Amsterdam Exchange Down 2%: Impact Of Trump's Latest Tariff Increase

Table of Contents

Immediate Impact on Key Amsterdam Exchange Sectors

The AEX Index, a key indicator of the Amsterdam Exchange's performance, suffered a substantial decline following the tariff announcement. This wasn't evenly distributed across sectors; the energy and technology sectors were disproportionately impacted. The increased uncertainty surrounding global trade has led to investor hesitancy, triggering significant sell-offs.

-

Significant decline in the AEX Index: The AEX Index plummeted, reflecting a widespread loss of investor confidence. Preliminary estimates suggest a drop exceeding the initial 2%, with further declines possible depending on market reactions in the coming days.

-

Disproportionate impact on energy and technology stocks: Companies heavily reliant on international trade, particularly within the energy and technology sectors, experienced sharper declines than others. For example, [insert name of a specific energy company] saw a [percentage]% drop, while [insert name of a tech company] experienced a [percentage]% decrease. This highlights the vulnerability of export-oriented businesses to trade wars.

-

Analysis of specific companies and their performance: A detailed analysis of individual company performances is crucial for understanding the nuanced impact of the tariffs. Further investigation will reveal the specific factors contributing to the varied responses of different companies listed on the Amsterdam Exchange.

-

Comparison to previous tariff-related market fluctuations: This downturn echoes similar market reactions observed during previous rounds of tariff increases. However, the cumulative effect of these actions is now more acutely felt, signifying a potential tipping point in market sentiment.

Broader European Market Reaction to Trump's Tariff Announcement

The ripple effect of the Amsterdam Exchange's drop extended across other European markets. The announcement fueled a general sense of uncertainty, negatively affecting investor confidence across the Eurozone. The Frankfurt, Paris, and London stock exchanges all experienced notable declines, demonstrating a synchronized response to the increased trade tensions.

-

Impact on other major European stock exchanges (e.g., Frankfurt, Paris, London): These exchanges registered significant drops, indicating a widespread concern about the potential long-term consequences of the escalating trade war. The interconnectedness of European markets amplified the initial shockwave from Amsterdam.

-

Changes in the Euro's value against the US dollar: The Euro experienced a weakening against the US dollar following the announcement, reflecting a decrease in investor confidence in the Eurozone economy. This currency fluctuation further exacerbates the economic challenges faced by European businesses.

-

Expert opinions on the long-term consequences for the EU economy: Economists express significant concern about the potential for prolonged economic slowdown. The uncertainty created by unpredictable trade policies inhibits investment and growth.

-

Comparison to similar trade disputes and their economic consequences: Historical precedents suggest that prolonged trade disputes can have severe long-term consequences, including decreased economic growth, increased inflation, and higher unemployment rates.

Potential Long-Term Economic Consequences for the Netherlands

The potential long-term consequences of the tariff increase on the Netherlands' economy are far-reaching. The Netherlands, with its robust export sector, is particularly vulnerable to disruptions in global trade. Foreign investment, a crucial engine of economic growth, could also be negatively affected.

-

Analysis of the Netherlands' key export markets and their vulnerability to tariffs: The Netherlands' reliance on specific export markets makes it susceptible to retaliatory tariffs. Industries like [mention specific Dutch export sectors] will be closely monitored for their ability to withstand these trade pressures.

-

Potential impact on foreign direct investment in the Netherlands: Uncertainty surrounding trade policies discourages foreign direct investment, potentially hindering future economic growth in the Netherlands.

-

Predictions for economic growth and inflation in the coming months: Economists predict a slowdown in economic growth and potentially increased inflation as a result of the higher import costs stemming from the tariffs.

-

Possible effects on the Dutch unemployment rate: If export-oriented industries are forced to scale back production or even shut down, the unemployment rate in the Netherlands may increase.

Government Response and Mitigation Strategies

The Dutch government is likely to implement mitigation strategies to minimize the negative economic impact. This may include negotiations with the US government and EU-wide coordination efforts.

-

Statements from Dutch government officials: The Dutch government has yet to issue an official statement addressing the immediate concerns, but close monitoring of the situation and the exploration of potential mitigation strategies are expected.

-

Potential economic stimulus packages: The government may consider stimulus packages designed to support affected industries and boost the overall economy.

