Apple Stock And Tariffs: Assessing The Risk To Buffett's Portfolio

Table of Contents

Apple's Global Supply Chain and Tariff Sensitivity

Apple's immense success is intertwined with its global supply chain, heavily reliant on manufacturing in China and other countries significantly affected by tariffs. This dependence creates a considerable vulnerability to tariff increases. When tariffs are imposed, the cost of production for Apple products rises, potentially squeezing profit margins. This increased cost of goods sold could force Apple to either absorb the losses, impacting profitability, or pass the increased costs on to consumers through higher prices. This latter scenario could negatively impact sales volume, especially if consumers are sensitive to price increases.

- Specific Product/Location Examples:

- iPhones: Significant portion assembled in China.

- iPads: Manufacturing spread across several Asian countries, many subject to tariffs.

- MacBooks: Components sourced globally, impacting final product costs.

- Apple Watches: Assembly and component sourcing in tariff-affected regions.

The potential for price increases due to tariffs is a major concern. Higher prices could reduce consumer demand, impacting Apple's revenue and, consequently, its stock price. The delicate balance between maintaining profitability and sustaining consumer demand in the face of rising costs presents a significant challenge for Apple.

The Impact on Apple's Stock Price

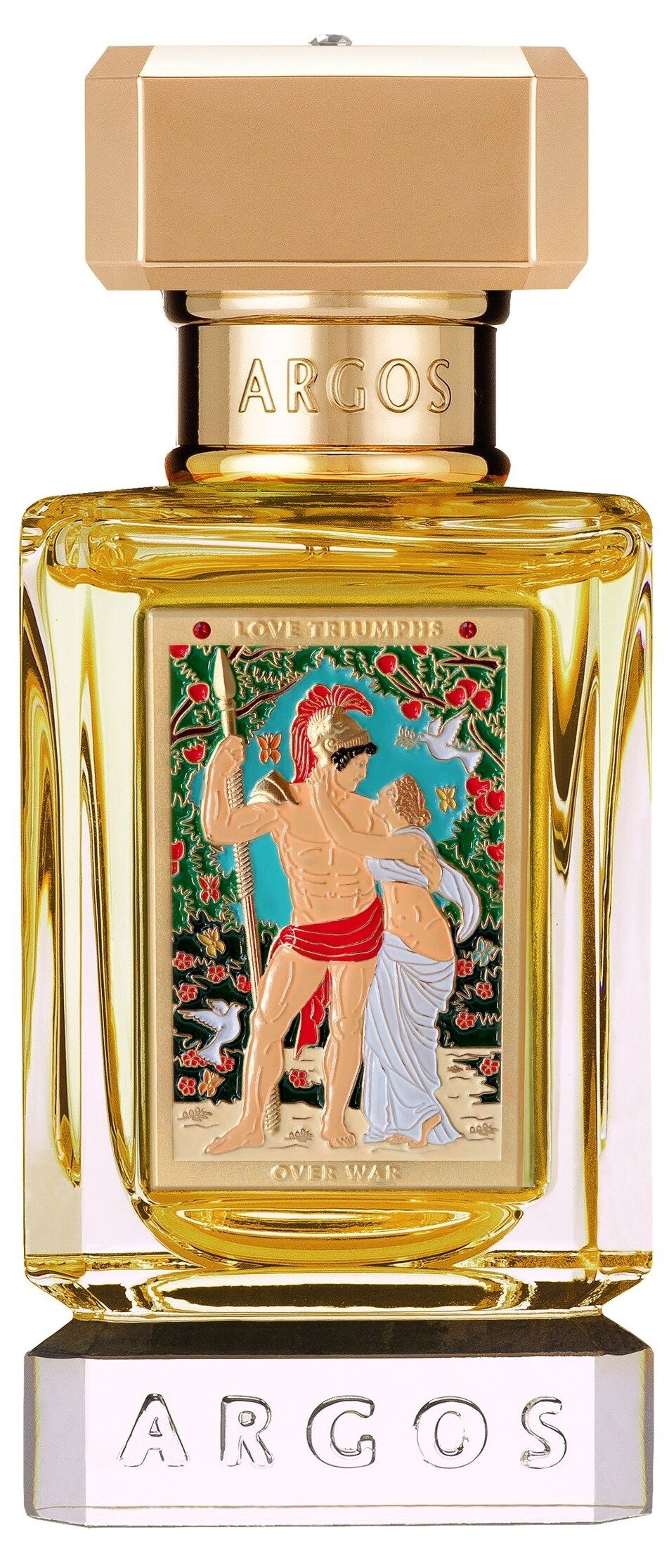

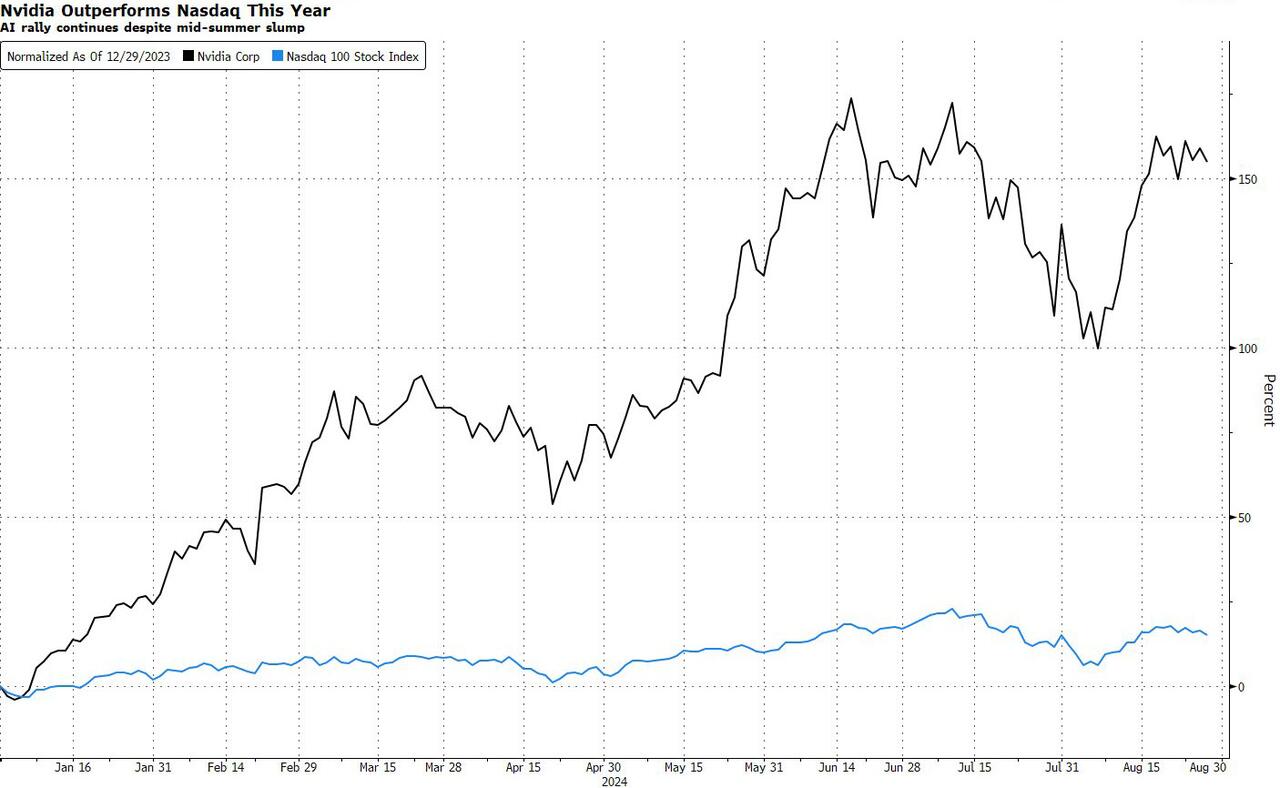

Analyzing Apple's historical stock performance in relation to past tariff announcements reveals a complex relationship. While not always directly proportional, increased trade tensions and tariff announcements often correlate with periods of stock market volatility, impacting Apple’s valuation. Investor sentiment plays a crucial role; negative news surrounding tariffs can trigger selling pressure, leading to a decline in Apple's stock price. Conversely, positive news or effective mitigation strategies by Apple could lead to a recovery or even an increase in stock value.

- Potential Scenarios:

- Moderate Impact: Minor price adjustments due to tariffs, offset by strong consumer demand and Apple’s innovative product cycle. Stock price experiences minor fluctuations.

- Significant Impact: Substantial price increases lead to reduced consumer demand, impacting Apple's profitability and leading to a significant drop in stock price.

- Minimal Impact: Apple successfully mitigates tariff impacts through diversification, cost-cutting, or absorbing increased costs. Stock price remains relatively stable.

