Apple Stock Dip: Key Levels Before Q2 Earnings

Table of Contents

Analyzing the Recent Apple Stock Dip

The recent decline in Apple stock price, reflected in the AAPL stock chart, can be attributed to several factors. Analyzing Apple stock performance requires considering both macroeconomic trends and company-specific news.

-

Market Sentiment and Broader Economic Concerns: The overall stock market sentiment has been somewhat bearish lately, influenced by concerns about inflation, rising interest rates, and potential economic slowdowns. This broader negative sentiment often affects even strong performers like Apple.

-

Specific News Affecting Apple: Recent news cycles might have played a role. For example, supply chain disruptions or increased competition in certain market segments could impact investor confidence and push the Apple stock price down. Concerns about weakening iPhone demand, particularly in key markets, also contributed to the recent dip.

-

Technical Analysis Indicators: Technical analysis of the Apple stock chart reveals indicators suggesting a potential correction. This could involve observing moving averages, Relative Strength Index (RSI), and other technical tools to identify potential support and resistance levels. (Insert chart showing recent Apple stock price movement here).

Key Support and Resistance Levels to Watch

Identifying key support and resistance levels is crucial for understanding potential price movements. These levels represent price points where buying or selling pressure is expected to be particularly strong.

-

Support Levels: Support levels represent prices where significant buying pressure is anticipated. If the price falls to a support level, buyers may step in, preventing further declines. Several technical indicators can help identify these levels; for example, previous lows, moving averages, or Fibonacci retracement levels.

-

Resistance Levels: Resistance levels are price points where selling pressure tends to outweigh buying pressure. If the Apple stock price approaches a resistance level, it may struggle to break through, resulting in a potential price reversal. Previous highs, trendlines, and Fibonacci retracement levels are helpful in identifying resistance areas.

(Insert chart highlighting key support and resistance levels here, perhaps using Fibonacci retracement lines or other technical indicators). This chart will be invaluable for understanding potential price targets.

Factors to Consider Before Q2 Earnings

Several factors will significantly influence Apple's Q2 earnings report and subsequent stock price movement. These factors require careful consideration before making any investment decisions related to AAPL stock.

-

iPhone Sales and Demand: iPhone sales are a significant driver of Apple's revenue. Any significant deviation from expectations regarding iPhone sales could impact the overall earnings report and the Apple stock price.

-

Performance of Other Apple Products: The performance of other Apple products, including Macs, iPads, wearables, and services, will also contribute to the overall financial picture. Strong performance in these areas can offset any weakness in iPhone sales.

-

Overall Revenue and Profit Projections: Analysts' revenue and profit projections for the quarter will play a major role in shaping market expectations. Any significant deviation from these projections could lead to increased market volatility.

-

Apple Guidance for Future Quarters: Apple's guidance for future quarters will provide insights into the company's outlook and expectations. Positive guidance can boost investor confidence, while negative guidance can lead to a stock price decline. Understanding the nuances of this Apple earnings report is critical.

Managing Risk in a Volatile Market

Navigating the uncertainty surrounding the Apple stock price requires a robust risk management strategy. Investors should consider the following:

-

Diversification of Investment Portfolio: Don't put all your eggs in one basket. Diversifying your investment portfolio across different asset classes can help mitigate the risk associated with any single stock, including Apple stock.

-

Dollar-Cost Averaging Strategy: This involves investing a fixed amount of money at regular intervals, regardless of the stock price. This strategy helps mitigate the risk of investing a large sum at a market high.

-

Stop-Loss Orders: Stop-loss orders are crucial for limiting potential losses. A stop-loss order automatically sells your shares when the price falls to a predetermined level.

Conclusion: Navigating the Apple Stock Dip and Preparing for Q2 Earnings

Understanding the key support and resistance levels outlined above, along with the potential factors impacting Apple's Q2 earnings, is crucial for navigating the current market uncertainty. The Apple stock outlook depends heavily on the actual results compared to market expectations. Remember to monitor Apple stock closely before the earnings announcement. A well-informed investment strategy, incorporating risk management techniques, is paramount. Before investing in Apple stock, or making any changes to your current holdings, conduct thorough research and carefully consider your individual investment goals and risk tolerance. Analyze Apple stock and make informed decisions. Invest in Apple stock wisely.

Featured Posts

-

Golz Und Brumme Erfolgsfaktoren Essener Leistungstraeger

May 24, 2025

Golz Und Brumme Erfolgsfaktoren Essener Leistungstraeger

May 24, 2025 -

Serious M56 Motorway Collision Car Overturn And Casualty Care

May 24, 2025

Serious M56 Motorway Collision Car Overturn And Casualty Care

May 24, 2025 -

Borsa Italiana La Fed Influenza Piazza Affari Banche In Ribasso Italgas Sale

May 24, 2025

Borsa Italiana La Fed Influenza Piazza Affari Banche In Ribasso Italgas Sale

May 24, 2025 -

Massachusetts Gun Trafficking Ring Busted 18 Brazilians Charged 100 Firearms Seized

May 24, 2025

Massachusetts Gun Trafficking Ring Busted 18 Brazilians Charged 100 Firearms Seized

