Apple Stock Plunges On $900 Million Tariff Projection

Table of Contents

The Impact of the $900 Million Tariff Projection on Apple's Profitability

The $900 million tariff projection directly threatens Apple's profitability in several ways, impacting its bottom line and investor confidence in Apple stock.

Reduced Profit Margins

The increased costs associated with tariffs translate directly into reduced profit margins for Apple. This is because the company is forced to either absorb the increased costs, reducing its profit per unit, or pass them on to consumers through higher prices. This impacts the affordability of popular products like iPhones and iPads.

- Specific examples: A $50 increase in the manufacturing cost of an iPhone, due to tariffs, could either significantly reduce Apple's profit margin on that device or necessitate a price increase, potentially impacting consumer demand.

- Decreased consumer demand: Higher prices due to tariffs can lead to decreased consumer demand, particularly in price-sensitive markets. This could result in lower sales volumes, further impacting Apple's overall profitability and Apple stock price.

- Impact on future product launches: The uncertainty surrounding tariffs may cause Apple to delay or reconsider future product launches, impacting its innovation pipeline and future revenue streams. This uncertainty further affects the Apple stock price.

Increased Production Costs

Apple's manufacturing heavily relies on Chinese factories. Tariffs on imported components and finished goods significantly increase Apple's production costs. This affects not only the price of its products but also its ability to compete effectively in the global market.

- Potential relocation of manufacturing: Apple may consider shifting some or all of its manufacturing outside of China to mitigate the impact of tariffs. However, this is a complex and costly undertaking, requiring significant investment and time.

- Challenges of moving production: Relocating manufacturing presents significant challenges, including finding suitable infrastructure, skilled labor, and navigating new regulatory environments. These logistical complications can further strain Apple's resources and impact its profitability.

- Increased logistical costs: Even if Apple maintains its Chinese manufacturing base, the increased tariffs lead to higher import costs, adding to logistical challenges and operational expenses. This directly reduces profit margins and puts downward pressure on Apple stock.

