Berkshire Hathaway's Stake Boosts Japan Trading House Stock Prices

Table of Contents

Berkshire Hathaway's Investments and Their Magnitude

Berkshire Hathaway's investment in these Japanese trading houses represents a substantial commitment. While the exact figures fluctuate with market changes, the initial investments totaled billions of dollars, signifying a major bet on the long-term potential of these established players. The investment amounts, expressed in both USD and JPY, varied slightly across the five companies, reflecting Berkshire Hathaway's strategic approach. Importantly, Berkshire acquired a significant, albeit not controlling, stake in each company.

-

Specific Investment Amounts (Illustrative – actual figures vary based on market fluctuations):

- Itochu: Approximately $6 billion USD (equivalent JPY)

- Mitsubishi: Approximately $5.5 billion USD (equivalent JPY)

- Sumitomo: Approximately $5 billion USD (equivalent JPY)

- Marubeni: Approximately $4.5 billion USD (equivalent JPY)

- Mitsui: Approximately $4 billion USD (equivalent JPY)

-

Comparison to Other Investments: This investment represents one of Berkshire Hathaway's largest single investments in non-US companies, highlighting its confidence in the long-term growth prospects of these trading houses. It's significantly larger than many of its previous investments in individual companies outside the US.

-

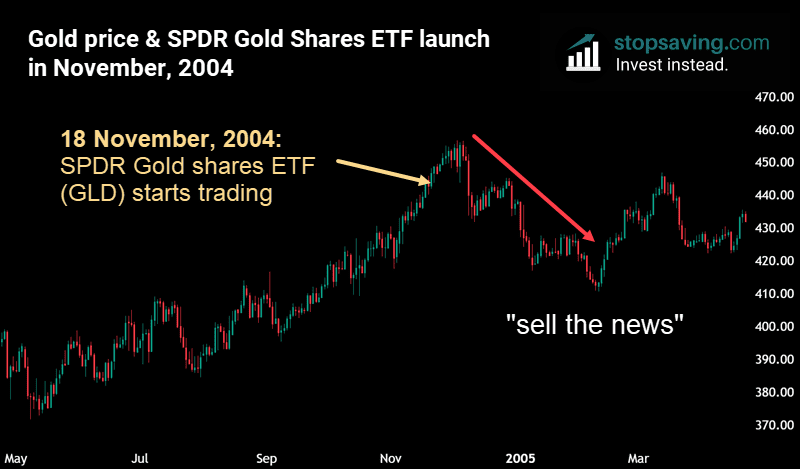

Timing of the Investment: The timing, amidst fluctuating global market conditions, signals a long-term strategic play rather than a short-term speculative maneuver. The relatively stable nature of the Japanese economy and the diversified nature of the trading houses likely contributed to the investment decision.

