Amundi MSCI World II UCITS ETF USD Hedged Dist: NAV Calculation And Tracking

Table of Contents

Understanding Net Asset Value (NAV) in ETFs

The Net Asset Value (NAV) of an ETF represents the total value of all the assets held within the fund, divided by the number of outstanding shares. For ETF investors, the NAV is a critical indicator of the fund's intrinsic worth.

- NAV vs. Market Price: While the NAV reflects the true value of the ETF's holdings, the market price is the price at which the ETF is currently trading on the exchange. These prices can differ due to factors like supply and demand, creating a bid-ask spread.

- NAV's Role in Buy/Sell Decisions: Understanding the NAV helps investors make informed buy and sell decisions. A low market price relative to the NAV might signal a buying opportunity, while the opposite could suggest a potential sell signal.

- Factors Affecting Daily NAV Fluctuations: Several factors contribute to daily NAV changes:

- Market Movements: Changes in the prices of the underlying assets significantly impact the ETF's NAV.

- Currency Exchange Rates: For a USD-hedged ETF like the Amundi MSCI World II UCITS ETF, currency fluctuations between the USD and other currencies held within the fund directly affect the NAV.

- Dividend Payouts: Dividend distributions from the underlying assets reduce the NAV on the ex-dividend date.

Understanding these dynamics is crucial for effective ETF pricing strategies.

Amundi MSCI World II UCITS ETF USD Hedged Dist: Specific NAV Calculation Components

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is determined by several key components:

- MSCI World Index: This ETF tracks the MSCI World Index, a broad market-capitalization-weighted index representing large and mid-cap equities across developed markets globally. The performance of this index is a primary driver of the ETF's NAV.

- USD Hedging Strategy: The "USD Hedged" designation signifies that the fund employs a currency hedging strategy to minimize the impact of exchange rate fluctuations between the USD and other currencies represented in the underlying index. This hedging reduces currency risk but doesn’t eliminate it entirely. The effectiveness of the hedge is factored into the daily NAV calculation.

- Dividend Distributions: The ETF distributes dividends received from the underlying companies. These distributions are calculated and subtracted from the NAV on the ex-dividend date. Investors can choose to reinvest these dividends, further impacting the NAV.

- Expense Ratios and Management Fees: The ETF's expense ratio (including management fees and other operating expenses) is deducted from the fund's assets, impacting the NAV. This is typically expressed as an annual percentage.

Tracking the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Staying informed about the daily NAV is vital for successful investing.

- Finding NAV Data: Reliable sources for accessing daily NAV information include:

- The official Amundi website

- Major financial news websites and data providers (e.g., Bloomberg, Yahoo Finance)

- Frequency of Updates: The NAV is typically updated daily, reflecting the closing prices of the underlying assets.

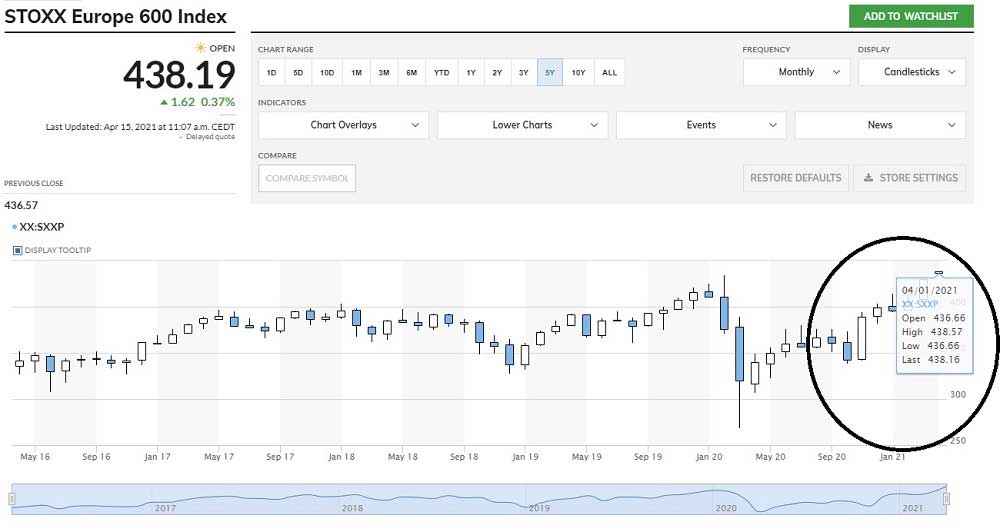

- Interpreting NAV Data: Tracking historical NAV data allows investors to analyze the ETF's performance over time and make informed decisions based on trends.

