Amundi MSCI All Country World UCITS ETF USD Acc: A Guide To Net Asset Value

Table of Contents

What is Net Asset Value (NAV)?

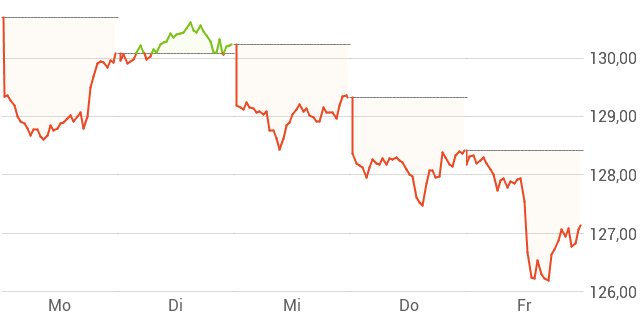

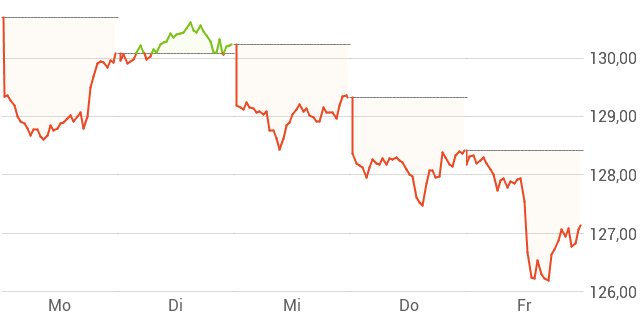

Net Asset Value (NAV) is simply the value of an ETF's assets minus its liabilities, divided by the number of outstanding shares. For the Amundi MSCI All Country World UCITS ETF USD Acc, this calculation involves determining the total market value of all the stocks, bonds, and other assets held within the ETF's portfolio. Liabilities, such as management fees and expenses, are then subtracted. The resulting figure is then divided by the total number of outstanding shares to arrive at the NAV per share.

Understanding the NAV is paramount for investors because it directly reflects the intrinsic value of their investment. Tracking the NAV allows investors to accurately gauge the performance of the Amundi MSCI All Country World UCITS ETF USD Acc over time, irrespective of short-term market fluctuations in the ETF's trading price.

- NAV reflects the market value of all ETF holdings. This means it considers the current prices of all the underlying assets.

- NAV is calculated daily, usually at market close. This ensures a relatively up-to-date representation of the ETF's value.

- Changes in NAV reflect changes in the value of underlying assets. A rising NAV generally indicates that the value of the ETF's holdings has increased.

- NAV per share is readily available from ETF providers and financial websites. Accessing this information is straightforward and crucial for informed decision-making.

Factors Affecting Amundi MSCI All Country World UCITS ETF USD Acc NAV

Several factors influence the NAV of the Amundi MSCI All Country World UCITS ETF USD Acc. These factors are largely external and often interconnected, making it crucial to understand their potential impact.

-

Global market fluctuations: Global economic events, such as recessions or periods of robust growth, significantly influence the overall market value of the ETF's holdings. A global market downturn will typically lead to a decline in the NAV.

-

Currency exchange rate effects: Because this is a USD-denominated ETF, fluctuations in the value of the US dollar against other currencies will directly affect the NAV. A strengthening dollar will generally increase the NAV (assuming other factors remain constant), while a weakening dollar will have the opposite effect.

-

Impact of individual stock performance: The ETF tracks the MSCI All Country World Index, a broad market index. However, the performance of individual stocks within that index will contribute to the overall NAV movement. Strong performance by major holdings will boost the NAV, while underperformance will have a negative impact.

-

Dividend distributions: When underlying companies within the index pay dividends, the ETF receives these dividends, which can positively impact the NAV. However, this impact is often temporary, as the distribution reduces the overall value of the holdings.

-

Global economic events (recessions, growth spurts): These macroeconomic factors have a substantial influence on the overall market value.

-

Performance of major market indices (e.g., S&P 500, FTSE 100): The performance of these indices offers insights into broader market trends and their potential effect on the ETF's NAV.

-

Changes in the USD exchange rate versus other currencies: Currency fluctuations can significantly affect the NAV of a USD-denominated ETF.

