Analysis: Westpac (WBC) Profit Decline And The Banking Sector Squeeze

Table of Contents

Factors Contributing to Westpac's (WBC) Profit Decline

Several interconnected factors have contributed to the noticeable Westpac (WBC) profit decline. Understanding these elements is key to grasping the current state of the Australian banking sector.

Increased Competition

The Australian banking sector is fiercely competitive. Established players like ANZ, NAB, and Commonwealth Bank, alongside the rapid rise of fintech disruptors, are vying for market share. This intense competition directly impacts Westpac's profitability.

- Increased mortgage competition: Lower interest rates and aggressive lending strategies from competitors are squeezing Westpac's mortgage lending margins.

- Pressure on interest margins: The fight for customers leads to a relentless downward pressure on interest margins, reducing the profit earned on loans and deposits.

- Innovative banking services from competitors: Fintech companies are offering innovative, customer-centric services, challenging the traditional banking model and forcing Westpac to invest heavily in digital transformation to stay competitive. This increased investment represents a significant cost.

These competitive pressures directly impact Westpac's revenue streams, making it harder to maintain profit margins and achieve growth targets. The impact of this increased competition is reflected in the bank's reduced net interest income.

Rising Operational Costs

Westpac, like other banks, faces escalating operational expenses that significantly affect its bottom line. These costs are eroding profit margins and hindering the bank's ability to maintain its profitability.

- Regulatory compliance costs: The Australian banking industry is subject to stringent regulations, leading to substantial compliance costs. These costs include investments in systems, personnel, and audits to ensure adherence to regulatory requirements.

- Technology investments (digital transformation): To compete effectively, Westpac must invest heavily in technology upgrades and digital transformation initiatives. This includes developing advanced digital banking platforms, improving cybersecurity, and implementing new technologies to enhance customer experience and operational efficiency. These are significant upfront investments.

- Staff salaries and benefits: Attracting and retaining skilled employees in a competitive job market requires substantial investment in salaries and benefits packages, adding to operational costs.

The rising cost-to-income ratio demonstrates the growing pressure of these operational expenses on Westpac's profit margins. Efficient cost management will be crucial for future profitability.

Economic Headwinds

The broader economic environment plays a significant role in influencing Westpac's performance. Macroeconomic factors such as inflation and interest rate hikes significantly impact lending activities and investment returns.

- Interest rate fluctuations: Changes in interest rates directly affect borrowing costs and lending profitability. Rising interest rates can lead to reduced demand for loans and increased loan defaults, negatively impacting Westpac's income.

- Inflation: High inflation erodes purchasing power and can lead to reduced consumer spending, impacting loan demand and overall economic activity.

- Consumer spending patterns: Changing consumer spending patterns and potential economic slowdowns can affect borrowing and spending habits, reducing revenue opportunities for Westpac.

- Potential recessionary pressures: The threat of a recession can significantly impact credit quality and loan defaults, putting further pressure on Westpac's profitability.

These economic headwinds create uncertainty and make it challenging for Westpac to accurately forecast its future financial performance.

The Wider Banking Sector Squeeze

The challenges faced by Westpac are not isolated; the entire Australian banking sector is experiencing a squeeze.

Regulatory Scrutiny

Increased regulatory oversight and stricter compliance requirements significantly impact the profitability and risk appetite of Australian banks.

- Increased capital requirements: Higher capital requirements mean banks need to hold more capital, reducing their capacity for lending and investment.

- Stricter lending standards: Tightened lending standards aim to reduce risk, but also restrict loan growth and potential revenue.

- Potential fines and penalties: Non-compliance with regulations can result in substantial fines and penalties, further impacting profitability.

These regulations, while necessary to ensure financial stability, significantly increase operational costs and reduce profitability for Australian banks.

Changing Customer Behaviour

The banking landscape is changing rapidly due to shifts in customer behaviour.

- Rise of fintech: Fintech companies are offering innovative, customer-centric services, challenging traditional banks' market share.

- Increased demand for digital banking services: Customers are increasingly demanding seamless digital banking experiences, requiring banks to invest heavily in digital infrastructure.

- Changing customer expectations: Customers have higher expectations for personalized services, faster transaction times, and increased transparency, pushing banks to adapt and innovate.

Banks must adapt to these changing customer expectations and invest in technology and services to remain competitive and retain customers.

Geopolitical Uncertainty

Global economic instability and geopolitical events also contribute to uncertainty in the Australian banking sector.

