Amundi MSCI World II UCITS ETF Dist: Daily NAV Updates And Analysis

Table of Contents

Understanding the Daily NAV of Amundi MSCI World II UCITS ETF Dist

What is NAV and why is it important?

Net Asset Value (NAV) represents the net value of an ETF's underlying assets per share. It's calculated by subtracting liabilities from the total value of the ETF's holdings, then dividing by the number of outstanding shares. The daily NAV reflects the performance of the ETF's underlying assets, primarily global equities in the case of the Amundi MSCI World II UCITS ETF Dist. This is a key indicator of your investment's performance. Understanding your NAV helps you:

- Calculate returns: Track your investment's growth by comparing the daily NAV to your purchase price.

- Evaluate investment performance: Compare the NAV to benchmarks like the MSCI World Index to assess the ETF's performance relative to its target market.

- Make informed decisions: Monitor NAV changes to understand market trends and potentially adjust your investment strategy.

- Understand currency impacts: Fluctuations in exchange rates can affect the NAV, especially since this ETF invests globally.

Where to find reliable daily NAV updates?

Reliable daily NAV information is essential. Here are the best places to look:

- Amundi Website: The official Amundi website is your primary source for accurate NAV data.

- Financial News Platforms: Major financial news sources often provide ETF NAV data. Always verify the source's reliability.

- Brokerage Accounts: Your brokerage account should display the current NAV of your holdings.

It's crucial to use reliable sources to avoid misinformation. Discrepancies between sources might arise due to reporting lags or different calculation methods. If inconsistencies occur, always prioritize data from the official Amundi website.

Analyzing the Amundi MSCI World II UCITS ETF Dist's Performance

Factors influencing daily NAV changes

Several factors influence the daily NAV of the Amundi MSCI World II UCITS ETF Dist:

- Market Movements: Global indices like the MSCI World Index, performance of specific sectors (e.g., technology, energy), and macroeconomic factors (e.g., interest rates, inflation) significantly impact NAV.

- Dividend Distributions: Dividend payouts from the underlying companies in the ETF affect the NAV on the ex-dividend date.

- Expense Ratios: The ETF's expense ratio, representing the annual cost of managing the fund, indirectly impacts NAV over time.

Understanding these interconnected factors helps you interpret daily NAV fluctuations in context.

