Airline Industry Faces Headwinds Amidst Global Oil Supply Shocks

Table of Contents

The Impact of Rising Fuel Costs on Airline Profitability

Fuel represents a substantial portion of an airline's operating costs, typically ranging from 20% to 40% depending on the airline and its routes. Even a modest increase in global oil supply disruption and subsequent price hikes translates into substantial losses for airlines, severely impacting their bottom line.

Direct Cost Increases

The direct impact of rising oil prices on airline profitability is undeniable. A small percentage increase in fuel prices can lead to millions, even billions, of dollars in added expenses for major airlines. This necessitates adjustments across the board.

- Fuel hedging strategies: Many airlines utilize hedging contracts to lock in future fuel prices, mitigating some risk. However, the effectiveness of these strategies depends on market predictability; unpredictable oil price volatility can render hedging contracts less effective.

- Fuel cost as a percentage of operating expenses: Low-cost carriers, often operating with leaner margins, are particularly vulnerable. A comparison of fuel costs as a percentage of operating expenses across various airlines reveals significant disparities in their resilience to oil price shocks.

- Fuel surcharges: Airlines often attempt to recoup some of these increased costs by implementing fuel surcharges on tickets. However, the extent to which these surcharges can offset rising fuel costs varies.

Cascading Effects on Operational Efficiency

Rising fuel costs don't just directly impact profit margins; they also force airlines to re-evaluate their operational efficiency. This often leads to difficult decisions that impact customers and the industry as a whole.

- Route adjustments: Airlines may optimize flight routes, potentially reducing the frequency of flights on less profitable routes or even canceling them altogether.

- Maintenance schedules: Budget cuts in maintenance could lead to potential safety concerns in the long run, as airlines struggle to balance cost-cutting measures with safety regulations.

- Fleet management: Airlines might accelerate the retirement of older, less fuel-efficient aircraft, while delaying the acquisition of new ones. Investing in more fuel-efficient aircraft is a long-term solution, but it requires substantial capital expenditure.

The Ripple Effect on Air Travel and the Broader Economy

The impact of rising fuel costs extends far beyond the airline industry itself, rippling outwards to affect consumers and the wider economy.

Increased Ticket Prices for Consumers

The increased cost of aviation fuel is inevitably passed on to consumers through higher ticket prices. This has a direct impact on air travel demand and the tourism industry as a whole.

- Statistical data on ticket price increases: Data clearly shows a correlation between oil price increases and subsequent airfare hikes. Analyzing this data across different regions and airlines provides valuable insights.

- Impact on leisure travel: Higher ticket prices disproportionately affect leisure travelers, potentially reducing the number of holiday trips taken.

- Impact on business travel: While business travel is often less price-sensitive, rising costs could still lead to a reduction in overall business trips.

- Price elasticity of demand: Understanding the price elasticity of demand for air travel – how sensitive demand is to price changes – is crucial for predicting the overall impact of higher ticket prices.

Economic Implications and Industry Consolidation

The financial strain on airlines due to soaring fuel costs could trigger a wave of mergers and acquisitions, leading to industry consolidation. This could have a profound impact on competition and consumer choice.

- Potential mergers or bankruptcies: Weaker airlines might struggle to survive, leading to mergers with larger competitors or even bankruptcy.

- Impact on employment: Industry consolidation could lead to job losses within the airline sector, affecting numerous employees and related industries.

- Government interventions or bailouts: Governments might intervene to support struggling airlines, potentially through financial bailouts or other forms of assistance. However, such interventions can be controversial and have long-term economic implications.

Strategies for Airlines to Mitigate the Impact of Oil Price Volatility

Airlines are actively seeking ways to mitigate the impact of volatile oil prices on their profitability and operations.

Fuel Hedging and Risk Management

Fuel hedging is a crucial risk management tool for airlines. However, its effectiveness depends on the accuracy of market predictions.

- Different types of fuel hedging contracts: Airlines employ various hedging strategies, including futures contracts, options, and swaps. The choice of hedging strategy depends on factors like risk tolerance and market outlook.

- Examples of successful and unsuccessful hedging strategies: Examining past cases of both successful and unsuccessful hedging strategies offers valuable lessons for future risk management.

- Limitations of hedging in unpredictable markets: In highly volatile markets, even sophisticated hedging strategies can fail to fully protect against unexpected price swings.

Technological Advancements and Operational Efficiency

Technological innovations and operational efficiencies can help airlines offset some of the increased fuel costs.

- Examples of fuel-efficient aircraft: The adoption of newer, more fuel-efficient aircraft is a key strategy for reducing fuel consumption.

- Implementation of advanced flight planning software: Optimizing flight routes and reducing fuel burn through sophisticated software is critical.

- Implementation of sustainable aviation fuels (SAFs): Investing in and utilizing sustainable aviation fuels is a longer-term strategy that offers both environmental and economic benefits.

