Analyzing The Dow: Impact Of US-China Trade Tensions On Futures

Table of Contents

Historical Correlation: Trade Wars and Dow Performance

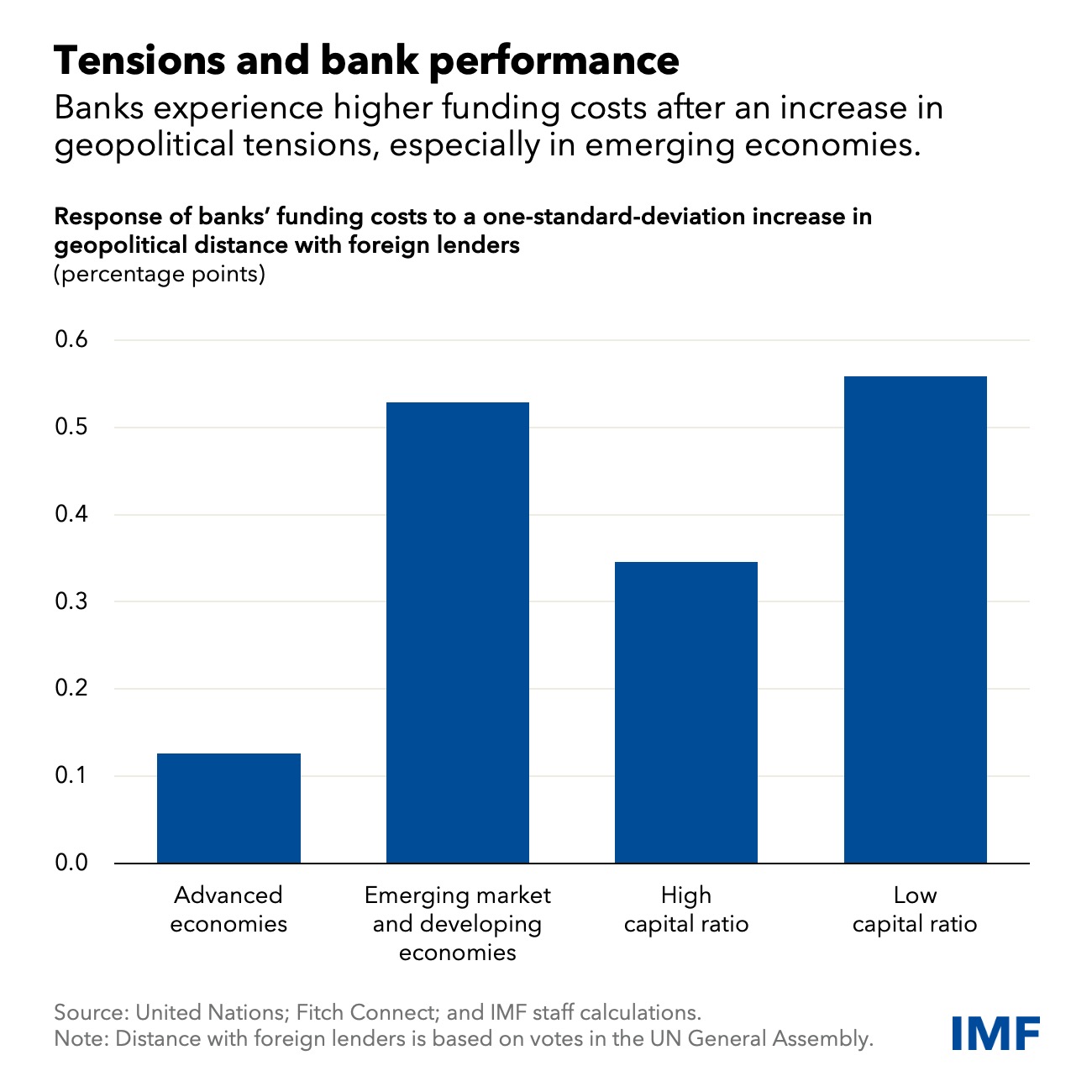

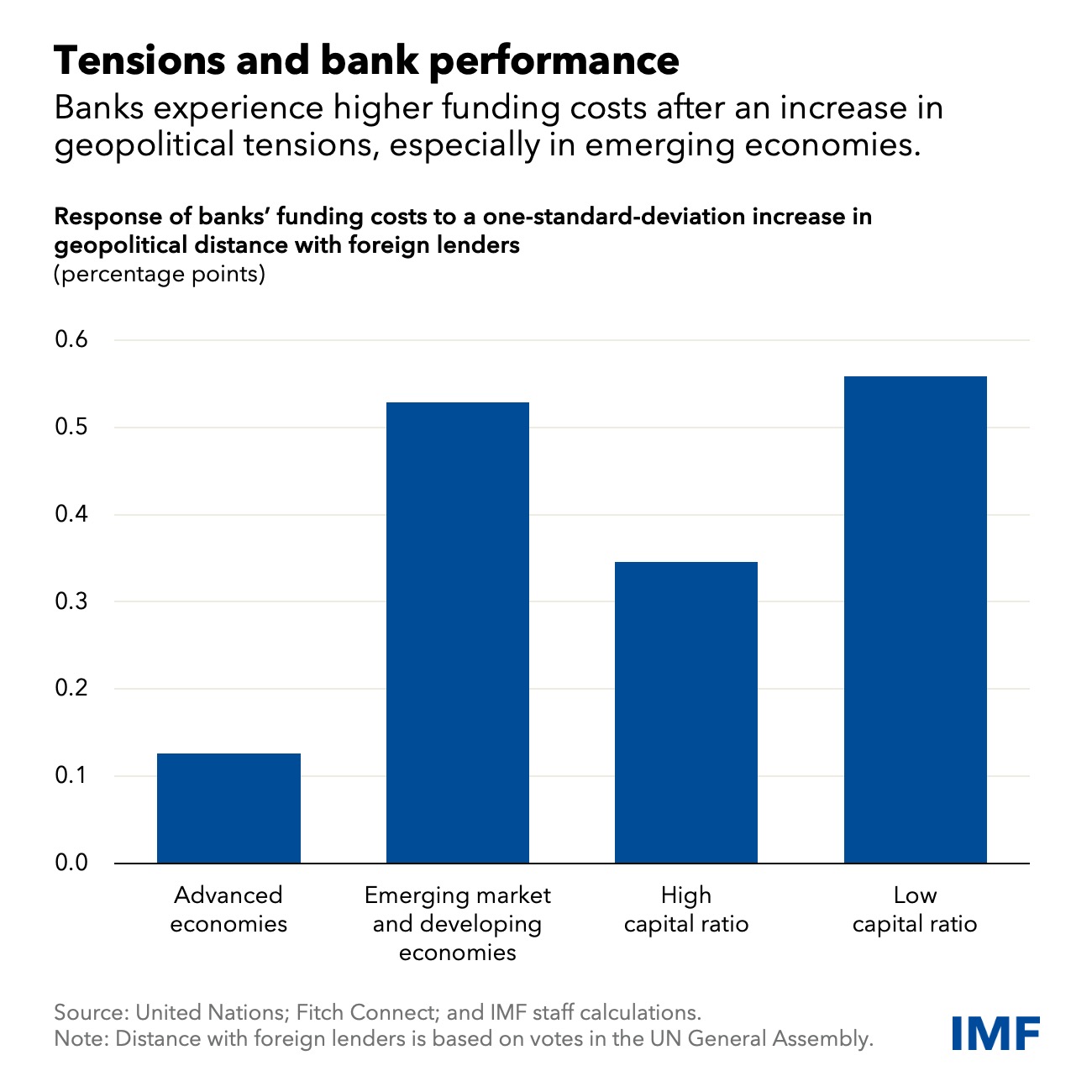

Analyzing historical data reveals a clear correlation between heightened US-China trade tensions and subsequent Dow fluctuations. Past instances of increased tariffs, trade restrictions, and escalating rhetoric have often led to immediate market corrections.

- 2018-2019 Trade War: The imposition of tariffs on hundreds of billions of dollars worth of goods resulted in significant Dow declines. Charts clearly illustrate a negative correlation between escalating tariff announcements and Dow performance during this period.

- Phase One Trade Deal (2020): The signing of the Phase One trade deal brought temporary relief, resulting in a positive market response and a bounce in Dow futures.

- Renewed Tensions (2020-Present): Renewed trade disputes and geopolitical uncertainties have again introduced volatility, highlighting the ongoing sensitivity of the Dow to US-China relations.

(Include charts and graphs visually representing the correlation between trade events and Dow fluctuations here.)

Using historical data and Dow chart analysis provides valuable context, illustrating the impact of tariff impact and trade negotiation effects on investor sentiment and market behavior. Understanding these historical patterns is crucial for predicting future responses.

Mechanisms of Influence: How Trade Disputes Affect Dow Futures

The influence of US-China trade disputes on Dow futures operates through several interconnected mechanisms:

- Investor Sentiment: Trade tensions fuel uncertainty and risk aversion among investors, leading to sell-offs and declines in stock prices, including Dow futures. Fear of economic slowdown often dominates investor sentiment.

- Supply Chain Disruptions: Tariffs and trade restrictions disrupt global supply chains, increasing costs for businesses and potentially impacting corporate earnings. This directly impacts the profitability of many Dow component companies.

