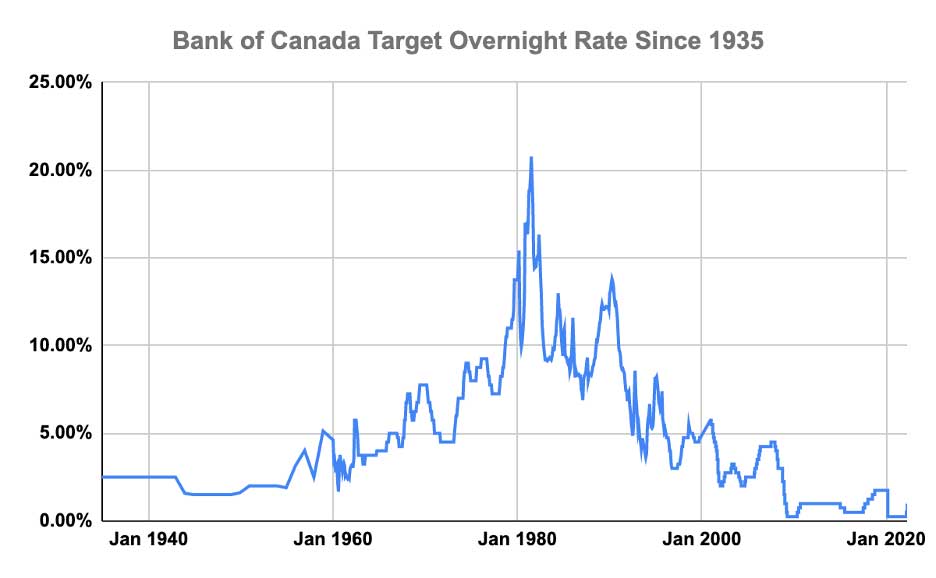

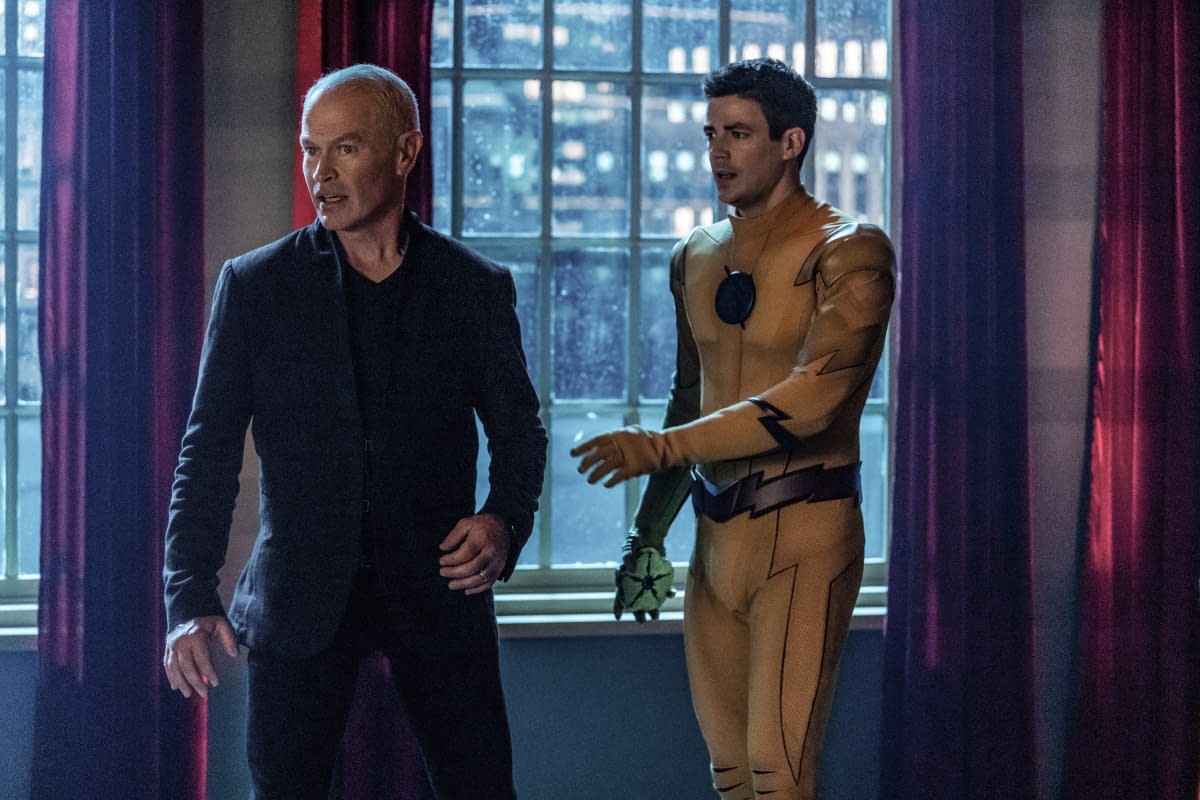

Bank Of Canada Interest Rates: Desjardins' Prediction Of Three More Cuts

Table of Contents

Desjardins' Forecast and its Rationale

Desjardins, a prominent Canadian financial institution, has predicted three further cuts to Bank of Canada interest rates. This forecast, detailed in their recent economic outlook report released on [Insert Date and Link to Report if available], suggests a significant easing of monetary policy.

- Source: Desjardins' Economic Outlook Report [Insert Date and Link to Report if available].

- Timing: The report suggests these cuts will be spaced out, potentially one per quarter, over the next [Number] months.

- Economic Indicators: This prediction is largely based on several key economic indicators. Desjardins points to softening inflation figures, slower-than-expected GDP growth, and a weakening housing market as primary reasons for their forecast. They also highlight concerns about a potential global economic slowdown impacting Canadian exports.

- Specific Concerns: Desjardins highlights the vulnerability of the Canadian housing market to higher interest rates, suggesting that further cuts are needed to prevent a more significant downturn. They also express concern about the impact of global uncertainty on business investment and consumer confidence.

Desjardins' reasoning is rooted in econometric models that analyze historical data and current economic trends. Their analysis suggests that the current level of interest rates is too restrictive for the current economic climate, leading to their projection of further rate cuts by the Bank of Canada. The interplay between inflation, economic growth, and employment figures heavily influences the central bank's decision-making, and Desjardins' forecast takes these interwoven factors into account.

Impact on Canadian Borrowers

Lower Bank of Canada interest rates will have a significant impact on Canadian borrowers.

- Mortgage Payments: Reduced interest rates will lead to lower monthly mortgage payments for those with variable-rate mortgages. This translates to substantial savings over the life of the mortgage. Homeowners could potentially refinance at lower rates to further reduce their monthly payments.

- Other Borrowing: Lower interest rates will also make borrowing cheaper for other forms of debt, such as lines of credit and personal loans. This could boost consumer spending.

