Analyzing The GOP Tax Plan: The Reality Of Deficit Reduction

Table of Contents

Projected Revenue Impacts and the Initial Forecast

The initial projections surrounding the GOP tax plan's revenue generation were optimistic. The plan significantly lowered both corporate and individual income tax rates, aiming to stimulate economic growth and, consequently, increase tax revenue. However, the reality fell short of these initial forecasts.

- Initial Congressional Budget Office (CBO) estimates: The CBO, a non-partisan agency, provided initial estimates that predicted a moderate increase in the deficit in the short term, followed by a gradual decrease. These estimates were heavily debated from the outset.

- Projected revenue increases vs. actual revenue: The actual revenue generated fell significantly below the projected figures. This shortfall contributed substantially to the widening national deficit.

- Impact of lowered corporate tax rates: The reduction in the corporate tax rate from 35% to 21% was a central component of the plan. While proponents argued this would boost investment and profitability, leading to increased tax revenue, the actual effect on corporate tax revenue was less dramatic than anticipated. Many corporations used the tax savings for stock buybacks and dividends rather than increased investment.

- Impact of changes to individual tax brackets: Changes to individual tax brackets also contributed to the overall revenue picture. While some individuals experienced tax cuts, others saw little to no change, resulting in a less significant boost to overall tax revenue than initially projected.

Economic Growth Claims and Supply-Side Economics

The GOP tax plan was largely based on supply-side economics, also known as "trickle-down economics." This theory posits that tax cuts for corporations and high-income earners will stimulate investment, job creation, and economic growth, ultimately leading to increased tax revenue.

- Explanation of "trickle-down economics": This theory suggests that tax cuts for businesses and the wealthy will incentivize investment and hiring, boosting overall economic activity. The resulting economic growth would then lead to increased tax revenue, offsetting the initial revenue loss from the tax cuts.

- Evidence supporting or refuting increased economic growth: While the economy did experience some growth following the tax cuts, the extent to which this growth can be directly attributed to the plan remains highly debated. Many economists argue that other factors, such as existing economic trends, contributed significantly to the growth observed.

- Analysis of job creation statistics following the tax cuts: Job creation statistics following the tax cuts were mixed, and not all economists attribute increased job growth solely to the tax plan. Many believe that other macroeconomic trends played a more significant role.

- Discussion of increased investment in the economy: While some increased investment occurred, it was not as substantial as proponents of the plan had predicted. This lack of significant investment further contributed to the limited revenue increase.

The Actual Deficit and Debt Under the GOP Tax Plan

The actual impact of the GOP tax plan on the national debt and deficit has been significant. The deficit widened considerably in the years following its implementation.

- Graphs and charts showing the change in the national debt: Visual representations clearly illustrate the increase in the national debt following the enactment of the tax plan. These visualizations readily demonstrate the discrepancy between projections and reality.

- Analysis of budget deficits over time: Analyzing budget deficits over time, comparing periods before and after the tax cuts, highlights the substantial increase in the deficit following the plan's implementation.

- Comparison to other periods of tax cuts and their impact on the deficit: Comparing the GOP tax plan's effects with those of previous tax cuts reveals varying outcomes, highlighting the complexities involved in predicting the economic impact of tax policy.

- Discussion of the long-term sustainability of the national debt: The continued rise in the national debt raises serious concerns about long-term fiscal sustainability. The increasing debt-to-GDP ratio poses challenges to future economic growth and stability.

Alternative Perspectives and Criticisms

The GOP tax plan and its impact on the deficit have faced significant criticism. Many economists and policymakers argue that the plan's benefits were not evenly distributed and that the predicted economic growth did not materialize to the extent anticipated.

- Arguments against supply-side economics: Critics argue that supply-side economics is not always effective and that tax cuts primarily benefit high-income earners and corporations, exacerbating income inequality rather than stimulating broad-based economic growth.

