Bank Of Canada's April Interest Rate Decision: Impact Of Trump Tariffs

Table of Contents

The Bank of Canada's Mandate and Current Economic Climate

The Bank of Canada operates under a dual mandate: maintaining price stability and fostering full employment. Achieving these goals requires a delicate balancing act, particularly in the current economic climate. Analyzing the current state of the Canadian economy is therefore paramount to understanding the upcoming interest rate decision. Several key indicators provide crucial insights:

- Inflation Rate: The current inflation rate, while showing signs of easing, remains above the Bank of Canada's target range of 1-3%. Any deviation from this target significantly influences the Bank's decision-making process.

- Unemployment Statistics: Unemployment figures reflect the health of the labor market. A robust labor market generally suggests a stronger economy, while high unemployment may warrant different monetary policy considerations. Current unemployment rates need careful consideration.

- GDP Growth: Recent GDP growth figures, along with future forecasts, paint a picture of the overall economic health. Strong growth may necessitate a more hawkish approach, while slower growth could suggest a more dovish stance.

- Other Relevant Indicators: Other indicators, such as consumer confidence, business investment, and housing market activity, also provide valuable context for the Bank of Canada's assessment.

Lingering Effects of Trump Tariffs on the Canadian Economy

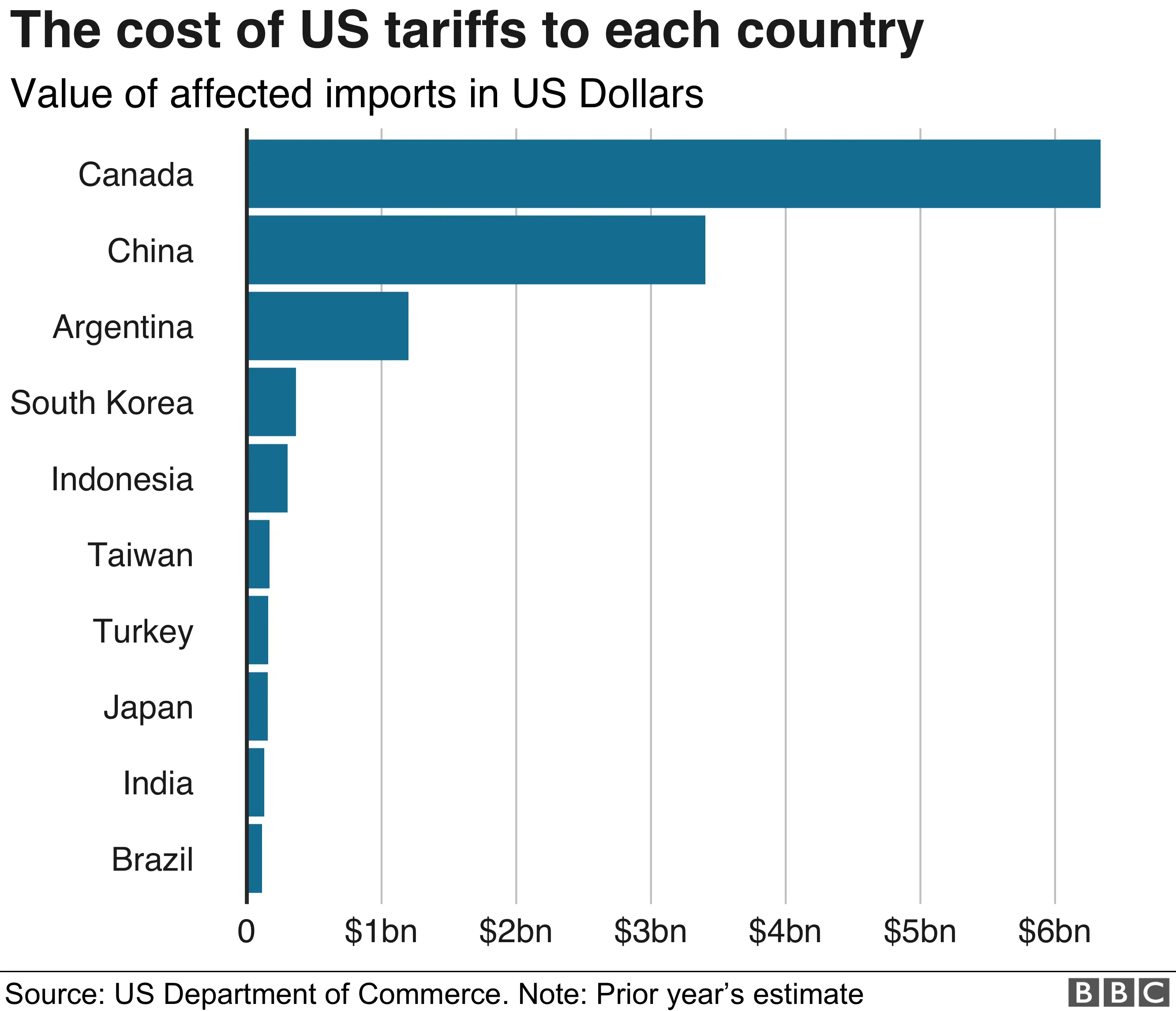

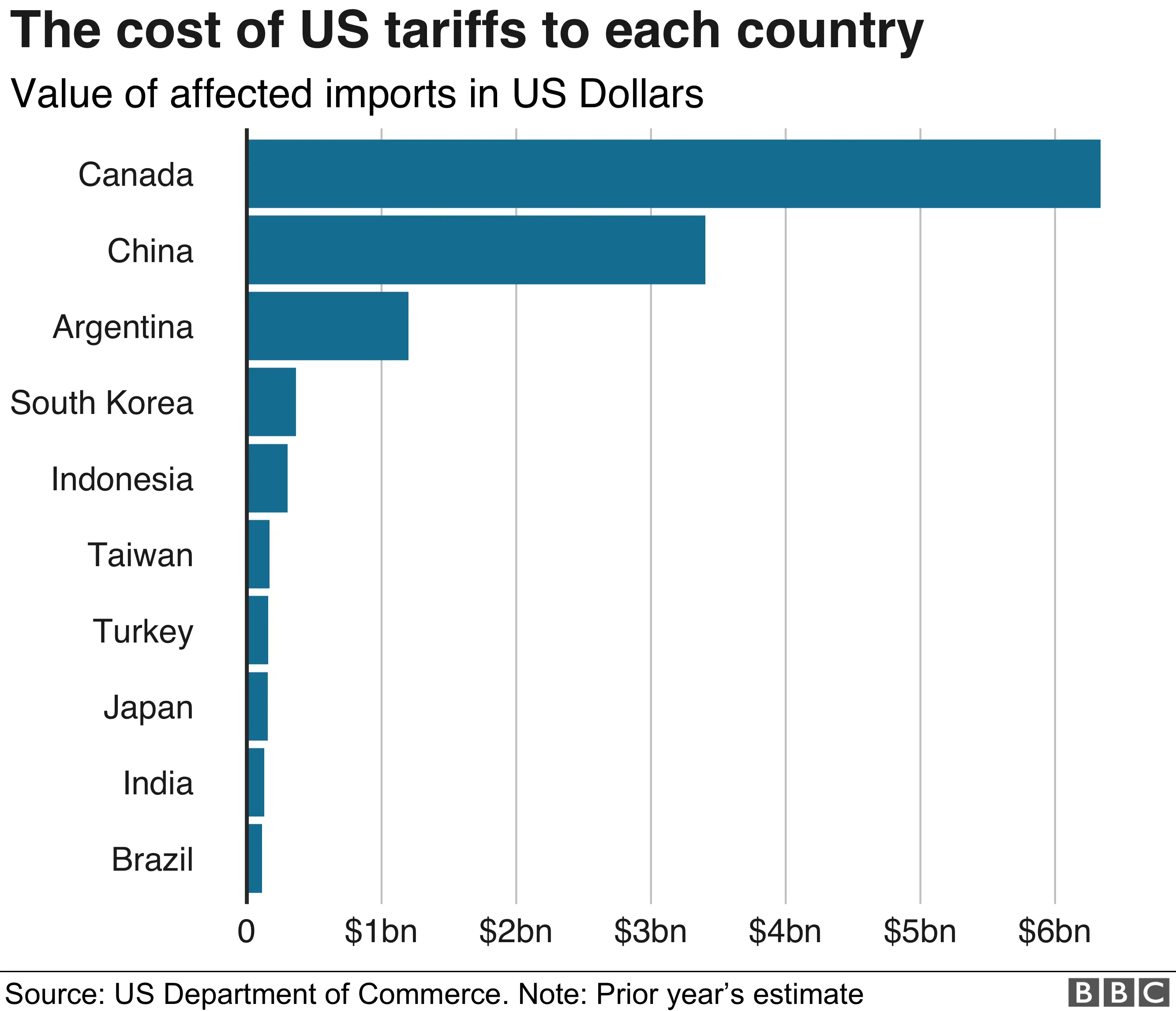

The Trump-era tariffs imposed significant challenges to the Canadian economy, leaving a lingering impact even after their implementation ended. Certain sectors felt the brunt of these trade restrictions more acutely than others.

