Analyzing Palantir's 30% Drop: A Buying Decision

Table of Contents

Understanding the Reasons Behind Palantir's Decline

Market Sentiment and Broader Tech Downturn

The recent downturn in Palantir's stock price isn't isolated; it reflects a broader trend impacting many high-growth technology stocks. Rising interest rates, persistent inflation, and concerns about a potential recession have created a risk-averse market environment. Investors are shifting away from speculative investments, impacting companies like Palantir, which, while showing strong growth potential, hasn't yet achieved consistent profitability.

- Rising Interest Rates: Higher interest rates increase borrowing costs for companies, impacting expansion plans and potentially reducing future earnings.

- Inflationary Pressures: Inflation erodes purchasing power and can lead to decreased consumer spending, affecting demand for Palantir's services.

- Recessionary Fears: Concerns about a potential economic slowdown contribute to investor uncertainty and a preference for safer investments.

Palantir's correlation with the broader tech market is undeniable; its stock price movements often mirror the Nasdaq Composite Index. Analyzing this correlation can provide further insights into the external factors contributing to Palantir's 30% drop.

Palantir's Financial Performance and Guidance

Analyzing Palantir's recent financial performance is crucial in understanding the stock's recent volatility. While the company has shown consistent revenue growth, profitability remains a challenge. Examining key metrics like revenue, operating income, and customer acquisition costs offers a clearer picture.

- Revenue Growth: Although revenue has increased year-over-year, the pace of growth may not meet overly optimistic market expectations.

- Operating Income: Palantir is still operating at a loss, though this is partially due to significant investments in R&D and sales & marketing.

- Customer Acquisition Costs: Attracting and retaining large enterprise clients is expensive, potentially impacting short-term profitability.

A careful review of Palantir's earnings reports and future guidance reveals whether the current valuation accurately reflects its financial performance and growth prospects. Specific numbers and comparisons with previous quarters are essential for a complete analysis.

Specific News and Events Impacting Palantir's Stock

Beyond broader market trends, specific news and events can significantly impact a company's stock price. Any contract delays, regulatory hurdles, or increased competitive pressure could contribute to the recent decline.

- Potential Contract Delays: Delays in securing or implementing large government or commercial contracts could negatively affect revenue projections.

- Competitive Landscape: The data analytics market is highly competitive, and the emergence of new players or intensified competition could put pressure on Palantir's market share.

- Regulatory Scrutiny: Any regulatory investigations or changes impacting Palantir's operations could create uncertainty and negatively impact investor sentiment.

Evaluating Palantir's Long-Term Potential

Government Contracts and Growth

Palantir's significant reliance on government contracts presents both opportunities and risks. Analyzing the pipeline of future government contracts and their potential value is crucial.

- Government Spending: Government budgets and priorities play a significant role in Palantir's revenue stream.

- Contract Renewals: Securing contract renewals is paramount for consistent revenue generation.

- Geopolitical Factors: Global events and shifts in government priorities can impact the demand for Palantir's services.

The size of the government contracting market and Palantir's market share within it are crucial factors to consider.

Commercial Sector Expansion

Palantir's strategic expansion into the commercial sector is vital for long-term growth and diversification. The success and potential of this expansion need to be evaluated.

- Commercial Partnerships: Strategic alliances and partnerships with key players in various industries contribute to market penetration.

- Client Acquisition: Winning new commercial clients across different sectors demonstrates market acceptance and demand.

- Revenue from Commercial Clients: The growth of revenue from the commercial sector showcases the success of Palantir's expansion strategy.

Data on market penetration and revenue from commercial clients are essential indicators of this sector's contribution to Palantir's overall performance.

Technological Innovation and Competitive Advantage

Palantir's technological capabilities and its competitive edge in the data analytics market significantly influence its long-term prospects.

- Data Integration and Analysis: Palantir's platform's ability to integrate and analyze vast amounts of data from various sources provides a competitive advantage.

- Artificial Intelligence and Machine Learning: The integration of AI and machine learning capabilities enhances the platform's functionalities and provides valuable insights.

- Cybersecurity: Palantir's focus on data security and compliance is critical in attracting clients concerned about data breaches.

