Analyzing Bitcoin's Potential For A 10x Price Appreciation

Table of Contents

H2: Bitcoin's Historical Price Performance and Growth Cycles

Understanding Bitcoin's past is crucial to predicting its future. Analyzing Bitcoin's price history reveals cyclical patterns of bull and bear markets, characterized by periods of intense growth followed by sharp corrections. The term "Bitcoin price history" is often used to refer to this volatile journey.

H3: Past Bull and Bear Markets

- Previous Bull Runs: Bitcoin has experienced several significant bull markets. The 2013 bull run saw a price increase of over 5,000%, while the 2017 bull run yielded a more than 2,000% increase. These "Bitcoin bull market" periods were driven by factors including increased media attention, growing institutional interest, and technological advancements.

- Halving Events: Bitcoin's halving events, which reduce the rate of new Bitcoin creation, have historically preceded bull markets. The reduced supply often leads to increased scarcity and price appreciation. Analyzing the impact of previous Bitcoin halvings is critical for understanding potential future price movements. This analysis involves looking at the "Bitcoin halving" cycles and their correlation to price increases.

- Comparison to Current Conditions: While past performance is not indicative of future results, comparing current market conditions (adoption rates, regulatory landscape, macroeconomic factors) to those preceding previous bull runs can offer valuable insights into the potential for a Bitcoin 10x price increase. Analyzing the "Bitcoin price chart analysis" is a useful tool in this regard.

H2: Macroeconomic Factors Influencing Bitcoin's Price

Global economic uncertainty and inflation are key drivers influencing Bitcoin's price. Bitcoin's limited supply and decentralized nature position it as a potential hedge against inflation and economic instability.

H3: Inflation and Global Economic Uncertainty

- Inflation as a Catalyst: High inflation erodes the purchasing power of fiat currencies, driving investors to seek alternative assets that retain their value. Bitcoin, with its fixed supply of 21 million coins, is often seen as a potential "Bitcoin inflation hedge."

- Geopolitical Instability: Periods of geopolitical instability can increase demand for Bitcoin as a safe-haven asset, leading to price appreciation. "Bitcoin as a safe haven" is a frequently discussed aspect of its value proposition.

- Fiat Currency Devaluation: The potential devaluation of major fiat currencies further strengthens Bitcoin's position as a store of value.

H3: Limited Supply and Value Retention

The inherent scarcity of Bitcoin, with a capped supply of 21 million coins, plays a crucial role in its potential for long-term value appreciation. This characteristic is often highlighted when discussing "macroeconomic factors affecting Bitcoin."

H2: Adoption and Technological Advancements Driving Bitcoin's Growth

Increased institutional adoption and technological advancements are catalysts for Bitcoin's potential growth.

H3: Growing Institutional Adoption

- Institutional Investment: The entry of large institutional investors, such as MicroStrategy and Tesla, into the Bitcoin market signals growing confidence and legitimacy, driving demand and price.

- Corporate Treasury Holdings: More and more corporations are adding Bitcoin to their balance sheets, further solidifying its place as an asset class.

H3: Technological Developments in the Bitcoin Ecosystem

- Lightning Network: The Lightning Network significantly improves Bitcoin's scalability and transaction speed, enhancing its usability for everyday payments. This is a key factor in discussions about "Bitcoin scalability."

- Regulatory Changes: Favorable regulatory changes in various jurisdictions can boost Bitcoin adoption and its price.

H2: Potential Risks and Challenges Hindering a 10x Price Increase

Despite its potential, several factors could hinder a Bitcoin 10x price increase.

H3: Regulatory Uncertainty

- Varying Regulations: Different jurisdictions have varying regulatory approaches towards cryptocurrencies, creating uncertainty and potentially impacting Bitcoin's price. "Bitcoin regulation" remains a complex and evolving landscape.

- Potential Bans or Restrictions: Strict regulatory measures or outright bans in major markets could negatively affect Bitcoin's price.

H3: Market Volatility and Price Corrections

Bitcoin's price is notoriously volatile, subject to significant corrections. This "Bitcoin price volatility" is a key risk factor.

H3: Competition from Altcoins

The emergence of competing cryptocurrencies ("altcoin competition") could potentially divert investment away from Bitcoin, impacting its dominance and price.