-

Sectoral shifts and their effect on the ETF's holdings: Changes in the relative performance of different economic sectors can influence the overall NAV.

Where to Find the Amundi MSCI All Country World UCITS ETF USD Acc NAV

Access to accurate and up-to-date Amundi MSCI All Country World UCITS ETF USD Acc NAV data is readily available through several reliable channels:

- Official ETF provider website (Amundi): Amundi's official website is the primary source for accurate NAV information.

- Reputable financial data providers (Bloomberg, Yahoo Finance, etc.): These providers offer real-time or near real-time data on ETF NAVs.

- Brokerage platforms: Most brokerage platforms display the NAV of ETFs held within client portfolios.

It's recommended to compare NAV data from different sources to ensure accuracy and identify any potential discrepancies. Be aware that there might be slight lags in data updates across different platforms.

- Regularly check the NAV for tracking performance: Consistent monitoring allows for effective performance evaluation.

- Compare NAV with the ETF's market price to identify potential arbitrage opportunities: This comparison can reveal potential discrepancies and trading opportunities.

- Use reliable sources to ensure accuracy: Stick to reputable sources to avoid misleading or outdated information.

- Understand data lags and potential discrepancies: Be aware that minor differences might exist between different data providers.

Understanding NAV and ETF Market Price Differences

While the NAV represents the underlying value of the ETF's holdings, the market price is the actual price at which the ETF is currently trading on the exchange. Sometimes, the market price can trade at a premium (above the NAV) or a discount (below the NAV). These differences are usually driven by supply and demand dynamics in the market. Understanding this difference is essential for informed trading decisions, as buying at a significant premium or selling at a significant discount might not be optimal.

Conclusion

Understanding the Net Asset Value (NAV) of the Amundi MSCI All Country World UCITS ETF USD Acc is crucial for making informed investment decisions. By regularly monitoring the NAV and understanding the factors influencing it, investors can better track the performance of their investment and make strategic choices. Remember to utilize reliable sources to access accurate Amundi MSCI All Country World UCITS ETF USD Acc NAV data and always consider the difference between the NAV and the market price. Keep monitoring the Amundi MSCI All Country World UCITS ETF USD Acc NAV to optimize your investment strategy!

Featured Posts

-

2025 Porsche Cayenne Interior And Exterior Design Image Gallery

May 24, 2025

2025 Porsche Cayenne Interior And Exterior Design Image Gallery

May 24, 2025 -

Annie Kilners Posts Following Kyle Walker Night Out Allegations Of Poisoning Men

May 24, 2025

Annie Kilners Posts Following Kyle Walker Night Out Allegations Of Poisoning Men

May 24, 2025 -

Unfall Stemwede Zusammenstoss Mit Baum Verletzte Person Aus Bad Essen

May 24, 2025

Unfall Stemwede Zusammenstoss Mit Baum Verletzte Person Aus Bad Essen

May 24, 2025 -

Ferrari 296 Speciale Detalhes Do Novo Motor Hibrido De 880 Cv

May 24, 2025

Ferrari 296 Speciale Detalhes Do Novo Motor Hibrido De 880 Cv

May 24, 2025 -

Tracking The Net Asset Value Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Tracking The Net Asset Value Of The Amundi Msci World Catholic Principles Ucits Etf Acc

May 24, 2025

Latest Posts

-

M6 Southbound Traffic 60 Minute Delays After Accident

May 24, 2025

M6 Southbound Traffic 60 Minute Delays After Accident

May 24, 2025 -

Major M56 Accident Severe Delays Impacting Cheshire And Deeside Drivers

May 24, 2025

Major M56 Accident Severe Delays Impacting Cheshire And Deeside Drivers

May 24, 2025 -

High Speed Police Chase The Incredible Refueling Incident

May 24, 2025

High Speed Police Chase The Incredible Refueling Incident

May 24, 2025 -

M56 Traffic Cheshire And Deeside Facing Significant Delays Due To Accident

May 24, 2025

M56 Traffic Cheshire And Deeside Facing Significant Delays Due To Accident

May 24, 2025 -

90mph Chase Ends With Unbelievable Mid Speed Refueling

May 24, 2025

90mph Chase Ends With Unbelievable Mid Speed Refueling

May 24, 2025