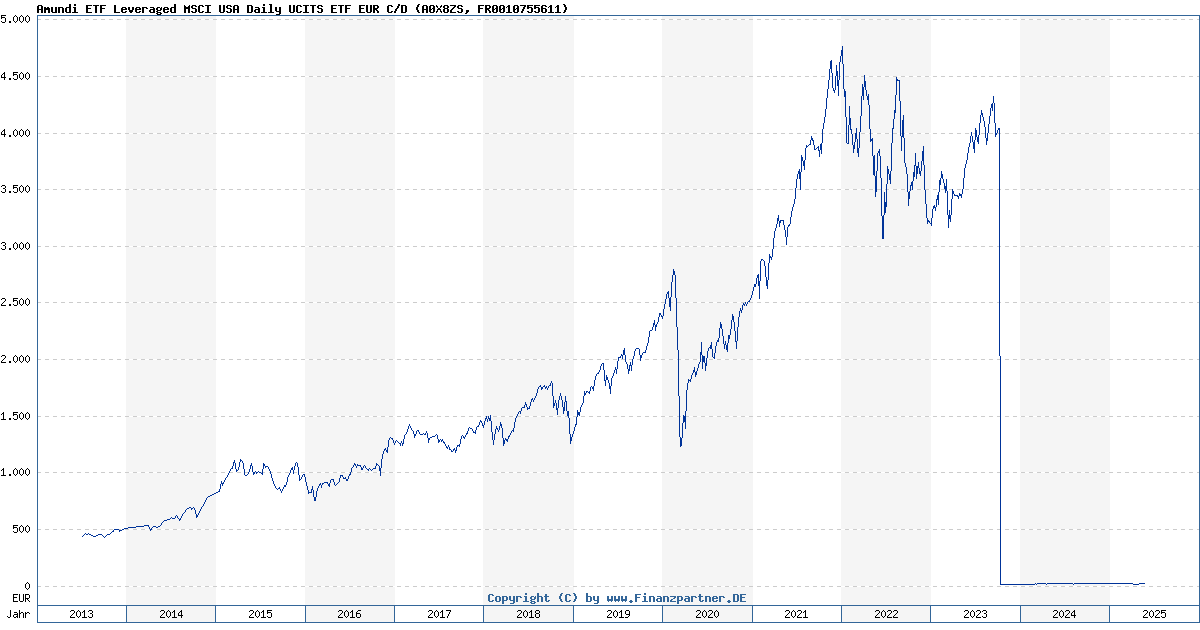

Long-term performance vs. short-term fluctuations

While daily NAV changes can be exciting, it's crucial to focus on the long-term performance trend. Passive investing, like this ETF offers, generally benefits from a long-term perspective. Short-term volatility is expected, but the Amundi MSCI World II UCITS ETF Dist aims for long-term growth mirroring the MSCI World Index. Historical data (easily found through reputable financial sites) will show the ETF's tendency towards long-term growth despite short-term market fluctuations.

Amundi MSCI World II UCITS ETF Dist: Dividend Distribution Analysis

Understanding the dividend distribution schedule

The Amundi MSCI World II UCITS ETF Dist distributes dividends periodically. The frequency and exact payment dates are usually outlined in the ETF's prospectus. Dividends are calculated based on the income generated by the underlying holdings. Remember to factor in the tax implications of dividend income in your country of residence.

The impact of dividends on NAV

Dividend payouts directly affect the NAV. On the ex-dividend date (the date after which you're no longer entitled to the dividend), the NAV typically decreases by the amount of the dividend per share. This is because the assets within the fund have decreased by the amount paid out. It's essential to distinguish between the gross NAV (before dividend distribution) and the net NAV (after distribution).

Conclusion

Regularly monitoring the daily NAV of the Amundi MSCI World II UCITS ETF Dist is crucial for making informed investment decisions. Understanding the factors influencing its performance, including market movements and dividend distributions, allows for a more comprehensive investment strategy. This ETF provides a diversified exposure to the global equity market, offering the potential for long-term growth through passive investing. By actively monitoring the Amundi MSCI World II UCITS ETF Dist’s NAV and understanding its performance drivers, you can effectively manage your investment and make informed choices that align with your financial goals. We encourage you to conduct further research on the Amundi MSCI World II UCITS ETF Dist and its suitability for your specific investment portfolio. Consult the official Amundi website and relevant prospectuses for detailed information. Remember, actively monitoring the Amundi MSCI World II UCITS ETF Dist’s NAV is key to successful long-term investing.

