Amundi MSCI World II UCITS ETF Dist: A Guide To Net Asset Value (NAV)

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated?

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. For the Amundi MSCI World II UCITS ETF Dist, this means calculating the total value of all the underlying assets within the ETF's portfolio. These assets typically include a diverse range of global equities mirroring the MSCI World Index.

The calculation process involves several steps:

- Determining the market value of all underlying assets: This involves assessing the current market price of each stock within the ETF's portfolio.

- Adding up the total value of all assets: This sums the market value of each holding to arrive at the total asset value.

- Subtracting liabilities: This includes expenses like management fees and other operational costs.

- Dividing by the number of outstanding shares: This final step gives the NAV per share.

Several factors can affect the NAV of the Amundi MSCI World II UCITS ETF Dist:

- Market fluctuations: Changes in the prices of the underlying equities directly influence the NAV.

- Currency exchange rates: As the ETF holds globally diversified assets, currency fluctuations can impact the overall value.

- Dividend reinvestment: Reinvesting dividends from underlying holdings increases the overall asset value and thus the NAV.

How NAV Impacts Amundi MSCI World II UCITS ETF Dist Investment Decisions

Daily NAV fluctuations directly impact the Amundi MSCI World II UCITS ETF Dist's share price. Monitoring the NAV is essential for several reasons:

- Investment timing: Observing NAV trends can help investors identify potential buying opportunities (when NAV is low) or selling points (when NAV is high).

- Performance evaluation: Comparing the NAV over time provides a clear picture of the ETF's performance and the return on your investment.

- Buy/sell decisions: Understanding NAV changes can inform informed buy/sell decisions, aligning your trades with the ETF’s underlying asset performance.

- Portfolio performance: Tracking NAV helps you assess the contribution of the Amundi MSCI World II UCITS ETF Dist to your overall portfolio performance.

Where to Find the Amundi MSCI World II UCITS ETF Dist NAV

Reliable sources for accessing real-time and historical NAV data for the Amundi MSCI World II UCITS ETF Dist include:

- Amundi's official website: This is the primary source for accurate and up-to-date information. Look for dedicated sections on ETF details and fund factsheets.

- Financial news websites: Major financial news providers usually display ETF NAVs, though always verify the source's reliability.

- Brokerage platforms: Most online brokerage accounts display real-time NAV for the ETFs held within your portfolio.

Remember to use trusted sources to ensure the accuracy of the NAV data you utilize. Misinformation can lead to poor investment decisions.

Understanding the Impact of Distributions on NAV

The Amundi MSCI World II UCITS ETF Dist makes dividend distributions periodically. These distributions impact the NAV:

- Ex-dividend date: The ex-dividend date is when the share price adjusts to reflect the upcoming dividend payment. On or after this date, purchasers will not receive the next dividend.

- Dividend reinvestment: Many investors opt for dividend reinvestment, where the distributions are automatically reinvested to purchase more shares. This increases the number of shares owned but might not immediately affect the NAV per share significantly.

- NAV before and after distributions: The NAV will typically drop on the ex-dividend date, reflecting the distribution paid out. However, the total value of your investment (considering both the cash received and the reduced NAV) should remain relatively consistent.

Conclusion: Mastering Amundi MSCI World II UCITS ETF Dist NAV for Informed Investing

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF Dist is crucial for making informed investment decisions. By monitoring NAV fluctuations, you can better time your entries and exits, assess performance, and manage your portfolio effectively. Remember to utilize reliable sources like Amundi's website and reputable financial news outlets to obtain accurate NAV data. Actively monitor your Amundi MSCI World II UCITS ETF Dist NAV, understand your ETF's NAV, and make informed decisions using NAV data to maximize your investment potential. Regularly reviewing your ETF’s NAV allows for better oversight and more strategic investment management.

Featured Posts

-

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist A Comprehensive Overview

May 24, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist A Comprehensive Overview

