Apple Stock (AAPL): Important Price Levels And Trading Strategies

Table of Contents

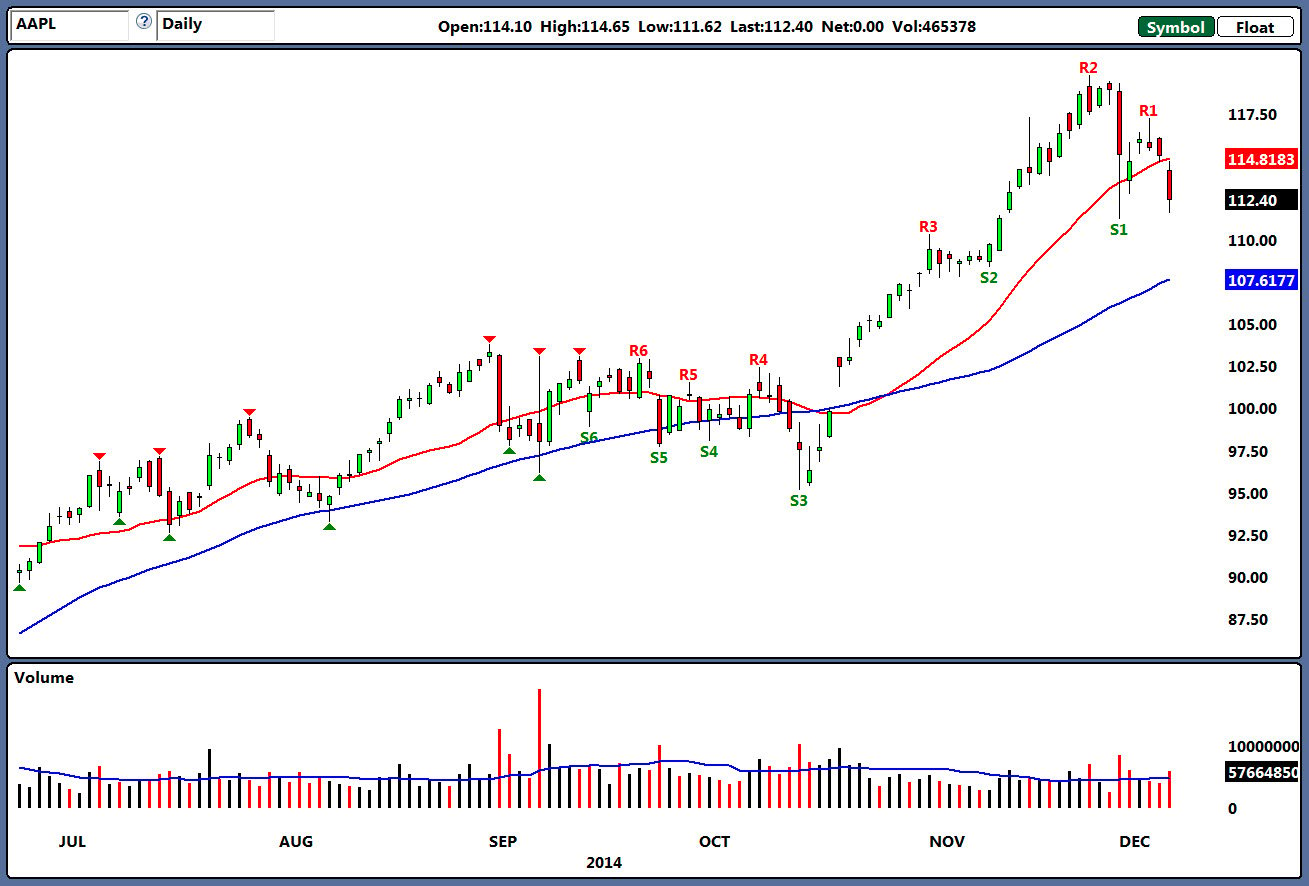

Identifying Key Support and Resistance Levels for Apple Stock (AAPL)

Identifying support and resistance levels is fundamental to successful AAPL stock trading. These levels represent price points where buying or selling pressure is historically strong, potentially influencing future price movements.

Historical Support Levels:

Analyzing past lows helps identify potential support areas where the price is likely to find buyers. Support levels act as a floor, preventing significant price declines.

- Example 1: Around $100 in early 2020, AAPL stock found strong support, bouncing back from the initial COVID-19 market crash. This level was significant due to a combination of factors, including bargain hunting and the anticipation of strong future performance. The 50-day moving average also coincided with this support, providing further confirmation.

- Example 2: The $130 level in 2021 acted as a temporary support before the stock rallied further. This resilience was partly driven by positive investor sentiment related to strong product sales and innovative product announcements. Observing the volume during this period shows increased buying pressure near this level.

- Technical Indicators: Moving averages (like the 50-day and 200-day MA) can help confirm support levels. When the price consistently finds support at a particular level and bounces off the moving average, it strengthens the validity of that support.

Historical Resistance Levels:

Past highs indicate potential resistance zones where selling pressure is expected. Resistance levels act as a ceiling, potentially hindering further price increases.