3. Conclusion:

Analyzing Bitcoin's potential for a 10x price appreciation requires considering its historical performance, macroeconomic factors, adoption rates, technological advancements, and inherent risks. While a 10x increase is theoretically possible given the right circumstances, it's crucial to acknowledge the significant volatility and uncertainties involved. Further research into Bitcoin 10x potential is recommended before making any investment decisions. Analyze Bitcoin's price appreciation potential carefully, and learn more about Bitcoin's future based on your own research and risk tolerance. Remember that this analysis does not constitute financial advice. Conduct thorough due diligence before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

Stephen Kings Endorsement Boosts The Life Of Chuck Movie Trailer

May 08, 2025

Stephen Kings Endorsement Boosts The Life Of Chuck Movie Trailer

May 08, 2025 -

Psg Nantes 0 0 Kazanc Yok Kayip Yok

May 08, 2025

Psg Nantes 0 0 Kazanc Yok Kayip Yok

May 08, 2025 -

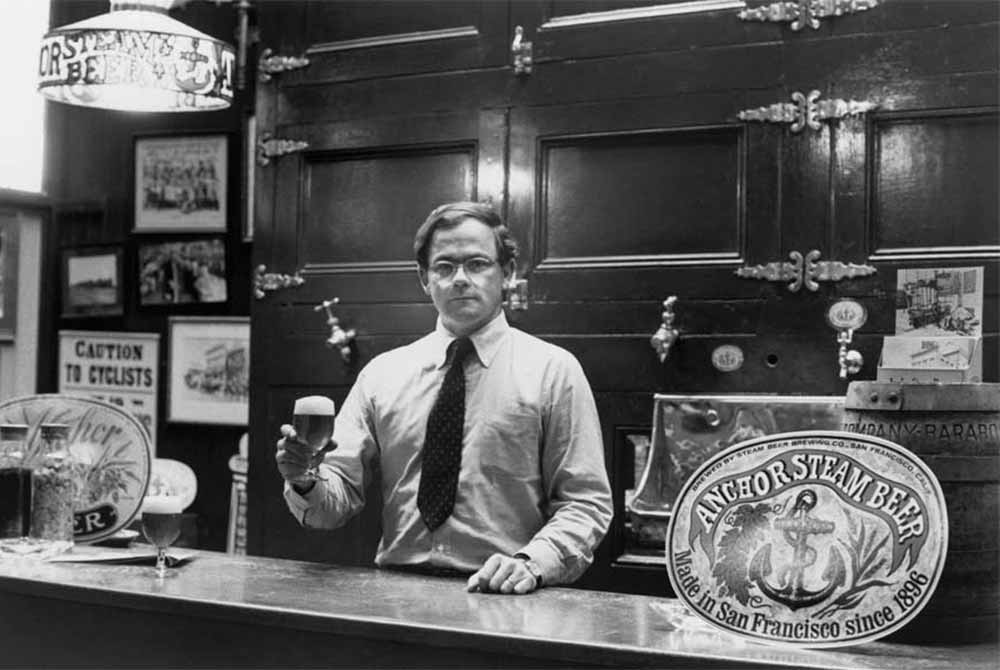

127 Years Of Brewing History Concludes Anchor Brewing Companys Closure

May 08, 2025

127 Years Of Brewing History Concludes Anchor Brewing Companys Closure

May 08, 2025 -

Bitcoins Recent Recovery A Sign Of Things To Come

May 08, 2025

Bitcoins Recent Recovery A Sign Of Things To Come

May 08, 2025 -

Lyon Psg Maci Canli Izle Hangi Kanalda Ve Ne Zaman

May 08, 2025

Lyon Psg Maci Canli Izle Hangi Kanalda Ve Ne Zaman

May 08, 2025

Latest Posts

-

Kripto Piyasasi Duesuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025

Kripto Piyasasi Duesuesue Ve Yatirimci Satislari Detayli Analiz

May 08, 2025 -

Counting Crows Snl Appearance A Career Turning Point

May 08, 2025

Counting Crows Snl Appearance A Career Turning Point

May 08, 2025 -

Kripto Yatirimlarinda Guevenlik Oenlemleri Spk Nin Yeni Duezenlemesi

May 08, 2025

Kripto Yatirimlarinda Guevenlik Oenlemleri Spk Nin Yeni Duezenlemesi

May 08, 2025 -

Kripto Paralarin Duesuesue Yatirimcilari Nasil Etkiliyor

May 08, 2025

Kripto Paralarin Duesuesue Yatirimcilari Nasil Etkiliyor

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Rise To Stardom

May 08, 2025