Comparing Palantir's technology and offerings to its main competitors highlights its unique selling points and potential advantages.

Assessing the Risk and Reward of Investing in Palantir

Valuation and Stock Price

Analyzing Palantir's current valuation relative to its historical performance and future prospects is key to determining its investment attractiveness.

- Price-to-Sales Ratio (PSR): Comparing Palantir's PSR to industry peers provides insights into its relative valuation.

- Future Growth Projections: Analyzing revenue growth projections and potential profitability assists in evaluating the long-term value potential.

- Discounted Cash Flow (DCF) Analysis: A DCF model can help estimate the intrinsic value of Palantir's stock.

Relevant valuation metrics and charts provide a visual representation of Palantir's valuation compared to its historical performance and competitors.

Risk Factors

Investing in Palantir involves significant risks that potential investors must acknowledge.

- High Growth Stock Volatility: High-growth stocks are generally more volatile than established, mature companies.

- Dependence on Large Contracts: Palantir's reliance on large government and commercial contracts exposes it to the risk of contract cancellations or delays.

- Competition: Intense competition in the data analytics market could impact market share and profitability.

Potential for Return

Based on the analysis, the potential for future returns needs to be carefully assessed.

- Positive Aspects: Strong revenue growth, potential for expansion into new markets, and technological innovation suggest a potential for significant upside.

- Negative Aspects: High valuation, limited profitability, and dependence on large contracts represent significant risks.

A balanced assessment of positive and negative factors is crucial for informed decision-making.

Conclusion: Should You Buy Palantir After its 30% Drop?

This analysis of Palantir's 30% drop reveals a mixed picture. While the recent decline reflects broader market headwinds and specific concerns about Palantir's financial performance, the company's long-term potential remains significant. Its innovative technology, expanding commercial sector presence, and continued involvement in critical government projects present opportunities for future growth. However, risks associated with high-growth stock volatility and reliance on large contracts need careful consideration.

Whether or not to buy Palantir after its 30% drop depends on your individual risk tolerance and investment horizon. If you're a long-term investor with a higher risk tolerance and believe in Palantir's long-term growth potential, this could be a compelling buying opportunity. However, those seeking lower-risk investments might want to wait for more evidence of sustained profitability or consider other investment options.

While this analysis suggests a cautious optimism, it's crucial to conduct your own thorough research before making any investment decisions regarding Palantir's 30% drop and its future prospects. Remember to carefully consider your personal investment goals and risk tolerance before acting on this information.

