Analyzing Trump's Backing Of The Nippon Steel Merger: Potential Implications

Table of Contents

Trump's Rationale Behind Supporting the Merger

Trump's endorsement of the Nippon Steel merger wasn't a random act; it likely stemmed from a confluence of economic and political factors. Understanding his motivations is crucial to comprehending the broader impact of this event. Several key drivers are apparent:

-

Strengthening US Steel Industry Competitiveness: Trump consistently emphasized bolstering American manufacturing and reducing reliance on foreign steel. The merger, by creating a larger, more efficient steel producer, could arguably enhance the competitiveness of US steel companies in the global market, potentially leading to increased exports and reduced trade deficits. This aligned perfectly with his "America First" agenda.

-

Job Creation and Protectionism: The Trump administration frequently highlighted job creation as a key policy goal. While the direct impact of the merger on US jobs is debatable, the hope was that a stronger, more competitive domestic steel industry could lead to increased employment opportunities within the sector, even indirectly through the creation of spin-off industries and related services. This protectionist approach aimed to safeguard American jobs from foreign competition.

-

Geopolitical Considerations (Countering Chinese Influence): The merger could be viewed as a strategic move to counter China's growing influence in the global steel market. By strengthening a key ally's steel industry – Japan – the US aimed to create a more balanced power dynamic within the sector. This strategic consideration aligns with broader US-Japan trade and security relationships.

-

Potential Campaign Contributions or Lobbying Influence: It's also important to consider the potential influence of lobbying efforts and campaign contributions. While difficult to definitively prove, such factors could have played a role in shaping the administration's stance on the merger. Investigating potential connections is necessary for a complete understanding of the issue.

Economic Implications of the Merger

The Nippon Steel merger has far-reaching economic consequences, impacting not only the steel industry but also related sectors. Analyzing these impacts is crucial to evaluating the overall success and ramifications of this merger.

-

Increased Market Concentration and Potential Price Increases: The merger resulted in a significant increase in market concentration, raising concerns about the potential for price gouging. Reduced competition could allow the merged entity to increase prices, impacting various downstream industries that rely heavily on steel.

-

Impact on Steel Consumers (e.g., Automotive, Construction Industries): Industries like automotive manufacturing and construction, which are large consumers of steel, could experience increased production costs due to potential price increases. This could, in turn, lead to higher prices for consumers of finished goods.

-

Effects on Smaller Steel Producers and Competition: Smaller steel producers face the risk of being squeezed out of the market by the newly formed giant. This reduced competition could stifle innovation and limit choices for consumers.

-

Analysis of Potential Efficiencies and Cost Savings Resulting from the Merger: While increased market concentration is a concern, the merger might also lead to operational efficiencies and cost savings due to economies of scale. These potential benefits, however, need to be carefully weighed against the possible negative impacts on competition and prices.

Geopolitical Implications of the Merger

The merger's geopolitical implications are far-reaching, impacting US-Japan relations and broader global trade dynamics. These impacts, however, must be considered alongside the other factors mentioned.

-

Impact on Trade Relations Between the US and Other Steel-Producing Nations: The merger could influence trade relations with other steel-producing countries, potentially leading to trade disputes or renegotiations of trade agreements. Countries may feel pressured to retaliate or seek similar consolidations within their industries.

-

Potential Shifts in Global Steel Production Dynamics: The merger signifies a significant shift in the global steel production landscape, potentially altering the balance of power and influencing future industry consolidation. This alters the landscape of global steel supply and demand dynamics.

-

Implications for National Security, Particularly Regarding Supply Chain Resilience: The merger has implications for national security, particularly regarding the resilience of the steel supply chain. The concentration of power in a fewer number of hands may affect the ability to respond effectively to unexpected disruptions.

-

Analysis of the Merger in Relation to Broader Trade Policies: The merger should be analyzed in the context of broader US and Japanese trade policies, including their approaches to tariffs, trade agreements, and regulatory frameworks. This comprehensive understanding of the broader context is vital.

Legal and Regulatory Scrutiny of the Merger

The Nippon Steel merger faced significant legal and regulatory scrutiny, highlighting the importance of antitrust laws and regulations. Understanding this aspect of the process helps in predicting the consequences of these types of mergers.

-

Antitrust Investigations and Their Potential Outcomes: Antitrust investigations by regulatory bodies in both the US and Japan were conducted to assess the potential impact of the merger on competition. These investigations aimed to ascertain whether the merger would unduly stifle competition or result in monopolistic practices.

-

Role of Regulatory Bodies in the US and Japan: Both the US and Japanese regulatory bodies played crucial roles in determining the fate of the merger, applying their respective antitrust laws and guidelines. Their decisions influenced the final outcome and set a precedent for future mergers in the industry.

-

Potential Challenges to the Merger Based on Competition Concerns: Several challenges to the merger arose, citing concerns about reduced competition and its potential harm to consumers and smaller steel producers. These challenges tested the legality and fairness of the merger.

-

Long-Term Effects of Regulatory Decisions on the Market: The regulatory decisions surrounding this merger have lasting effects on the steel market, shaping future mergers and acquisitions in the sector. These decisions influence market dynamics for many years after the fact.

