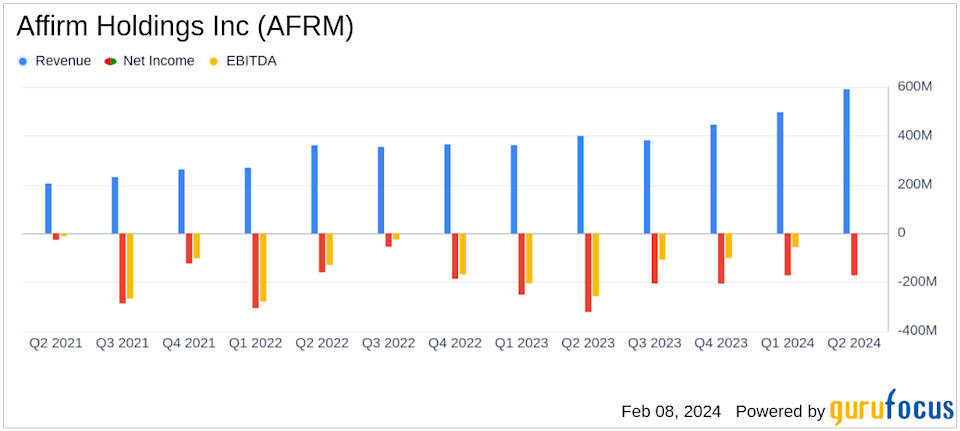

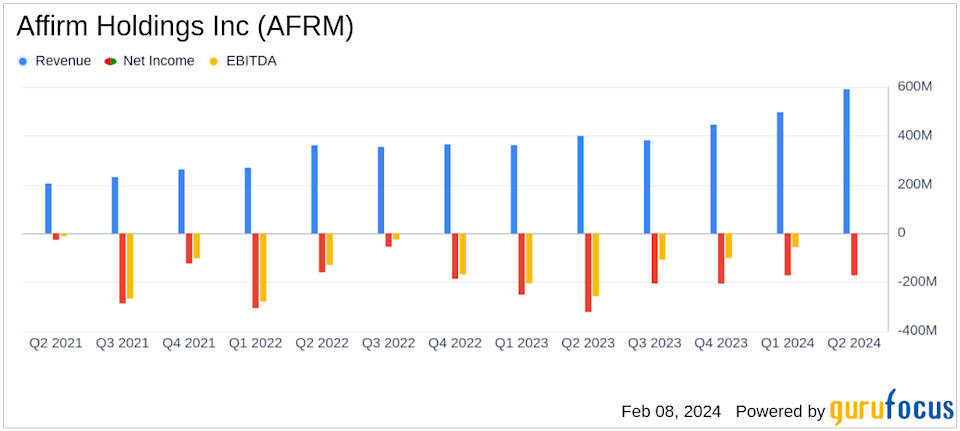

Analysis: Did Trump Tariffs Kill The Affirm Holdings (AFRM) IPO?

Table of Contents

Trump Tariffs and Global Supply Chain Disruptions

The Trump administration's imposition of tariffs on various imported goods significantly increased import costs. This had a ripple effect throughout the global supply chain, impacting businesses across numerous sectors. For AFRM and its merchant partners, this translated into higher costs for goods.

- Increased Input Costs: Tariffs directly increased the price of imported raw materials and finished goods, impacting the profitability of AFRM's merchant partners.

- Higher Prices for Consumers: To offset increased input costs, merchants often passed these expenses onto consumers, leading to higher prices for goods and services. This, in turn, could decrease consumer demand for BNPL services, as it impacts discretionary spending.

- Supply Chain Bottlenecks: Tariffs contributed to disruptions in the global supply chain, leading to delays, shortages, and increased uncertainty. This instability could have impacted the timing and execution of AFRM's business plans.

- Reduced Merchant Profitability: Lower profit margins for merchants due to increased costs might have reduced their willingness to partner with or heavily promote BNPL services like Affirm's.

The resulting inflation and uncertainty created a challenging landscape for a company like AFRM, navigating its initial public offering.

Impact on Consumer Spending and Discretionary Income

Tariffs contributed to a rise in inflation, eroding consumer disposable income. This reduction in spending power directly impacted discretionary spending categories, including BNPL services.

- Reduced Disposable Income: Higher prices for essential goods and services left consumers with less money available for non-essential purchases.

- Shifting Spending Priorities: Consumers might have prioritized essential expenses, reducing their utilization of BNPL options for discretionary items.

- Decreased BNPL Adoption Rates: While the BNPL market was growing, the economic uncertainty stemming from tariffs likely dampened its growth rate, potentially impacting AFRM's user acquisition targets.