Impact on Stock Prices of Japanese Trading Houses

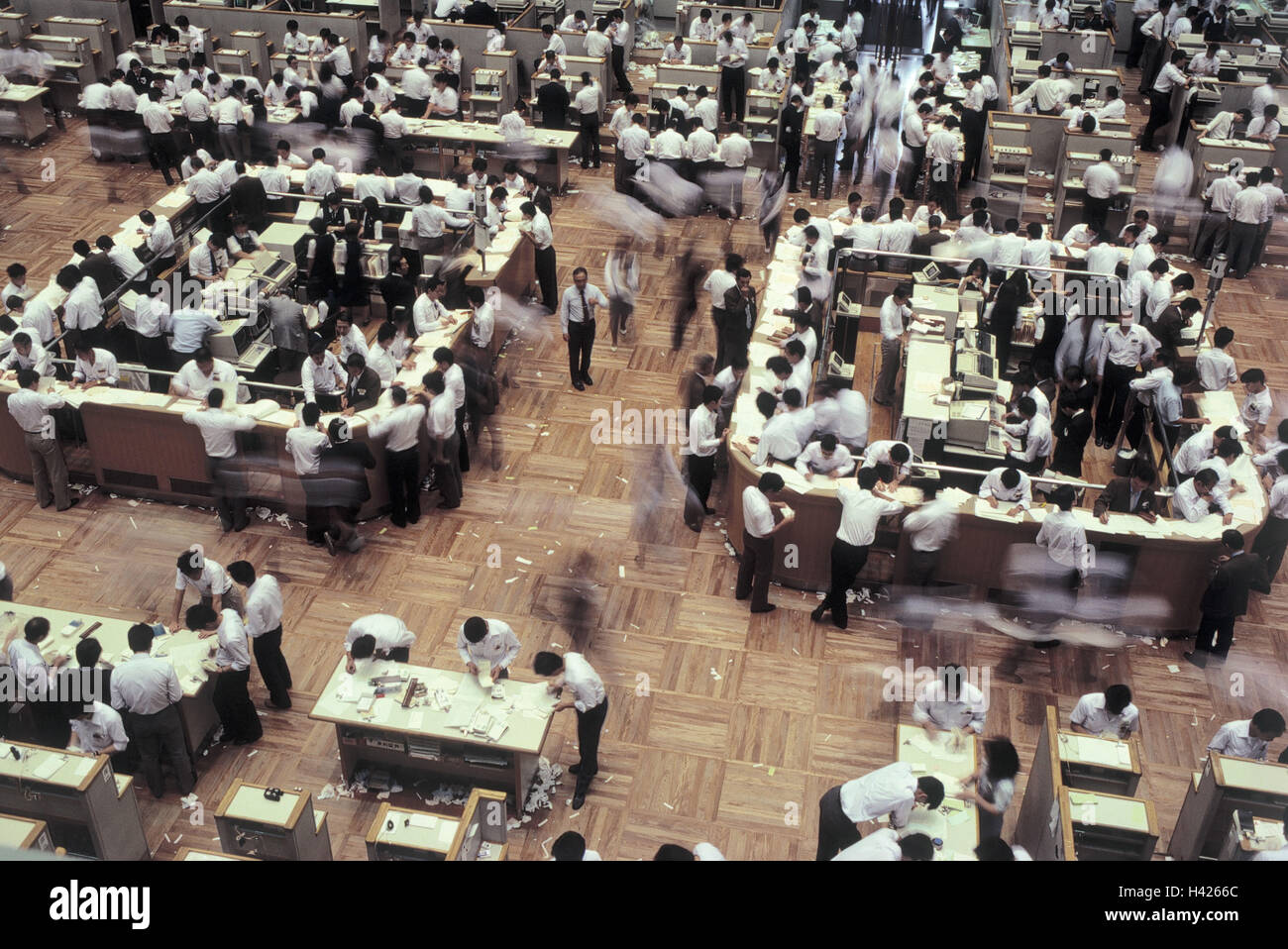

The impact on the stock prices of the five trading houses was immediate and substantial. Following the announcement of Berkshire Hathaway's investment, we witnessed a significant upward movement in share prices.

-

Stock Price Percentage Change (Illustrative – figures will vary): While precise figures fluctuate constantly, each of the five companies experienced double-digit percentage increases in their share price in the days and weeks following the news. For example, Itochu might have seen a 15-20% increase. It's important to note that these increases reflected a combination of the news and broader market trends.

-

Comparison to Overall Market Performance: The increase in the trading houses' stock prices outperformed the broader Japanese market index, underlining the unique impact of Berkshire Hathaway's endorsement.

-

Investor Sentiment and Trading Volume: Investor sentiment surged positively, leading to increased trading volume. The perception of Berkshire Hathaway's involvement as a vote of confidence boosted market confidence in these companies. This is clearly illustrated in trading charts showing significant increases in both price and volume. (Insert Chart Here)

Reasons Behind Berkshire Hathaway's Investment in Japanese Trading Houses

Warren Buffett's decision to invest in these Japanese trading houses is likely driven by a confluence of factors:

-

Long-Term Value Potential: These companies represent established, diversified entities with a long track record of profitability. Their involvement in numerous sectors, from energy and metals to consumer goods and infrastructure, provides resilience against economic downturns.