- Example 1: The $180 level in late 2021 acted as a significant resistance level, repeatedly halting upward momentum. This was partly due to profit-taking and concerns about valuation. High trading volume near this level further confirms its resistance characteristic.

- Example 2: Round number prices (like $200, $250) often act as psychological resistance levels as investors are hesitant to push beyond them.

- Volume Analysis: High volume near a resistance level confirms its strength. If the price breaks through resistance with high volume, it signals a stronger potential for continued upward movement.

Apple Stock (AAPL) Trading Strategies Based on Price Levels

Effective trading strategies for AAPL leverage these support and resistance levels.

Breakout Trading Strategy:

Breakout trading involves identifying and exploiting price movements beyond support or resistance levels.

- Identifying a Breakout: Look for increasing volume, a decisive break beyond the resistance level, and a strong candle indicating sustained momentum.

- Risk Management: Always use stop-loss orders to limit potential losses. Position sizing (only risking a small percentage of your capital on each trade) is crucial.

- Example: A breakout above a significant resistance level, accompanied by high volume, suggests increased bullish sentiment and may signal a substantial price increase. However, it's important to wait for confirmation before entering the position.

Pullback Trading Strategy:

A pullback occurs after a significant price surge. It represents a temporary correction before the potential resumption of the uptrend.

- Identifying a Pullback: Use Fibonacci retracements (which identify potential support levels during pullbacks) or other technical indicators to identify potential entry points.

- Entry Points: Look for buying opportunities near Fibonacci retracement levels (like 38.2%, 50%, or 61.8%) within the pullback.

- Risk Mitigation: Use stop-loss orders below the swing low of the pullback to limit potential losses.

Range-Bound Trading Strategy:

A range-bound market occurs when the price consolidates between well-defined support and resistance levels.

- Identifying a Range: Observe the consistent trading within a specific price range.

- Strategies: Use support and resistance levels for entry and exit points. Indicators like Bollinger Bands can help identify potential breakouts or reversals within the range.

- Stop-Losses: Use tight stop-losses to minimize risk in range-bound trading, as prices can quickly move outside the defined range.

Fundamental Analysis of Apple Stock (AAPL) and its Impact on Price Levels

Fundamental analysis complements technical analysis in understanding AAPL's price movements.

Earnings Reports and Their Influence:

Earnings reports significantly impact AAPL's stock price, often shifting support and resistance levels.

- Positive Surprises: Exceeding analyst expectations generally leads to price increases and pushes resistance levels higher.

- Negative Surprises: Disappointing results can cause price drops and create new support levels.

- Analyst Expectations: Understanding analyst consensus before an earnings release is vital for predicting potential market reactions.

Product Launches and Market Trends:

New product releases and broader market trends strongly influence AAPL's stock price.

- Product Launches: The launch of the iPhone 14, for example, had a positive impact on the AAPL stock price.

- Market Trends: Macroeconomic factors (like interest rates and inflation) and industry trends can greatly affect investor sentiment and AAPL's valuation.

Conclusion:

Successfully trading Apple Stock (AAPL) requires a thorough understanding of key support and resistance levels, coupled with a well-defined trading strategy. By carefully analyzing historical price data, incorporating technical indicators, and considering fundamental factors like earnings reports and product launches, you can improve your decision-making process. Remember to always practice proper risk management techniques. Continue to research and learn about Apple Stock (AAPL) and refine your trading strategies for optimal results. Start analyzing the important price levels of Apple Stock (AAPL) today to enhance your investment strategy.

Featured Posts

-

Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Analisi Della Classifica

May 24, 2025

Forbes 2025 Chi Sono Gli Uomini Piu Ricchi Del Mondo Analisi Della Classifica

May 24, 2025 -

Joy Crookes Unveils Powerful New Single Carmen

May 24, 2025

Joy Crookes Unveils Powerful New Single Carmen

May 24, 2025 -

China Us Trade Deal The Final Push Before The Deadline

May 24, 2025

China Us Trade Deal The Final Push Before The Deadline

May 24, 2025 -

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf

May 24, 2025 -

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025

Philips Future Health Index 2025 Ais Transformative Potential In Global Healthcare

May 24, 2025

Latest Posts

-

Claiming Italian Citizenship The Updated Great Grandparent Rule

May 24, 2025

Claiming Italian Citizenship The Updated Great Grandparent Rule

May 24, 2025 -

Changes To Italian Citizenship Law Great Grandparent Claims

May 24, 2025

Changes To Italian Citizenship Law Great Grandparent Claims

May 24, 2025 -

Italian Citizenship New Law On Great Grandparent Lineage

May 24, 2025

Italian Citizenship New Law On Great Grandparent Lineage

May 24, 2025 -

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025

Italy Eases Citizenship Requirements Great Grandparent Descent

May 24, 2025 -

New Italian Law Easier Citizenship For Great Grandchildren

May 24, 2025

New Italian Law Easier Citizenship For Great Grandchildren

May 24, 2025