-

Negotiations with the US government: Diplomatic efforts to resolve the trade disputes are crucial for mitigating the negative consequences for the Dutch economy.

-

EU-wide strategies to counter the impact of the tariffs: The EU is likely to coordinate its response to these tariffs to limit the overall negative impact on its member states.

Conclusion

President Trump's latest tariff increase has had a significant and immediate impact on the Amsterdam Exchange, causing a 2% drop and sending shockwaves through European markets. The energy and technology sectors were particularly hard hit. This downturn highlights the interconnectedness of global markets and the potential for long-term economic consequences, including decreased growth, increased inflation, and higher unemployment in the Netherlands and across Europe. The Dutch government and the EU as a whole will need to implement effective mitigation strategies to counteract the negative impacts. Stay updated on the latest news regarding the Amsterdam Exchange and Trump's tariffs to better understand the evolving situation and its consequences. Follow our updates on the impact of these tariffs on the Amsterdam Exchange and learn more about the effects of trade wars on the Amsterdam Exchange.

Featured Posts

-

Live Euro Klimt Boven 1 08 Impact Van Hogere Rentes

May 25, 2025

Live Euro Klimt Boven 1 08 Impact Van Hogere Rentes

May 25, 2025 -

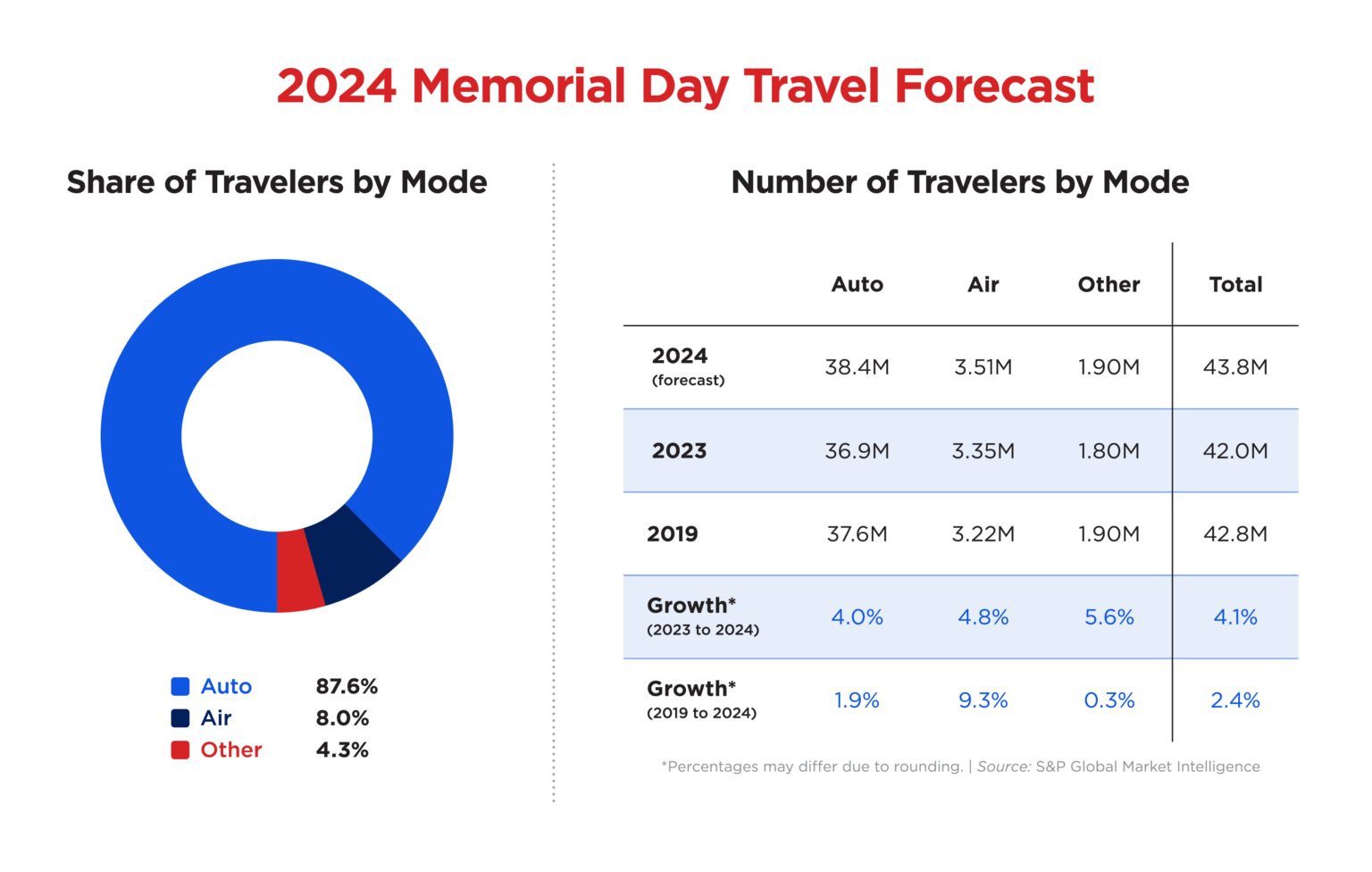

