Addressing Investor Concerns: BofA's View On Stretched Stock Market Valuations

Table of Contents

BofA's Rationale for Stretched Valuations

BofA's warning about stretched stock market valuations isn't arbitrary; it's rooted in a thorough analysis of key valuation metrics and market trends. Their research highlights several factors contributing to their assessment of overvaluation. This analysis utilizes both quantitative data and qualitative market observations to provide a comprehensive picture.

-

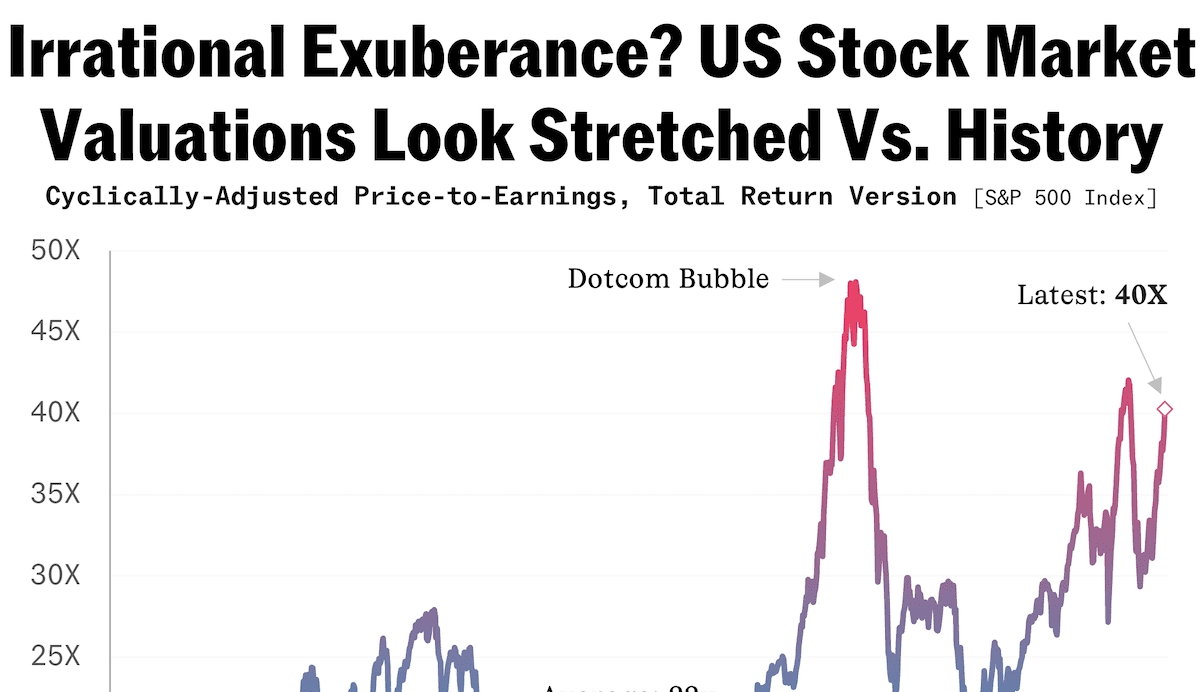

Elevated Price-to-Earnings (P/E) Ratios: BofA's research likely points to significantly elevated P/E ratios across various market sectors compared to historical averages. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, implying potentially inflated stock prices. This discrepancy between current valuations and historical norms is a key indicator of potential overvaluation.

-

Sector-Specific Overvaluation: The analysis likely identifies specific sectors exhibiting particularly high valuations. These sectors, possibly driven by hype or speculative investment, might be disproportionately vulnerable to a market correction. Identifying these overvalued sectors allows for more targeted risk management within an investment portfolio.

-

Proprietary Valuation Models: BofA utilizes sophisticated proprietary valuation models to assess market health. These models likely incorporate a range of factors beyond simple P/E ratios, offering a more nuanced perspective on market valuation. The output of these models likely supports their assessment of stretched valuations.

-

Comparison to Previous Market Cycles: BofA's analysis likely compares current valuations to previous market cycles and corrections. This historical context helps determine whether current valuations are sustainable or represent a bubble prone to bursting. Understanding past market behaviors provides valuable insights into potential future trends.

Impact of Macroeconomic Factors on Stock Market Valuations

Macroeconomic factors play a significant role in shaping stock market valuations. Several external forces are contributing to BofA's concerns:

-

Persistent Inflation: High and persistent inflation erodes corporate earnings and reduces the real value of future cash flows, thereby impacting stock valuations. Inflationary pressures make it more expensive for companies to operate and can reduce consumer spending, directly affecting profitability.

