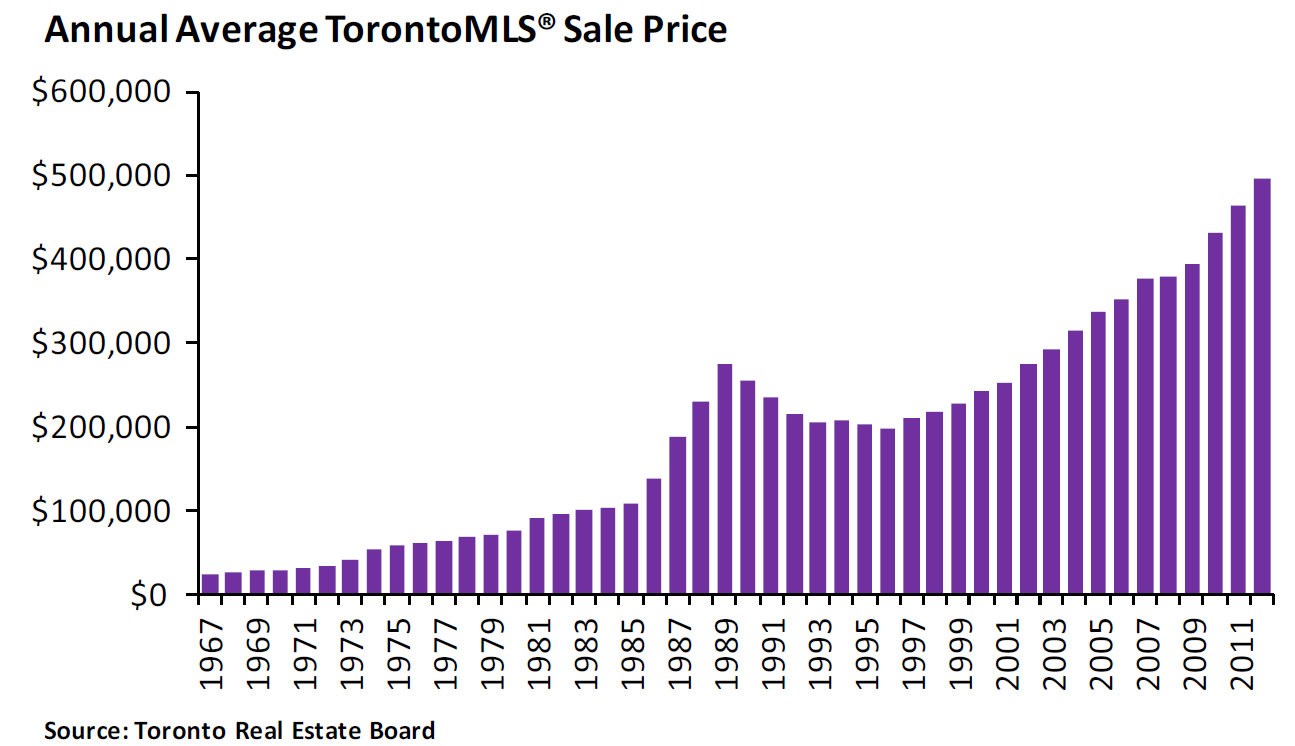

Analysis Of Toronto's Housing Market: 23% Sales Decline, 4% Price Dip

Table of Contents

Factors Contributing to the Toronto Housing Market Slowdown

Several interconnected factors have contributed to the slowdown in the Toronto housing market. These include rising interest rates, economic uncertainty, and an increase in housing inventory.

Rising Interest Rates

The Bank of Canada's aggressive interest rate hikes have significantly impacted the affordability of homes in Toronto. These increases have led to:

- Increased mortgage payments: Higher interest rates translate directly into larger monthly mortgage payments, making homeownership less accessible for many potential buyers.

- Reduced borrowing power: With higher rates, lenders are approving smaller mortgages, reducing the amount buyers can borrow and consequently limiting their purchasing power in the Toronto real estate market.