May 24, 2025 -

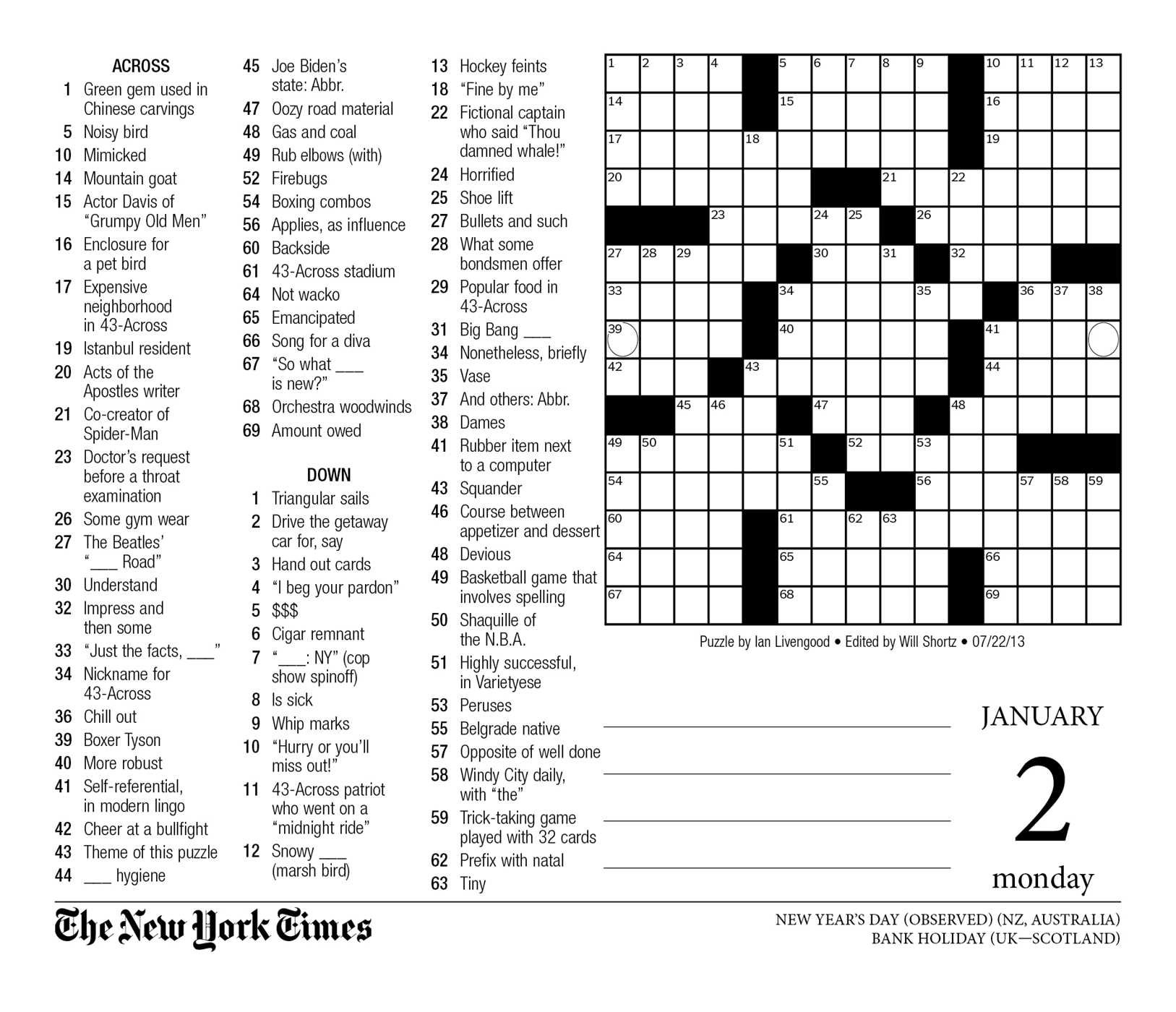

Solve The Nyt Mini Crossword April 8 2025 Tuesday Hints And Answers

May 24, 2025

Solve The Nyt Mini Crossword April 8 2025 Tuesday Hints And Answers

May 24, 2025

Latest Posts

-

Italys New Citizenship Law Claiming Rights Through Great Grandparents

May 24, 2025

Italys New Citizenship Law Claiming Rights Through Great Grandparents

May 24, 2025 -

Successfully Negotiating A Best And Final Job Offer Tips And Strategies

May 24, 2025

Successfully Negotiating A Best And Final Job Offer Tips And Strategies

May 24, 2025 -

Podcast Production Revolutionized Ais Role In Analyzing Repetitive Data

May 24, 2025

Podcast Production Revolutionized Ais Role In Analyzing Repetitive Data

May 24, 2025 -

The Trump Tax Bill Key Amendments And House Vote Outcome

May 24, 2025

The Trump Tax Bill Key Amendments And House Vote Outcome

May 24, 2025 -

The Future Of Ai Hardware Open Ai And Jony Ives Potential Collaboration

May 24, 2025

The Future Of Ai Hardware Open Ai And Jony Ives Potential Collaboration

May 24, 2025