- Variable-Rate Mortgages: While beneficial for those with variable-rate mortgages, there's a potential risk that rates could rise again in the future, leading to increased monthly payments. Borrowers should understand the potential for fluctuation inherent in variable-rate products.

- Large Purchases: Lower interest rates will incentivize consumers to make larger purchases, such as houses and cars, due to lower financing costs.

The impact will vary depending on the type of mortgage or loan. Individuals with variable-rate mortgages will see an immediate benefit, while those with fixed-rate mortgages will not see a direct impact until their mortgage renewal.

Implications for the Canadian Economy

The predicted interest rate cuts by the Bank of Canada carry significant implications for the Canadian economy.

- Economic Growth: Lower interest rates are intended to stimulate economic growth by making borrowing more attractive for businesses and consumers. This could lead to increased investment and spending, boosting GDP.

- Inflation: While designed to boost the economy, interest rate cuts could also fuel inflation if demand outpaces supply. The Bank of Canada will need to carefully monitor inflation rates to avoid this scenario.

- Canadian Dollar: Lower interest rates can weaken the Canadian dollar relative to other currencies. This could benefit Canadian exporters but could also increase the cost of imported goods.

- Business Investment and Consumer Spending: Lower borrowing costs could encourage businesses to invest in expansion and equipment upgrades, while consumers might be more inclined to increase spending on durable goods and non-essential items.

The overall impact on the economy will depend on a variety of interacting factors, including global economic conditions and domestic consumer confidence. There is potential for both positive and negative consequences, underscoring the complexity of the situation.

Alternative Perspectives and Counterarguments

While Desjardins' forecast suggests three interest rate cuts, it's important to consider alternative viewpoints. Not all financial institutions agree on the future trajectory of Bank of Canada interest rates.

- Differing Predictions: Some analysts predict fewer or even no rate cuts, citing concerns about persistent inflation or the strength of the Canadian economy.

- Influencing Factors: Unexpected economic shocks, like a sharper-than-expected global recession or a sudden surge in inflation, could cause the Bank of Canada to deviate from its expected path.