-

Rising Interest Rates: Increased interest rates impact discounted cash flow valuations. Higher rates reduce the present value of future earnings, making stocks less attractive compared to bonds and other fixed-income instruments. This can lead to a downward pressure on stock prices.

-

Recession Risk: The looming threat of a recession significantly influences market sentiment and investor behavior. Concerns about economic slowdown can cause investors to sell off assets, potentially leading to a sharp market correction. Recessionary fears generally translate to lower stock valuations.

-

Geopolitical Uncertainty: Global geopolitical events, such as wars or trade disputes, introduce uncertainty and volatility into the market. Such events can negatively impact investor confidence, leading to lower valuations and increased market fluctuations.

Potential Risks and Investment Strategies in a Stretched Market

Given BofA's concerns, investors need to adopt a cautious approach and implement effective risk management strategies:

-

Risk Mitigation Strategies: In a potentially volatile market, it's crucial to reduce risk exposure. This might involve reducing overall equity holdings, increasing cash reserves, or focusing on less volatile investments.

-

Portfolio Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) is essential to mitigate risk. A diversified portfolio is less susceptible to large losses from any single investment or market sector.

-

Defensive Investing: Shifting towards more defensive investment strategies, such as investing in high-quality dividend-paying stocks or government bonds, can help protect against market downturns. Defensive strategies prioritize capital preservation over aggressive growth.

-

Value vs. Growth Investing: Carefully evaluate value versus growth investing approaches. Value investing, focusing on undervalued companies, might be more attractive in a market deemed overvalued. Growth investing, focusing on companies with high growth potential, carries greater risk in such environments.

-

Portfolio Adjustments: Based on BofA's assessment, investors should consider adjusting their portfolios to reflect the heightened risk. This might involve rebalancing asset allocations, reducing exposure to overvalued sectors, or increasing allocations to more defensive asset classes.

Conclusion

This article highlighted BofA's concerns about stretched stock market valuations, analyzing contributing factors and their potential impact. The analysis considered macroeconomic conditions, valuation metrics, and potential investment strategies for navigating this environment. Understanding these factors is critical for informed decision-making.

Understanding BofA's perspective on stretched stock market valuations is crucial for informed investment decisions. Carefully consider your investment strategy and seek professional financial advice to manage risk and navigate the complexities of the current market. Learn more about managing your portfolio in the face of stretched stock market valuations and contact a financial advisor today.

Featured Posts

-

Cne Seis Pruebas Del Bloqueo Ilegal De Su Pagina Web

May 19, 2025

Cne Seis Pruebas Del Bloqueo Ilegal De Su Pagina Web

May 19, 2025 -

Ufc 313 Livestream Guide Pereira Vs Ankalaev Fight Online

May 19, 2025

Ufc 313 Livestream Guide Pereira Vs Ankalaev Fight Online

May 19, 2025 -

Prohibicion De Celulares En Segunda Vuelta Correismo Presenta Impugnacion

May 19, 2025

Prohibicion De Celulares En Segunda Vuelta Correismo Presenta Impugnacion

May 19, 2025 -

Preparation D Un Salami Au Chocolat Une Recette Facile Et Gourmande De France

May 19, 2025

Preparation D Un Salami Au Chocolat Une Recette Facile Et Gourmande De France

May 19, 2025 -

Home And Abroad Fp Videos Report On Continuing Tariff Instability

May 19, 2025

Home And Abroad Fp Videos Report On Continuing Tariff Instability

May 19, 2025

Latest Posts

-

Paige Bueckers A Huskies Of Honor Induction By Dom Amore

May 19, 2025

Paige Bueckers A Huskies Of Honor Induction By Dom Amore

May 19, 2025 -

Hopkins Mn Honors Paige Bueckers City Renamed For Wnba Debut

May 19, 2025

Hopkins Mn Honors Paige Bueckers City Renamed For Wnba Debut

May 19, 2025 -

Azzi Fudd And Paige Bueckers Different Looks U Conn Vs Wnba Draft

May 19, 2025

Azzi Fudd And Paige Bueckers Different Looks U Conn Vs Wnba Draft

May 19, 2025 -

U Conn Stars Azzi Fudd And Paige Bueckers Casual Vs Formal Fashion

May 19, 2025

U Conn Stars Azzi Fudd And Paige Bueckers Casual Vs Formal Fashion

May 19, 2025 -

Find Final Destination 5 Where To Stream Or Watch In Theaters

May 19, 2025

Find Final Destination 5 Where To Stream Or Watch In Theaters

May 19, 2025