Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The $900 Million Tariff: A Detailed Breakdown

The recent $900 million tariff, imposed by [Country Name] on various Apple products, significantly impacted the company's financial performance. This tariff specifically targets key products like iPhones, iPads, and MacBooks, impacting a substantial portion of Apple's revenue stream. The reasons cited for the imposition of these tariffs include [State the reason given by the country imposing the tariffs, e.g., trade imbalances, national security concerns]. The timing of the announcement – [mention the date] – contributed to the immediate and sharp decline in Apple's stock price.

- Specific product categories affected and their estimated tariff costs: The tariff disproportionately affects iPhones (estimated cost increase per unit: $[amount]), iPads (estimated cost increase per unit: $[amount]), and MacBooks (estimated cost increase per unit: $[amount]).

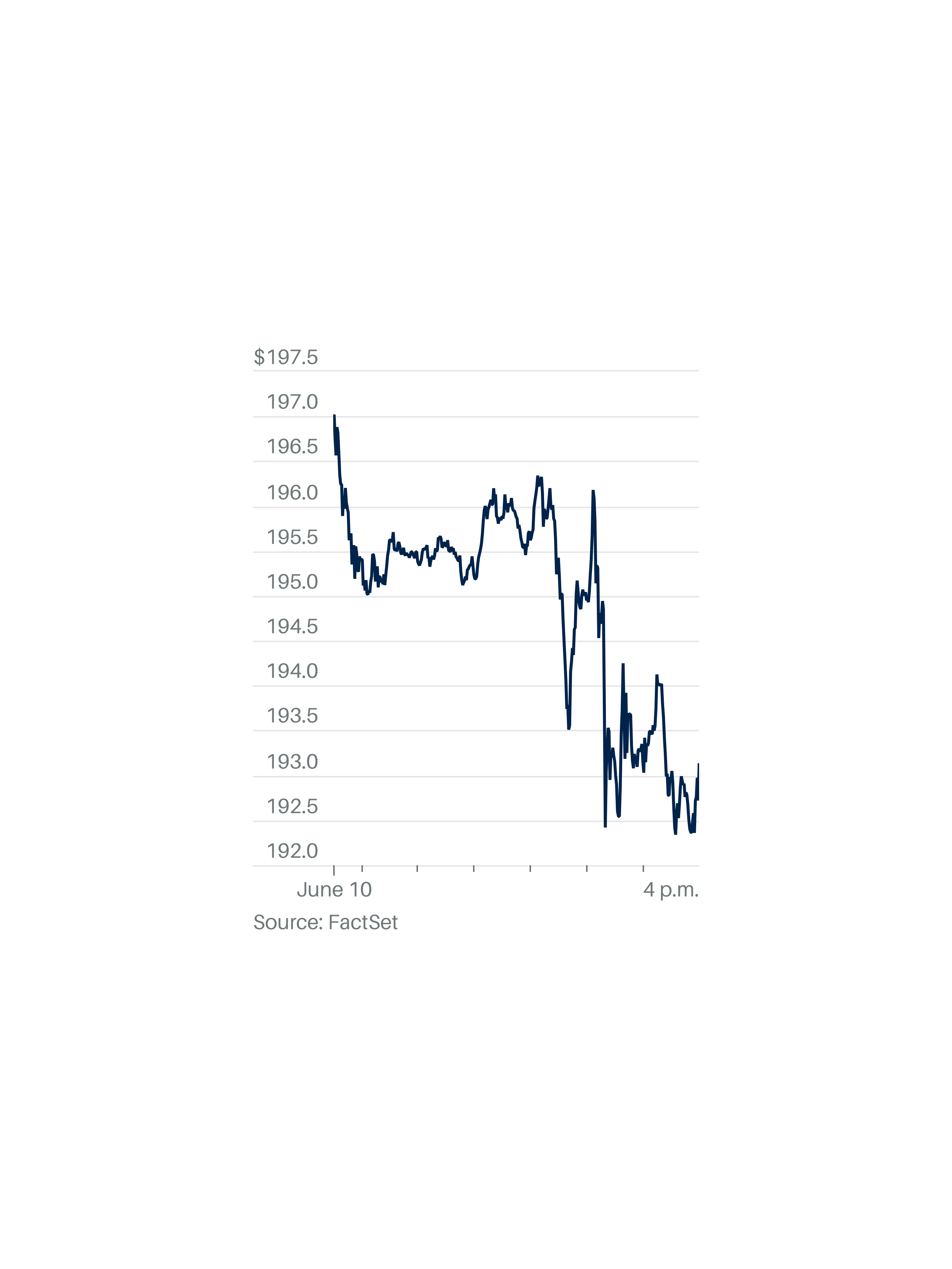

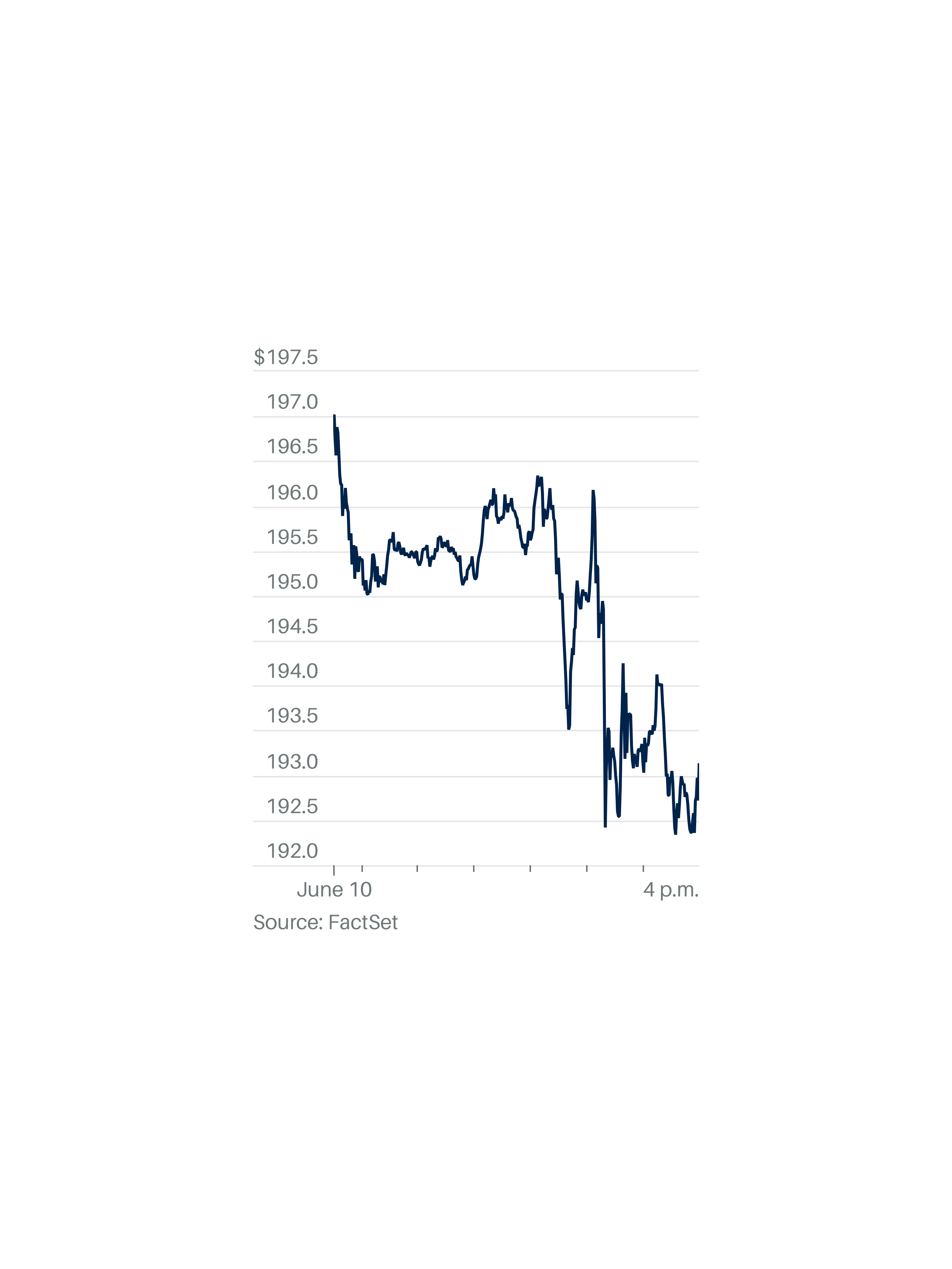

- Percentage change in Apple's stock price following the tariff announcement: Following the announcement, Apple's stock price experienced a [percentage]% drop, wiping out billions in market capitalization.

- Comparison to previous tariff impacts on Apple: This tariff represents [comparison to previous tariffs, e.g., the largest single tariff impact on Apple to date, a significant escalation compared to previous years].

