Analysis: Key Provisions Of The GOP's Comprehensive Bill

Table of Contents

Tax Reform Measures within the GOP's Comprehensive Bill

The GOP comprehensive bill proposes sweeping changes to the nation's tax code. Keywords associated with this section include tax cuts, corporate tax rates, individual income tax, tax brackets, and tax deductions. These proposed changes aim to stimulate economic growth, but their impact remains a subject of intense debate.

-

Changes to Individual Income Tax Brackets: The bill suggests [insert specific percentage changes and income thresholds if available]. For example, it might propose lowering the top marginal tax rate from [current rate] to [proposed rate] for individuals earning over [dollar amount]. This could significantly benefit high-income earners, while potentially offering smaller tax breaks to lower and middle-income individuals.

-

Corporate Tax Rate Reductions: The proposed reduction in the corporate tax rate from [current rate] to [proposed rate] aims to boost business investment and job creation. Supporters argue this will increase competitiveness and attract foreign investment. However, critics express concern that this could exacerbate income inequality and lead to further tax cuts for corporations, with little benefit trickling down to average Americans.

-

Tax Deductions and Credits: The bill may alter or eliminate existing tax deductions and credits. For example, changes to deductions for mortgage interest, charitable contributions, or state and local taxes could significantly affect specific demographics. A detailed analysis of the winners and losers under these revised deductions is crucial for a complete understanding of the bill's impact.

-

Projected Revenue Impact and Budget Deficits: The long-term fiscal consequences of these tax proposals are a major point of contention. Independent analyses will be crucial to predict the impact on the national debt and the potential for increased budget deficits. This will likely be a central focus of political debate surrounding the bill's passage.

Spending Cuts and Budgetary Allocations in the GOP Bill

The GOP comprehensive bill also proposes significant changes to government spending and budgetary allocations. Key terms for this section include government spending, budget cuts, fiscal policy, defense spending, and social programs.

-

Proposed Cuts to Government Programs: The bill outlines specific cuts to various government agencies and programs. For instance, it might propose reducing funding for [specific program 1] by [percentage or dollar amount] and for [specific program 2] by [percentage or dollar amount]. These cuts could significantly impact the delivery of essential services.

-

Impact on Essential Services: The proposed reductions could lead to decreased funding for healthcare, education, and infrastructure projects. This will likely lead to heated public debate concerning the societal costs of these fiscal decisions and their long-term effects.

-

Increased Defense Spending: Conversely, the bill may include increased spending on national defense, potentially diverting funds from other crucial areas. The implications of this reallocation of resources for national security and foreign policy will need careful consideration.

-

Impact on National Debt and Fiscal Outlook: The overall effect of these spending changes on the national debt and long-term fiscal outlook is a critical area of concern. Independent economic analysis is crucial to assess the long-term sustainability of this budgetary plan.

Regulatory Changes and Deregulation Efforts in the GOP's Comprehensive Bill

A key aspect of the GOP comprehensive bill involves significant regulatory changes and deregulation efforts. Relevant keywords include deregulation, regulatory reform, environmental regulations, financial regulations, and healthcare regulations.

-

Areas of Proposed Deregulation: The bill likely proposes deregulation in various sectors, including environmental protection, financial services, and potentially healthcare. Specific examples of targeted regulations are necessary to fully evaluate the consequences of these changes.

-

Economic and Social Consequences: Deregulation can have both positive and negative economic and social impacts. While proponents argue it stimulates economic growth and reduces burdens on businesses, critics fear it could lead to negative consequences for consumer protection, worker safety, and environmental preservation.

-

Impact on Consumer Protection and Worker Safety: Reduced oversight could compromise consumer protection measures and worker safety standards. A thorough assessment of the potential risks is crucial for a comprehensive evaluation.

-

Environmental Consequences: Relaxing environmental regulations could lead to increased pollution and harm the environment. This is a key area of concern for environmental groups and will likely trigger strong public response.

Potential Political and Social Impact of the GOP Comprehensive Bill

The GOP comprehensive bill is expected to have significant political and social consequences. Keywords for this section include political ramifications, social impact, public opinion, partisan divide, and political consequences.

-

Impact on Different Demographic Groups: The bill's effects will vary across different demographic groups. Analyzing the disparate impact on income brackets, geographic locations, and social groups is essential for understanding the broader societal consequences.

-

Political Fallout and Upcoming Elections: The bill's passage or failure will likely have significant implications for upcoming elections, shaping political landscapes and influencing future policy debates.

-

Public Opinion and Surveys: Analyzing public opinion polls and surveys will provide insights into public sentiment towards the proposed changes and their acceptance or rejection by the electorate.

-

Potential for Legal Challenges: The bill's provisions could face legal challenges, leading to potential court battles and protracted legal processes that could further impact its implementation and ultimate effect.

Conclusion

This analysis has explored the key provisions of the GOP's comprehensive bill, examining its proposed tax reforms, spending cuts, regulatory changes, and potential political and social ramifications. The bill presents a complex interplay of economic, social, and political factors with potentially significant long-term consequences. The projected impacts on various sectors and demographic groups highlight the need for thorough and objective evaluation before its implementation.

Understanding the implications of the GOP's comprehensive bill is crucial for informed civic engagement. Continue to research the details of this significant legislation and participate in the ongoing conversation surrounding the GOP comprehensive bill and its impact on your community and the nation. Stay informed about further analyses and developments regarding this pivotal piece of legislation.