Conclusion

The Trump administration's backing of the Nippon Steel merger had profound implications, affecting not only the global steel market but also broader economic and geopolitical dynamics. The economic consequences, ranging from potential price increases to changes in market concentration, need careful consideration. Similarly, the geopolitical ramifications, involving US-Japan relations and the global balance of power in steel production, require comprehensive evaluation. The legal and regulatory scrutiny further highlights the complexities of such large-scale mergers. The "Trump Nippon Steel Merger" serves as a case study in the interwoven nature of economics, geopolitics, and regulatory processes. Stay informed on the continuing implications of the Trump Nippon Steel Merger by following our updates and exploring further research on this pivotal moment in the global steel industry.

Featured Posts

-

Nea Smyrni Eisvoli Liston Se Zaxaroplasteio Binteo

May 27, 2025

Nea Smyrni Eisvoli Liston Se Zaxaroplasteio Binteo

May 27, 2025 -

Katsina Security Forces Eliminate 12 Bandits

May 27, 2025

Katsina Security Forces Eliminate 12 Bandits

May 27, 2025 -

Comedy Central Hd Finding And Watching Ted

May 27, 2025

Comedy Central Hd Finding And Watching Ted

May 27, 2025 -

Was Geschah Am 9 Mai Wichtige Ereignisse Und Historische Daten

May 27, 2025

Was Geschah Am 9 Mai Wichtige Ereignisse Und Historische Daten

May 27, 2025 -

Nora Fatehi And Jason Derulos Snake A Uk British Asian Chart Topping Hit

May 27, 2025

Nora Fatehi And Jason Derulos Snake A Uk British Asian Chart Topping Hit

May 27, 2025

Latest Posts

-

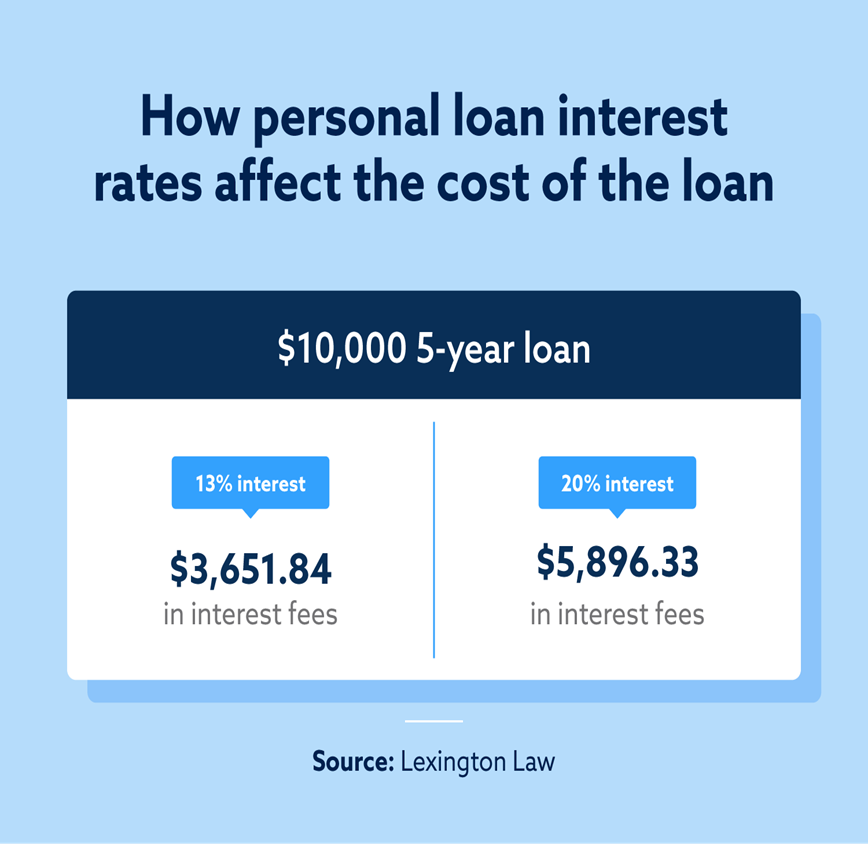

Understanding Todays Personal Loan Interest Rates

May 28, 2025

Understanding Todays Personal Loan Interest Rates

May 28, 2025 -

Samsung Galaxy S25 Ultra 256 Go Test Et Avis Complet

May 28, 2025

Samsung Galaxy S25 Ultra 256 Go Test Et Avis Complet

May 28, 2025 -

Offre Limitee Samsung Galaxy S25 Ultra 256 Go A 1196 50 E

May 28, 2025

Offre Limitee Samsung Galaxy S25 Ultra 256 Go A 1196 50 E

May 28, 2025 -

Tyrese Haliburton Picks Pacers Vs Knicks Game 1 Predictions And Best Bets

May 28, 2025

Tyrese Haliburton Picks Pacers Vs Knicks Game 1 Predictions And Best Bets

May 28, 2025 -

Vente Flash Samsung Galaxy S25 Ultra 256 Go 5 Etoiles A 1196 50 E

May 28, 2025

Vente Flash Samsung Galaxy S25 Ultra 256 Go 5 Etoiles A 1196 50 E

May 28, 2025