Assessing Stock Market Valuations: BofA's Advice For Investors

Table of Contents

Understanding Current Market Conditions and Economic Indicators

Analyzing macroeconomic factors is paramount when assessing stock market valuations. These factors significantly influence stock prices and overall market sentiment. Key indicators to consider include:

-

Inflation rates: High inflation erodes purchasing power and can lead to increased interest rates, impacting corporate profitability and stock valuations. BofA's analysis of inflation trends provides crucial context for investment strategies.

-

Interest rates: Interest rate hikes by central banks can cool down economic activity, affecting corporate borrowing costs and consequently, stock prices. BofA's predictions on interest rate movements are vital for understanding their impact on stock market valuations.

-

GDP growth: Strong GDP growth usually indicates a healthy economy, boosting corporate earnings and positively impacting stock valuations. Conversely, slow or negative GDP growth can signal economic trouble and lower stock prices. BofA's GDP forecasts are valuable tools for investors.

-

Geopolitical events: Unforeseen events like wars, political instability, or trade disputes can significantly impact market sentiment and stock market valuations. BofA's geopolitical risk assessments offer insights into potential market disruptions.

-

Leading economic indicators: Paying close attention to consumer confidence indices and manufacturing PMI (Purchasing Managers' Index) provides early signals of economic shifts and their potential impact on stock prices. BofA's reports often include detailed analyses of these leading indicators.

Understanding how these indicators interact and affect stock prices requires careful analysis. For instance, rising inflation coupled with rising interest rates can create a challenging environment for growth stocks, while defensive stocks may perform better. BofA's research and reports provide valuable context and predictions for navigating these complex market dynamics.

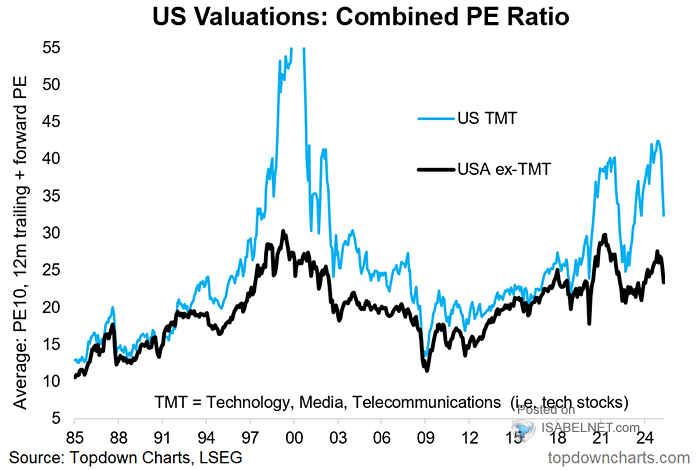

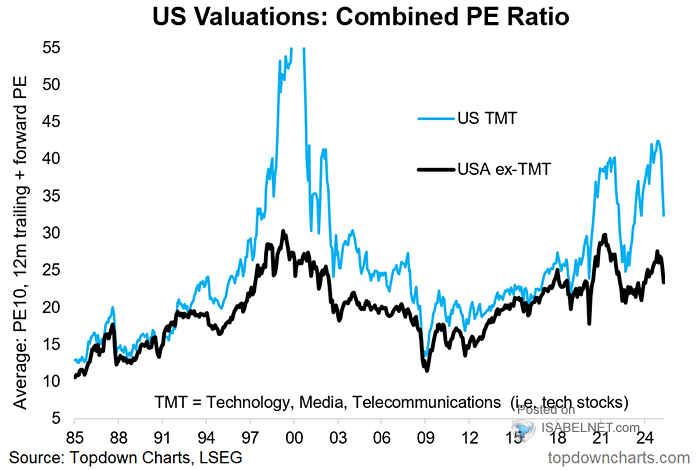

Key Valuation Metrics: A BofA Perspective

BofA utilizes several key valuation ratios to assess the intrinsic value of stocks. These include:

- Price-to-Earnings (P/E) ratio: This compares a company's stock price to its earnings per share. A high P/E ratio might suggest the stock is overvalued, while a low P/E ratio could indicate undervaluation. BofA considers the P/E ratio within its sector context.

- Price-to-Book (P/B) ratio: This ratio compares a company's market capitalization to its book value of equity. A low P/B ratio can suggest that a stock is undervalued, relative to its assets. BofA’s analysts use this metric cautiously, understanding its limitations with intangible assets.

- Price-to-Sales (P/S) ratio: This ratio compares a company's market capitalization to its revenue. It's particularly useful for valuing companies with negative earnings. BofA's analysis often incorporates this ratio when evaluating high-growth companies.

