BBAI Stock Upgrade: Defense Sector Growth Fuels Positive Outlook

Table of Contents

Booming Defense Spending Drives BBAI Growth

The global geopolitical landscape is characterized by increasing instability, leading to a significant rise in defense spending worldwide. Key regions, including Europe, Asia, and North America, are witnessing substantial increases in their defense budgets, directly impacting companies like BBAI that operate within this sector. This heightened demand for defense technologies is a primary driver behind BBAI's recent success and the subsequent stock upgrade.

- Increased government contracts awarded to BBAI: BBAI has secured several lucrative contracts from various government agencies, bolstering its revenue streams and solidifying its position as a key player in the defense industry. These contracts often involve long-term partnerships, providing stability and predictable revenue growth.

- Expansion into new defense technologies (e.g., AI, robotics): BBAI is strategically investing in cutting-edge technologies such as artificial intelligence and robotics, positioning itself to capitalize on the growing demand for advanced defense systems. This forward-thinking approach strengthens its competitive advantage.

- Strategic partnerships with key players in the defense industry: Collaborations with established industry leaders allow BBAI to leverage their expertise and expand its market reach, further driving growth and innovation. These partnerships provide access to wider resources and networks.

- Growing demand for BBAI's products/services within the defense sector: BBAI's products and services are increasingly sought after by defense organizations worldwide, reflecting a strong market need and validation of its technological capabilities. This increased demand directly translates to higher sales and profitability.

Technological Innovation and Competitive Advantage

BBAI's stock upgrade isn't solely based on increased defense spending; it's also a testament to the company's commitment to technological innovation. This commitment to R&D has resulted in a significant competitive advantage within the sector.

- Specific examples of innovative technologies developed by BBAI: BBAI's portfolio includes [insert specific examples of BBAI's innovative technologies, e.g., advanced sensor systems, next-generation communication networks, or specialized software]. Highlighting these specifics showcases concrete achievements.

- Patents and intellectual property held by BBAI: A strong intellectual property portfolio protects BBAI's innovations and provides a significant barrier to entry for competitors, further solidifying its market position. Mention the number of patents if possible.

- BBAI's research and development efforts: Ongoing investment in R&D demonstrates BBAI's commitment to staying ahead of the curve and maintaining its competitive edge. Emphasize the size of this investment if possible.

- Competitive advantage over other players in the sector: BBAI's unique technological capabilities and strong intellectual property portfolio differentiate it from competitors, giving it a significant advantage in securing contracts and expanding market share.

Strong Financial Performance and Future Projections

BBAI's recent financial reports paint a picture of robust growth and profitability, significantly contributing to the positive outlook for the stock.

- Revenue growth and profitability: Highlight specific figures demonstrating consistent revenue growth and increasing profitability over recent quarters or years. Use charts and graphs if possible.

- Positive earnings per share (EPS): Showcase the positive EPS trend, indicating strong financial health and growth potential.

- Strong balance sheet and cash flow: A strong balance sheet and positive cash flow demonstrate financial stability and the capacity for future investments and expansion.

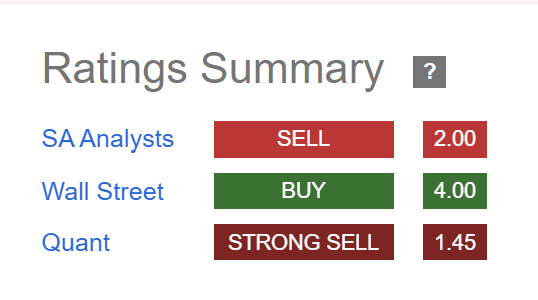

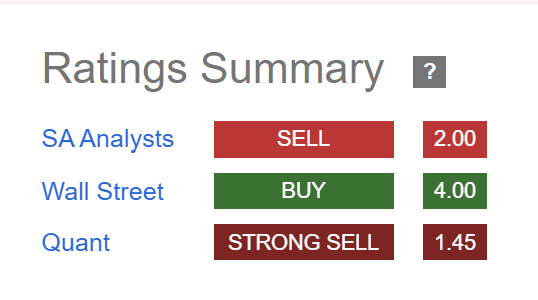

- Analyst forecasts and price targets for BBAI stock: Mention any positive analyst forecasts and price targets, providing further validation for the positive outlook on BBAI stock. Cite reputable sources.

Risk Factors and Potential Challenges

While the outlook for BBAI is largely positive, it's crucial to acknowledge potential risks and challenges that could impact its future performance. A balanced assessment builds trust and showcases responsible analysis.

- Geopolitical instability and its impact on defense spending: Changes in global political dynamics could lead to shifts in defense budgets, potentially impacting BBAI's revenue streams.

- Competition from other defense contractors: The defense industry is highly competitive. The emergence of new competitors or technological advancements by existing players could pose a challenge to BBAI's market share.

- Supply chain disruptions: Disruptions to global supply chains could impact BBAI's production capacity and delivery timelines.

- Regulatory hurdles and compliance issues: Navigating complex regulatory environments and ensuring compliance with various regulations can present significant challenges.

Conclusion

The BBAI stock upgrade is a compelling reflection of the company's strong performance, driven by significant growth within the defense sector. This growth is underpinned by increasing defense spending globally, BBAI's commitment to technological innovation, and its impressive financial performance. While potential risks exist, the overall outlook for BBAI remains positive, based on its strategic positioning, technological advancements, and strong financial foundation. The BBAI stock upgrade presents a compelling investment opportunity, fueled by the significant growth within the defense sector. Conduct thorough due diligence, but don't miss out on learning more about this potentially lucrative stock upgrade and its implications. Consider adding BBAI to your portfolio for potential long-term growth.

Featured Posts

-

Michael Schumacher De Mallorca A Suiza En Helicoptero Para Una Visita Familiar

May 20, 2025

Michael Schumacher De Mallorca A Suiza En Helicoptero Para Una Visita Familiar

May 20, 2025 -

Ferrari Icin Felaket Hamilton Ve Leclerc Yaristan Cikarildi

May 20, 2025

Ferrari Icin Felaket Hamilton Ve Leclerc Yaristan Cikarildi

May 20, 2025 -

The Tony Hinchcliffe Wwe Segment A Critical Analysis Of Its Failure

May 20, 2025

The Tony Hinchcliffe Wwe Segment A Critical Analysis Of Its Failure

May 20, 2025 -

Watch Bournemouth Vs Fulham Live Premier League Match Details April 14th 2025

May 20, 2025

Watch Bournemouth Vs Fulham Live Premier League Match Details April 14th 2025

May 20, 2025 -

Talisca Nin Saha Ici Tartismasinin Ardindan Fenerbahce Nin Tadic Plani

May 20, 2025

Talisca Nin Saha Ici Tartismasinin Ardindan Fenerbahce Nin Tadic Plani

May 20, 2025