BCE Inc.'s Dividend Reduction: Analysis And Future Outlook

Table of Contents

Reasons Behind BCE Inc.'s Dividend Reduction

Several factors contributed to BCE Inc.'s decision to reduce its dividend. Understanding these factors is crucial for assessing the long-term implications for BCE stock and its dividend prospects.

Increased Capital Expenditures

BCE Inc. is making substantial investments in upgrading its network infrastructure. This includes significant capital expenditures (CAPEX) on expanding its 5G network coverage, deploying fiber optic infrastructure for faster broadband services, and investing in other cutting-edge technologies.

- Cost: These projects represent billions of dollars in investment, placing significant strain on BCE's cash flow.

- Long-Term Benefits: These investments are essential for maintaining BCE's competitive edge in the telecom industry and ensuring long-term growth, though the short-term impact on the dividend is undeniable.

- Inflationary Pressures: Rising inflation has further increased the cost of these capital-intensive projects, putting additional pressure on BCE's finances.

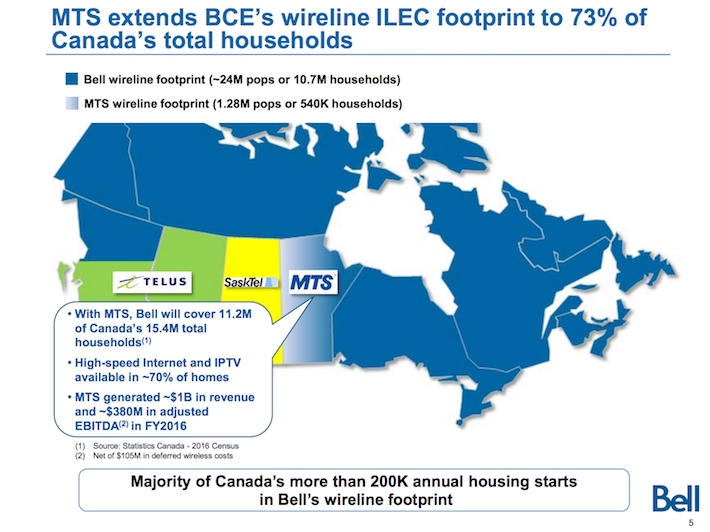

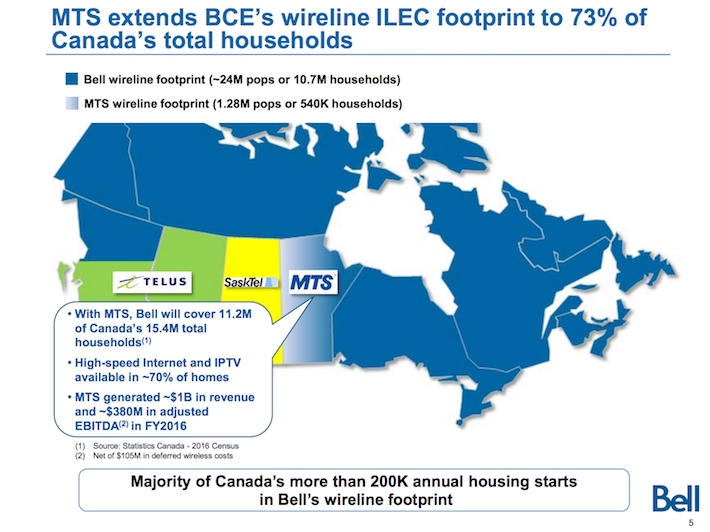

- Comparison with Telus: While Telus is also investing heavily in network infrastructure, a detailed comparison of CAPEX spending and its impact on dividend payouts reveals different strategic priorities between the two major Canadian telecom players.

Debt Management and Financial Leverage

BCE Inc.'s dividend reduction is also partly related to its debt levels and financial leverage. Maintaining a healthy balance sheet is paramount, especially during times of economic uncertainty.

- Key Financial Ratios: Analyzing BCE's debt-to-equity ratio and interest coverage ratio provides insight into the company's financial health and its ability to sustain its dividend payments. High debt levels can restrict future dividend increases.

- Debt Reduction Strategy: BCE's strategy for reducing its debt burden will directly influence its future dividend policy.

- Industry Peer Comparison: Comparing BCE's financial health and leverage ratios to those of its competitors, such as Telus, helps to contextualize the situation and assess the relative strength of its balance sheet.

Impact of Economic Uncertainty

The current macroeconomic environment significantly impacts BCE Inc.'s financial performance and its dividend policy. Inflation, interest rate hikes, and potential recessionary pressures are all key factors to consider.