Featured Posts

-

Dow Jones Index Steady Climb Fueled By Positive Pmi Data

May 25, 2025

Dow Jones Index Steady Climb Fueled By Positive Pmi Data

May 25, 2025 -

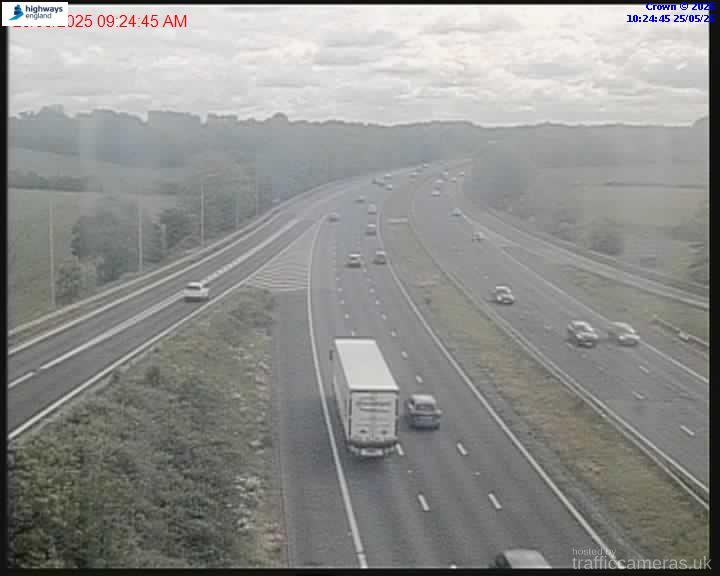

M56 Road Closure Current Traffic Updates Following Accident

May 25, 2025

M56 Road Closure Current Traffic Updates Following Accident

May 25, 2025 -

How Nicki Chapman Made 700 000 Investing In A Country Property

May 25, 2025

How Nicki Chapman Made 700 000 Investing In A Country Property

May 25, 2025 -

Country Living Awaits Your Guide To An Escape To The Countryside

May 25, 2025

Country Living Awaits Your Guide To An Escape To The Countryside

May 25, 2025 -

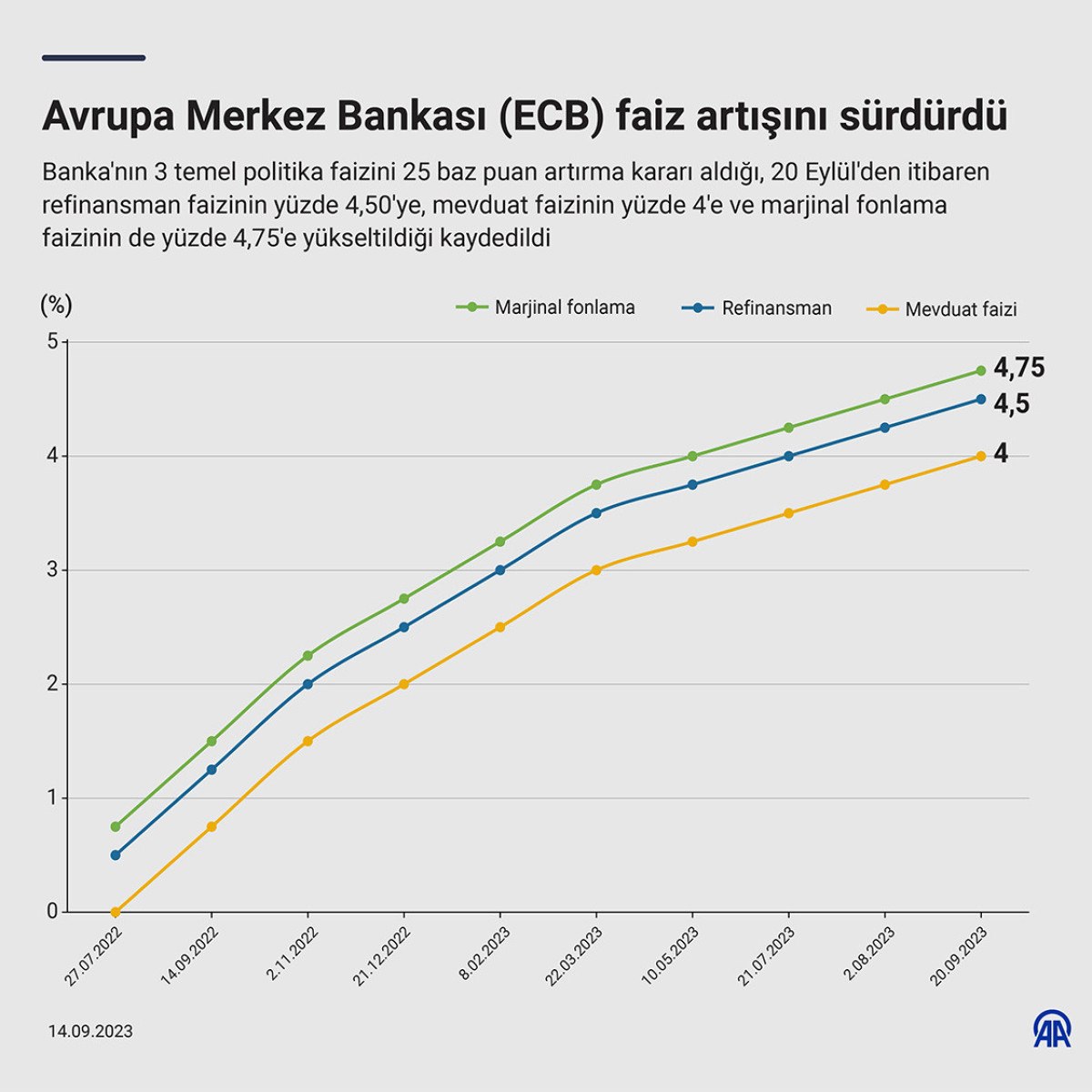

Avrupa Borsalari Ecb Faiz Politikasinda Degisimden Nasil Etkilendi

May 25, 2025

Avrupa Borsalari Ecb Faiz Politikasinda Degisimden Nasil Etkilendi

May 25, 2025

Latest Posts

-

Tracking The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Tracking The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