Conclusion

The airline industry is undeniably facing significant challenges due to global oil supply shocks and the subsequent surge in fuel costs. These challenges impact profitability, air travel accessibility, and the broader economy. The increased costs are passed on to consumers through higher ticket prices, potentially impacting both leisure and business travel. Moreover, the financial strain could trigger mergers, bankruptcies, and job losses within the sector.

The future of the airline industry hinges on its ability to adapt to this volatile environment. Further research and investment in sustainable aviation fuels (SAFs) and other innovative solutions for fuel efficiency are crucial to navigating these headwinds and ensuring the long-term viability of air travel. Understanding the complexities of global oil supply shocks and their impact on the airline industry is paramount for investors, policymakers, and travelers alike. Effective fuel cost management and proactive strategies are essential for the continued success of the aviation industry.

Featured Posts

-

Gaza Aid Ship Attacked Drones Target Activist Vessel

May 03, 2025

Gaza Aid Ship Attacked Drones Target Activist Vessel

May 03, 2025 -

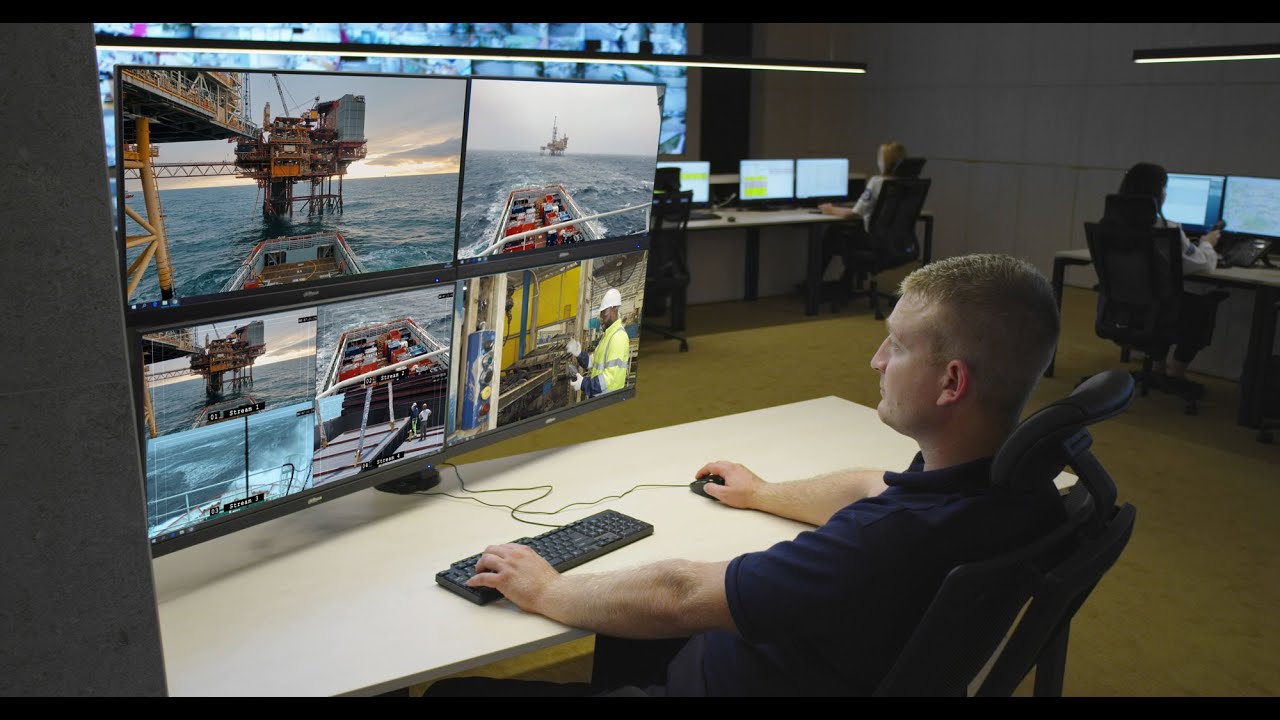

Sydney Harbour Surveillance Monitoring The Rise Of Chinese Maritime Activity

May 03, 2025

Sydney Harbour Surveillance Monitoring The Rise Of Chinese Maritime Activity

May 03, 2025 -

Analysis Of Financing Options For A 270 M Wh Bess Project In Belgium

May 03, 2025

Analysis Of Financing Options For A 270 M Wh Bess Project In Belgium

May 03, 2025 -

Fortnites Shifting Landscape The Implications Of Removed Game Modes

May 03, 2025

Fortnites Shifting Landscape The Implications Of Removed Game Modes

May 03, 2025 -

Souness On Rice Arsenal Star Needs Final Third Boost For World Class Potential

May 03, 2025

Souness On Rice Arsenal Star Needs Final Third Boost For World Class Potential

May 03, 2025