Analysis: Record $16.3 Billion In U.S. Customs Duties Collected In April

Table of Contents

Surging Import Volume: A Primary Driver of Increased Customs Duties

A primary driver behind the record-high April U.S. Customs Duties collection is the significant increase in import volume. The correlation between these two factors is straightforward: more imported goods equal higher duty collections. This surge wasn't uniform across all sectors; certain categories experienced exponential growth.

-

Specific import categories showing significant growth: Consumer electronics, apparel, and certain manufactured goods showed particularly strong growth. The post-pandemic surge in consumer spending significantly boosted demand for imported products.

-

Data illustrating the percentage increase in import volume: Preliminary data suggests a double-digit percentage increase in overall import volume compared to April of the previous year, further emphasizing the magnitude of this surge. Official figures from the U.S. Census Bureau will offer a more detailed breakdown.

-

Analysis of consumer spending patterns impacting imports: Increased disposable income, pent-up demand following pandemic restrictions, and shifts in consumer preferences towards imported goods all contributed to this higher import volume.

The Impact of Recent Tariff Adjustments on Customs Duty Revenue

Recent adjustments to import tariffs and trade policies undoubtedly influenced the April revenue figures. While specific details regarding tariff changes require further analysis from official sources, it's likely that modifications to existing tariffs on certain goods, along with any newly imposed tariffs, played a role.

-

Summary of key tariff changes implemented: While a comprehensive list requires official data release, any recent shifts in tariff rates on key import categories would need to be analyzed for their contribution to the increased revenue.

-

Impact of tariffs on specific industries: Certain sectors might have experienced disproportionately higher duty payments due to targeted tariff increases. The impact varied based on the specific industry and the elasticity of demand for their products.

-

Mention any exemptions or exclusions from tariffs: The existence of tariff exemptions or exclusions for specific goods or countries could also affect the overall revenue collected. These exceptions can significantly alter the final duty amounts.

Economic Indicators and their Correlation with Customs Duty Collections

Macroeconomic indicators are strongly correlated with import activity and, consequently, customs duty collections. A robust U.S. economy generally translates to higher import demand, driving up revenue from U.S. Customs Duties.

-

Correlation between key economic indicators and import volume: Positive GDP growth, low unemployment, and high consumer confidence typically indicate a strong economy, leading to increased imports and, in turn, higher customs duty revenue.

-

Analysis of the impact of inflation on import costs and duties: Inflation can increase the value of imported goods, potentially leading to higher duty payments, even if the volume of imports remains unchanged.

-

Discussion of the relationship between consumer confidence and import spending: High consumer confidence indicates a willingness to spend more, leading to greater import demand and higher customs duty collections.

Implications of Record Customs Duty Collections for the US Economy

The record-breaking $16.3 billion in U.S. Customs Duties collected in April has significant implications for the U.S. economy and government finances.

-

Potential impact on the national debt: This substantial increase in revenue can contribute to a reduction in the national debt or provide additional funding for government programs.

-

Effect on government spending and investment: The influx of revenue offers the government more financial flexibility in terms of budget allocation, potentially allowing for increased spending on infrastructure or social programs.

-

Long-term implications for trade relations: The level of U.S. Customs Duties collected reflects the ongoing state of international trade and can influence future trade negotiations and policy decisions.

Conclusion: Understanding the Significance of Record U.S. Customs Duties

The record-breaking $16.3 billion in U.S. Customs Duties collected in April 2024 is a significant event with far-reaching consequences. This surge is largely attributed to increased import volumes fueled by robust consumer spending and economic growth, coupled with the effects of recent tariff adjustments. This substantial revenue has significant implications for the U.S. government's budget, fiscal policy, and overall economic health. Understanding these factors and their interplay is crucial for navigating the complexities of international trade and its impact on the U.S. economy. To stay informed about the evolving landscape of U.S. Customs Duties and their impact on the economy, subscribe to our updates, follow relevant news sources, and continue researching the topic of U.S. Customs Duties and international trade.