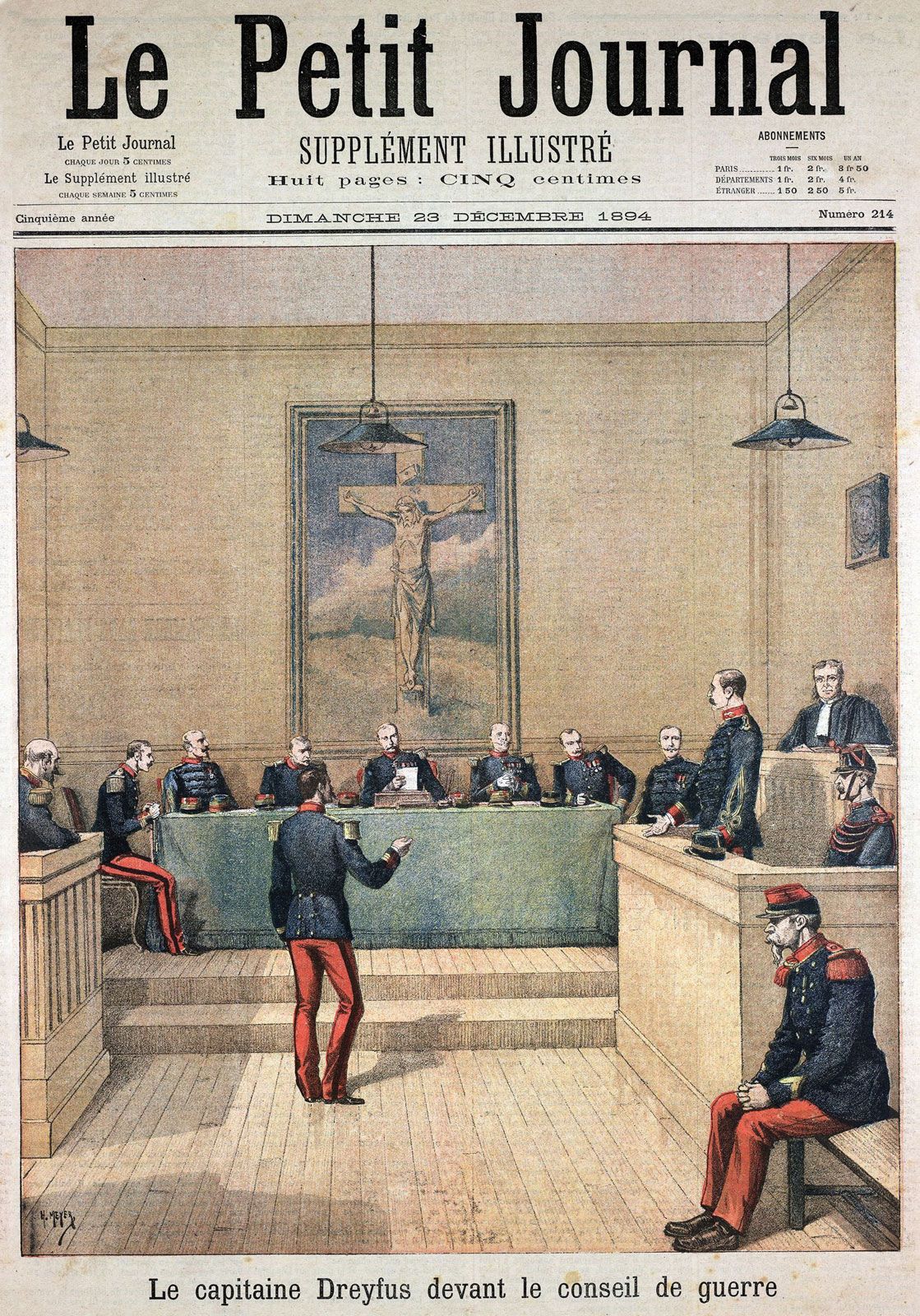

Posthumous Honor For Alfred Dreyfus French Parliament Considers Symbolic Promotion

May 25, 2025

Posthumous Honor For Alfred Dreyfus French Parliament Considers Symbolic Promotion

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Tracking The Net Asset Value Nav

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Tracking The Net Asset Value Nav

May 25, 2025 -

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis

May 25, 2025

Investing In The Amundi Dow Jones Industrial Average Ucits Etf Nav Analysis

May 25, 2025 -

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Understanding The Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025