- Uncertainties and Risks: Economic forecasting is inherently uncertain. Unforeseen events and shifts in economic indicators can significantly alter the outlook.

Considering these counterarguments underscores the complexities involved in predicting future interest rate movements. The economic landscape is constantly evolving, and several unpredictable factors could impact the Bank of Canada's decisions.

Conclusion

Desjardins' prediction of three more Bank of Canada interest rate cuts carries significant implications for Canadian borrowers and the economy as a whole. While lower rates could benefit borrowers through reduced mortgage payments and increased borrowing capacity, they also present potential risks, including increased inflation and a weaker Canadian dollar. Alternative perspectives exist, highlighting the inherent uncertainty in economic forecasting. Understanding the potential impacts of changes in Bank of Canada interest rates is crucial for making informed financial decisions. Stay informed about changes in Bank of Canada interest rates and their implications for your financial planning. Regularly monitor updates on Bank of Canada interest rates to make informed financial decisions.

Featured Posts

-

Understanding The Karate Kid Franchise The Role Of Legend Of Miyagi Do

May 23, 2025

Understanding The Karate Kid Franchise The Role Of Legend Of Miyagi Do

May 23, 2025 -

Kevin Bacon And Julianne Moore Star In Netflixs Upcoming Dark Comedy Series

May 23, 2025

Kevin Bacon And Julianne Moore Star In Netflixs Upcoming Dark Comedy Series

May 23, 2025 -

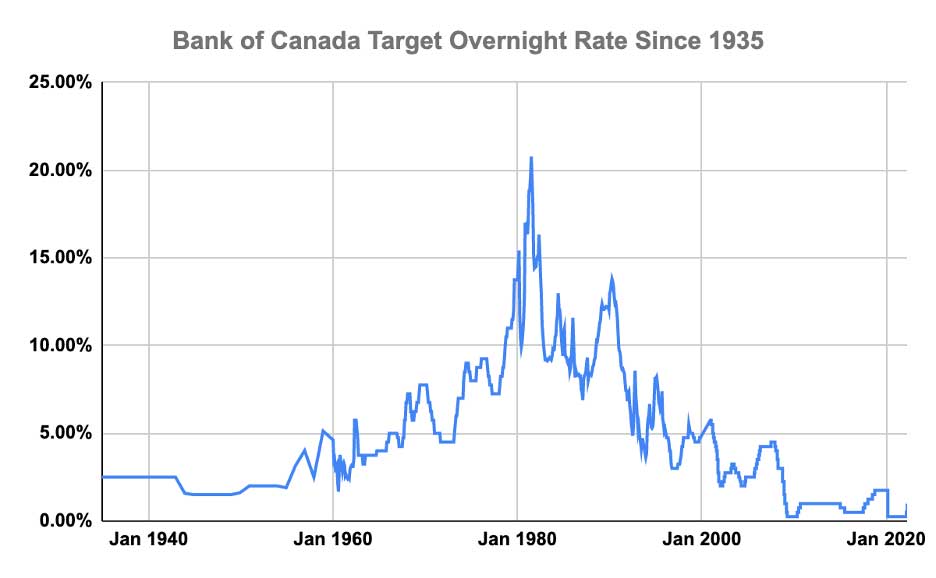

South Africa Praises Ramaphosas Composure Analyzing His White House Response

May 23, 2025

South Africa Praises Ramaphosas Composure Analyzing His White House Response

May 23, 2025 -

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025 -

Would Damien Darhk Defeat Superman Neal Mc Donough Weighs In

May 23, 2025

Would Damien Darhk Defeat Superman Neal Mc Donough Weighs In

May 23, 2025

Latest Posts

-

Just In Time Jonathan Groffs Shot At A Tony Award

May 23, 2025

Just In Time Jonathan Groffs Shot At A Tony Award

May 23, 2025 -

Will Jonathan Groff Make Tony Awards History With Just In Time

May 23, 2025

Will Jonathan Groff Make Tony Awards History With Just In Time

May 23, 2025 -

Jonathan Groff Bobby Darin Inspiration And The Intense Drive Behind His Just In Time Performance

May 23, 2025

Jonathan Groff Bobby Darin Inspiration And The Intense Drive Behind His Just In Time Performance

May 23, 2025 -

Instinct Magazine Interview Jonathan Groff On Asexuality

May 23, 2025

Instinct Magazine Interview Jonathan Groff On Asexuality

May 23, 2025 -

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025