May 24, 2025 -

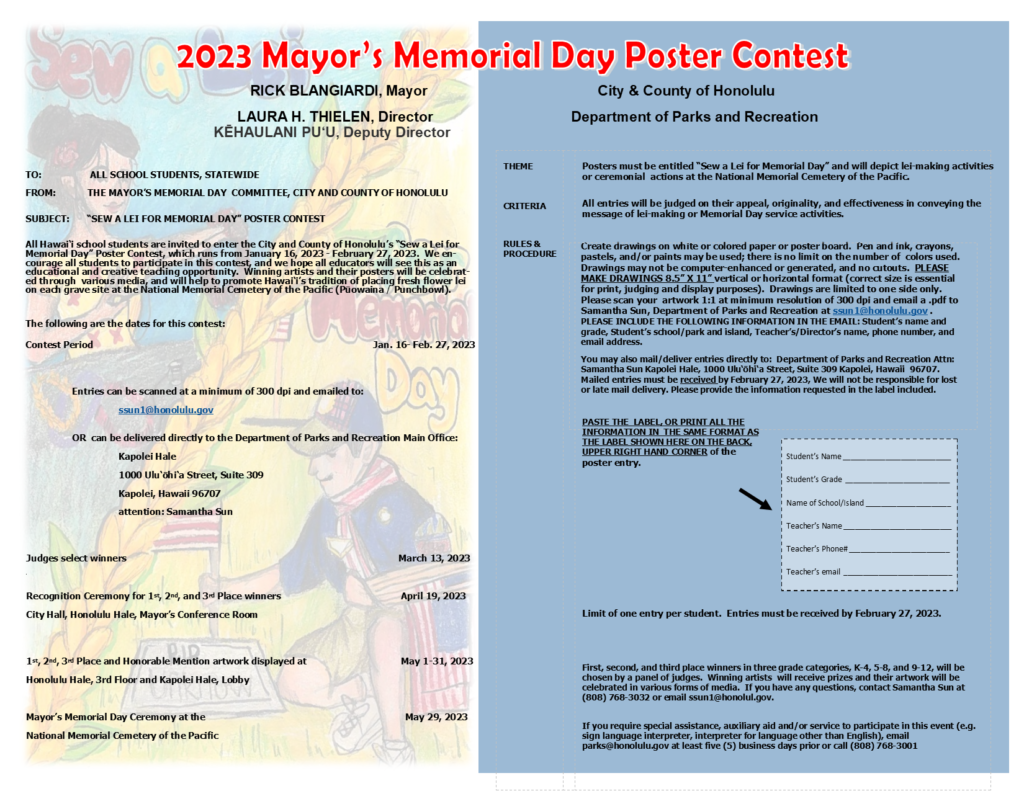

Hawaii Keiki Memorial Day Lei Making Poster Contest Showcasing Young Artists

May 24, 2025

Hawaii Keiki Memorial Day Lei Making Poster Contest Showcasing Young Artists

May 24, 2025 -

Experience The Ferrari Challenge Racing Days In South Florida

May 24, 2025

Experience The Ferrari Challenge Racing Days In South Florida

May 24, 2025 -

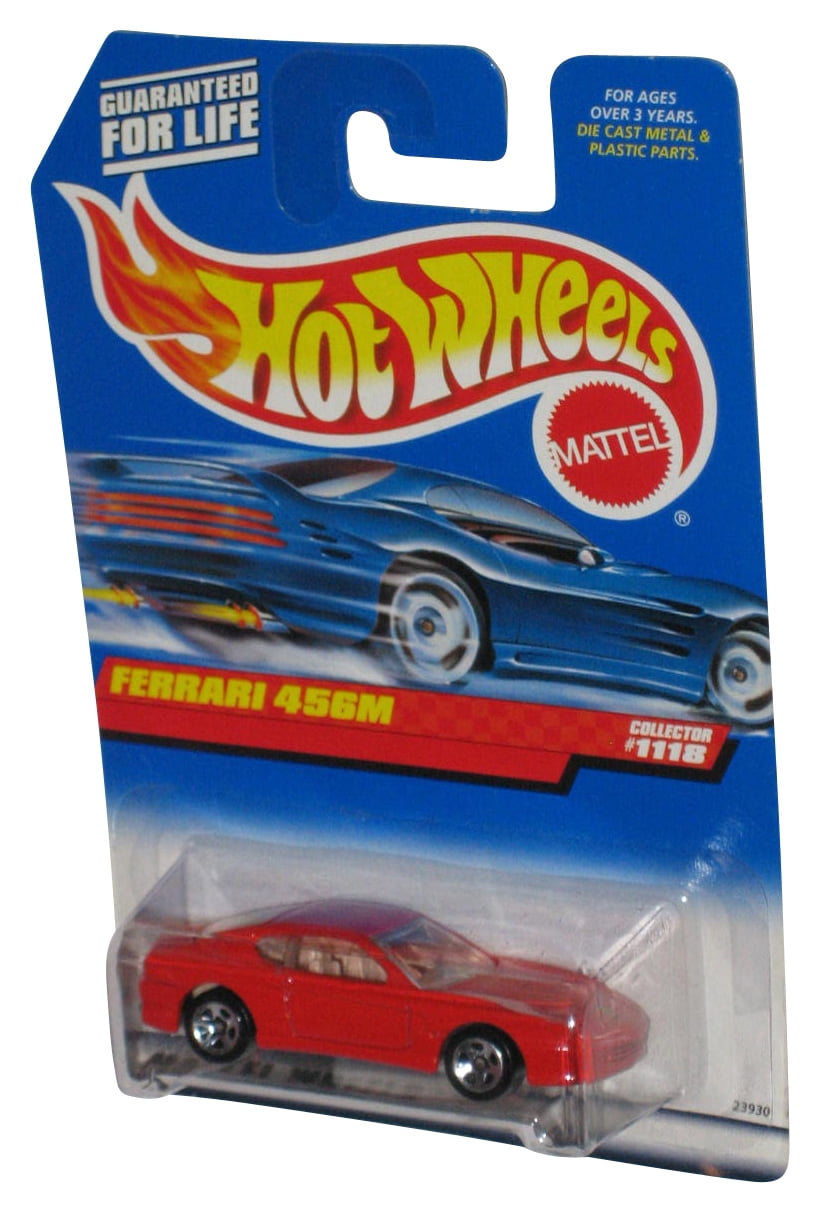

Mamma Mia A Look At The New Ferrari Hot Wheels Car Sets

May 24, 2025

Mamma Mia A Look At The New Ferrari Hot Wheels Car Sets

May 24, 2025 -

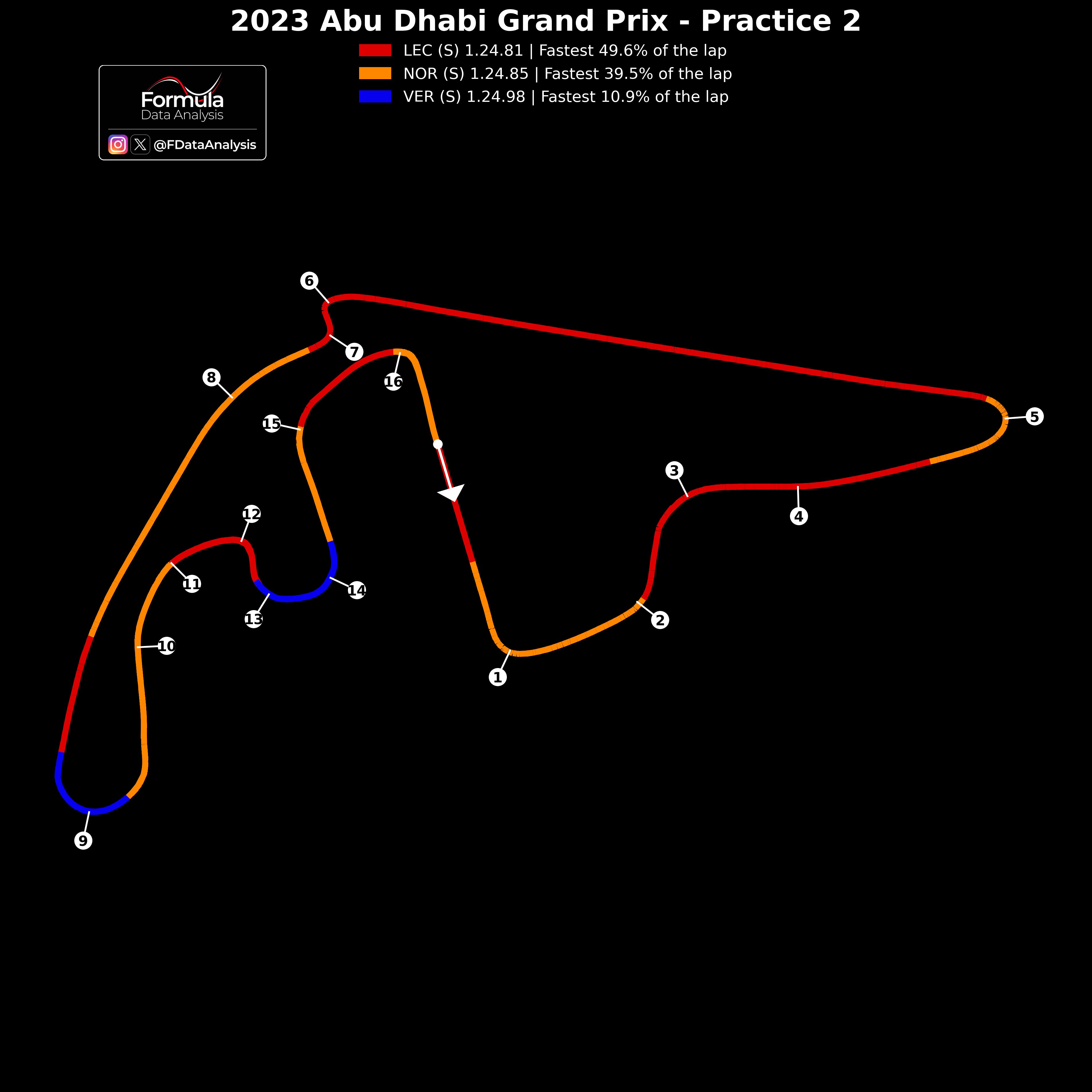

Ranking The 10 Fastest Standard Production Ferraris A Track Day Analysis

May 24, 2025

Ranking The 10 Fastest Standard Production Ferraris A Track Day Analysis

May 24, 2025

Latest Posts

-

The M62 Relief Road Burys Unrealised Transport Plan

May 24, 2025

The M62 Relief Road Burys Unrealised Transport Plan

May 24, 2025 -

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025

M56 Motorway Crash Car Overturns Paramedics Treat Casualty

May 24, 2025 -

M62 Westbound Road Closure Resurfacing Project Manchester To Warrington

May 24, 2025

M62 Westbound Road Closure Resurfacing Project Manchester To Warrington

May 24, 2025 -

Burys Lost Motorway Investigating The Unbuilt M62 Relief Road

May 24, 2025

Burys Lost Motorway Investigating The Unbuilt M62 Relief Road

May 24, 2025 -

M6 Accident Delays And Diversions Latest News

May 24, 2025

M6 Accident Delays And Diversions Latest News

May 24, 2025