- Global inflation: Global inflation impacts interest rates, exchange rates, and overall economic conditions, creating uncertainty for Australian banks.

- Supply chain disruptions: Supply chain disruptions affect businesses and economies globally, impacting lending activities and investment returns.

- International conflicts: Geopolitical instability and international conflicts can create market volatility and uncertainty, impacting investment decisions and overall financial stability.

These external factors introduce an additional layer of complexity for Australian banks, making accurate forecasting and financial planning more challenging.

Westpac (WBC) Profit Decline and the Future of the Banking Sector

In summary, the Westpac (WBC) profit decline is a result of a confluence of factors, including intensified competition, rising operational costs, economic headwinds, and a broader banking sector squeeze characterized by increased regulatory scrutiny, changing customer behaviour, and geopolitical uncertainty. To navigate these challenges, Australian banks, including Westpac, need to prioritize digital transformation, optimize costs, diversify revenue streams, and enhance customer experience. They also need to proactively manage risks associated with economic downturns and global uncertainties.

Stay informed on the ongoing analysis of Westpac (WBC) profit decline and its implications for the wider banking sector squeeze by following reputable financial news sources like the Australian Financial Review, The Sydney Morning Herald, and Bloomberg. Understanding these trends is crucial for investors and anyone interested in the future of the Australian financial landscape.

Featured Posts

-

Chris Pratt Praises Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025

Chris Pratt Praises Patrick Schwarzeneggers Full Frontal Scene

May 06, 2025 -

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025

Razdelis Li Patrik Shvartsenegger I Ebbi Chempion Dlya Kim Kardashyan

May 06, 2025 -

Arnold Schwarzenegger Bueszke Lehet Fiara Joseph Baena Eredmenyei

May 06, 2025

Arnold Schwarzenegger Bueszke Lehet Fiara Joseph Baena Eredmenyei

May 06, 2025 -

Far Right Candidate Faces Centrist In Romanias Presidential Runoff

May 06, 2025

Far Right Candidate Faces Centrist In Romanias Presidential Runoff

May 06, 2025 -

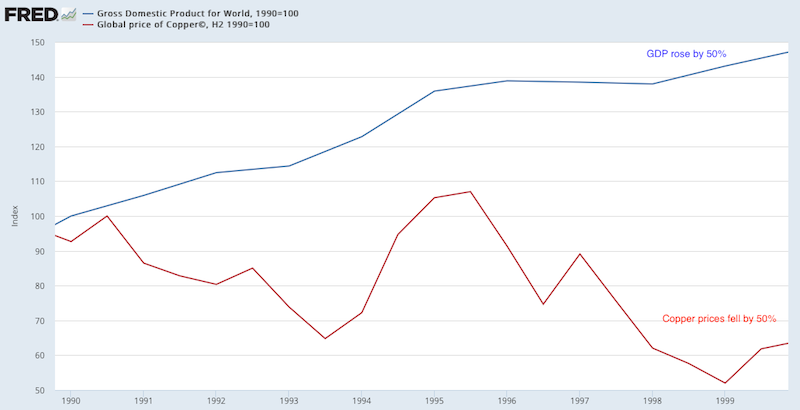

Rising Copper Prices Impact Of China Us Trade Negotiations

May 06, 2025

Rising Copper Prices Impact Of China Us Trade Negotiations

May 06, 2025

Latest Posts

-

Mindy Kaling Quebra O Silencio Relacionamento Complicado Com Ex Colega De The Office

May 06, 2025

Mindy Kaling Quebra O Silencio Relacionamento Complicado Com Ex Colega De The Office

May 06, 2025 -

Mindy Kaling Revelacao Sobre Relacionamento Conturbado Com Colega De The Office

May 06, 2025

Mindy Kaling Revelacao Sobre Relacionamento Conturbado Com Colega De The Office

May 06, 2025 -

Mindy Kalings Transformation Slim Figure Stuns Fans

May 06, 2025

Mindy Kalings Transformation Slim Figure Stuns Fans

May 06, 2025 -

Red Carpet Reveal Mindy Kaling Shows Off Slimmer Physique

May 06, 2025

Red Carpet Reveal Mindy Kaling Shows Off Slimmer Physique

May 06, 2025 -

Mindy Kalings Weight Loss A New Look At The Series Premiere

May 06, 2025

Mindy Kalings Weight Loss A New Look At The Series Premiere

May 06, 2025