- Impact on first-time homebuyers: First-time homebuyers, often relying on maximum borrowing capacity, are particularly vulnerable to these changes, facing a significantly reduced ability to enter the market.

For example, the Bank of Canada's increase of the overnight rate by 1% in June 2023 directly correlated with a noticeable dip in sales reported in July. Data from the Toronto Real Estate Board (TREB) will be crucial in further demonstrating this correlation.

Economic Uncertainty

Broader economic factors are also playing a role in the Toronto housing market slowdown. High inflation and concerns about a potential recession are creating uncertainty among both buyers and investors:

- Impact of inflation on consumer spending: Inflation erodes purchasing power, leading consumers to curb spending on non-essential items, including real estate.

- Investor hesitancy: Economic uncertainty makes investors more cautious, leading to reduced investment in the Toronto real estate market.

- Job market concerns: Concerns about potential job losses or economic slowdown can deter potential buyers from making large purchases like homes.

Economic indicators such as the Consumer Price Index (CPI) and GDP growth forecasts provide valuable insights into the overall economic climate and its effect on the Toronto housing market.

Increased Housing Inventory

The increased supply of homes available for sale in Toronto is another key factor contributing to the market slowdown. This increased inventory has led to:

- Comparison of current inventory levels to previous years: A significant increase in active listings compared to previous years reflects a shift in market dynamics.

- Impact on buyer negotiation power: With more choices available, buyers have greater leverage to negotiate lower prices, impacting average sale prices.

Data on active listings and months of inventory from TREB clearly illustrate this shift, showing a move away from the seller's market conditions previously seen in Toronto.

Impact on Different Market Segments

The slowdown in the Toronto housing market is affecting different segments differently.

Condo Market

The condo market in Toronto has also experienced a slowdown, although perhaps less dramatically than the detached home market. We are seeing:

- Sales volume changes: A decrease in condo sales, though possibly less pronounced than the decline in detached home sales.

- Price fluctuations: While prices have dipped, the extent of the price drop might be less significant compared to the detached home sector.

- Specific areas within Toronto experiencing different impacts: Certain condo submarkets within Toronto might be faring better than others, depending on factors such as location, amenities, and building quality.

Data specific to Toronto condo sales and prices will be needed to fully analyze this segment.

Detached Homes

The market for detached homes in Toronto has experienced a more pronounced slowdown compared to the condo market:

- Sales volume changes: A sharp decrease in sales volume compared to previous years, reflecting a substantial decrease in buyer activity.

- Price fluctuations: A more significant price drop compared to condos, reflecting increased buyer negotiation power and reduced demand.

- Variations across different neighborhoods: The impact varies across different neighborhoods, with some areas experiencing a steeper decline than others due to localized market conditions.

Data on detached home sales and prices will provide a clearer picture of the impact on this segment of the Toronto real estate market.

First-Time Homebuyers

First-time homebuyers are facing considerable challenges in the current Toronto housing market:

- Impact of affordability: Rising interest rates and higher prices make homeownership increasingly difficult to achieve.

- Competition: While competition has lessened compared to previous years, it still remains a factor for first-time buyers with limited resources.

- Government policies: Government policies aimed at cooling the market may also indirectly impact first-time homebuyers' access to affordable housing.

Statistics on first-time homebuyer activity in Toronto will further illustrate the struggles faced by this demographic.

Predictions and Outlook for the Toronto Housing Market

Predicting the future of the Toronto housing market requires careful consideration of current trends and potential future events.

Short-Term Forecast (Next 6-12 Months)

Based on current trends, the short-term forecast for the Toronto housing market suggests:

- Expected sales volumes: Sales volumes are expected to remain relatively low in the next 6-12 months.

- Potential price adjustments: Prices may continue to adjust downwards, albeit potentially at a slower pace than in the recent past.