- Utilizing Tracking Tools: Many financial platforms and charting tools offer real-time and historical NAV data, simplifying the monitoring process. These ETF tracking tools can be incredibly useful for visualizing performance and identifying potential trends.

Potential Risks Associated with the Amundi MSCI World II UCITS ETF USD Hedged Dist

While ETFs offer diversification, they are not without risk:

- Market Risk: The value of the ETF can fluctuate due to overall market conditions.

- Currency Risk: Even with the USD hedging strategy, some residual currency risk remains, especially if the hedging strategy is not perfectly effective.

- Tracking Error: While aiming to mirror the MSCI World Index, a small degree of tracking error (the difference between the ETF's performance and the index's performance) is possible and will impact the NAV.

- Due Diligence: Thorough research and understanding of the associated risks are essential before investing in any ETF, including the Amundi MSCI World II UCITS ETF USD Hedged Dist.

Conclusion: Making Informed Decisions with Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Information

Understanding the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV calculation and tracking is crucial for informed investment decisions. By regularly monitoring the NAV and considering the factors influencing it, investors can better assess the fund's performance and make appropriate adjustments to their portfolios. Utilize the readily available resources—Amundi's website, financial data providers, and charting tools—to access real-time NAV and historical NAV data. Remember that responsible investing involves understanding inherent risks. Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist and its NAV calculation to make informed investment decisions. Conduct thorough due diligence and consider seeking professional financial advice before making any investment choices.

Featured Posts

-

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudby I Nyneshnyaya Zhizn

May 25, 2025

Pobediteli Evrovideniya Poslednie 10 Let Ikh Sudby I Nyneshnyaya Zhizn

May 25, 2025 -

How Nicki Chapman Made 700 000 Investing In A Country Property

May 25, 2025

How Nicki Chapman Made 700 000 Investing In A Country Property

May 25, 2025 -

Ritka Porsche 911 80 Millio Forintos Extra Csomaggal

May 25, 2025

Ritka Porsche 911 80 Millio Forintos Extra Csomaggal

May 25, 2025 -

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 25, 2025

Glastonbury 2025 Lineup Is It The Best Yet Charli Xcx Neil Young And More

May 25, 2025 -

Tecnologia Hibrida De Ponta O Ferrari 296 Speciale De 880 Cv

May 25, 2025

Tecnologia Hibrida De Ponta O Ferrari 296 Speciale De 880 Cv

May 25, 2025

Latest Posts

-

West Hams Kyle Walker Peters Bid Transfer News And Analysis

May 25, 2025

West Hams Kyle Walker Peters Bid Transfer News And Analysis

May 25, 2025 -

Avrupa Borsalari Ve Ecb Nin Faiz Karari Analiz Ve Tahminler

May 25, 2025

Avrupa Borsalari Ve Ecb Nin Faiz Karari Analiz Ve Tahminler

May 25, 2025 -

Avrupa Borsalari Guenluek Raporu 16 Nisan 2025 Stoxx Europe 600 Ve Dax 40 In Performansi

May 25, 2025

Avrupa Borsalari Guenluek Raporu 16 Nisan 2025 Stoxx Europe 600 Ve Dax 40 In Performansi

May 25, 2025 -

Faiz Indirimi Avrupa Borsalarinin Yeni Durumu

May 25, 2025

Faiz Indirimi Avrupa Borsalarinin Yeni Durumu

May 25, 2025 -

16 Nisan 2025 Avrupa Borsalari Analizi Stoxx Europe 600 Ve Dax 40 Ta Gerileme

May 25, 2025

16 Nisan 2025 Avrupa Borsalari Analizi Stoxx Europe 600 Ve Dax 40 Ta Gerileme

May 25, 2025