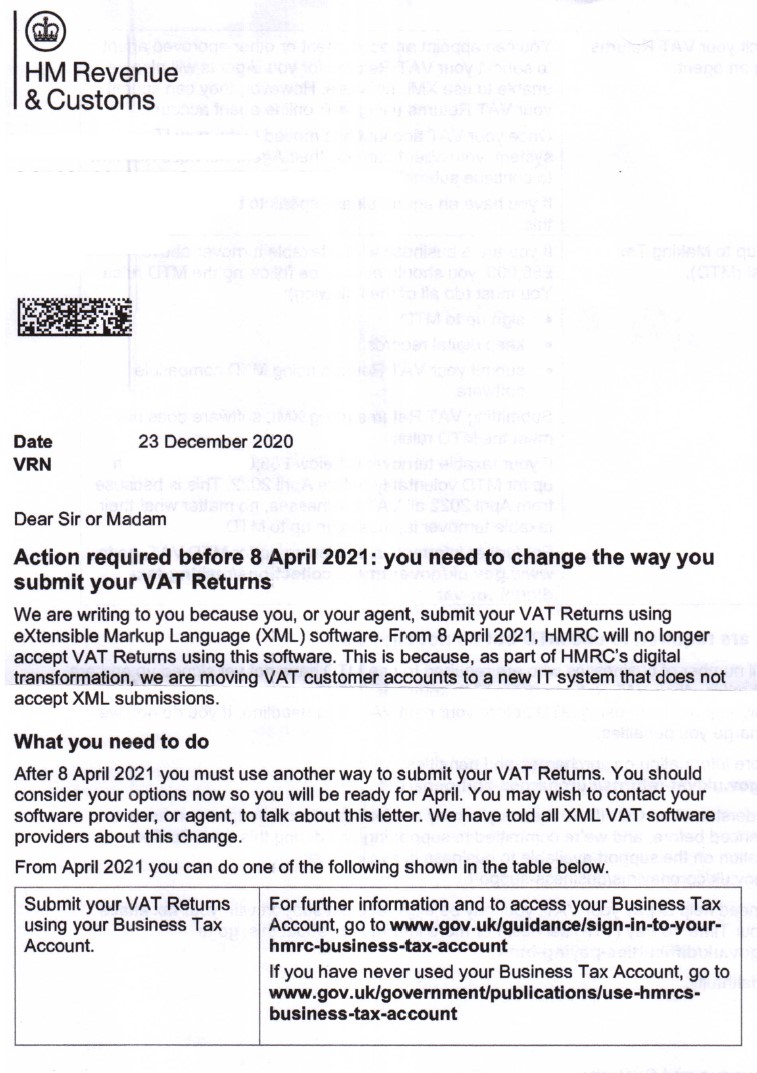

- Letter: Official HMRC letters will always feature the HMRC letterhead and include your unique reference number. Check for any inconsistencies or spelling errors, a common sign of fraudulent communication.

- Email: HMRC may contact you via email if you have registered your email address with them. Always verify the sender's email address to ensure it's a legitimate HMRC address. HMRC will never ask for sensitive information via email.

- Online Account Messages: Regularly checking your online HMRC account is crucial. HMRC often posts important messages and updates directly to your account, offering a secure communication channel.

Important Considerations:

- Verify Authenticity: Always verify the authenticity of any HMRC communication. Look for official letterheads, secure online portals, and correct contact details.

- Identify Phishing Scams: Be aware of phishing scams attempting to impersonate HMRC. HMRC will never ask for your bank details, passwords, or PIN numbers via email or phone.

- Regular Account Checks: Make checking your online HMRC account a regular habit. This ensures you don't miss any important updates or messages.

Common Reasons for HMRC Child Benefit Messages

HMRC may contact you for various reasons related to your Child Benefit. These include:

- Changes to Eligibility Criteria: Your eligibility for Child Benefit can change due to alterations in your income, residency status, or family circumstances. HMRC may require updated information to assess your ongoing eligibility.

- Overpayments or Underpayments: HMRC may identify overpayments or underpayments based on their records. They will contact you to discuss repayment or claim arrears.

- Requests for Additional Information or Verification: They may request additional information to verify your details or confirm your entitlement to Child Benefit.

- Updates to Child Benefit Rates: You may receive updates regarding changes in Child Benefit rates and payment schedules.

- Tax Implications of Child Benefit: HMRC may contact you regarding the tax implications of receiving Child Benefit, particularly the High Income Child Benefit Charge.

How to Respond to HMRC Messages About Child Benefit

Prompt and accurate responses to HMRC communications are essential to avoid delays or penalties. Here's how to respond effectively:

- Responding to Letters: If you receive a letter, carefully read the instructions and return any required forms promptly, ensuring all information is accurate and complete.

- Using the Online HMRC Portal: The HMRC online portal provides a secure way to access and update your information, submit documents, and communicate with HMRC. Make sure your online profile is up to date.

- Contacting HMRC: For queries or further assistance, contact HMRC using the official contact information provided on their website. This might include a phone number, online helpdesk, or a dedicated email address.

What Happens if You Don't Respond to HMRC Messages?

Ignoring HMRC communications can have serious consequences:

- Delays or Cessation of Payments: Failure to respond may lead to delays or even the cessation of your Child Benefit payments.

- Additional Charges or Penalties: HMRC may impose additional charges or penalties for non-compliance or failure to provide necessary information.

- Further Investigations: Ignoring communications could trigger further investigations by HMRC, potentially causing additional stress and inconvenience.

Dealing with Overpayments or Underpayments

If you receive a notification about an overpayment, HMRC will usually outline a repayment plan. If you believe there's been an underpayment, you can claim arrears through the HMRC online portal or by contacting their helpline.

- HMRC Resources: Utilize the resources and guidance available on the HMRC website to resolve any issues related to overpayments or underpayments.

- Appeals Process: If you disagree with HMRC's decision, you have the right to appeal their decision, following their official appeals process.

Taking Action on Your HMRC Child Benefit Messages

Promptly responding to HMRC communications regarding your Child Benefit is crucial. Verifying the authenticity of messages and regularly checking your online HMRC account helps prevent delays and potential penalties. Understanding your Child Benefit entitlements and responsibilities is vital.

Don't delay! Review your HMRC communications regarding your Child Benefit immediately. If you have any questions, contact HMRC for assistance. Understanding your Child Benefit entitlements and responsibilities is crucial.

For further information and resources, please visit the official HMRC website: [Insert Link to HMRC Child Benefit Page Here]

Featured Posts

-

The Enduring Appeal Of Agatha Christies Hercule Poirot

May 20, 2025

The Enduring Appeal Of Agatha Christies Hercule Poirot

May 20, 2025 -

Atkinsrealis Droit Inc Votre Partenaire Juridique

May 20, 2025

Atkinsrealis Droit Inc Votre Partenaire Juridique

May 20, 2025 -

Fremantles Q1 Revenue Decline A 5 6 Drop Explained

May 20, 2025

Fremantles Q1 Revenue Decline A 5 6 Drop Explained

May 20, 2025 -

Elections Cameroun 2032 Macron Referendum Et La Question Du Troisieme Mandat

May 20, 2025

Elections Cameroun 2032 Macron Referendum Et La Question Du Troisieme Mandat

May 20, 2025 -

Agatha Christies Poirot Character Analysis And Case Studies

May 20, 2025

Agatha Christies Poirot Character Analysis And Case Studies

May 20, 2025