Analysis: Trump's Comments On Banning Congressional Stock Trades In Time Interview

Table of Contents

Trump's Stance on a Congressional Stock Trades Ban

In his Time interview, Trump didn't mince words. He expressed strong disapproval of lawmakers profiting from insider information or using their positions for personal financial gain. While the exact phrasing requires careful examination of the interview transcript, the overall sentiment was clear: he believes a ban on Congressional stock trading is necessary.

- Specific quotes: (Insert direct quotes from the Time interview here, properly attributed). For example, “[Insert quote showing Trump's opposition to Congressional stock trading].”

- Justification: Trump likely based his stance on concerns about conflicts of interest and the erosion of public trust in government. He likely viewed it as a way to improve public perception and restore faith in the political system.

- Potential motivations: Beyond genuine concern, Trump's statement could be interpreted as a strategic move to appeal to a segment of voters who are increasingly wary of perceived corruption in Washington. This could also be a calculated attempt to influence the current political landscape.

Public Opinion and the Debate Surrounding Congressional Stock Trading

Public sentiment regarding Congressional stock trading is overwhelmingly negative. Polls consistently show a significant majority of Americans favor a ban, driven by a deep-seated belief that lawmakers should not profit from their positions.

- Statistics on public opinion polls: (Insert relevant statistics here, citing sources). For example: "A recent poll by [Pollster name] found that [percentage]% of Americans support a ban on Congressional stock trading."

- Arguments in favor of a ban: The main arguments focus on preventing conflicts of interest, enhancing public trust, and ensuring fairness and equity in the political process. The perception that lawmakers might prioritize personal financial gain over constituents' needs fuels the calls for reform.

- Arguments against a ban: Opponents argue that a ban infringes on individual liberty and could inadvertently create unforeseen consequences. Concerns have been raised about the potential for overregulation and unintended effects on the financial markets.

Legislative Efforts and Potential Outcomes of a Ban

Several legislative efforts are underway at the federal level to address Congressional stock trading. These range from bills proposing outright bans to those advocating for stricter disclosure requirements and limitations on trading activities.

- Specific bills: (Name and briefly describe relevant bills, including bill numbers and sponsors). For example: "The 'Stop Trading on Congressional Knowledge' Act (STOCK Act) aims to..."

- Key players: (Identify key senators, representatives, and advocacy groups involved in pushing for or opposing legislation).

- Potential challenges: The path to enacting a comprehensive ban faces significant hurdles, including lobbying efforts from powerful interest groups, and concerns about constitutionality and the potential for unintended consequences.

- Possible consequences: A successful ban could significantly enhance public trust, reducing cynicism and improving the image of Congress. However, unintended consequences could include limiting the pool of candidates willing to serve and potentially impacting market stability.

Comparison to Other Countries' Approaches to Congressional/Parliamentary Stock Trading

Many countries have adopted stricter regulations on parliamentary stock trading than the United States. The UK, Canada, and Australia, for instance, have varying levels of restrictions, including outright bans in some cases.

- Specific examples: (Provide details on specific policies and their effectiveness in different countries). For example: "In the UK, MPs are subject to strict rules regarding financial declarations, and some forms of trading are prohibited."

- Comparisons and contrasts: Comparing the US system to those in other developed nations reveals a relative lack of regulation in the American context, highlighting the urgency for reform.

- Lessons learned: The experiences of other countries provide valuable lessons about the potential benefits and drawbacks of different approaches, informing the debate on a potential Congressional Stock Trades Ban in the US.

Conclusion

Trump's strong condemnation of Congressional stock trading underscores the growing public concern over this issue. His comments, while potentially politically motivated, highlight the intense debate surrounding a potential ban. The arguments for a ban center on preventing conflicts of interest and improving public trust, while opponents express concerns about individual freedom and unintended consequences. Legislative efforts are ongoing, but the path to a successful ban remains challenging. By learning from the experiences of other countries, the US can move towards a system that better serves the interests of its citizens.

What are your thoughts on the potential for a Congressional Stock Trades Ban? Share your opinions in the comments below!