Buffett's Investment Strategy and Risk Mitigation

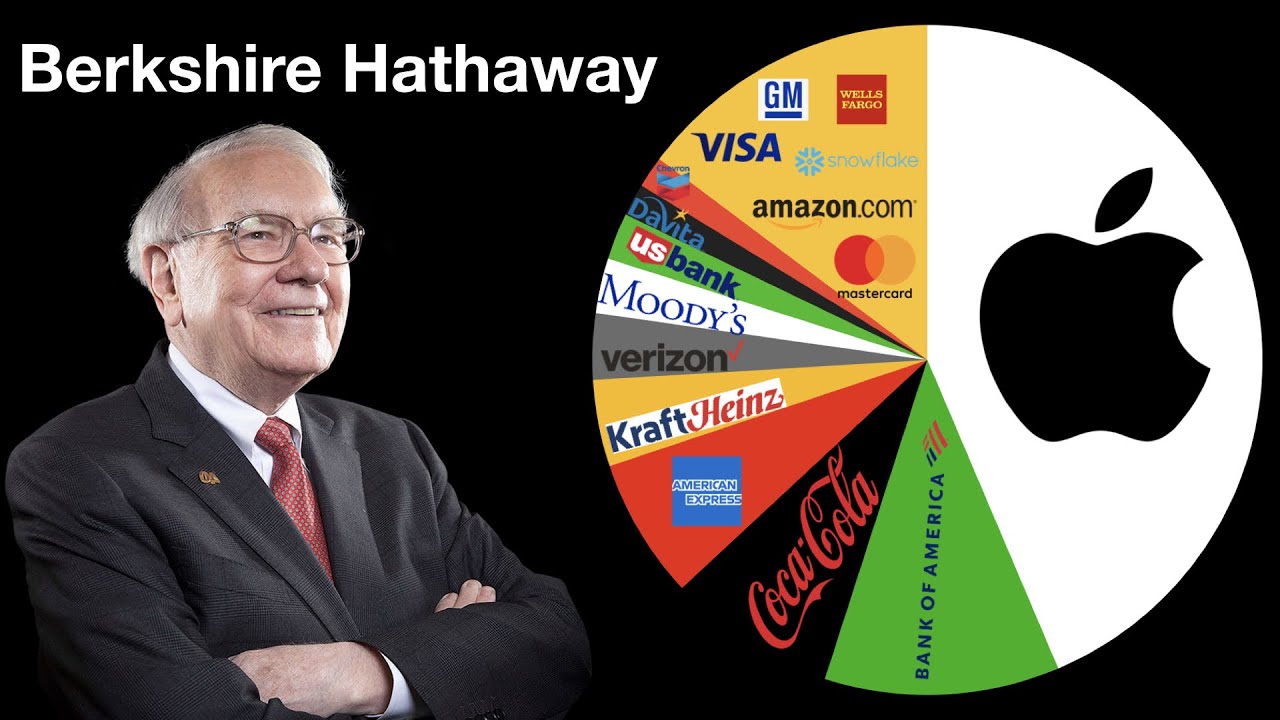

Warren Buffett's investment philosophy centers on long-term value investing and risk management. While a significant portion of Berkshire Hathaway's portfolio is invested in Apple, it's crucial to understand that this is part of a highly diversified portfolio. This diversification acts as a buffer against the risks associated with any single investment, including Apple's vulnerability to tariffs. Berkshire Hathaway's vast holdings across various sectors mitigate the impact of any potential downturn in Apple's stock. While Buffett’s long-term perspective is a strength, the scale of the Apple investment warrants a focus on diversification against tariff risk.

- Potential Diversification Strategies:

- Increased investment in companies less susceptible to tariff impacts.

- Investments in sectors benefitting from reshoring or nearshoring trends.

- Hedging strategies to mitigate currency risks associated with international trade.

Other Berkshire Hathaway holdings, such as Coca-Cola, American Express, and Bank of America, offer a counterbalance to potential Apple losses. This diverse portfolio offers resilience against sector-specific risks, including those stemming from tariffs.

Alternative Investment Strategies in a Tariff-Driven Market

Investors seeking to protect their portfolios from tariff-related risks can explore various alternative strategies. One approach involves focusing on companies that engage in domestic manufacturing, reducing their exposure to global supply chain disruptions and tariffs. Investing in sectors less dependent on global trade, such as utilities or healthcare, could provide a measure of insulation from trade wars. Furthermore, actively managed funds employing quantitative strategies focusing on factors like value, momentum, and quality could help navigate the volatility associated with tariffs.

- Examples of Alternative Investments:

- Companies involved in domestic manufacturing and supply chains.

- Utilities and infrastructure companies.

- Healthcare and pharmaceutical companies.

- Gold as a traditional safe haven asset.

