Apple Stock Under Pressure: Q2 Earnings Report Looms

Table of Contents

Factors Contributing to Apple Stock Pressure

Several interconnected factors are contributing to the current pressure on Apple stock. These include slowing iPhone sales, supply chain disruptions, and the broader impact of rising inflation and economic uncertainty.

Slowing iPhone Sales

Market saturation, increasing competition from Android manufacturers, and the global economic slowdown are all contributing to a potential decline in iPhone sales. This decrease in unit sales directly impacts overall revenue and profit margins, a key concern for investors.

- Market Saturation: The global smartphone market is nearing saturation, leaving less room for significant growth in iPhone sales.

- Intense Competition: Android competitors are offering increasingly competitive devices at various price points, putting pressure on Apple's market share.

- Economic Slowdown: The current global economic climate is leading consumers to delay large purchases, impacting demand for high-priced electronics like iPhones.

Apple may need to implement new strategies to boost sales, such as aggressive marketing campaigns, more competitive pricing, or focusing on expanding into new markets. Recent reports suggest a potential slowdown in iPhone 14 sales compared to the iPhone 13 launch, adding further fuel to these concerns.

Supply Chain Disruptions

Apple, like many other tech giants, continues to grapple with significant supply chain disruptions. Geopolitical instability, component shortages, and potential factory closures in key manufacturing regions pose ongoing challenges.

- Geopolitical Instability: Tensions in various regions of the world impact the smooth flow of components and finished products.

- Component Shortages: The global chip shortage, while easing somewhat, still presents obstacles to Apple's production capacity.

- Factory Closures: COVID-19 related lockdowns and other unforeseen circumstances can cause temporary or prolonged production halts.

These disruptions directly affect production costs and product availability, potentially impacting Apple's profitability and its ability to meet consumer demand. Apple has been actively working on diversifying its supply chain to mitigate future risks.

Rising Inflation and Economic Uncertainty

Macroeconomic factors are significantly influencing investor confidence in Apple stock. Rising inflation is impacting consumer spending, while interest rate hikes by central banks increase the cost of borrowing and potentially trigger a recession.

- Inflation's Impact: Higher prices for goods and services reduce disposable income, potentially dampening demand for non-essential electronics.

- Interest Rate Hikes: Increased borrowing costs make it more expensive for consumers to finance purchases, including iPhones.

- Recessionary Fears: Concerns about a potential global recession are causing investors to become more risk-averse, leading to a sell-off in many stocks, including Apple.

Analyst forecasts vary, but many predict a challenging economic environment that could directly impact Apple's performance in the coming quarters.

Analyst Predictions and Expectations for Q2 Earnings

Analysts have varying expectations for Apple's Q2 earnings, with some expressing cautious optimism while others remain more conservative.

Consensus Estimates

The consensus estimates from various reputable financial sources, like Bloomberg and Yahoo Finance, suggest a moderate growth in EPS and revenue compared to the same period last year. However, these predictions vary significantly across different analyst firms, highlighting the uncertainty surrounding the upcoming report.

Key Metrics to Watch

Investors will closely scrutinize several key metrics in the Q2 earnings report:

- iPhone Sales: The performance of the iPhone segment remains paramount, given its significant contribution to Apple's overall revenue.

- Services Revenue: Growth in Apple's Services division (App Store, Apple Music, iCloud, etc.) is crucial for demonstrating diversification and resilience.

- Gross Margins: Maintaining healthy gross margins amidst rising production costs and economic headwinds will be a key indicator of Apple's financial health.

These metrics will be carefully analyzed to assess Apple's overall financial health and growth trajectory.

Potential for Positive Surprises

Despite the headwinds, some potential factors could lead to better-than-expected Q2 results:

- Strong Demand for Specific Products: Specific product categories, like the Apple Watch or AirPods, might outperform expectations.

- Successful Cost-Cutting Measures: Apple's ability to efficiently manage costs could positively impact its profit margins.

- New Product Launches: The launch of new products or services could boost sales and revenue in the later part of the quarter.

