Analyzing Uber's Stock Performance During Potential Recessions

Table of Contents

Uber's Business Model and Recession Resilience

Uber's success hinges on its dual-sided marketplace connecting riders and drivers, and customers and delivery partners. However, its resilience during a recession depends on several key factors.

Demand Elasticity in Ridesharing and Delivery

A crucial aspect of analyzing Uber's stock performance during a recession is understanding the elasticity of demand for its services. During economic downturns, discretionary spending often shrinks. Ridesharing, while convenient, might be viewed as a non-essential expense, leading to decreased demand.

- Increased price sensitivity during recessions: Consumers become more price-conscious, potentially opting for cheaper alternatives like public transport.

- Potential shift in demand from rides to cheaper alternatives: This shift could impact Uber's ride-hailing revenue significantly.

- Potential increase in food delivery demand (depending on restaurant industry resilience): Interestingly, the food delivery sector might experience a relative increase in demand as people curtail dining out, potentially offsetting some losses from reduced ride-sharing usage. This is heavily dependent on the restaurant industry's ability to withstand the recession.

Cost-Cutting Measures and Operational Efficiency

Uber has demonstrated a capacity for cost reduction in the past. Analyzing its past responses to economic headwinds is vital for predicting its future behavior. This includes examining its ability to manage driver payouts, marketing expenses, and operational overhead.

- Examples of past cost-cutting initiatives: Reviewing Uber's historical financial reports will reveal previous cost-cutting measures implemented during challenging economic periods.

- Potential for increased automation and AI to reduce operational costs: Uber's ongoing investment in technology could provide avenues for efficiency gains and cost reduction during a recession.

- Impact of fluctuating fuel prices on profitability: Fuel costs represent a significant expense for drivers. Fluctuations in fuel prices directly impact profitability and driver compensation, creating challenges for Uber during periods of economic uncertainty.

External Factors Affecting Uber Stock During Recessions

Beyond Uber's internal operations, external forces significantly impact its stock performance.

Impact of Inflation and Interest Rates

Inflation and interest rate hikes are significant macroeconomic factors influencing consumer spending and investor sentiment.

- Relationship between inflation and Uber's ridership numbers: High inflation erodes purchasing power, potentially leading to lower ridership and reduced demand for Uber's services.

- Impact of higher interest rates on Uber's ability to secure funding: Higher interest rates increase borrowing costs, making it more expensive for Uber to secure funding for expansion and operations.

- Potential for decreased investor confidence: Rising interest rates often lead to a shift in investor preference towards less risky, higher-yield investments, potentially reducing demand for Uber's stock.

Government Regulations and Industry Competition

Government regulations and intense competition within the ride-sharing and delivery sector add further complexity to the analysis of Uber's stock performance during a recession.

- Impact of regulatory changes on Uber's operating costs: Changes in minimum wage laws, licensing requirements, or other regulations can significantly impact Uber's operating costs and profitability.

- Competitive threats from rival ridesharing and delivery services: Increased competition from rivals like Lyft, DoorDash, and others intensifies the pressure on Uber's market share and profitability during economic downturns.

- Potential for consolidation within the industry: Recessions can trigger consolidation as weaker players are forced out of the market, creating both opportunities and challenges for Uber.

Investing in Uber During Uncertain Economic Times

Investing in Uber during a potential recession presents both risks and opportunities.

Risk Assessment and Due Diligence

Before investing in Uber's stock during uncertain economic times, thorough risk assessment is critical.

- Potential downsides of investing in Uber during an economic downturn: The analysis above highlights the potential for reduced demand, increased costs, and decreased profitability during a recession.

- Importance of considering alternative investment options: Diversification is key to mitigating risk. Consider spreading investments across various asset classes to reduce exposure to the volatility of Uber's stock.

- Importance of consulting with a financial advisor: Seeking professional financial advice before making investment decisions is crucial, especially in uncertain economic climates.

Long-Term Growth Potential and Valuation

Despite the risks, Uber's long-term growth potential remains a significant factor to consider.

- Factors that may contribute to long-term growth (e.g., technological advancements): Uber's investments in technology, autonomous vehicles, and new service offerings could drive long-term growth.