Conclusion: Navigating the Apple Stock and Tariff Landscape

The impact of tariffs on Apple's stock and Buffett's portfolio is a complex issue with varying potential outcomes. While Apple's global supply chain creates significant tariff vulnerability, Buffett's diversified investment strategy provides a level of mitigation. However, investors must remain vigilant and understand that the Apple stock and tariff landscape is dynamic and requires continuous monitoring. Conducting thorough research and seeking professional financial advice is paramount before making any investment decisions. Staying informed about the evolving Apple stock and tariff situation is crucial for mitigating potential risks and capitalizing on opportunities. Remember to always consider a diversified investment portfolio to minimize risk.

Featured Posts

-

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets

May 25, 2025

Securing Your Bbc Big Weekend 2025 Sefton Park Tickets

May 25, 2025 -

Zimmermann Showcases Amira Al Zuhair At Paris Fashion Week

May 25, 2025

Zimmermann Showcases Amira Al Zuhair At Paris Fashion Week

May 25, 2025 -

5 4 Victory Maryland Softball Triumphs Over Delaware

May 25, 2025

5 4 Victory Maryland Softball Triumphs Over Delaware

May 25, 2025 -

Porsche 911 Extrem Atalakitas 80 Millio Forintert

May 25, 2025

Porsche 911 Extrem Atalakitas 80 Millio Forintert

May 25, 2025 -

Apples Stock Performance Key Levels And Q2 Expectations

May 25, 2025

Apples Stock Performance Key Levels And Q2 Expectations

May 25, 2025

Latest Posts

-

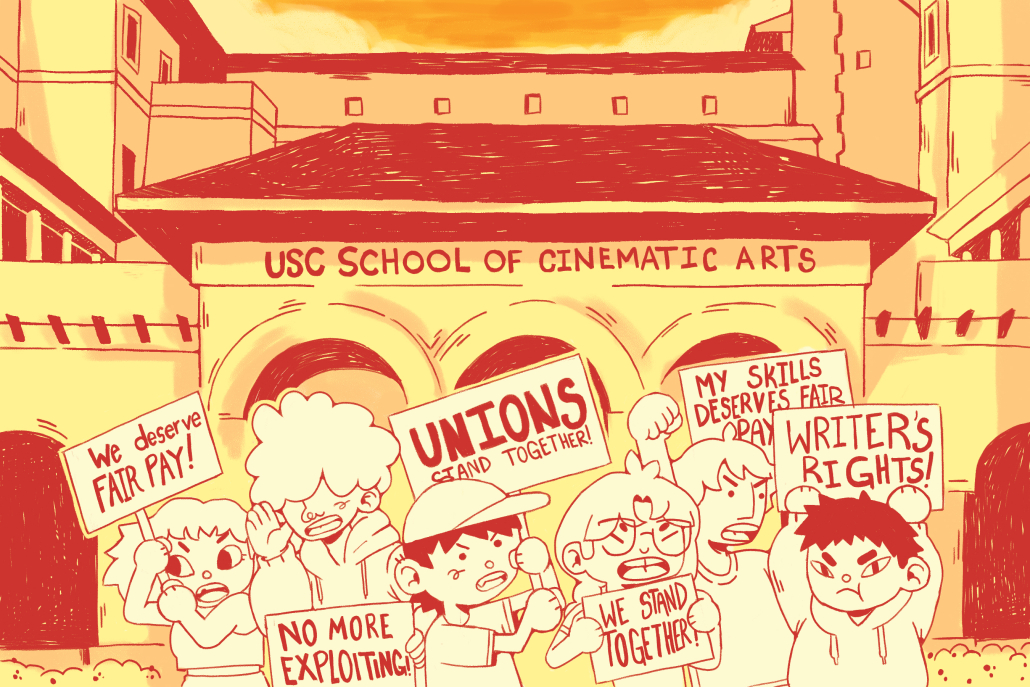

Hollywood Production Grinds To Halt Amidst Dual Strike

May 25, 2025

Hollywood Production Grinds To Halt Amidst Dual Strike

May 25, 2025 -

Post Roe America How Over The Counter Birth Control Changes The Game

May 25, 2025

Post Roe America How Over The Counter Birth Control Changes The Game

May 25, 2025 -

Hollywood Shut Down The Double Strikes Impact On Film And Television

May 25, 2025

Hollywood Shut Down The Double Strikes Impact On Film And Television

May 25, 2025 -

300 Million Cyberattack Impact On Marks And Spencers Finances

May 25, 2025

300 Million Cyberattack Impact On Marks And Spencers Finances

May 25, 2025 -

Anchor Brewing Companys Closure A Legacy Of Craft Beer Ends

May 25, 2025

Anchor Brewing Companys Closure A Legacy Of Craft Beer Ends

May 25, 2025