Strategies for Investors

Investing in Apple stock involves inherent risks in the current economic climate.

Risk Assessment

Before making any investment decisions, it's vital to assess the potential risks associated with Apple stock, including:

- Continued decline in iPhone sales.

- Further supply chain disruptions.

- A deeper-than-expected economic slowdown.

Investment Strategies

Investment strategies should align with individual risk tolerance. Options range from holding existing shares, buying additional shares if the price dips, or even selling shares depending on individual circumstances and market predictions. Remember to consult with a qualified financial advisor before making any investment decisions.

Diversification

Diversification is crucial for mitigating risk. Don't put all your eggs in one basket; diversify your investment portfolio across different asset classes and industries to reduce the impact of any single investment's underperformance.

Apple Stock Under Pressure – What's Next?

Apple stock is currently facing pressure due to slowing iPhone sales, supply chain disruptions, and broader economic uncertainty. The upcoming Q2 earnings report is critical, and investors will closely scrutinize key metrics like iPhone sales, Services revenue, and gross margins. While potential risks exist, Apple also possesses strengths that could lead to positive surprises. Analysts' predictions vary significantly, highlighting the uncertainty surrounding the company's immediate future. The overall outlook remains balanced, with both potential risks and opportunities.

Stay tuned for the upcoming Apple Q2 earnings report and keep a close watch on how this impacts Apple stock under pressure. Make sure to conduct your own thorough research before making any investment decisions, and remember to consult with a financial advisor for personalized guidance.

