B.C. Billionaire's Pursuit Of Hudson's Bay Leases: A Major Retail Shakeup?

Table of Contents

The Billionaire's Profile and Investment Strategy

The unnamed B.C. billionaire, a renowned real estate mogul with a substantial investment portfolio, boasts a long history of successful retail acquisitions and property development. Their investment philosophy centers on identifying undervalued assets with high redevelopment potential, transforming them into lucrative properties. Past successes include the revitalization of several prominent downtown cores, demonstrating a keen eye for strategic investment opportunities. Their interest in Hudson's Bay leases likely stems from several factors:

- Redevelopment Potential: Many Hudson's Bay locations occupy prime real estate in major urban centers. Redevelopment could significantly increase property value through mixed-use projects incorporating residential, commercial, and entertainment spaces.

- Strategic Retail Expansion: Acquiring these leases offers a direct route to expansion in the competitive retail sector, leveraging existing infrastructure and established customer bases.

- Portfolio Diversification: Adding a diverse range of retail properties to their existing real estate holdings strengthens their overall investment portfolio, reducing risk and increasing long-term profitability.

Hudson's Bay Company's Current Situation and Vulnerabilities

Hudson's Bay Company (HBC), a Canadian retail giant, is currently navigating a challenging market. While a historically significant player, HBC has faced declining market share and fluctuating financial performance in recent years. This, coupled with increasing online competition, has led to vulnerabilities that may make leasing or selling properties a strategic move:

- Debt Reduction: Selling off real estate assets could generate significant capital, allowing HBC to reduce debt and improve its financial stability.

- Focus on Core Business: By divesting from certain properties, HBC could streamline operations and concentrate on its core business, potentially boosting profitability.

- Strategic Realignment: The sale of leases might represent a strategic realignment, allowing HBC to refocus on its most profitable ventures and adapt to the changing retail environment.

Impact on Canadian Retail Landscape

The consequences of this potential acquisition are far-reaching, impacting various facets of the Canadian retail landscape:

- Retail Offerings: Changes in retail offerings at acquired locations could mean the replacement of existing stores with new businesses, possibly altering the overall shopping experience in affected areas.

- Local Businesses and Employment: The acquisition may affect local businesses and employment, depending on the redevelopment plans and potential displacement of existing tenants. A thorough assessment of the economic effects is crucial.

- Increased Competition: The entry of a new major player into the market through these acquisitions could increase competition, forcing other retailers to adapt and innovate to maintain their market share.

Legal and Regulatory Hurdles

The billionaire's acquisition attempt will likely encounter several legal and regulatory hurdles:

- Antitrust Laws: Acquiring a significant number of Hudson's Bay leases could trigger antitrust concerns, potentially leading to regulatory scrutiny and delays.

- Zoning Regulations: Redevelopment plans may be subject to local zoning regulations, adding complexity and potentially limiting the scope of the project.

- Acquisition Process: The actual acquisition process, encompassing due diligence, negotiations, and legal approvals, could take a considerable amount of time.

Alternative Scenarios and Future Outlook

The current situation presents several potential outcomes beyond the primary acquisition scenario:

- Alternative Buyers: Other investors might emerge, competing for the Hudson's Bay leases, leading to a bidding war or a different outcome entirely.

- Hudson's Bay Strategy Shift: HBC might alter its strategic direction, choosing to retain some or all of the properties, thereby preventing the acquisition.

Predicting the future is challenging, but the long-term impact on the Canadian retail industry will likely depend on the specific outcome of this investment.

B.C. Billionaire's Pursuit of Hudson's Bay Leases: What's Next?

The B.C. billionaire's pursuit of Hudson's Bay leases has the potential to significantly reshape the Canadian retail landscape. The implications are complex, involving redevelopment possibilities, legal challenges, and significant impacts on the overall market. While the outcome remains uncertain, the potential for a major retail shakeup is undeniable. The acquisition, or lack thereof, will undoubtedly redefine the future of several key properties and the overall Canadian retail scene. Stay informed about developments in the B.C. billionaire's pursuit of Hudson's Bay leases—this is a story that deserves continued attention.