- Potential for Uber to gain market share: Economic downturns can create opportunities for companies to gain market share from weaker competitors.

- Valuation analysis of Uber stock: A thorough valuation analysis, considering various factors like future earnings potential and discount rates, is crucial for determining whether Uber's stock is fairly valued.

Conclusion: Navigating Uber's Stock Performance During Potential Recessions

Analyzing Uber's stock performance during potential recessions requires a multifaceted approach, considering its business model's resilience, external economic factors, and the company's long-term growth prospects. While the risks are significant, including decreased demand and increased competition, opportunities exist for growth in certain segments (e.g., food delivery) and the potential for market share gains. Before investing, conducting thorough research, diversifying your portfolio, and consulting with a financial advisor are crucial steps. Understanding the complexities of Uber's stock performance during potential recessions is crucial for making informed investment decisions. Don't hesitate to seek professional financial guidance to navigate this complex landscape effectively.

Featured Posts

-

Cnn Releases Video Of New Orleans Jail Escape

May 18, 2025

Cnn Releases Video Of New Orleans Jail Escape

May 18, 2025 -

Majority Plan King Day Celebrations But Significant Minority Wants Holiday Ended

May 18, 2025

Majority Plan King Day Celebrations But Significant Minority Wants Holiday Ended

May 18, 2025 -

Reflecting On Six Years A Celebration Of Tom Clancys The Division 2

May 18, 2025

Reflecting On Six Years A Celebration Of Tom Clancys The Division 2

May 18, 2025 -

Emergency Response Following Amsterdam Hotel Stabbing Five Suffer Serious Injuries

May 18, 2025

Emergency Response Following Amsterdam Hotel Stabbing Five Suffer Serious Injuries

May 18, 2025 -

Kanye Westo Sokiruojantis Poelgis Paviesinta Biancos Censori Nuoga Nuotrauka

May 18, 2025

Kanye Westo Sokiruojantis Poelgis Paviesinta Biancos Censori Nuoga Nuotrauka

May 18, 2025

Latest Posts

-

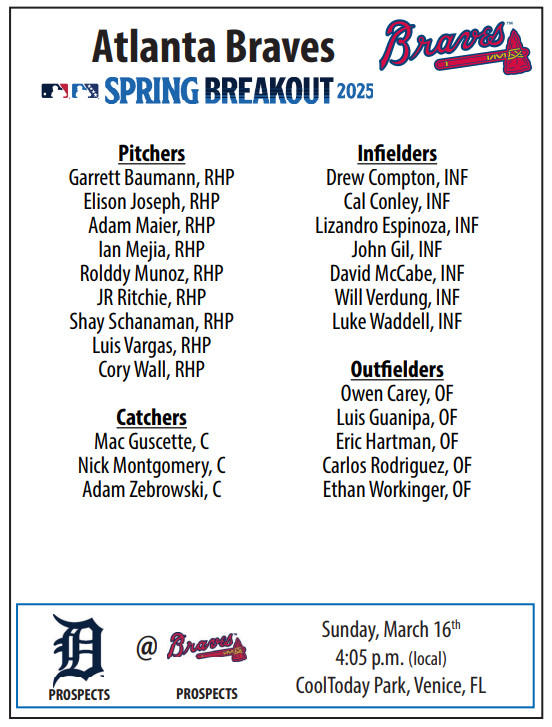

Spring Breakout 2025 Rosters A Comprehensive Guide

May 18, 2025

Spring Breakout 2025 Rosters A Comprehensive Guide

May 18, 2025 -

Spring Breakout Rosters 2025 Key Additions And Departures

May 18, 2025

Spring Breakout Rosters 2025 Key Additions And Departures

May 18, 2025 -

The 2025 Spring Breakout Rosters A Scouting Report

May 18, 2025

The 2025 Spring Breakout Rosters A Scouting Report

May 18, 2025 -

Spring Breakout 2025 Rosters Unveiling The Teams

May 18, 2025

Spring Breakout 2025 Rosters Unveiling The Teams

May 18, 2025 -

Complete Spring Breakout 2025 Rosters Players To Watch

May 18, 2025

Complete Spring Breakout 2025 Rosters Players To Watch

May 18, 2025