- Factors that could influence the market: Changes in interest rate policy, shifts in economic conditions, and fluctuations in housing inventory will all play a role in shaping the short-term outlook.

Long-Term Outlook (Next 3-5 Years)

The long-term outlook for the Toronto housing market presents a more complex picture:

- Potential drivers of future growth or decline: Long-term economic growth, population changes, and government policies will be key factors.

- Long-term affordability concerns: Affordability will remain a major concern, especially for first-time homebuyers.

- Anticipated policy changes: Future government policies could influence supply and demand, impacting both prices and sales volume.

Conclusion: Navigating the Shifting Sands of the Toronto Housing Market

The Toronto housing market has experienced a significant shift, with a remarkable 23% decline in sales and a 4% drop in average prices. This downturn is primarily attributed to rising interest rates, economic uncertainty, and increased housing inventory. These factors have impacted different market segments differently, posing significant challenges, particularly for first-time homebuyers. While the short-term outlook suggests continued adjustment, the long-term trajectory depends on various economic and policy factors. For buyers, this presents opportunities for negotiation, while sellers need to adjust their pricing strategies accordingly.

Stay updated on the latest trends in the Toronto housing market by following [your website/blog/social media]. Understanding the current dynamics is crucial for making informed decisions in this ever-evolving real estate landscape.

