Bank Of Canada And Trump Tariffs: Examining The April Rate Cut Discussion

Table of Contents

The Economic Climate Preceding the April Rate Cut

The Canadian economy leading up to April 2018 presented a mixed picture. While not in a recession, several indicators suggested a slowdown in growth.

- GDP Growth: Growth was moderating, falling below its potential.

- Inflation Rates: Inflation remained relatively low, staying below the BoC's target range.

- Unemployment Figures: Unemployment remained steady, but wage growth was sluggish.

- Consumer Confidence: Consumer confidence showed signs of weakening, impacted by global uncertainty.

- Housing Market Trends: The housing market, a key driver of the Canadian economy, exhibited signs of cooling, particularly in certain regions.

Adding to these domestic concerns was the escalating global trade uncertainty, primarily fueled by the US-China trade war. This global instability cast a long shadow over the Canadian economy, further complicating the BoC's decision-making process.

Trump Tariffs and Their Ripple Effect on the Canadian Economy

President Trump's tariffs, particularly those targeting Canadian lumber and aluminum, directly impacted key sectors of the Canadian economy. These tariffs disrupted established trade flows, leading to reduced exports and impacting Canadian producers.

- Lumber Tariffs: The tariffs on Canadian softwood lumber significantly hurt the forestry industry, leading to job losses and reduced production.

- Aluminum Tariffs: Similarly, tariffs on aluminum impacted Canadian aluminum producers, forcing them to adjust production and potentially affecting downstream industries.

- Supply Chain Disruptions: The tariffs created ripple effects throughout the Canadian economy, causing supply chain disruptions and impacting businesses reliant on imported goods and exports.

- Investor Uncertainty: The uncertainty surrounding trade relations with the United States dampened investor sentiment, making Canadian businesses less inclined to invest and hindering economic growth. This was reflected in a decline in business investment.

The Bank of Canada's Response and Rationale for the April Rate Cut

The BoC cited several factors in its justification for the April rate cut, including weakening economic growth, subdued inflation, and heightened global uncertainty. While not explicitly stating the tariffs as the sole reason, the BoC's statement acknowledged the significant impact of global trade tensions.

- BoC Statement: The official statement highlighted the need to stimulate economic activity amidst weakening global growth and reduced business investment.

- Weakening Economic Growth: The BoC cited the moderating GDP growth as a key factor prompting the rate cut.

- Inflation Concerns: Low inflation allowed for the rate cut without significant inflation risks.

- Global Uncertainty: The ongoing trade disputes and global economic uncertainties were clearly highlighted as significant contributing factors.

Alternative Perspectives on the Rate Cut Decision

Not all economists agreed with the BoC's assessment. Some argued that other factors, such as the cooling housing market or domestic policy issues, were more significant drivers of the rate cut.

- Differing Viewpoints: Some economists argued that the rate cut was a preemptive measure to address potential future slowdowns, unrelated to the immediate impact of the tariffs.

- Alternative Explanations: Other analyses pointed to structural issues within the Canadian economy as a major contributor to the slow growth, independent of the trade war.

Conclusion: Understanding the Bank of Canada's Response to Trump Tariffs

In conclusion, while the BoC's official statement didn't explicitly single out the Trump tariffs as the primary reason for the April rate cut, the tariffs undoubtedly contributed to the overall economic uncertainty that influenced the decision. The combination of weakening domestic growth and heightened global uncertainty, largely driven by the trade tensions, played a crucial role in the BoC's monetary policy response. To gain a deeper understanding of the complex interplay between the "Bank of Canada and Trump Tariffs," further research into economic data and expert analyses is recommended. Continue exploring this crucial topic to better understand the ongoing impact on the Canadian economy.

