Are Hedge Funds Betting On Norwegian Cruise Line (NCLH) Stock?

Table of Contents

Analyzing Hedge Fund Holdings in NCLH

Determining the extent of hedge fund involvement in NCLH requires careful analysis of various data sources.

SEC Filings and 13F Data

The Securities and Exchange Commission (SEC) mandates that institutional investors, including hedge funds, file quarterly 13F reports disclosing their long positions in U.S. equities. Analyzing these filings provides insights into hedge fund ownership of NCLH stock. However, interpreting 13F data comes with its own set of challenges:

- Reporting Lags: There's a significant lag between the quarter's end and the filing deadline, meaning the data isn't completely up-to-date.

- Partial Disclosure: 13F filings don't reveal the complete picture. Hedge funds aren't obligated to disclose all their holdings, including short positions and certain derivatives.

- Data Complexity: Sifting through numerous 13F filings to identify specific hedge fund investments in NCLH requires significant time and effort.

While identifying specific prominent hedge funds heavily invested in NCLH from publicly available data is difficult without dedicated financial databases, consistent monitoring of these filings provides a general overview of institutional investor sentiment.

News and Media Reports

Financial news outlets often report on significant hedge fund activity in publicly traded companies. Searching for articles mentioning "NCLH investment" and "hedge fund activity" can provide valuable supplementary information. For example:

- [Insert link to a relevant news article 1, if available] – This article highlights [brief summary of article's findings].

- [Insert link to a relevant news article 2, if available] – This report suggests [brief summary of article's findings].

Expert Opinions

Financial analysts and experts often offer insights into hedge fund sentiment towards specific stocks. Their perspectives, based on in-depth analysis and market knowledge, can further inform our understanding of NCLH investment trends. For example:

- " [Quote from a financial analyst on their outlook for NCLH],” [Source of quote].

- “[Quote from a market expert on hedge fund activity in the cruise industry],” [Source of quote].

Factors Influencing Hedge Fund Interest in NCLH

Several factors influence whether hedge funds find NCLH an attractive investment.

Post-Pandemic Recovery

The cruise industry's recovery from the pandemic significantly impacts NCLH's stock price. Key indicators include:

- Booking Trends: Strong booking numbers suggest increased consumer confidence and potential for revenue growth.

- Passenger Numbers: Rising passenger numbers reflect a return to pre-pandemic travel levels.

- Revenue Growth: Positive revenue growth demonstrates the company's ability to rebound from the pandemic's impact.

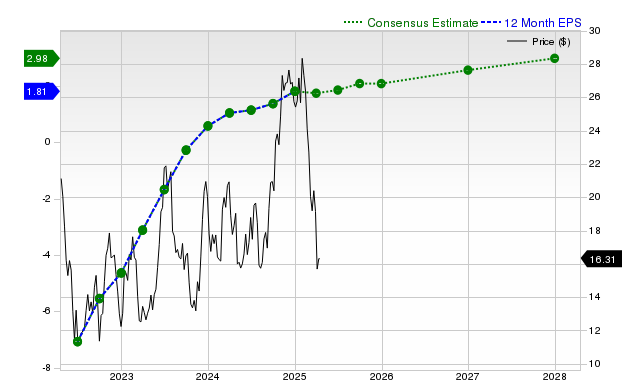

NCLH's Financial Performance

Analyzing NCLH's financial performance is crucial:

- Revenue: Consistent revenue growth indicates strong operational performance.

- Earnings: Profitability is a key factor influencing investor sentiment.

- Debt-to-Equity Ratio: A high debt-to-equity ratio may signal increased financial risk.

Market Sentiment and Industry Trends

Broader market trends and industry-specific factors also play a role:

- Inflation: High inflation can impact consumer spending and travel budgets.

- Interest Rates: Rising interest rates can increase borrowing costs for NCLH.

- Fuel Prices: Fluctuations in fuel prices directly impact the cruise industry's profitability.

Potential Risks and Rewards of Investing in NCLH

Investing in NCLH stock carries both risks and rewards.