Investor Sentiment and Market Reaction

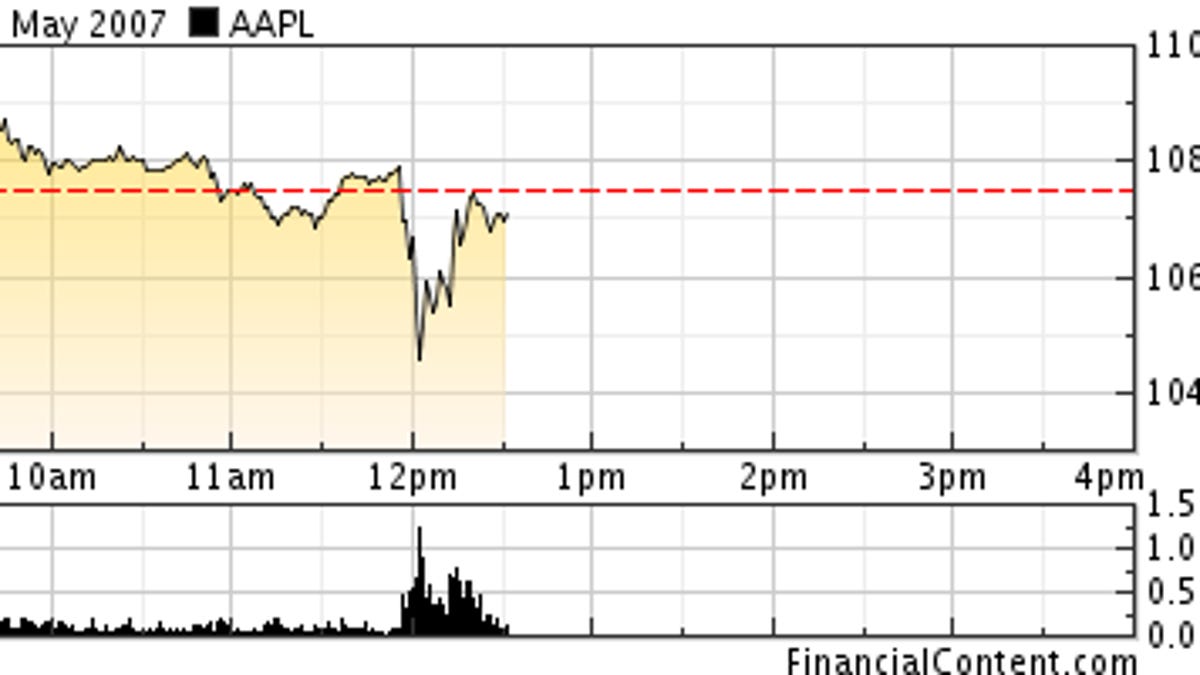

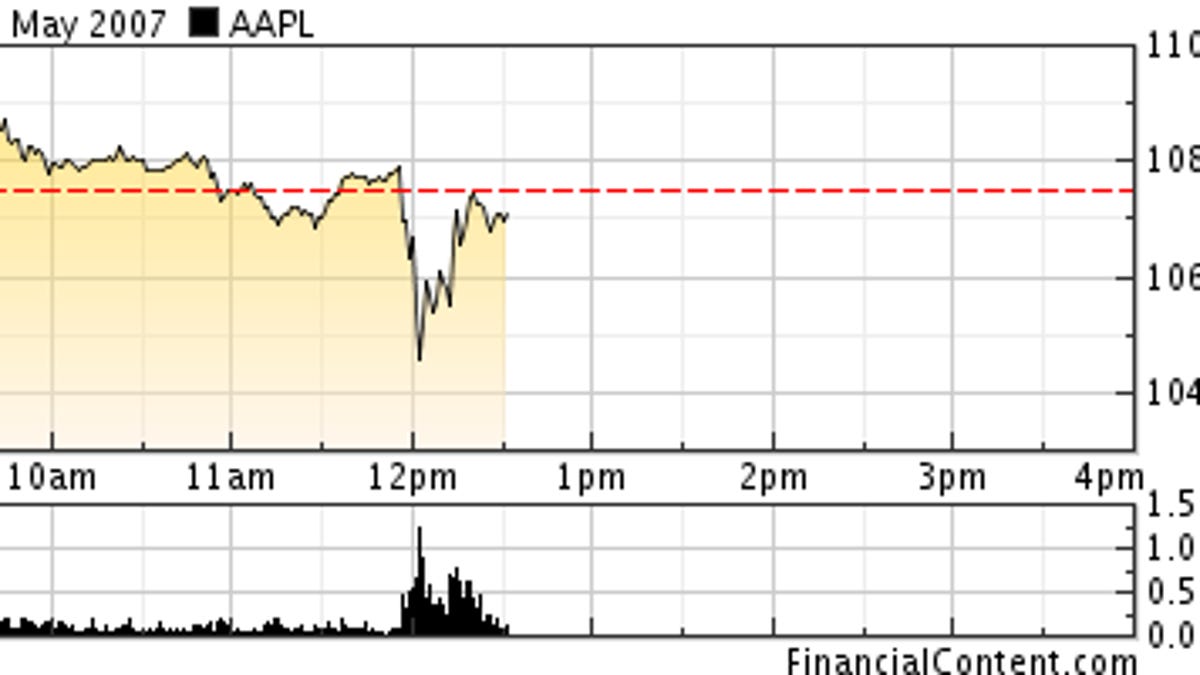

The tariff announcement immediately impacted investor sentiment and caused significant market reaction. The uncertainty surrounding the trade war and its future impact on Apple's financial performance contributed to a decline in Apple stock price.

- Stock price fluctuations: The announcement caused immediate and substantial fluctuations in Apple's stock price, reflecting the market's concern about the company's future profitability.

- Analyst predictions: Analysts have revised their earnings projections for Apple downward, reflecting the anticipated negative impact of tariffs on the company's financial performance. This further impacts confidence in the Apple stock.

- Impact on investor confidence: The uncertainty created by the trade war has eroded investor confidence in Apple's long-term growth prospects, leading some investors to sell off their Apple stock holdings.

The Broader Context of the US-China Trade War and its Influence on Apple Stock

The $900 million tariff projection is not an isolated event but a part of the larger ongoing US-China trade war, a complex geopolitical situation that significantly impacts Apple and other multinational corporations.

Escalating Trade Tensions

The unpredictable nature of the ongoing trade war adds another layer of complexity to the challenges faced by Apple. The possibility of further escalation, with additional tariffs or trade restrictions, creates significant uncertainty for investors.

- Ongoing negotiations: While negotiations between the US and China continue, the outcome remains uncertain, adding to the volatility of the situation. This uncertainty significantly impacts the Apple stock price and investor sentiment.

- Potential future tariff increases: The possibility of further tariff increases cannot be ruled out, creating substantial risk for companies like Apple that rely heavily on global supply chains.

- Uncertainty surrounding the trade relationship: The unpredictable nature of the US-China trade relationship adds to the risk, making it difficult for companies to plan effectively and investors to predict future performance.

Geopolitical Risks and Their Impact on Apple's Global Operations

The trade war presents several geopolitical risks that directly impact Apple's global operations. These risks extend beyond just financial considerations and include reputational damage and supply chain disruptions.