- Agriculture: The Canadian agricultural sector, a major exporter, faced significant disruption due to tariffs on key products. This resulted in reduced export volumes and revenue losses for farmers.

- Manufacturing: Canadian manufacturers, reliant on trade with the United States, experienced reduced competitiveness and faced challenges maintaining export markets. This led to job losses and reduced investment in certain segments.

- Supply Chain Disruptions: The tariffs triggered widespread supply chain disruptions, leading to increased costs for businesses and ultimately consumers. These disruptions continue to resonate within the Canadian economy.

- Government Support Measures: The Canadian government implemented various support measures to mitigate the impact of the tariffs on affected industries. The effectiveness of these measures remains a subject of ongoing debate and analysis. The long-term consequences of these tariffs are still unfolding, impacting everything from pricing to investment decisions.

Potential Interest Rate Scenarios and Their Implications

The Bank of Canada faces several potential scenarios for its April interest rate decision: an increase, a decrease, or maintaining the current rate. Each scenario has significantly different implications for businesses and consumers.

- Rate Hike: An interest rate hike aims to curb inflation by making borrowing more expensive. This can dampen economic growth but may help stabilize prices. The impact on consumers would be felt through higher borrowing costs for mortgages, loans, and credit cards. Businesses may reduce investment and hiring.

- Rate Cut: A rate cut stimulates economic activity by making borrowing cheaper. This could boost growth but risks exacerbating inflation if not carefully managed. Consumers would benefit from lower borrowing costs, while businesses might increase investment and hiring. However, the potential for increased inflation must be carefully weighed.

- Holding Steady: Maintaining the current rate offers a neutral stance, allowing the Bank to observe the effects of previous policy decisions and assess the evolving economic conditions before making further adjustments. This approach avoids immediate shocks but may delay necessary action if the economic landscape shifts dramatically.

Expert Opinions and Market Reactions

Leading economists and financial analysts offer varied perspectives on the anticipated interest rate decision, reflecting the complexity of the current economic environment. Their opinions are valuable in anticipating potential market reactions.

- Expert Predictions: Many experts weigh the trade-offs between managing inflation and sustaining economic growth. Their opinions will likely shape market expectations and influence the Bank's final decision. Quoting these experts adds credibility and insightful context to the analysis.

- Market Reactions: The announcement's impact on financial markets, including stock markets and currency exchange rates, is difficult to predict precisely. Historically, interest rate decisions have spurred market volatility, underscoring the importance of careful market observation. Analyzing past market reactions to similar announcements can provide valuable insights into likely scenarios.

Conclusion: Understanding the Bank of Canada's April Interest Rate Decision and its Connection to Trump Tariffs

The Bank of Canada's April interest rate decision is a critical event for the Canadian economy, intricately linked to the lingering effects of the Trump-era tariffs. The current economic climate, characterized by inflation concerns and lingering trade impacts, necessitates careful consideration of the potential consequences of each decision – rate hike, cut, or holding steady. Understanding the Bank of Canada's response to these economic challenges, including the lasting effects of trade policies, is crucial for both businesses and consumers. Stay informed about the Bank of Canada's future interest rate decisions and follow the ongoing impact of trade policies on the Canadian economy to navigate this complex economic landscape effectively. Learn more about the Bank of Canada's response to economic challenges and make informed decisions about your financial future.

Featured Posts

-

April 15 2025 Daily Lotto Winning Numbers Revealed

May 02, 2025

April 15 2025 Daily Lotto Winning Numbers Revealed

May 02, 2025 -

Legendary Dallas Figure Dies At 100

May 02, 2025

Legendary Dallas Figure Dies At 100

May 02, 2025 -

Dallas And Carrie Actress Dies Amy Irvings Moving Tribute

May 02, 2025

Dallas And Carrie Actress Dies Amy Irvings Moving Tribute

May 02, 2025 -

Filmmakers Sue Michael Sheen And Channel 4 For Copyright Infringement

May 02, 2025

Filmmakers Sue Michael Sheen And Channel 4 For Copyright Infringement

May 02, 2025 -

Bbc Two Hd Tv Guide Find Newsround Listings

May 02, 2025

Bbc Two Hd Tv Guide Find Newsround Listings

May 02, 2025