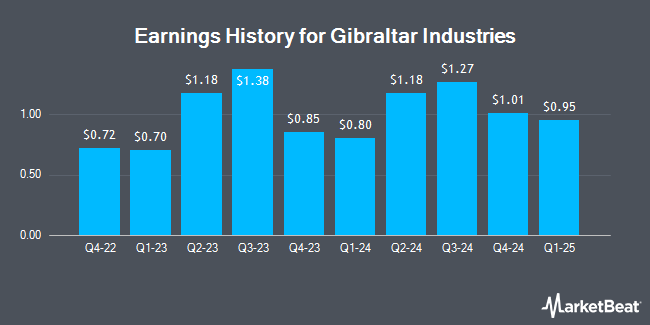

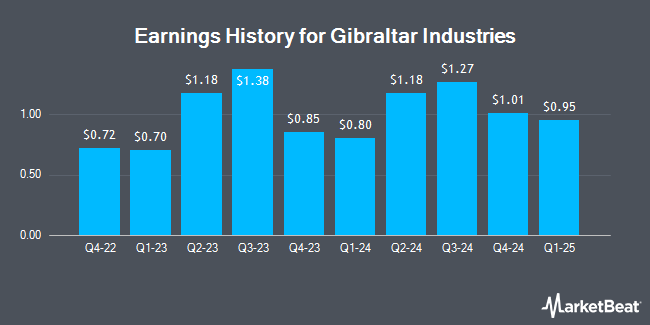

Analyzing Gibraltar Industries (ROCK) Upcoming Earnings Report

Table of Contents

Understanding Gibraltar Industries' (ROCK) Business Model and Recent Performance

Gibraltar Industries (ROCK) operates primarily in two core business segments: building products and renewable energy solutions. The building products segment focuses on providing a variety of products for residential and commercial construction, encompassing roofing, decking, and related materials. Their renewable energy solutions segment caters to the growing demand for sustainable energy infrastructure. Recent performance has shown a mixed bag. While revenue growth has been observed in specific segments, overall profitability has been impacted by factors like increased material costs and supply chain disruptions.

- Key Revenue Drivers: Strong demand for residential construction materials, growth in the renewable energy sector, and strategic acquisitions have all contributed to Gibraltar Industries' revenue.

- Profit Margins and Trends: Profit margins have faced pressure due to inflationary pressures and supply chain bottlenecks, leading to a need for careful scrutiny of the upcoming report's margin data.

- Debt Levels and Financial Health: Monitoring the company's debt-to-equity ratio and interest coverage ratio is crucial to assessing its financial health and ability to withstand economic downturns.

- Competitor Analysis: Analyzing ROCK's competitive landscape, including key players and their market share, provides context for interpreting the company's performance.

Key Factors to Watch in the Upcoming ROCK Earnings Report

The upcoming ROCK earnings report is highly anticipated, with analysts closely monitoring several key performance indicators. The overall market sentiment will undoubtedly influence how the report is received. Investors should pay close attention to:

- Revenue Growth Expectations: Analysts' consensus estimates for revenue growth will be a key benchmark against which actual results will be compared.

- Earnings Per Share (EPS) Projections: Meeting or exceeding EPS projections is crucial for maintaining investor confidence and supporting the stock price.

- Guidance for Future Quarters: Management's outlook for future quarters will provide insights into the company's expectations for future performance and potential challenges.

- Capital Expenditures and Investments: Significant capital expenditures could signal future growth potential, but also impact short-term profitability.

- Impact of Supply Chain Disruptions: The ongoing impact of supply chain disruptions on ROCK's operations and profitability is a major concern for investors.

Evaluating ROCK's Valuation and Investment Implications

Analyzing Gibraltar Industries' valuation requires examining several key metrics. The price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and other valuation multiples will be essential in determining whether the stock is currently undervalued or overvalued.

- Current Market Capitalization: Understanding the company's current market cap provides context for assessing its size and investment potential within the broader market.

- Historical Stock Price Performance: Reviewing historical stock price trends can offer insights into the stock's volatility and potential future performance.

- Analyst Ratings and Price Targets: Consulting with analyst ratings and price targets can provide additional perspective on the stock's valuation.

- Potential Catalysts for Stock Price Appreciation: Identifying potential catalysts, such as new product launches or strategic acquisitions, is crucial for assessing future upside potential.

- Risks Associated with the Investment: Understanding the risks associated with investing in ROCK, including market volatility and industry-specific challenges, is critical for risk management.

How to Effectively Analyze Gibraltar Industries (ROCK) Earnings Report Data

Effectively analyzing the earnings report requires a comprehensive understanding of financial statements. This involves scrutinizing the income statement, balance sheet, and cash flow statement.

- Key Financial Ratios to Focus On: Pay close attention to metrics such as gross profit margin, operating profit margin, return on equity (ROE), and debt-to-equity ratio.

- Comparison to Industry Benchmarks: Compare ROCK's performance against its industry peers to assess its relative strength and weaknesses.

- Understanding the Company's Narrative: Consider the company's own explanation of its performance and future outlook, paying close attention to management commentary.

- Identifying Red Flags or Positive Signals: Look for any unusual trends or inconsistencies in the financial data that may indicate potential problems or opportunities.

Making Informed Investment Decisions Based on the ROCK Earnings Report

In conclusion, analyzing Gibraltar Industries (ROCK) upcoming earnings report requires a multifaceted approach encompassing an understanding of the company's business model, recent performance, and future expectations. By carefully evaluating the key factors discussed above and conducting thorough due diligence, investors can gain valuable insights into the company's potential and make informed investment decisions. Remember that market conditions are dynamic. Continue your own analysis of Gibraltar Industries (ROCK), considering all relevant factors before making any investment decisions. Stay informed about future Gibraltar Industries (ROCK) reports and monitor the company's progress to make well-informed, long-term investment choices.

Featured Posts

-

Yamamoto And Edman Power Dodgers To 3 0 Win Against Cubs

May 13, 2025

Yamamoto And Edman Power Dodgers To 3 0 Win Against Cubs

May 13, 2025 -

Stuttgart Open Sabalenka Uses Photo To Dispute Umpires Call

May 13, 2025

Stuttgart Open Sabalenka Uses Photo To Dispute Umpires Call

May 13, 2025 -

Stuttgart Open Ostapenko Defeats Swiatek Secures Semifinal Spot

May 13, 2025

Stuttgart Open Ostapenko Defeats Swiatek Secures Semifinal Spot

May 13, 2025 -

Dodgers 11 10 Heartbreaker A Game Of Inches

May 13, 2025

Dodgers 11 10 Heartbreaker A Game Of Inches

May 13, 2025 -

Eurovision 2025 Sissal Danmarks Deltager

May 13, 2025

Eurovision 2025 Sissal Danmarks Deltager

May 13, 2025