- Risks associated with supply chain disruptions: The trade war creates the risk of disruptions to Apple's global supply chain, potentially leading to shortages of components or finished goods.

- Impact on sales in key markets: Tariffs and trade restrictions can negatively impact Apple's sales in key markets, particularly in China, which is a significant consumer market for its products.

- Reputational damage: The ongoing trade war could negatively impact Apple's reputation in certain markets, potentially affecting its brand loyalty and consumer perception.

Strategies for Investors Navigating the Volatility of Apple Stock

While the current situation presents challenges, investors can employ several strategies to navigate the volatility of Apple stock.

Analyzing Long-Term Growth Potential

Despite the short-term headwinds caused by tariffs, Apple retains significant long-term growth potential. Investors should consider factors beyond the immediate impact of the trade war.

- Focus on Apple's innovation: Apple's history of innovation and its ability to introduce new and disruptive products are key factors to consider when assessing its long-term growth potential.

- Market share: Apple maintains a strong market share in many of its product categories, providing a solid foundation for future growth.

- Diversification strategy: Apple's efforts to diversify its revenue streams beyond iPhones, through services and other product categories, are important for mitigating risks.

Diversification of Investment Portfolios

To mitigate the risk associated with volatile stocks like Apple, investors should diversify their investment portfolios.

- Importance of a well-diversified portfolio: A well-diversified portfolio reduces the impact of any single investment's performance on the overall portfolio returns.

- Exploring alternative investment opportunities: Investors can consider diversifying into other asset classes, such as bonds, real estate, or alternative investments, to balance their portfolio risk.

Monitoring Market Trends and News

Staying informed about market trends, news, and developments affecting Apple stock is crucial.

- Reliable news sources: Investors should rely on reputable financial news sources and analytical reports to make informed investment decisions.

- Financial analysis tools: Utilizing financial analysis tools and resources can provide valuable insights into Apple's financial performance and market trends.

Conclusion

The $900 million tariff projection significantly impacts Apple's stock price, profitability, and investor sentiment. This situation highlights the broader implications of the ongoing US-China trade war. While the short-term outlook may appear challenging, Apple's long-term growth potential remains substantial, given its innovation track record and market dominance. However, the current uncertainties emphasize the importance of diversification and informed decision-making.

Stay updated on Apple stock's performance and monitor the impact of tariffs on Apple's future. Learn more about mitigating investment risks related to Apple stock. Analyze Apple's long-term prospects despite current challenges. Consult with a financial advisor before making any investment decisions related to Apple stock. Remember, careful monitoring and diversification are crucial for navigating the volatility of the Apple stock market.

Featured Posts

-

The Future Of Museum Programs Under Trumps Proposed Cuts

May 24, 2025

The Future Of Museum Programs Under Trumps Proposed Cuts

May 24, 2025 -

Relx Sterk Financieel Resultaat 2025 Dankzij Ai Implementatie

May 24, 2025

Relx Sterk Financieel Resultaat 2025 Dankzij Ai Implementatie

May 24, 2025 -

Beurzen Herstellen Na Trumps Uitstel Aex Fondsen Boeken Winsten

May 24, 2025

Beurzen Herstellen Na Trumps Uitstel Aex Fondsen Boeken Winsten

May 24, 2025 -

This Weeks Hottest R And B Tracks Leon Thomas And Flo Lead The Pack

May 24, 2025

This Weeks Hottest R And B Tracks Leon Thomas And Flo Lead The Pack

May 24, 2025 -

Ferrari Service Centre Opens In Bengaluru A New Era For Owners

May 24, 2025

Ferrari Service Centre Opens In Bengaluru A New Era For Owners

May 24, 2025

Latest Posts

-

1050 Price Hike At And T On Broadcoms V Mware Acquisition

May 24, 2025

1050 Price Hike At And T On Broadcoms V Mware Acquisition

May 24, 2025 -

Broadcoms Extreme V Mware Price Hike At And T Details A 1050 Cost Increase

May 24, 2025

Broadcoms Extreme V Mware Price Hike At And T Details A 1050 Cost Increase

May 24, 2025 -

Posthaste Understanding The Current Crisis In The Global Bond Market

May 24, 2025

Posthaste Understanding The Current Crisis In The Global Bond Market

May 24, 2025 -

V Mware Costs To Skyrocket 1050 At And Ts Response To Broadcoms Price Hike

May 24, 2025

V Mware Costs To Skyrocket 1050 At And Ts Response To Broadcoms Price Hike

May 24, 2025 -

The Posthaste Threat Unstable Bond Markets And Global Economic Consequences

May 24, 2025

The Posthaste Threat Unstable Bond Markets And Global Economic Consequences

May 24, 2025