Featured Posts

-

Alex Carusos Playoff History Making Performance In Thunder Game 1 Victory

May 08, 2025

Alex Carusos Playoff History Making Performance In Thunder Game 1 Victory

May 08, 2025 -

Exploring The Unique Double Performances In Okc Thunders Record Books

May 08, 2025

Exploring The Unique Double Performances In Okc Thunders Record Books

May 08, 2025 -

Nba Game Thunder Vs Trail Blazers Full Game Details For March 7th

May 08, 2025

Nba Game Thunder Vs Trail Blazers Full Game Details For March 7th

May 08, 2025 -

Shokantna Pobeda Vesprem Go Eliminira Ps Zh Vo Ligata Na Shampionite

May 08, 2025

Shokantna Pobeda Vesprem Go Eliminira Ps Zh Vo Ligata Na Shampionite

May 08, 2025 -

Angels Prospect Pipeline A Brutal Assessment From Mlb Analysts

May 08, 2025

Angels Prospect Pipeline A Brutal Assessment From Mlb Analysts

May 08, 2025

Latest Posts

-

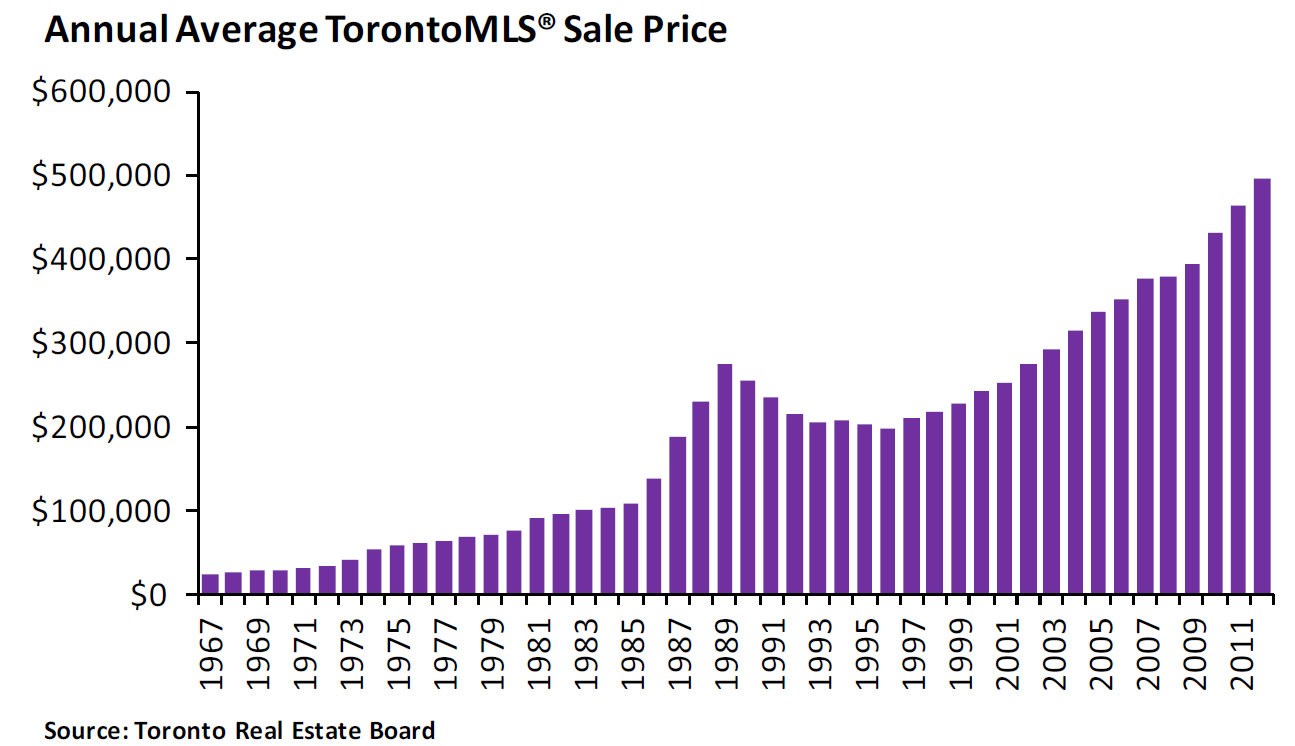