- Data on Consumer Sentiment: Surveys conducted during this period often showed decreased consumer confidence and increased concerns about future economic prospects, suggesting reduced willingness to take on additional debt through BNPL.

Investor Sentiment and Market Volatility

The trade war and the uncertainty surrounding the Trump tariffs negatively impacted overall investor sentiment. This climate of uncertainty could have affected investor confidence in the BNPL sector, including AFRM.

- Risk Aversion: Investors, particularly in a volatile market, tend to be more risk-averse. Investing in a relatively new company like AFRM during this time might have been perceived as riskier than investing in established companies.

- Market Volatility and IPO Valuation: Market fluctuations influenced the valuation of the AFRM IPO. Uncertainty often leads to lower valuations for newly public companies.

- Impact on Investment Decisions: The unpredictable nature of the trade war and its impact on businesses likely caused some investors to delay investment in BNPL companies, directly affecting AFRM's IPO performance.

The overall economic uncertainty significantly impacted investor decisions around growth stocks and companies in relatively new industries.

Alternative Explanations for AFRM IPO Performance

While the Trump tariffs played a role, attributing AFRM's IPO performance solely to them would be an oversimplification. Other factors need consideration.

- Competition in the BNPL Market: AFRM faced competition from other BNPL providers, impacting its market share and growth potential.

- Broader Macroeconomic Conditions: The global economy experienced broader challenges beyond tariffs, including fluctuating interest rates and potential recessions, affecting investor sentiment and the overall market.

- Company-Specific Factors: AFRM’s internal operational efficiency, marketing strategies, and management decisions also contributed to its overall performance and IPO success.

A comprehensive assessment necessitates considering all these contributing elements.

Conclusion: Did Trump Tariffs Significantly Impact the Affirm Holdings (AFRM) IPO? A Final Assessment

While it’s difficult to definitively establish direct causality, the Trump tariffs likely played a contributing, albeit possibly indirect, role in the economic landscape surrounding AFRM's IPO. The increased import costs, inflation, reduced consumer spending, and overall economic uncertainty created a challenging environment. However, it's crucial to acknowledge the multiple factors influencing the outcome, including competition, broader macroeconomic trends, and AFRM's internal performance. Analyzing the impact of tariffs on the AFRM IPO requires considering the interplay of these various elements. Further research into Trump's trade policies and AFRM, including detailed financial data and industry analyses, is encouraged. Share your thoughts – how significant do you believe the impact of the tariffs was on the Affirm Holdings (AFRM) IPO?

Featured Posts

-

1 050 Price Hike At And Ts Reaction To Broadcoms V Mware Deal

May 14, 2025

1 050 Price Hike At And Ts Reaction To Broadcoms V Mware Deal

May 14, 2025 -

Alkaras Kako Inspirise Mlade Tenisere

May 14, 2025

Alkaras Kako Inspirise Mlade Tenisere

May 14, 2025 -

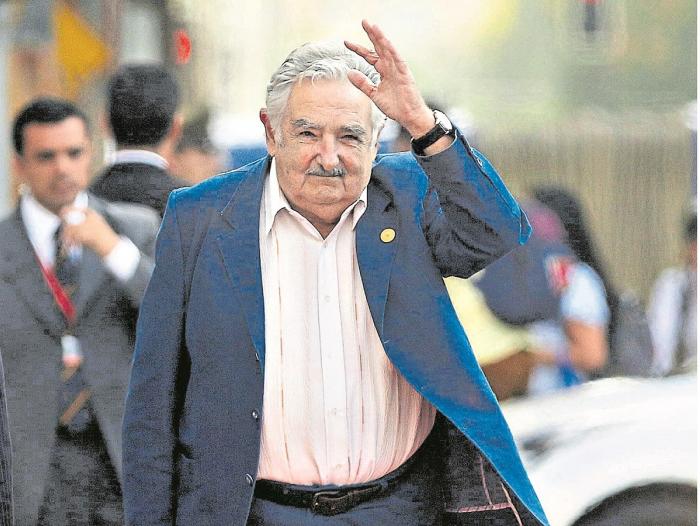

Muertes De Jose Mujica El Legado Del Presidente Uruguayo

May 14, 2025

Muertes De Jose Mujica El Legado Del Presidente Uruguayo

May 14, 2025 -

Maya Jama Spotted On A Date In London With Unidentified Man

May 14, 2025

Maya Jama Spotted On A Date In London With Unidentified Man

May 14, 2025 -

Manchester Uniteds Pursuit Of Championship Talent Transfer Fee And Competition

May 14, 2025

Manchester Uniteds Pursuit Of Championship Talent Transfer Fee And Competition

May 14, 2025