Volatility and Uncertainty

NCLH stock is inherently volatile due to:

- Economic Downturns: Recessions can significantly reduce travel demand.

- Geopolitical Events: Global instability can disrupt travel plans and impact stock prices.

- Health Concerns: Future pandemics or health crises could negatively affect the cruise industry.

Growth Potential and Long-Term Outlook

Despite the risks, NCLH offers potential for growth through:

- Expansion Plans: New ships and destinations can attract new customers.

- Market Share: Gaining market share within the competitive cruise industry can boost profitability.

- Innovation: Investments in technology and customer experience can drive growth.

Comparison to Competitors

Comparing NCLH's performance with competitors like Carnival Corporation (CCL) and Royal Caribbean Cruises (RCL) provides valuable context for assessing its relative strength and potential.

Conclusion

Determining whether hedge funds are significantly invested in NCLH requires continuous monitoring of SEC filings, news reports, and expert analyses. While definitive evidence of widespread hedge fund interest may be elusive from publicly available information, the factors influencing their investment decisions—the post-pandemic recovery, NCLH's financial performance, and broader market sentiment—are all crucial to assess. Whether this translates to a bullish or bearish sentiment is ultimately a matter of ongoing interpretation. Before investing in Norwegian Cruise Line (NCLH) stock, conduct your own thorough research, considering the inherent volatility and risks associated with the cruise industry and the broader stock market. Consult with a financial advisor for personalized guidance. For further resources on NCLH investments and cruise stock analysis, explore reputable financial news websites and investment platforms. Remember, all investments carry risk.

Featured Posts

-

Rui Ro Dau Tu Danh Gia Ky Luong Truoc Khi Gop Von Vao Cong Ty Co Dau Hieu Lua Dao

May 01, 2025

Rui Ro Dau Tu Danh Gia Ky Luong Truoc Khi Gop Von Vao Cong Ty Co Dau Hieu Lua Dao

May 01, 2025 -

Gaslucht Roden Loos Alarm

May 01, 2025

Gaslucht Roden Loos Alarm

May 01, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Nha Vo Dich Dau Tien Va Hanh Trinh Den Vinh Quang

May 01, 2025

Giai Bong Da Thanh Nien Sinh Vien Quoc Te Nha Vo Dich Dau Tien Va Hanh Trinh Den Vinh Quang

