Amundi Dow Jones Industrial Average UCITS ETF: Daily NAV And Its Significance

Table of Contents

What is the Amundi Dow Jones Industrial Average UCITS ETF?

The Amundi Dow Jones Industrial Average UCITS ETF is designed to track the performance of the prestigious Dow Jones Industrial Average. Its investment objective is to mirror the movements of this major US stock market index as closely as possible. The "UCITS" designation signifies that this ETF complies with the Undertakings for Collective Investment in Transferable Securities (UCITS) directive, a regulatory framework within the European Union. This makes it readily accessible and attractive to investors across Europe. Furthermore, this ETF boasts a low expense ratio, meaning a smaller percentage of your investment goes towards fees, allowing for potentially higher returns.

- Replicates the DJIA index: The ETF aims to accurately reflect the price movements of the 30 large, publicly traded companies that constitute the DJIA.

- Provides diversified exposure to 30 large US companies: Investing in this ETF gives you instant diversification across a basket of leading American companies, reducing the risk associated with holding individual stocks.

- Suitable for long-term investors: The ETF is ideally suited for investors with a long-term investment horizon seeking exposure to the US equity market.

- UCITS compliant for ease of access across Europe: Its UCITS structure simplifies the investment process for European investors, streamlining regulatory compliance.

Understanding Daily NAV and its Calculation

The daily NAV (Net Asset Value) of the Amundi Dow Jones Industrial Average UCITS ETF represents the value of the ETF's underlying assets per share. It's calculated daily by taking the total value of all the assets held by the ETF (shares of the 30 DJIA companies), subtracting any liabilities, and dividing by the total number of outstanding shares.

Several factors influence the daily NAV, most significantly:

- Market movements: Fluctuations in the prices of the 30 constituent companies of the DJIA directly impact the ETF's NAV. A rising market generally leads to a higher NAV, and vice versa.

- Currency fluctuations: If you are holding a share class denominated in a currency other than USD, fluctuations in exchange rates can affect the NAV in your local currency.

The NAV is typically published at the end of the trading day, reflecting the closing prices of the underlying assets.

- Daily calculation based on the closing prices of the underlying assets: The NAV calculation uses the final prices of the DJIA components at the market close.

- Influenced by market volatility: Market ups and downs directly translate to NAV changes.

- Usually available at the end of the trading day: Investors can typically access the updated NAV at the close of the trading session.

- Reflects the net asset value per share: This figure shows the value of one share of the Amundi Dow Jones Industrial Average UCITS ETF.

The Significance of Daily NAV for Investors

The daily NAV is a vital tool for investors tracking their Amundi Dow Jones Industrial Average UCITS ETF performance. By monitoring the daily NAV, investors can:

- Track investment performance: Comparing the daily NAV against your initial investment allows you to gauge your returns.

- Compare with benchmarks: You can compare the ETF's performance against the DJIA itself to assess its tracking efficiency.

- Inform investment decisions (buy/sell): Analyzing NAV trends can help in making informed buy or sell decisions.

- Calculate returns on investment: Using the daily NAV data, you can easily calculate your overall returns.

You can find the daily NAV information on the official Amundi website, reputable financial news websites, and through your brokerage account.

Risks Associated with Investing in the Amundi Dow Jones Industrial Average UCITS ETF

Investing in any stock market-related product carries inherent risks. With the Amundi Dow Jones Industrial Average UCITS ETF, key risks include:

- Market risk (fluctuations in the DJIA): The DJIA, and consequently the ETF, is subject to market volatility. Bear markets can lead to significant NAV declines.

- Currency risk (if holding a non-USD denominated share class): If you invest in a share class not denominated in US dollars, currency fluctuations can influence your returns.

- Counterparty risk (risk of default of the ETF issuer): While rare, there's a small risk associated with the ETF issuer's potential inability to meet its obligations.

- Consider other investment options to diversify portfolio: It is crucial to diversify your investments across different asset classes to mitigate risk. Don't put all your eggs in one basket.