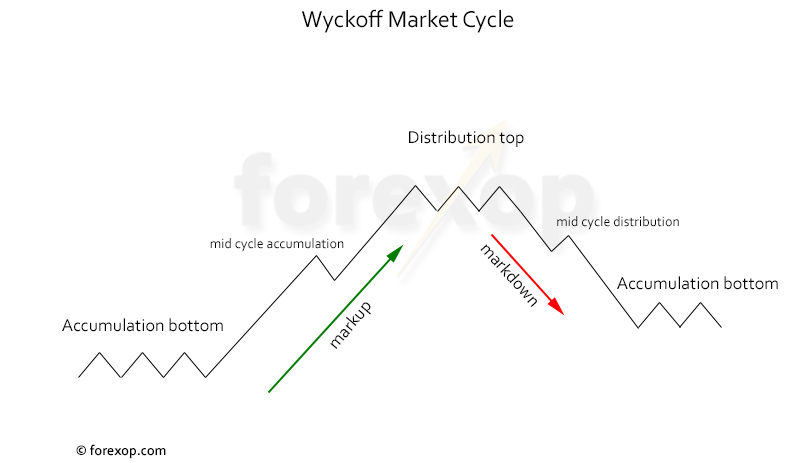

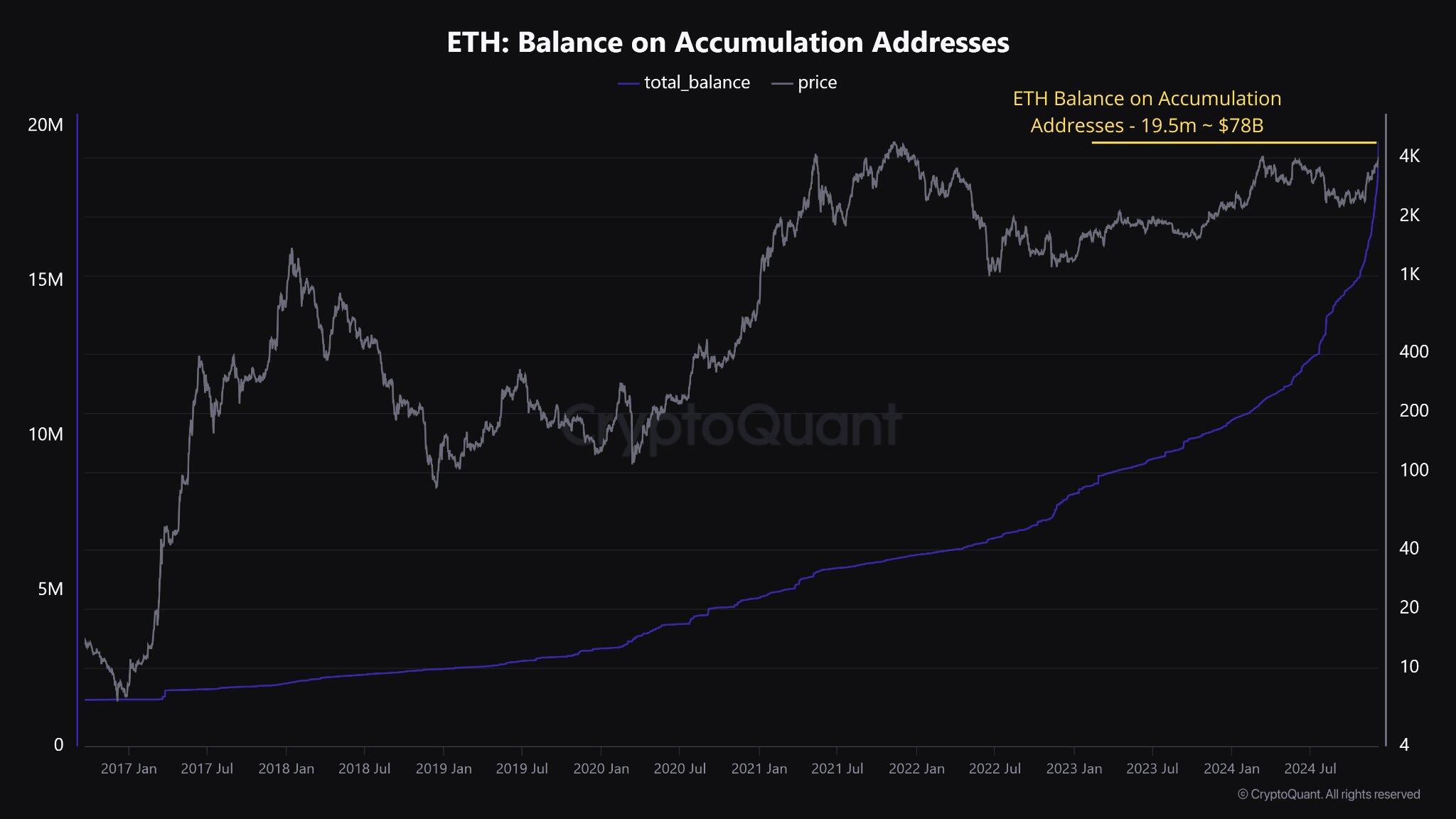

Is 2 700 The Next Ethereum Price Target A Wyckoff Accumulation Perspective

May 08, 2025

Is 2 700 The Next Ethereum Price Target A Wyckoff Accumulation Perspective

May 08, 2025 -

Ethereums Potential 2 700 Rally Analyzing The Wyckoff Accumulation Pattern

May 08, 2025

Ethereums Potential 2 700 Rally Analyzing The Wyckoff Accumulation Pattern

May 08, 2025 -

Ethereum Price Poised For 2 700 Surge As Wyckoff Accumulation Completes

May 08, 2025

Ethereum Price Poised For 2 700 Surge As Wyckoff Accumulation Completes

May 08, 2025 -

Ethereum Price Prediction 2 700 On The Horizon

May 08, 2025

Ethereum Price Prediction 2 700 On The Horizon

May 08, 2025 -

Trump Media Partners With Crypto Com For Etf Launch Details And Implications

May 08, 2025

Trump Media Partners With Crypto Com For Etf Launch Details And Implications

May 08, 2025