Featured Posts

-

Myanmar Foto Foto Menunjukkan Ribuan Pekerja Terjebak Dalam Sindikat Penipuan Online

May 13, 2025

Myanmar Foto Foto Menunjukkan Ribuan Pekerja Terjebak Dalam Sindikat Penipuan Online

May 13, 2025 -

Leonardo Di Caprios Shocking Relationship Twist Is His Dating Rule Officially Broken

May 13, 2025

Leonardo Di Caprios Shocking Relationship Twist Is His Dating Rule Officially Broken

May 13, 2025 -

Hogyan Mondott Nemet Leonardo Di Caprio A Heroinra 30 Evvel Ezelott

May 13, 2025

Hogyan Mondott Nemet Leonardo Di Caprio A Heroinra 30 Evvel Ezelott

May 13, 2025 -

Nmmc Launches Heatwave Advisory Aala Unhala Niyam Pala Campaign In Navi Mumbai

May 13, 2025

Nmmc Launches Heatwave Advisory Aala Unhala Niyam Pala Campaign In Navi Mumbai

May 13, 2025 -

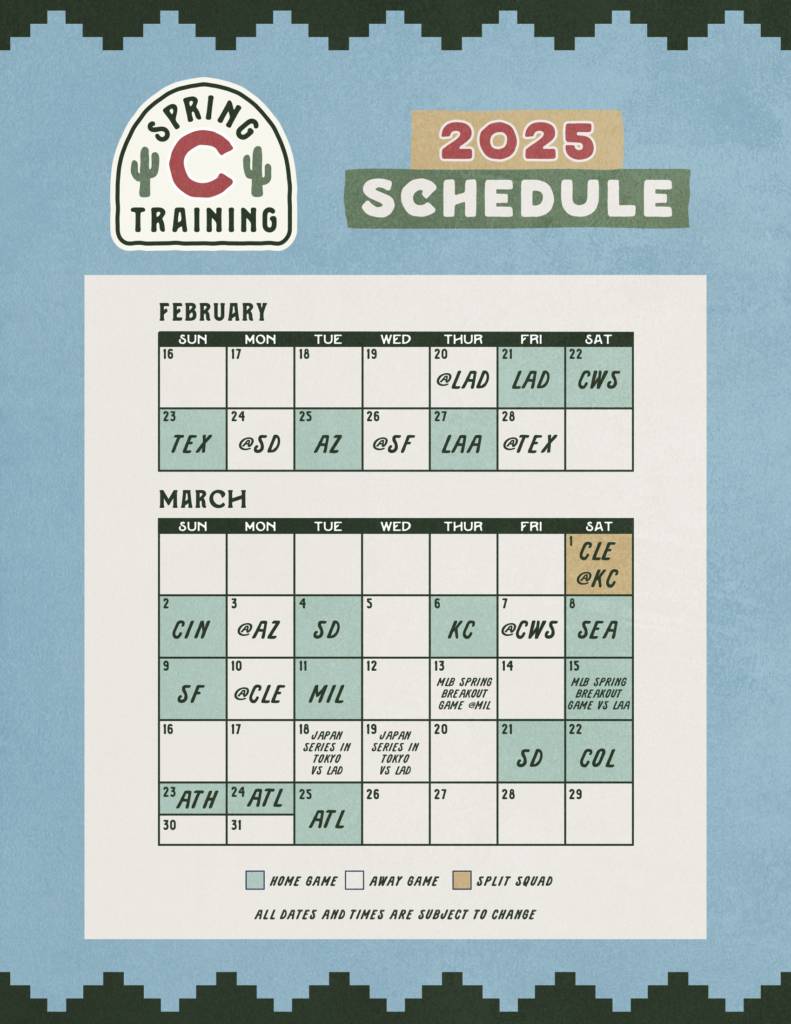

Analyzing The Cubs Performance Game 25 2025

May 13, 2025

Analyzing The Cubs Performance Game 25 2025

May 13, 2025