- Potential Risks: Reduced consumer spending due to inflation and economic uncertainty could negatively impact BCE's revenue, making it more challenging to sustain a high dividend payout.

- Impact on Revenue: The telecom sector is not immune to economic downturns; decreased demand for services could affect BCE's profitability and its ability to maintain its dividend.

- Industry-wide Challenges: The entire telecom sector faces similar challenges related to inflation and economic uncertainty, affecting all players and requiring adaptive strategies for dividend management.

Analyzing the Impact of the Dividend Cut on Investors

The BCE Inc. dividend reduction has had a multifaceted impact on investors. Understanding both the short-term and long-term implications is crucial for making informed investment decisions.

Short-Term Market Reaction

The immediate market response to the dividend cut was largely negative, resulting in a decline in BCE's stock price.

- Stock Price Movement: The extent of the stock price drop reflects investor sentiment regarding the company's future prospects.

- Trading Volume: Increased trading volume in the aftermath of the announcement indicates heightened investor activity and market volatility.

- Analyst Reactions: Financial analysts' opinions and recommendations following the dividend cut played a significant role in shaping investor sentiment.

Long-Term Implications for Dividend Growth

The long-term implications of the BCE Inc. dividend reduction depend on the company's financial performance and strategic decisions.

- Commitment to Shareholder Returns: BCE's commitment to returning value to shareholders, even with a reduced dividend, is crucial to investor confidence.

- Potential for Future Increases: The potential for future dividend increases depends on improved financial performance, reduced debt, and strong revenue growth.

- Alternative Shareholder Returns: Stock buybacks may become a more prevalent method of returning value to shareholders in the coming years.

Comparison with Competitor Dividend Policies

Comparing BCE's dividend policy with its competitors offers valuable context.

- Dividend Yields and Payout Ratios: Analyzing the dividend yields and payout ratios of competitors like Telus helps assess BCE's relative attractiveness to investors.

- Competitive Landscape: The competitive landscape in the Canadian telecom industry influences the dividend policies of all major players.

Future Outlook for BCE Inc.'s Dividend

Predicting the future of BCE Inc.'s dividend requires considering several factors.

Management's Guidance

BCE's official statements regarding its future dividend policy provide important insights.

- Press Releases and Earnings Calls: Analyzing BCE's official communications offers clues regarding the company's expectations for future dividend payments.

Potential Scenarios for Future Dividend Payments

Different scenarios are possible, depending on various economic and financial assumptions.

- Optimistic Scenario: Strong revenue growth and efficient debt management could lead to dividend increases in the future.

- Pessimistic Scenario: Continued economic uncertainty and slower revenue growth could result in further dividend reductions or a prolonged period of stagnant dividend payments.

Investment Strategy Recommendations

Investors need to adapt their strategies based on their risk tolerance and investment goals.

- Risk Tolerance: Investors with a higher risk tolerance might consider holding BCE stock despite the dividend reduction, anticipating future growth.

- Investment Strategies: Diversification and a long-term investment horizon are essential for mitigating risks associated with BCE stock.

Conclusion: Making Informed Decisions about BCE Inc.'s Dividend Reduction

The BCE Inc. dividend reduction reflects a confluence of factors, including increased capital expenditures, debt management concerns, and economic uncertainty. Understanding these factors and their impact on the company's financial health is crucial for investors. While the short-term implications have been negative, the long-term outlook depends on BCE's ability to navigate these challenges effectively and deliver on its strategic priorities. Therefore, thorough research, including exploring resources like BCE's investor relations website, is vital before making any investment decisions related to BCE Inc. stock and its evolving dividend policy. Remember to always consult with a financial advisor before making significant investment choices.

Featured Posts

-

Ian Mc Kellens Call For Honesty In The Acting Community

May 13, 2025

Ian Mc Kellens Call For Honesty In The Acting Community

May 13, 2025 -

How To Make Spring Break Unforgettable For Kids Fun Activities And Travel Tips

May 13, 2025

How To Make Spring Break Unforgettable For Kids Fun Activities And Travel Tips

May 13, 2025 -

Blue Origin Rocket Launch Cancelled Subsystem Issue Delays Mission

May 13, 2025

Blue Origin Rocket Launch Cancelled Subsystem Issue Delays Mission

May 13, 2025 -

Prolonged Captivity In Gaza The Plight Of Hostage Families

May 13, 2025

Prolonged Captivity In Gaza The Plight Of Hostage Families

May 13, 2025 -

Funeral Arrangements For 15 Year Old School Stabbing Victim Announced

May 13, 2025

Funeral Arrangements For 15 Year Old School Stabbing Victim Announced

May 13, 2025