Planning Your Memorial Day Trip The Busiest Flight Days Of 2025

May 25, 2025

Planning Your Memorial Day Trip The Busiest Flight Days Of 2025

May 25, 2025 -

The Four Women Who Married Frank Sinatra Their Stories

May 25, 2025

The Four Women Who Married Frank Sinatra Their Stories

May 25, 2025 -

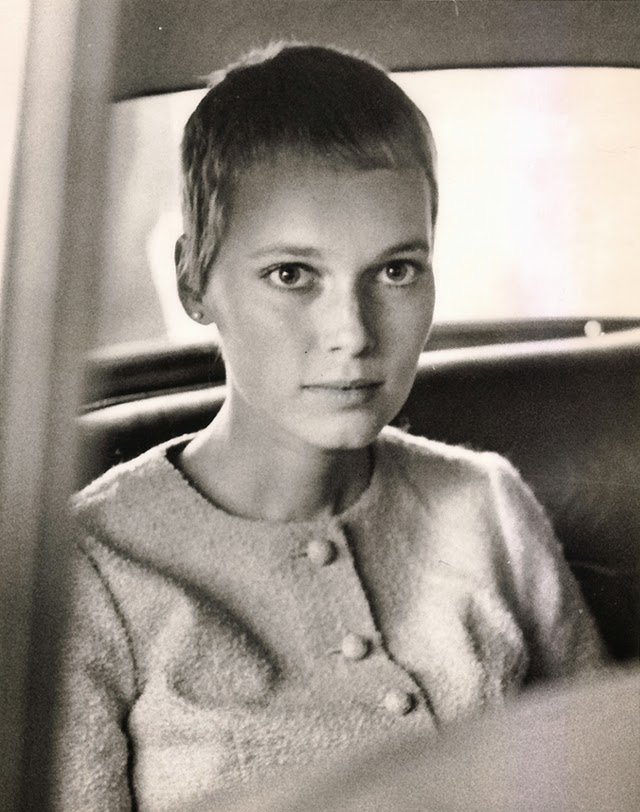

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 25, 2025

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 25, 2025 -

Porsche Macan Your Comprehensive Buyers Guide 2024

May 25, 2025

Porsche Macan Your Comprehensive Buyers Guide 2024

May 25, 2025

Latest Posts

-

Monaco Corruption Scandal The Prince And His Financial Advisor

May 25, 2025

Monaco Corruption Scandal The Prince And His Financial Advisor

May 25, 2025 -

Georgia Man Charged With Murder 19 Years After Wifes Killing And Nannys Disappearance

May 25, 2025

Georgia Man Charged With Murder 19 Years After Wifes Killing And Nannys Disappearance

May 25, 2025 -

The Tumultuous Week That Defined Joe Bidens Post Presidential Life

May 25, 2025

The Tumultuous Week That Defined Joe Bidens Post Presidential Life

May 25, 2025 -

Joe Bidens Post Presidency The Week That Changed Everything

May 25, 2025

Joe Bidens Post Presidency The Week That Changed Everything

May 25, 2025 -

The Week That Derailed Joe Bidens Post Presidency A Critical Examination

May 25, 2025

The Week That Derailed Joe Bidens Post Presidency A Critical Examination

May 25, 2025