Are Stretched Stock Market Valuations Justified? BofA's Take.

Table of Contents

BofA's Assessment of Current Stock Market Valuations

BofA's assessment of current stock market valuations paints a complex picture. While acknowledging the impressive growth in certain sectors, they highlight key concerns stemming from elevated valuations.

High P/E Ratios and Their Implications

One of the most significant indicators BofA examines is the Price-to-Earnings (P/E) ratio. Currently, many sectors exhibit P/E ratios significantly higher than their historical averages. This suggests that investors are paying a premium for current earnings.

- High P/E ratios across various sectors: BofA's analysis shows elevated P/E ratios not just in the tech sector, but also in consumer discretionary and healthcare, indicating a broad market phenomenon.

- Comparison to historical averages: Current P/E ratios are considerably above long-term averages, raising concerns about potential overvaluation and future correction risks. For instance, the S&P 500's P/E ratio currently exceeds its 20-year average by a significant margin (Specific data from BofA's report would be inserted here).

- Potential risks: High P/E ratios generally suggest that future earnings growth needs to be substantial to justify current prices. Failure to meet these expectations could lead to significant market corrections, impacting overall stock market valuation.

The Role of Interest Rates and Inflation

Rising interest rates and persistent inflation significantly impact stock valuations. These factors play a crucial role in BofA's assessment.

- Impact on discounted cash flow models: Higher interest rates increase the discount rate used in discounted cash flow (DCF) models, reducing the present value of future earnings, and thus impacting stock valuations negatively.

- Inflation's erosion of future earnings: Inflation erodes the purchasing power of future earnings, reducing their real value and affecting stock prices. BofA likely incorporated inflation forecasts into its valuation models.

- BofA's interest rate and inflation predictions: (Insert BofA's predictions for interest rates and inflation from their report. This could include specific percentage increases or decreases and timelines). These predictions heavily influence their outlook on stock market valuation.

Impact of Economic Growth Projections

BofA's economic growth projections are fundamental to their assessment of stock market valuations. Strong growth generally supports higher valuations, while weaker growth can lead to downward pressure.

- Correlation between economic growth and stock market performance: Historically, robust economic growth tends to correlate with strong stock market performance, boosting corporate earnings and justifying higher stock prices.

- BofA's specific growth projections: (Insert BofA's specific GDP growth projections here). Their outlook on economic expansion or contraction directly impacts their assessment of whether current stock market valuations are justified.

- Recession risk and its influence: If BofA anticipates a recession, this would likely lead to a downward revision of their valuation estimates, suggesting that current stock market valuations are stretched.

Counterarguments and Alternative Perspectives

While BofA expresses concerns about stretched stock market valuations, several counterarguments exist.

Arguments for Justified Valuations

Some argue that current high valuations are justified due to several factors:

- Technological innovation and disruptive technologies: Rapid advancements in technology are driving significant growth in certain sectors, potentially justifying higher valuations based on future earnings potential.

- Long-term growth potential: Investors may be willing to pay a premium for companies with strong long-term growth prospects, even if current P/E ratios appear high. This is particularly true for companies in high-growth sectors.

- Examples of companies with strong future earnings potential: (Cite specific examples of companies and their growth projections here). These examples are often used to justify the higher valuations seen across the broader market.

Other Financial Institutions' Views

It's crucial to consider perspectives from other financial institutions. While BofA's analysis is valuable, it's not the only view.

- Comparing perspectives: (Mention other investment banks’ analyses and their conclusions regarding stock market valuations. Highlight areas of agreement or disagreement with BofA’s findings). This allows for a more comprehensive understanding of the market.

- Divergent opinions and their implications: Differences in opinion highlight the complexities and uncertainties involved in predicting future market performance.

Conclusion

BofA's analysis suggests that current stretched stock market valuations present both opportunities and risks. While technological innovation and long-term growth potential support higher valuations in some sectors, elevated P/E ratios, coupled with the potential impact of rising interest rates and inflation, raise concerns about sustainability. Understanding whether stretched stock market valuations are justified is crucial for informed investment decisions. Dive deeper into BofA’s analysis and other market research to make your own assessment of current stock market valuations and develop a sound investment strategy.

Featured Posts

-

Reviving The 80s Selena Gomezs Sophisticated High Waisted Suit

May 03, 2025

Reviving The 80s Selena Gomezs Sophisticated High Waisted Suit

May 03, 2025 -

Hasil Pertemuan Jokowi Erdogan 13 Kerja Sama Strategis Untuk Indonesia Dan Turki

May 03, 2025

Hasil Pertemuan Jokowi Erdogan 13 Kerja Sama Strategis Untuk Indonesia Dan Turki

May 03, 2025 -

The Farage Lowe Feud Latest Developments And Public Barbs

May 03, 2025

The Farage Lowe Feud Latest Developments And Public Barbs

May 03, 2025 -

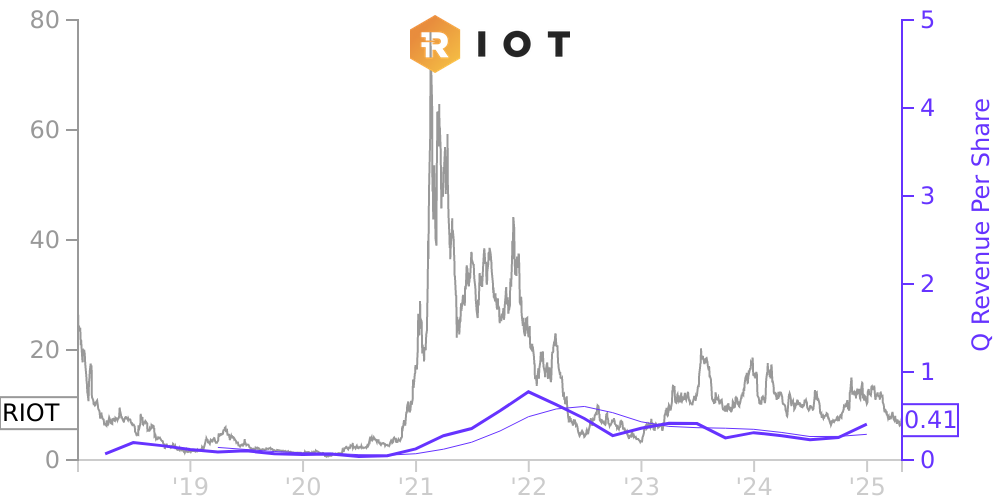

Riot Stock Price Falls Understanding The Recent Decline Riot

May 03, 2025

Riot Stock Price Falls Understanding The Recent Decline Riot

May 03, 2025 -

This Country From Coast To Coast

May 03, 2025

This Country From Coast To Coast

May 03, 2025