Featured Posts

-

Late Game Heroics Taylor Wards Grand Slam Secures Angels Win Against Padres

May 15, 2025

Late Game Heroics Taylor Wards Grand Slam Secures Angels Win Against Padres

May 15, 2025 -

Steigt Die Euphorie Der Privatanleger Droht Ein Boersencrash

May 15, 2025

Steigt Die Euphorie Der Privatanleger Droht Ein Boersencrash

May 15, 2025 -

Mental Health And Gender Euphoria In The Transgender Community A Call For Improved Measurement

May 15, 2025

Mental Health And Gender Euphoria In The Transgender Community A Call For Improved Measurement

May 15, 2025 -

R5 45 Crore Penalty On Paytm Payments Bank Fiu Inds Action On Money Laundering Issues

May 15, 2025

R5 45 Crore Penalty On Paytm Payments Bank Fiu Inds Action On Money Laundering Issues

May 15, 2025 -

Are Bmw And Porsche Losing Ground In China A Look At Market Share And Competition

May 15, 2025

Are Bmw And Porsche Losing Ground In China A Look At Market Share And Competition

May 15, 2025

Latest Posts

-

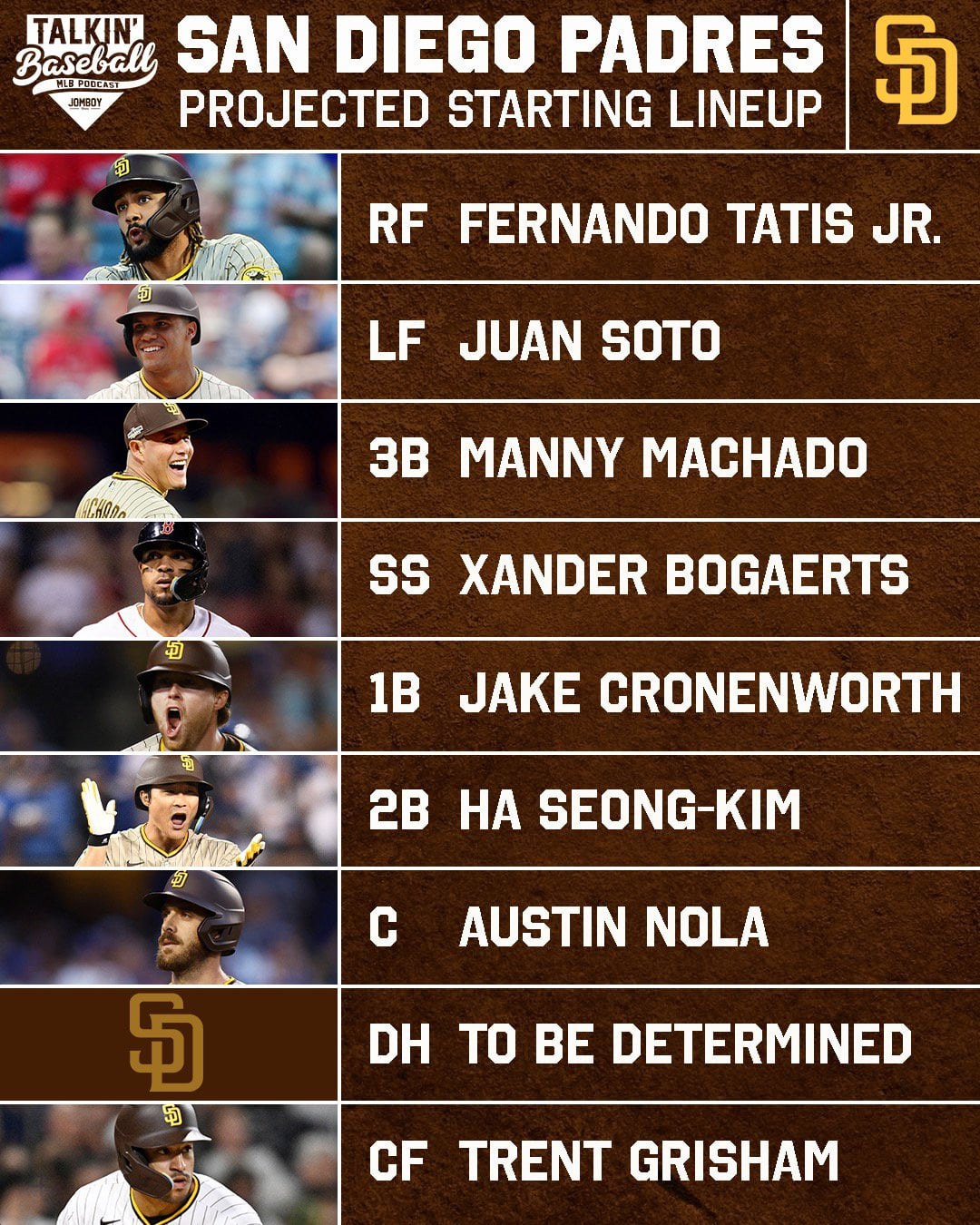

San Diego Padres Opening Series Full Details Announced By Sycuan Casino Resort

May 15, 2025

San Diego Padres Opening Series Full Details Announced By Sycuan Casino Resort

May 15, 2025 -

San Diego Padres Pregame Report Rain Tatis And Campusano News

May 15, 2025

San Diego Padres Pregame Report Rain Tatis And Campusano News

May 15, 2025 -

Los Angeles Dodgers Promote Hyeseong Kim To Major Leagues

May 15, 2025

Los Angeles Dodgers Promote Hyeseong Kim To Major Leagues

May 15, 2025 -

Sycuan Casino Resort Presents Padres Opening Series Details

May 15, 2025

Sycuan Casino Resort Presents Padres Opening Series Details

May 15, 2025 -

Padres Game Update Rain Delay Impacts Lineup With Tatis And Campusano

May 15, 2025

Padres Game Update Rain Delay Impacts Lineup With Tatis And Campusano

May 15, 2025