Analyzing Apple's Response to the Tariffs

Apple has yet to release an official detailed statement addressing the full financial implications of these tariffs. However, initial responses suggest [Summary of Apple's official statements]. To mitigate the negative impacts, Apple might consider several strategies:

- Potential price increases: Passing some or all of the tariff costs onto consumers through higher product prices is a likely scenario.

- Shifting production: Relocating some manufacturing operations to countries outside of [Country Name]'s jurisdiction could reduce future tariff exposure. This is a complex process involving significant investment and logistical challenges.

- Cost-cutting measures: Apple might explore various cost-cutting measures within its supply chain to absorb some of the tariff impact without raising prices.

The long-term impact on Apple’s supply chain will be significant. Re-aligning global manufacturing strategies will require considerable time and resources.

Investor Sentiment and Market Reaction

The market reacted swiftly and negatively to the news. The initial stock price drop was followed by [Describe the subsequent market reaction, including volatility]. Investor sentiment reflects significant concern, with a widespread expectation of [mention investor expectations, e.g., reduced profit margins, decreased consumer demand].

- Stock price fluctuations before, during, and after the tariff announcement: [Chart or graph visualizing stock price fluctuations would be beneficial here].

- Changes in trading volume: Trading volume significantly increased following the tariff announcement, reflecting heightened investor activity.

- Quotes from financial analysts and experts: Many analysts have expressed concerns, with [Name of Analyst] stating "[Quote from analyst]".

Long-Term Implications for Apple and the Tech Sector

The $900 million tariff on Apple products has broader implications beyond Apple itself. It highlights the increasing risks associated with global trade tensions and the potential for similar tariff actions against other tech companies.

- Potential ripple effects on related industries: The tariff could impact related industries like component manufacturing and retail sales.

- Comparisons to similar tariff disputes in the past: This situation echoes previous trade disputes, underscoring the need for proactive strategies to manage geopolitical risks.

- Predictions for future trade relations between involved countries: The outcome of this situation will significantly influence future trade relations and potentially set a precedent for similar actions.

Conclusion: Navigating the Apple Stock Slump – A Look Ahead

The $900 million tariff represents a significant challenge for Apple. The immediate impact has been a notable stock slump, prompting concerns about future profitability. Apple's response, the market's reaction, and the broader implications for the tech sector will unfold over time. The long-term consequences remain uncertain, depending on Apple's strategic responses, further trade developments, and consumer behavior. To make informed investment decisions, it is crucial to follow the Apple stock slump, monitor the tariff impact, and stay updated on Apple's financial performance. Stay informed about future developments and continue to analyze the evolving situation to navigate this challenging period for Apple's stock.

Featured Posts

-

Essen Emotionale Geschichten Rund Um Das Uniklinikum

May 25, 2025

Essen Emotionale Geschichten Rund Um Das Uniklinikum

May 25, 2025 -

Urban Oasis How A Seattle Park Became A Refuge During Covid 19

May 25, 2025

Urban Oasis How A Seattle Park Became A Refuge During Covid 19

May 25, 2025 -

Novo Ferrari 296 Speciale 880 Cv De Potencia Hibrida

May 25, 2025

Novo Ferrari 296 Speciale 880 Cv De Potencia Hibrida

May 25, 2025 -

Joy Crookes I Know You D Kill Song Release Lyrics And Music Video

May 25, 2025

Joy Crookes I Know You D Kill Song Release Lyrics And Music Video

May 25, 2025 -

Woody Allen Sexual Abuse Accusations Reignited By Sean Penns Endorsement

May 25, 2025

Woody Allen Sexual Abuse Accusations Reignited By Sean Penns Endorsement

May 25, 2025

Latest Posts

-

Trumps Trade War With Europe Understanding The Reasons Behind The Outburst

May 25, 2025

Trumps Trade War With Europe Understanding The Reasons Behind The Outburst

May 25, 2025 -

A Fathers 2 2 Million Challenge Rowing For His Sons Life

May 25, 2025

A Fathers 2 2 Million Challenge Rowing For His Sons Life

May 25, 2025 -

2 2 Million Treatment A Fathers Determination And A Rowing Journey

May 25, 2025

2 2 Million Treatment A Fathers Determination And A Rowing Journey

May 25, 2025 -

Fathers Incredible Rowing Journey To Fund Sons 2 2 Million Treatment

May 25, 2025

Fathers Incredible Rowing Journey To Fund Sons 2 2 Million Treatment

May 25, 2025 -

The Sutton Hoo Ship Burial A Sixth Century Vessel And Its Significance

May 25, 2025

The Sutton Hoo Ship Burial A Sixth Century Vessel And Its Significance

May 25, 2025