Conclusion: Monitoring Your Investment in the Amundi Dow Jones Industrial Average UCITS ETF Through Daily NAV

Understanding the daily NAV of the Amundi Dow Jones Industrial Average UCITS ETF is critical for effective investment management. By regularly monitoring the daily NAV, you can track your investment's performance against the DJIA, make informed buy/sell decisions, and calculate your returns. Remember to consider the inherent risks associated with stock market investments and diversify your portfolio accordingly. For more information on ETFs, the DJIA, and the Amundi Dow Jones Industrial Average UCITS ETF, refer to the Amundi website [insert Amundi website link here]. Regularly monitor your Amundi Dow Jones Industrial Average UCITS ETF daily NAV to track your ETF, monitor your investment, and stay informed about DJIA performance.

Featured Posts

-

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 25, 2025

Amundi Msci World Catholic Principles Ucits Etf Acc A Guide To Net Asset Value Nav

May 25, 2025 -

Desempenho Aprimorado Ferrari 296 Speciale Com 880 Cv Hibridos

May 25, 2025

Desempenho Aprimorado Ferrari 296 Speciale Com 880 Cv Hibridos

May 25, 2025 -

Neden Porsche 956 Araclari Tavanlardan Asili Durumda Sergileniyor

May 25, 2025

Neden Porsche 956 Araclari Tavanlardan Asili Durumda Sergileniyor

May 25, 2025 -

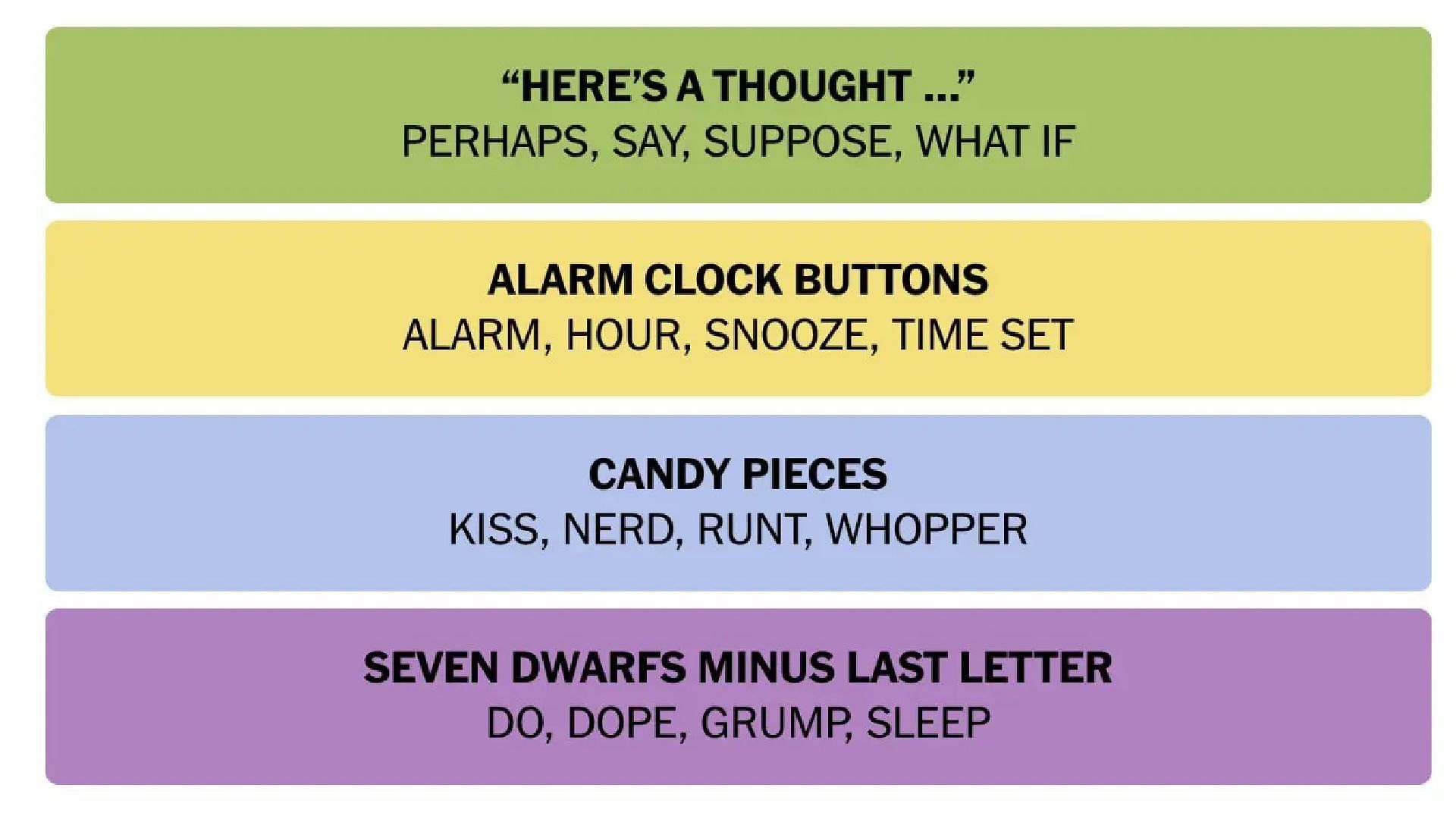

March 18 2025 New York Times Connections Game Puzzle 646 Answers

May 25, 2025

March 18 2025 New York Times Connections Game Puzzle 646 Answers

May 25, 2025 -

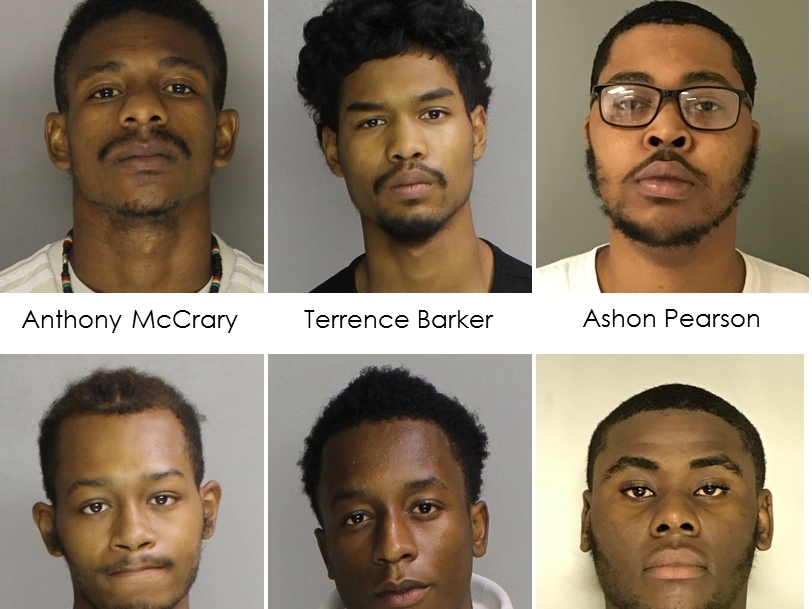

Major Gun Trafficking Bust In Massachusetts 18 Brazilian Nationals Face Charges

May 25, 2025

Major Gun Trafficking Bust In Massachusetts 18 Brazilian Nationals Face Charges

May 25, 2025

Latest Posts

-

Relx Succesformule Ai Als Motor Voor Groei Zelfs In Economisch Moeilijke Tijden

May 25, 2025

Relx Succesformule Ai Als Motor Voor Groei Zelfs In Economisch Moeilijke Tijden

May 25, 2025 -

Analyse Stijgende Kapitaalmarktrentes En Euros Sterkte

May 25, 2025

Analyse Stijgende Kapitaalmarktrentes En Euros Sterkte

May 25, 2025 -

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 25, 2025

Trumps Tariff Decision 8 Jump In Euronext Amsterdam Stock Trading

May 25, 2025 -

Ai Gedreven Groei Hoe Relx De Zwakke Economie Overwint

May 25, 2025

Ai Gedreven Groei Hoe Relx De Zwakke Economie Overwint

May 25, 2025 -

Amsterdam Stock Index Plunges Over 4 Hits Year Low

May 25, 2025

Amsterdam Stock Index Plunges Over 4 Hits Year Low

May 25, 2025