Featured Posts

-

New Program Offers Technical Skills Training To Transgender People In Punjab

May 10, 2025

New Program Offers Technical Skills Training To Transgender People In Punjab

May 10, 2025 -

Nhl News Leon Draisaitl Injured Future Uncertain For Oilers Top Scorer

May 10, 2025

Nhl News Leon Draisaitl Injured Future Uncertain For Oilers Top Scorer

May 10, 2025 -

Summer Travel 2024 Real Id Requirements And Airport Checkpoints

May 10, 2025

Summer Travel 2024 Real Id Requirements And Airport Checkpoints

May 10, 2025 -

Trumps Greenland Gambit A Closer Look At Increased Danish Influence

May 10, 2025

Trumps Greenland Gambit A Closer Look At Increased Danish Influence

May 10, 2025 -

100 Days Of Trump How Did It Impact Elon Musks Fortune

May 10, 2025

100 Days Of Trump How Did It Impact Elon Musks Fortune

May 10, 2025

Latest Posts

-

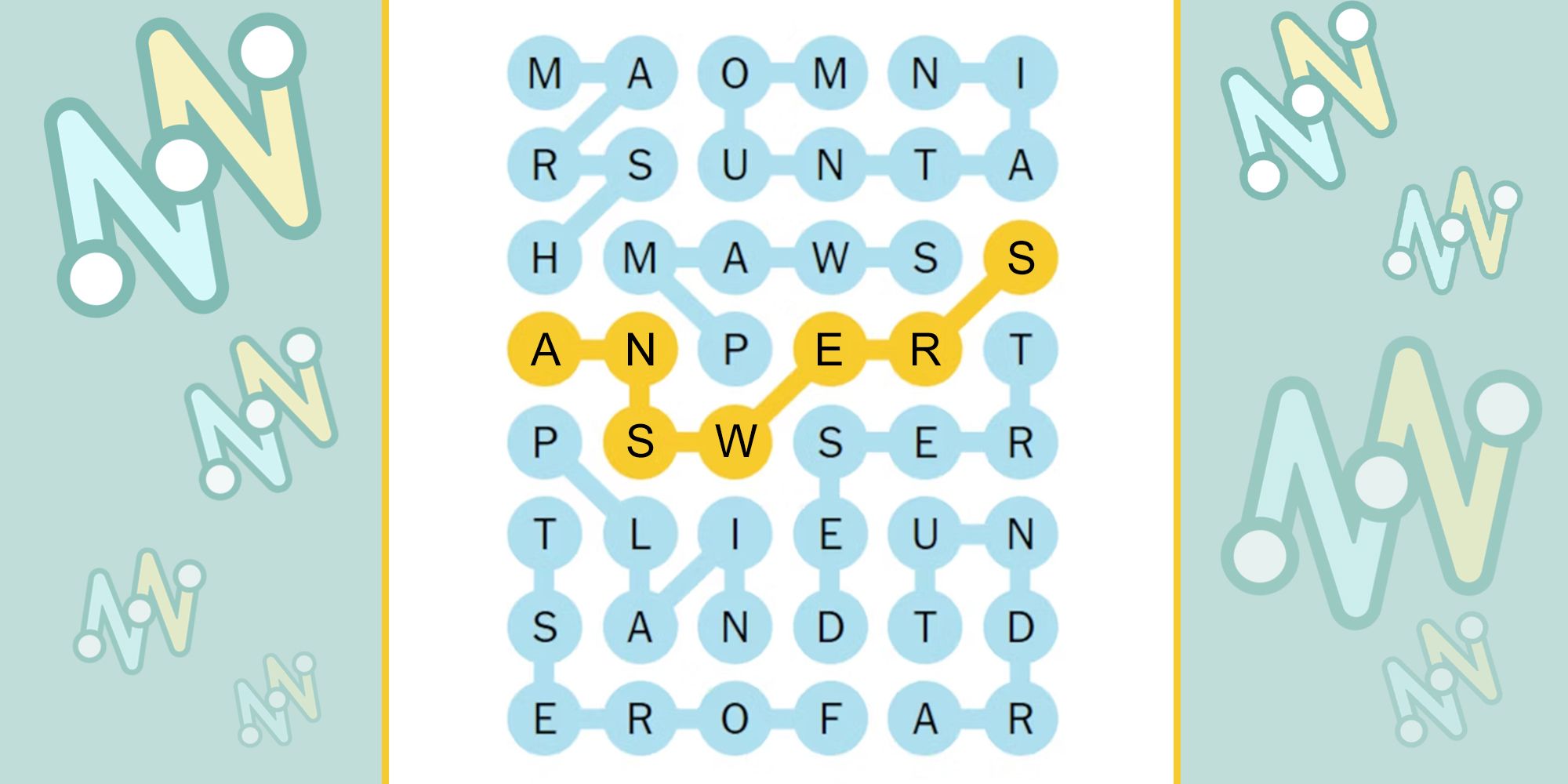

Nyt Strands Answers And Hints Tuesday March 4 2024 Game 366

May 10, 2025

Nyt Strands Answers And Hints Tuesday March 4 2024 Game 366

May 10, 2025 -

Solve Nyt Strands Puzzle 366 March 4th Hints And Answers

May 10, 2025

Solve Nyt Strands Puzzle 366 March 4th Hints And Answers

May 10, 2025 -

Strands Nyt Tuesday March 4th Complete Answers And Hints For Puzzle 366

May 10, 2025

Strands Nyt Tuesday March 4th Complete Answers And Hints For Puzzle 366

May 10, 2025 -

Nyt Strands Hints And Answers For Tuesday March 4 Game 366

May 10, 2025

Nyt Strands Hints And Answers For Tuesday March 4 Game 366

May 10, 2025 -

Wednesday March 12 Nyt Strands Puzzle Hints And Answers Game 374

May 10, 2025

Wednesday March 12 Nyt Strands Puzzle Hints And Answers Game 374

May 10, 2025