- Global Economic Growth: A prolonged trade war can negatively affect global economic growth, reducing demand for goods and services, and further impacting corporate profits and Dow performance.

- Currency Fluctuations: Fluctuations in the USD/CNY exchange rate influence the profitability of multinational corporations with significant operations in China. A stronger dollar can negatively impact the earnings of US companies selling goods in China.

- Specific Dow Components: Companies heavily reliant on trade with China (e.g., technology firms, consumer goods companies) are particularly vulnerable to trade tensions. Analyzing the impact on these specific Dow components is crucial for understanding the overall market effect.

Predictive Modeling and Forecasting Dow Futures

Predicting the exact impact of US-China trade tensions on Dow futures is challenging, but econometric models and quantitative analysis can offer valuable insights.

- Econometric Models: These statistical models use historical data and economic indicators (e.g., trade volume, tariff levels, economic growth forecasts) to forecast Dow performance. However, the complexity of these models and the limitations in accurately capturing all relevant factors can impact predictive accuracy.

- Quantitative Analysis: This involves analyzing large datasets to identify patterns and correlations between trade developments and market reactions.

- Sentiment Analysis: Analyzing news articles, social media posts, and investor commentary can provide insights into market sentiment and expectations. This can help gauge the potential market reaction to specific trade developments.

Despite these tools, accurate prediction remains difficult due to the unpredictable nature of geopolitical events and the complex interplay of factors affecting market behavior.

Investment Strategies for Navigating Trade Uncertainty

Navigating the uncertainty surrounding US-China trade relations requires a robust investment strategy focusing on risk management and diversification.

- Hedging Strategies: Options and futures contracts can be used to hedge against potential losses in Dow futures resulting from trade tensions.

- Portfolio Diversification: Diversifying your portfolio across different asset classes and sectors reduces the overall impact of any single factor, such as trade disputes. Investment diversification is key to mitigating risk.

- Focus on Resilient Companies: Invest in companies with strong domestic markets or diversified global footprints that are less vulnerable to trade disruptions.

- Risk Management: Regularly review your portfolio, adjust your asset allocation based on market developments, and maintain a well-defined risk tolerance level.

Conclusion: Mitigating the Impact of US-China Trade Tensions on Your Dow Investments

The relationship between US-China trade relations and Dow futures is complex and significant. Understanding the mechanisms through which trade tensions impact the market, leveraging predictive modeling, and employing proactive investment strategies are crucial for mitigating risks. Conduct thorough research, diversify your investments, and develop a robust strategy to navigate future uncertainties related to Dow futures and US-China trade tensions. Stay updated on trade developments and continue analyzing the Dow to make informed investment decisions. Proactive risk management is paramount when dealing with the volatility associated with US-China trade disputes and their impact on Dow futures.

Featured Posts

-

Shedeur Sanders Athleticism Deions Honest Assessment

Apr 26, 2025

Shedeur Sanders Athleticism Deions Honest Assessment

Apr 26, 2025 -

Middle Management Their Crucial Role In Organizational Effectiveness

Apr 26, 2025

Middle Management Their Crucial Role In Organizational Effectiveness

Apr 26, 2025 -

Discover The Countrys Top New Business Locations

Apr 26, 2025

Discover The Countrys Top New Business Locations

Apr 26, 2025 -

Ajax Vs Az Security Beefed Up Due To Fan Misconduct Concerns

Apr 26, 2025

Ajax Vs Az Security Beefed Up Due To Fan Misconduct Concerns

Apr 26, 2025 -

Exclusive Access A Side Hustle For Investing In Elon Musks Businesses

Apr 26, 2025

Exclusive Access A Side Hustle For Investing In Elon Musks Businesses

Apr 26, 2025

Latest Posts

-

Nba Playoffs Knicks Vs Celtics Prediction Picks And Best Bets For Game 1

May 06, 2025

Nba Playoffs Knicks Vs Celtics Prediction Picks And Best Bets For Game 1

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions And Betting Picks For Nba Playoffs

May 06, 2025 -

Knicks Vs Celtics Prediction Game 1 Playoffs Best Bets And Picks

May 06, 2025

Knicks Vs Celtics Prediction Game 1 Playoffs Best Bets And Picks

May 06, 2025 -

How To Watch Celtics Vs Pistons Live Stream And Tv Channel Info

May 06, 2025

How To Watch Celtics Vs Pistons Live Stream And Tv Channel Info

May 06, 2025 -

March 23rd Celtics Vs Trail Blazers Game Time Tv Channel And Live Stream

May 06, 2025

March 23rd Celtics Vs Trail Blazers Game Time Tv Channel And Live Stream

May 06, 2025