May 01, 2025 -

4 3 Royals Win Garcia Homer And Witts Rbi Double Decide The Game

May 01, 2025

4 3 Royals Win Garcia Homer And Witts Rbi Double Decide The Game

May 01, 2025 -

Northumberland Mans Homemade Boat A Global Voyage

May 01, 2025

Northumberland Mans Homemade Boat A Global Voyage

May 01, 2025

Latest Posts

-

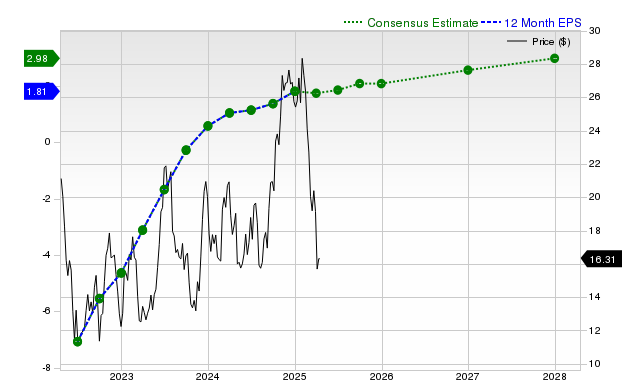

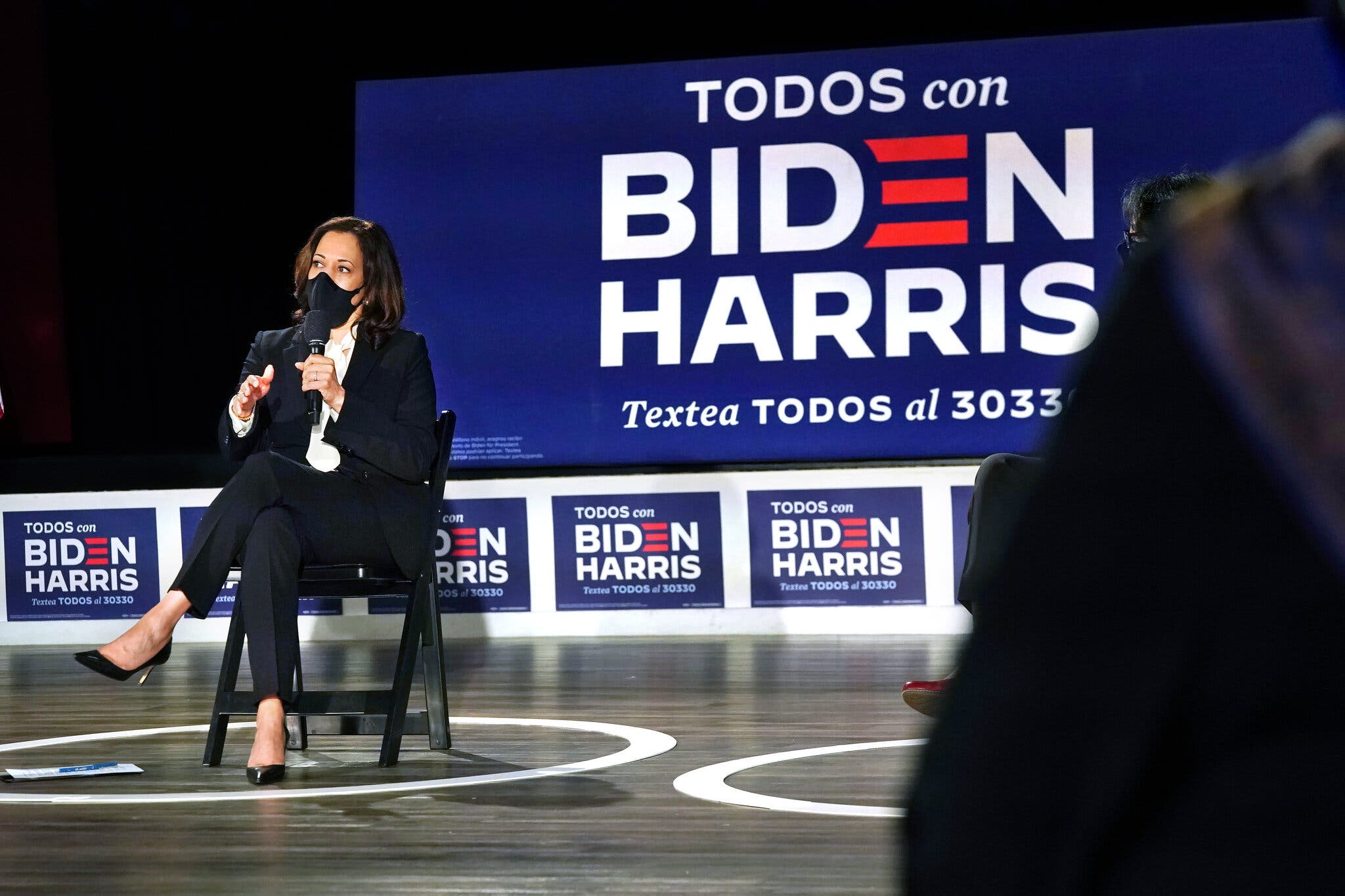

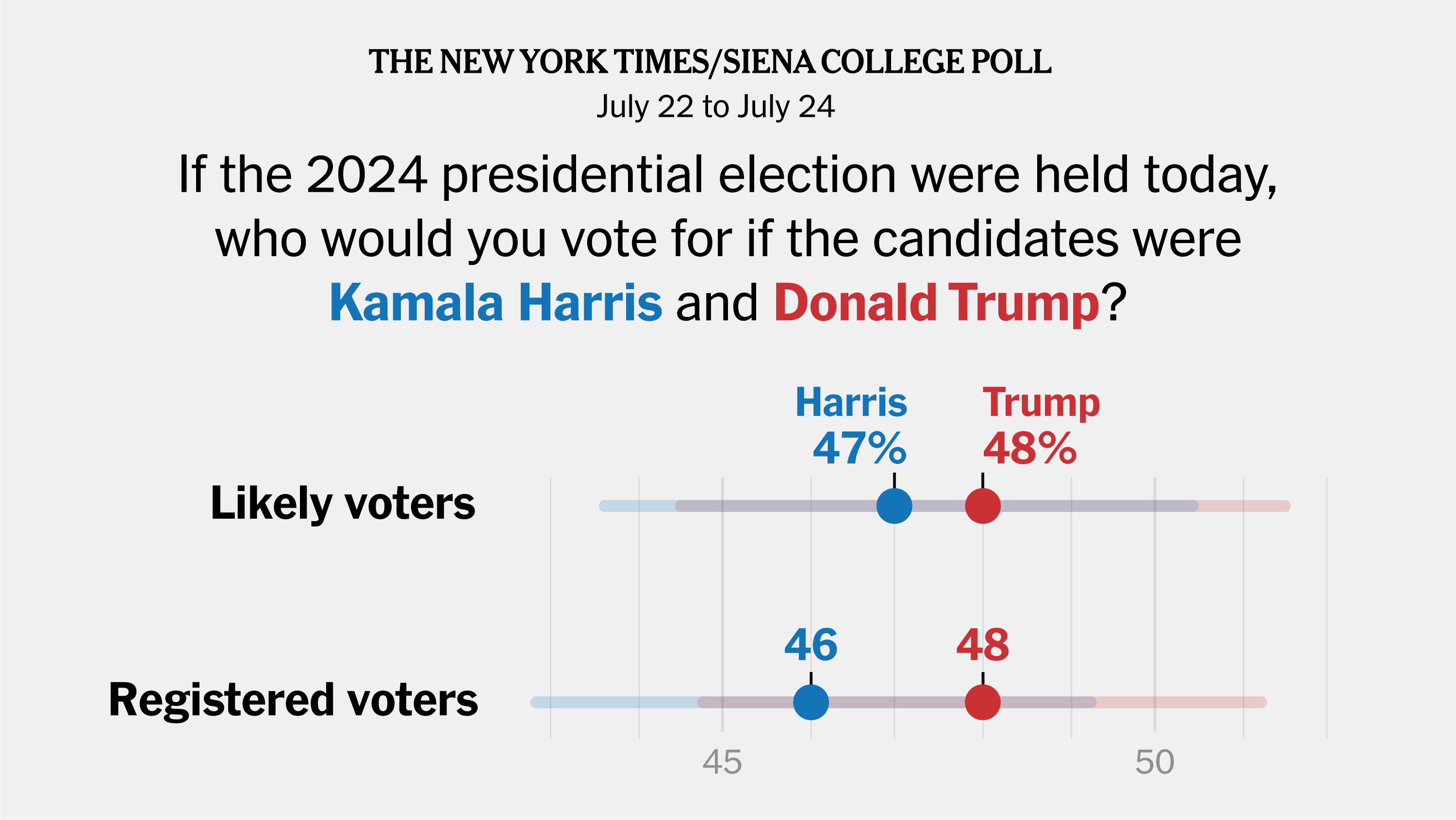

The Vice Presidency A New Life For Kamala Harris

May 01, 2025

The Vice Presidency A New Life For Kamala Harris

May 01, 2025 -

Germanys Klingbeil Rejects Renewed Russian Gas Imports

May 01, 2025

Germanys Klingbeil Rejects Renewed Russian Gas Imports

May 01, 2025 -

Is Kamala Harris Planning A Political Comeback

May 01, 2025

Is Kamala Harris Planning A Political Comeback

May 01, 2025 -

Analysis Kamala Harris Planned Political Comeback

May 01, 2025

Analysis Kamala Harris Planned Political Comeback

May 01, 2025 -

When Is Kamala Harris Returning To Politics

May 01, 2025

When Is Kamala Harris Returning To Politics

May 01, 2025