However, it's crucial to remember that these ratios are just tools. BofA emphasizes that relying solely on these metrics is insufficient. Different industries have vastly different valuation benchmarks. A high P/E ratio might be justified for a fast-growing technology company, but not for a mature utility company. BofA's approach considers the specific industry context and utilizes these ratios in conjunction with other analytical methods.

Identifying Undervalued and Overvalued Stocks (BofA's Approach)

BofA employs a multi-faceted approach to identify undervalued and overvalued securities. Their methodology combines quantitative and qualitative analysis:

- Discounted Cash Flow (DCF) analysis: This is a fundamental valuation method that projects future cash flows and discounts them back to their present value. BofA's analysts use sophisticated DCF models incorporating their own economic forecasts and industry-specific assumptions.

- Financial health assessment: BofA meticulously examines a company's financial statements, including debt levels, profitability, and cash flow generation. A company's financial strength is crucial in determining its long-term viability and valuation.

- Qualitative factors: BofA considers non-financial aspects, such as management quality, competitive landscape, and future growth potential. A strong management team and a robust competitive advantage can justify a higher valuation.

- Risk assessment: BofA incorporates risk assessment into its valuation process, acknowledging that higher risk warrants a lower valuation. Their analysis considers various sources of risk, including macroeconomic uncertainty, industry-specific risks, and company-specific risks.

BofA's track record demonstrates the effectiveness of this integrated approach. Their analysts successfully identify both undervalued opportunities and potential overvalued assets, contributing to the firm's overall investment success.

Risk Management and Portfolio Diversification in Stock Market Valuation

Effective stock market valuation is not just about identifying undervalued stocks; it's also about managing risk and diversifying your portfolio. BofA emphasizes the importance of:

- Risk mitigation: BofA advises investors to diversify across different asset classes, sectors, and geographies to mitigate risk exposure. This approach reduces the impact of any single investment performing poorly.

- Diversification strategies: BofA helps clients construct diversified portfolios tailored to their risk tolerance and investment goals. This can include a mix of stocks, bonds, and alternative investments.

- Portfolio rebalancing: Regularly rebalancing your portfolio to maintain your desired asset allocation helps manage risk and potentially improve long-term returns. BofA's wealth management services often include portfolio rebalancing strategies.

By adopting a diversified portfolio strategy and actively managing risk, investors can better navigate market volatility and protect their investment capital. BofA’s expertise in portfolio construction and risk management assists clients in achieving their investment objectives while mitigating potential losses.

Conclusion

Accurately assessing stock market valuations is critical for successful investing. BofA’s expertise offers valuable insights into utilizing key metrics, analyzing market conditions, and managing risk. By understanding macroeconomic factors, employing key valuation ratios like P/E, P/B, and P/S, and diversifying your portfolio, you can make more informed decisions. Remember to leverage resources like BofA's research and market analysis to enhance your understanding of stock market valuations and make sound investment choices. Start improving your approach to stock market valuations today!

Featured Posts

-

Hands On With Googles Prototype Ai Smart Glasses

May 22, 2025

Hands On With Googles Prototype Ai Smart Glasses

May 22, 2025 -

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Ano

May 22, 2025

Los 5 Mejores Podcasts De Misterio Suspenso Y Terror En Ano

May 22, 2025 -

Discover Provence A Self Guided Walking Itinerary From Mountains To Mediterranean

May 22, 2025

Discover Provence A Self Guided Walking Itinerary From Mountains To Mediterranean

May 22, 2025 -

Kartels Restrictions A Safety Measure Says Police Source Trinidad And Tobago Newsday

May 22, 2025

Kartels Restrictions A Safety Measure Says Police Source Trinidad And Tobago Newsday

May 22, 2025 -

Nato Da Tuerkiye Nin Artan Etkisi Guec Dengesi Ve Stratejik Ortakliklar

May 22, 2025

Nato Da Tuerkiye Nin Artan Etkisi Guec Dengesi Ve Stratejik Ortakliklar

May 22, 2025

Latest Posts

-

Fed Ex Truck Fire On Route 283 In Lancaster County Pa

May 22, 2025

Fed Ex Truck Fire On Route 283 In Lancaster County Pa

May 22, 2025 -

Significant Fire At Used Car Dealership Investigation Underway

May 22, 2025

Significant Fire At Used Car Dealership Investigation Underway

May 22, 2025 -

Used Car Lot Fire Emergency Crews On Scene

May 22, 2025

Used Car Lot Fire Emergency Crews On Scene

May 22, 2025 -

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Insurance

May 22, 2025

Understanding Susquehanna Valley Storm Damage Prevention Mitigation And Insurance

May 22, 2025 -

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025

Susquehanna Valley Storm Damage A Comprehensive Guide To Repair And Restoration

May 22, 2025