Featured Posts

-

Indonesia Classic Art Week 2025 Porsche Dan Perpaduan Seni

May 25, 2025

Indonesia Classic Art Week 2025 Porsche Dan Perpaduan Seni

May 25, 2025 -

Exploring The Countrys Business Hotspots Opportunities And Challenges

May 25, 2025

Exploring The Countrys Business Hotspots Opportunities And Challenges

May 25, 2025 -

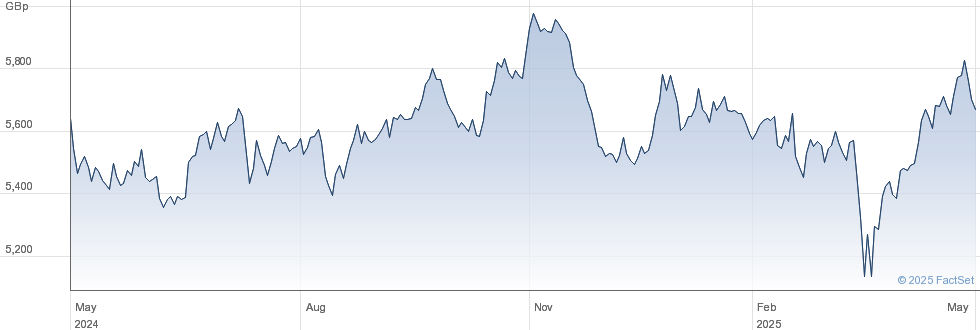

Analyzing The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025

Analyzing The Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Dist

May 25, 2025 -

French Elections 2024 Bardellas Path To Power

May 25, 2025

French Elections 2024 Bardellas Path To Power

May 25, 2025 -

Trump Suffers Another Legal Loss In Elite Law Firm Dispute

May 25, 2025

Trump Suffers Another Legal Loss In Elite Law Firm Dispute

May 25, 2025

Latest Posts

-

The Looming Canada Post Strike A Customer Perspective

May 25, 2025

The Looming Canada Post Strike A Customer Perspective

May 25, 2025 -

Canada Post Facing Strike The Customer Fallout

May 25, 2025

Canada Post Facing Strike The Customer Fallout

May 25, 2025 -

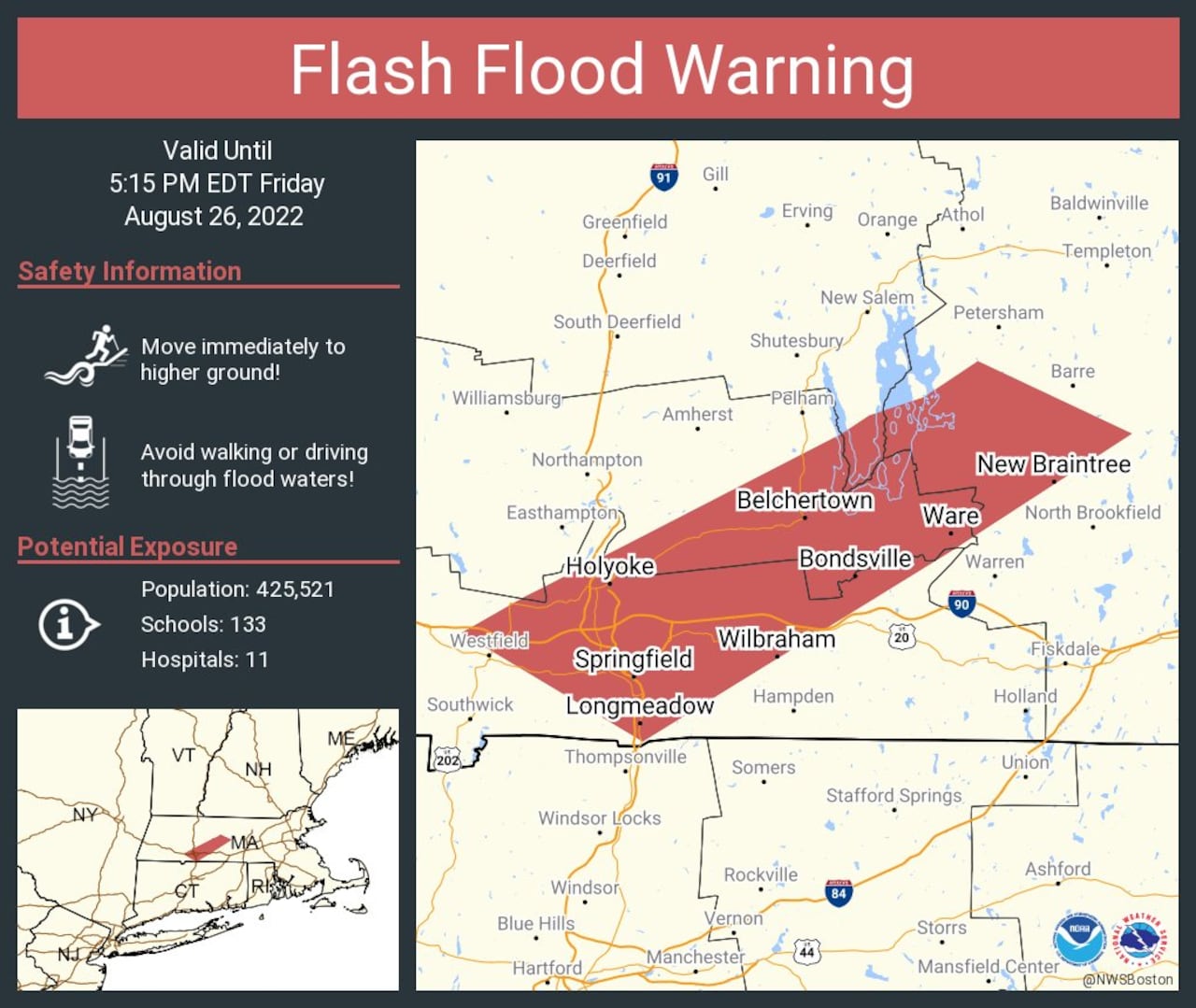

Flash Flood Threat Hampshire And Worcester Counties On High Alert Thursday

May 25, 2025

Flash Flood Threat Hampshire And Worcester Counties On High Alert Thursday

May 25, 2025 -

Is A Canada Post Strike Driving Customers Away

May 25, 2025

Is A Canada Post Strike Driving Customers Away

May 25, 2025 -

Urgent Flash Flood Warning Issued For Hampshire And Worcester Thursday Night

May 25, 2025

Urgent Flash Flood Warning Issued For Hampshire And Worcester Thursday Night

May 25, 2025