Analyzing The G-7's Proposed Changes To De Minimis Tariffs For Chinese Products

Table of Contents

Understanding De Minimis Tariffs and Their Current Impact

H3: Definition and Purpose of De Minimis Tariffs: De minimis tariffs refer to the low value threshold below which imported goods are exempt from customs duties. Their purpose is to simplify customs procedures and reduce the administrative burden on importers, particularly for smaller shipments. This benefits consumers by potentially lowering prices on smaller imported items and also reduces the compliance costs for businesses importing smaller quantities of goods from abroad.

H3: Current De Minimis Tariff Levels for Chinese Products: Currently, de minimis tariff levels for Chinese products vary across G7 nations. While specific thresholds are constantly subject to change and vary widely by country and product type, it's crucial to understand that these differences impact the competitiveness of Chinese goods in global markets. For example, lower thresholds make importing smaller quantities of Chinese goods more attractive. Reliable data from official government sources (links to those sources would be included here) would be necessary to provide exact current figures.

- Impact on small businesses: Low de minimis thresholds allow small businesses to import smaller batches of goods from China more easily, boosting their competitiveness.

- Revenue implications for governments: Current de minimis levels translate to a loss of potential tariff revenue for governments. The exact amount varies greatly by country and is difficult to quantify precisely without country-specific data.

- Impact on competitiveness of Chinese goods: The current system, with varying thresholds across nations, can significantly impact the global competitiveness of Chinese products. Lower thresholds in some countries give Chinese exporters an advantage, while higher thresholds in others could diminish that advantage.

The G-7's Proposed Changes: A Detailed Examination

H3: Reasons Behind the Proposed Modifications: The G7's proposed modifications to de minimis tariffs for Chinese products stem from various concerns. These may include anxieties about unfair trade practices, intellectual property theft, and national security issues related to certain imports from China. The aim is often to level the playing field and address perceived imbalances in international trade.

H3: Specific Proposals and Their Potential Effects: The specifics of the proposed changes vary among G7 nations. Some proposals suggest raising the de minimis thresholds, while others may focus on specific product categories, potentially targeting industries deemed sensitive from a national security perspective. The effects on businesses range from increased costs for imports (if thresholds are raised) to potentially less administrative burden for smaller businesses in certain situations. These changes can also have significant repercussions on global supply chains, leading to disruptions and the need for companies to re-evaluate their sourcing strategies.

- Key proposals and numerical implications: (Specific numerical examples of proposed changes would be included here, referencing official G7 statements or related documents).

- Potential benefits and drawbacks: Increased revenue for governments vs. higher costs for consumers and businesses; enhanced national security vs. potential trade disputes.

- Alignment with stated goals: (An assessment of whether the proposals effectively address the G7's stated goals would be included here).

Economic and Geopolitical Implications of the Proposed Changes

H3: Impact on Businesses and Consumers: The proposed changes will disproportionately affect small and medium-sized enterprises (SMEs) that rely on importing Chinese goods. Higher de minimis thresholds will lead to increased costs, potentially forcing price increases for consumers and potentially reducing the availability of certain products. Larger businesses may have more resources to absorb these cost increases.

H3: Geopolitical Ramifications: The G7's actions could trigger retaliatory measures from China, escalating trade tensions and impacting US-China relations more broadly. The changes could also influence global trade alliances, potentially strengthening some and weakening others depending on the reactions of affected countries.

- Shifts in global trade patterns: The proposed changes may lead to businesses seeking alternative sourcing locations outside of China, thus shifting global trade flows.

- Impact on different industries: Industries heavily reliant on Chinese imports will be particularly vulnerable to the effects of increased tariffs.

- Potential for trade disputes and retaliatory tariffs: The risk of trade disputes and retaliatory tariffs is significant, potentially leading to a global trade war.

Analyzing the Long-Term Effects of the Proposed De Minimis Tariff Changes

H3: Predicting Future Trade Flows: The changes in de minimis tariffs will likely reshape trade flows between China and G7 nations. We might see a decrease in imports from China in certain sectors, replaced by goods from other countries.

H3: Adaptation Strategies for Businesses: Businesses need to develop strategies to navigate this new tariff environment. This might involve diversifying sourcing, investing in automation to offset increased costs, or exploring new markets.

- Increased diversification of sourcing: Businesses can reduce their reliance on China by sourcing goods from other countries.

- Mitigation of increased costs: Strategies like process optimization and improved efficiency can help offset increased costs.

- Long-term implications for economic growth: The long-term impact on economic growth will depend on how effectively businesses adapt to these changes and the overall geopolitical response.

Conclusion: Understanding the Future of De Minimis Tariffs for Chinese Products

The G7's proposed changes to de minimis tariffs for Chinese products have significant economic and geopolitical implications. The adjustments will undoubtedly reshape global trade patterns, impacting businesses, consumers, and international relations. The key takeaway is that businesses need to be proactive in adapting to this shifting landscape. Staying informed about further developments and engaging in open discussions about the future of de minimis tariffs for Chinese products is crucial for all stakeholders. Further research into the specific proposals of each G7 nation, and analysis of the potential impact on specific industries, is recommended to gain a more comprehensive understanding of this complex issue.

Featured Posts

-

Finale Na Ln Shpani A Shampion Po Penali Protiv Khrvatska

May 23, 2025

Finale Na Ln Shpani A Shampion Po Penali Protiv Khrvatska

May 23, 2025 -

Memorial Day 2025 Date History And Three Day Weekend

May 23, 2025

Memorial Day 2025 Date History And Three Day Weekend

May 23, 2025 -

Gospodaryuvannya Bez Storonnikh Tov Z Odnim Uchasnikom Perevagi Ta Nedoliki

May 23, 2025

Gospodaryuvannya Bez Storonnikh Tov Z Odnim Uchasnikom Perevagi Ta Nedoliki

May 23, 2025 -

Manchester United News Ten Hags Leverkusen Link And The Manager Search

May 23, 2025

Manchester United News Ten Hags Leverkusen Link And The Manager Search

May 23, 2025 -

Alerta Meteorologica Vaguada Y Sistema Frontal Provocaran Lluvias Este Sabado

May 23, 2025

Alerta Meteorologica Vaguada Y Sistema Frontal Provocaran Lluvias Este Sabado

May 23, 2025

Latest Posts

-

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 23, 2025

Wwe Wrestle Mania 41 Golden Belts Memorial Day Weekend Ticket Sale

May 23, 2025 -

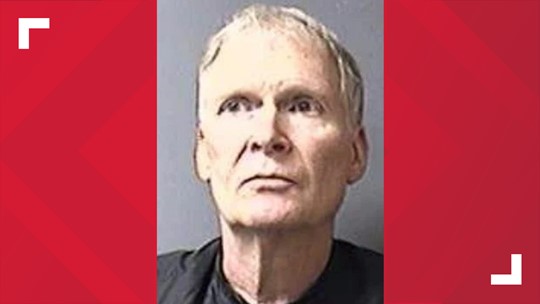

Child Sex Crimes Case Columbus Mans Conviction

May 23, 2025

Child Sex Crimes Case Columbus Mans Conviction

May 23, 2025 -

Behind The Scenes Neal Mc Donoughs Preparation For Bull Riding Video

May 23, 2025

Behind The Scenes Neal Mc Donoughs Preparation For Bull Riding Video

May 23, 2025 -

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Details

May 23, 2025

Sylvester Stallone Returns In Tulsa King Season 2 Blu Ray Details

May 23, 2025 -

Columbus Man Convicted On Child Sex Charges

May 23, 2025

Columbus Man Convicted On Child Sex Charges

May 23, 2025