Featured Posts

-

Channel 4s Million Pound Giveaway A Review By Christopher Stevens

May 02, 2025

Channel 4s Million Pound Giveaway A Review By Christopher Stevens

May 02, 2025 -

Newsround Bbc Two Hd When And Where To Watch

May 02, 2025

Newsround Bbc Two Hd When And Where To Watch

May 02, 2025 -

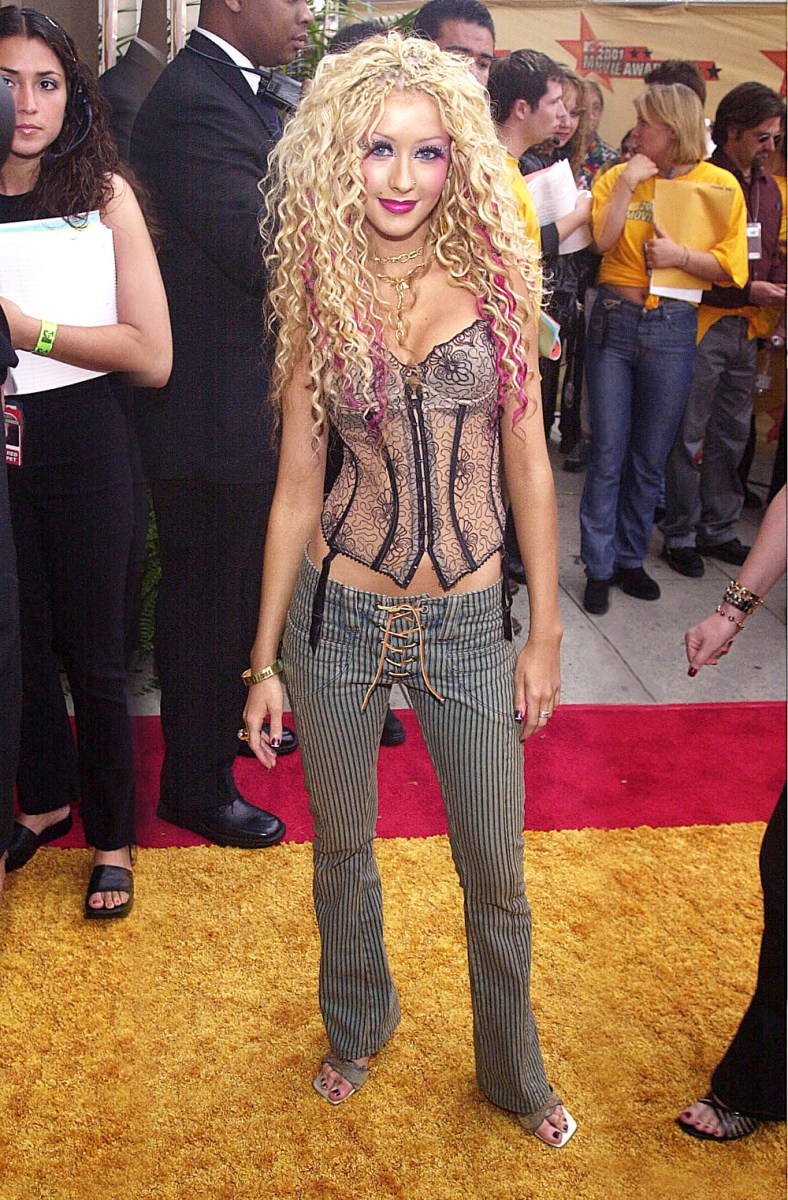

Is That Christina Aguilera Fans Question Singers Altered Appearance

May 02, 2025

Is That Christina Aguilera Fans Question Singers Altered Appearance

May 02, 2025 -

Ceki Hetimi Vazhdon Pas Sulmit Vdekjeprures Me Thike Ne Qender Tregtare

May 02, 2025

Ceki Hetimi Vazhdon Pas Sulmit Vdekjeprures Me Thike Ne Qender Tregtare

May 02, 2025 -

Ripple Vs Sec 50 M Settlement Impact On Xrp And Future Outlook

May 02, 2025

Ripple Vs Sec 50 M Settlement Impact On Xrp And Future Outlook

May 02, 2025