Featured Posts

-

Your Guide To Getting Bbc Radio 1 Big Weekend Tickets

May 25, 2025

Your Guide To Getting Bbc Radio 1 Big Weekend Tickets

May 25, 2025 -

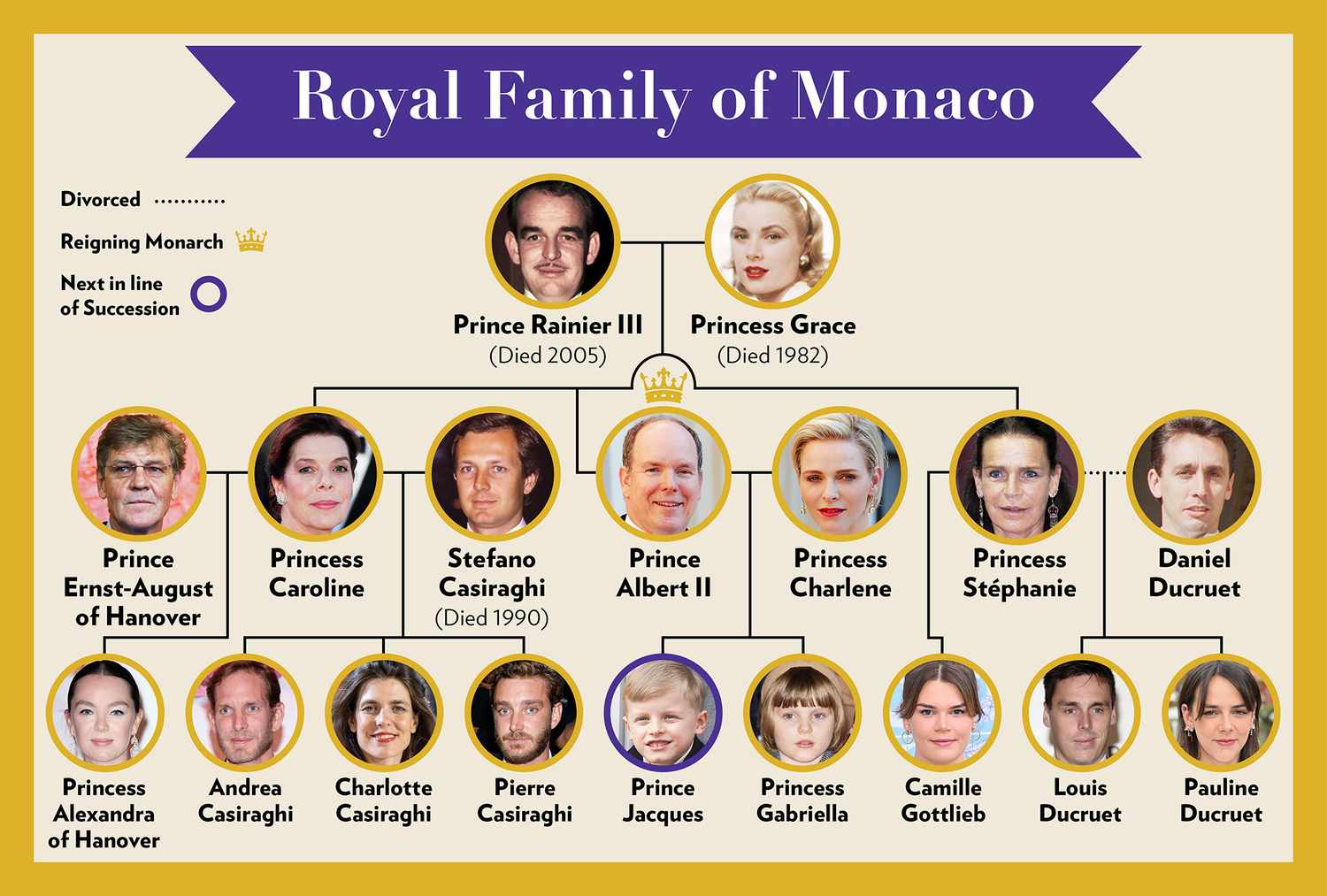

Investigation Into Monacos Royal Finances A Corruption Scandal Unfolds

May 25, 2025

Investigation Into Monacos Royal Finances A Corruption Scandal Unfolds

May 25, 2025 -

Krasivaya Data 89 Svadeb Na Kharkovschine

May 25, 2025

Krasivaya Data 89 Svadeb Na Kharkovschine

May 25, 2025 -

Flash Flood Emergency Safety Tips And Survival Strategies

May 25, 2025

Flash Flood Emergency Safety Tips And Survival Strategies

May 25, 2025 -

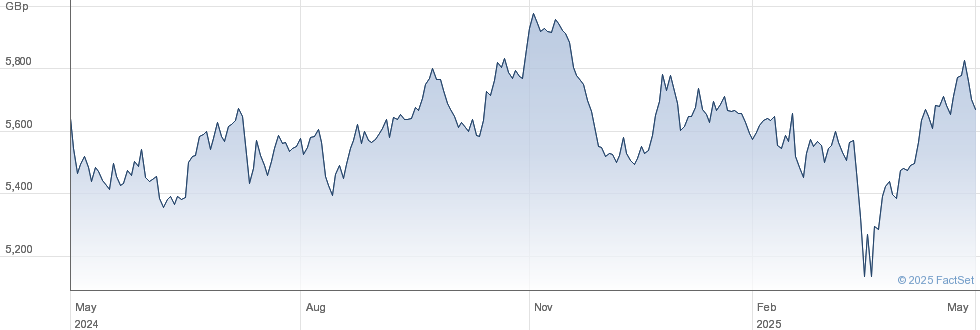

Understanding The Net Asset Value Of Amundi Msci World Catholic Principles Ucits Etf

May 25, 2025

Understanding The Net Asset Value Of Amundi Msci World Catholic Principles Ucits Etf

May 25, 2025

Latest Posts

-

Dave Turmels Arrest In Italy Canadas Fugitive Captured

May 25, 2025

Dave Turmels Arrest In Italy Canadas Fugitive Captured

May 25, 2025 -

The Impact Of Mandarin Killings On The Hells Angels Business Model

May 25, 2025

The Impact Of Mandarin Killings On The Hells Angels Business Model

May 25, 2025 -

Hells Angels New Business Model Insights From Mandarin Killings

May 25, 2025

Hells Angels New Business Model Insights From Mandarin Killings

May 25, 2025 -

Mandarin Killing Highlights Hells Angels New Business Model

May 25, 2025

Mandarin Killing Highlights Hells Angels New Business Model

May 25, 2025 -

Tariffs And The Fed Jerome Powells Concerns About Economic Stability

May 25, 2025

Tariffs And The Fed Jerome Powells Concerns About Economic Stability

May 25, 2025