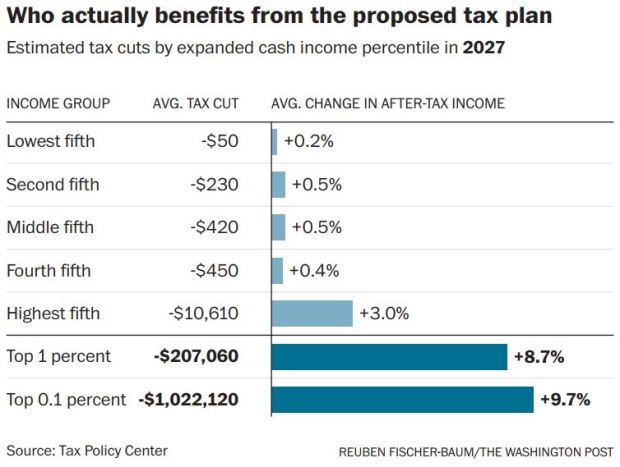

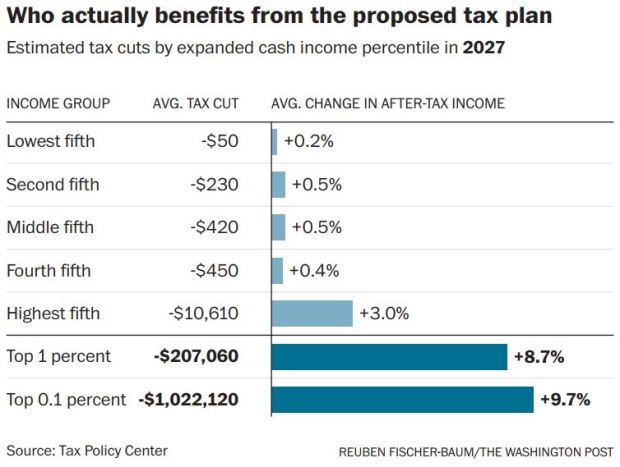

- Critique of the plan's distributional effects: The tax cuts disproportionately benefited the wealthy, leading to concerns about increased income inequality and a widening gap between the rich and the poor.

- Concerns about long-term fiscal sustainability: The significant increase in the national debt raises concerns about the long-term fiscal health of the nation and the potential for future economic instability.

- Analysis of alternative approaches to deficit reduction: Alternative approaches to deficit reduction, such as targeted spending cuts or increased taxes on higher-income individuals and corporations, have been proposed and debated.

Conclusion

This analysis of the GOP tax plan's impact on deficit reduction reveals a complex picture. While initial projections promised substantial revenue increases and economic growth, the actual outcome has presented a different reality. The national debt has continued to rise, raising concerns about long-term fiscal stability. The differing perspectives on the plan's effectiveness highlight the need for ongoing scrutiny and debate.

Call to Action: Understanding the complexities of the GOP tax plan and its effect on the deficit is crucial for informed civic engagement. Continue researching and analyzing GOP tax plan deficit reduction, exploring related terms like "tax cut impact on debt" and "supply-side economics effectiveness," to form your own conclusions and advocate for responsible fiscal policy.

Featured Posts

-

Marc Lievremont A Millau Un Souvenir Inoubliable

May 20, 2025

Marc Lievremont A Millau Un Souvenir Inoubliable

May 20, 2025 -

Four Star Admiral Convicted A Look At The Corruption Case

May 20, 2025

Four Star Admiral Convicted A Look At The Corruption Case

May 20, 2025 -

Hamiltons Struggles A Detailed Comparison Against Charles Leclercs Success In F1 This Year

May 20, 2025

Hamiltons Struggles A Detailed Comparison Against Charles Leclercs Success In F1 This Year

May 20, 2025 -

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025

Hmrcs New Side Hustle Tax Rules A Us Style Snooping Scheme

May 20, 2025 -

London Parks Transformed Rylances Condemnation Of Music Festivals

May 20, 2025

London Parks Transformed Rylances Condemnation Of Music Festivals

May 20, 2025