Featured Posts

-

The Gates Daughter Phoebe On Pressure Privilege And Finding Her Own Path

Apr 26, 2025

The Gates Daughter Phoebe On Pressure Privilege And Finding Her Own Path

Apr 26, 2025 -

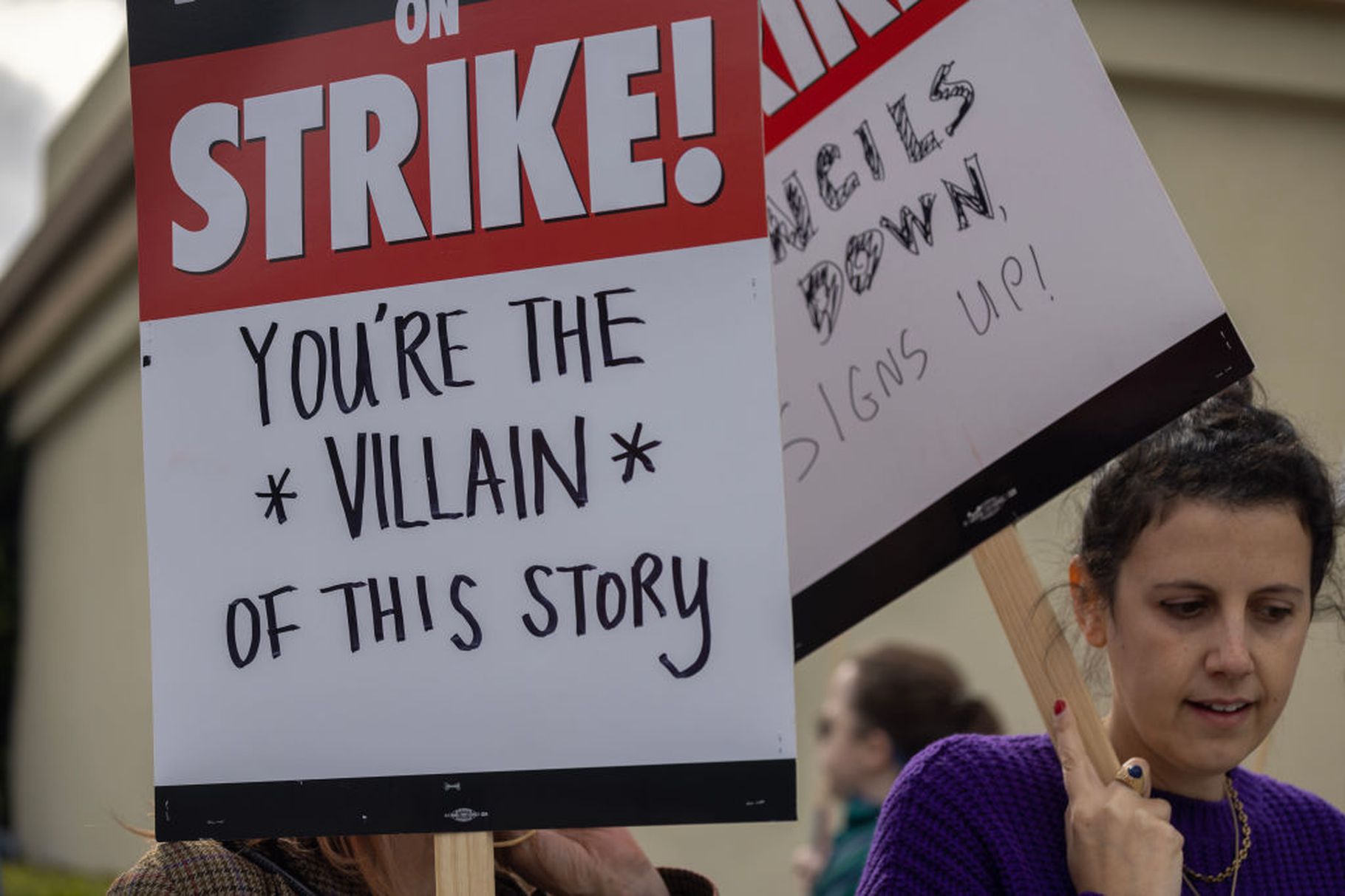

Double Trouble In Hollywood The Impact Of The Writers And Actors Strike

Apr 26, 2025

Double Trouble In Hollywood The Impact Of The Writers And Actors Strike

Apr 26, 2025 -

Zoete Nederlandse Broodjes Een Culinaire Paradox

Apr 26, 2025

Zoete Nederlandse Broodjes Een Culinaire Paradox

Apr 26, 2025 -

Photo 5137807 Benson Boone At The 2025 I Heart Radio Music Awards

Apr 26, 2025

Photo 5137807 Benson Boone At The 2025 I Heart Radio Music Awards

Apr 26, 2025 -

The Impact Of Trump Tariffs Ceo Perspectives On Economic Slowdown

Apr 26, 2025

The Impact Of Trump Tariffs Ceo Perspectives On Economic Slowdown

Apr 26, 2025

Latest Posts

-

Understanding Tracee Ellis Rosss Family Background

May 06, 2025

Understanding Tracee Ellis Rosss Family Background

May 06, 2025 -

1973 Royal Albert Hall An Unforgettable Night With Diana Ross

May 06, 2025

1973 Royal Albert Hall An Unforgettable Night With Diana Ross

May 06, 2025 -

Reliving The Magic Diana Ross At The Royal Albert Hall 1973

May 06, 2025

Reliving The Magic Diana Ross At The Royal Albert Hall 1973

May 06, 2025 -

Diana Rosss Legendary 1973 Royal Albert Hall Performance A Retrospective

May 06, 2025

Diana Rosss Legendary 1973 Royal Albert Hall Performance A Retrospective

May 06, 2025 -

Tracee Ellis Rosss Family Tree Celebrities And Icons

May 06, 2025

Tracee Ellis Rosss Family Tree Celebrities And Icons

May 06, 2025