-

Portfolio Diversification: This investment offers Berkshire Hathaway a strategic opportunity to diversify its portfolio geographically into a stable and significant Asian market.

-

Growth Potential in the Japanese Economy: While facing demographic challenges, the Japanese economy remains relatively stable, offering potential for long-term growth. These trading houses are well-positioned to benefit from this growth.

-

Sectoral Diversification: The trading houses' involvement in various vital sectors minimizes risk by spreading investments across several market segments.

-

Expert Opinions: Financial analysts have praised the move, citing the undervalued nature of these companies and the strategic benefits for Berkshire Hathaway. (Insert Quote from Analyst Here)

-

Strategic Advantages for Berkshire Hathaway: This investment could open doors for future collaborations and partnerships within Japan and potentially across Asia, enhancing Berkshire's overall global presence.

Long-Term Implications and Future Outlook

The long-term implications of Berkshire Hathaway's investment extend beyond individual stock prices.

-

Potential for Further Investment: There's potential for Berkshire Hathaway to increase its stake in these companies further, signifying an even stronger commitment to the Japanese market.

-

Strategic Partnerships: Future collaborations between the trading houses and other Berkshire Hathaway subsidiaries are a distinct possibility.

-

Long-Term Growth Projections: Analysts predict continued growth for these trading houses, particularly with the increasing global demand for commodities and infrastructure development. However, challenges such as global economic uncertainty and competition should be considered.

-

Risks and Challenges: While the prospects are positive, global economic uncertainty, geopolitical factors, and potential regulatory changes in Japan represent potential risks.

Conclusion

Berkshire Hathaway's investment in Japanese trading houses represents a significant event, highlighting Warren Buffett's confidence in the long-term stability and growth potential of these established companies and the Japanese economy. The subsequent surge in stock prices underlines the immediate market impact. While potential risks exist, the strategic advantages and long-term growth prospects suggest a positive outlook for both Berkshire Hathaway and the involved Japanese trading houses. Stay informed about further developments by subscribing to our newsletter or following our publication for more in-depth analysis of Berkshire Hathaway's investment in Japanese trading house stock prices.

Featured Posts

-

Next Pope Selection Cardinals Consider Candidate Profiles

May 08, 2025

Next Pope Selection Cardinals Consider Candidate Profiles

May 08, 2025 -

Luis Enrique I Tregon Deren Pese Yjeve Te Psg Se

May 08, 2025

Luis Enrique I Tregon Deren Pese Yjeve Te Psg Se

May 08, 2025 -

Permbysja E Psg Nga Humbja E Mundshme Ne Fitore Minimaliste

May 08, 2025

Permbysja E Psg Nga Humbja E Mundshme Ne Fitore Minimaliste

May 08, 2025 -

Trump Media Partners With Crypto Com For Etf Launch Details And Implications

May 08, 2025

Trump Media Partners With Crypto Com For Etf Launch Details And Implications

May 08, 2025 -

Bitcoin Price Prediction 1 500 Rise In Five Years Examining The Claims

May 08, 2025

Bitcoin Price Prediction 1 500 Rise In Five Years Examining The Claims

May 08, 2025

Latest Posts

-

Could Xrp Etf Approval Unleash 800 Million In First Week Investment

May 08, 2025

Could Xrp Etf Approval Unleash 800 Million In First Week Investment

May 08, 2025 -

Xrp Etfs Potential For 800 Million In Week 1 Inflows Upon Approval

May 08, 2025

Xrp Etfs Potential For 800 Million In Week 1 Inflows Upon Approval

May 08, 2025 -

See Krypto In Action New Footage From The Upcoming Superman Film

May 08, 2025

See Krypto In Action New Footage From The Upcoming Superman Film

May 08, 2025 -

Xrp Price Surge Outperforming Bitcoin Post Sec Grayscale Etf Filing Recognition

May 08, 2025

Xrp Price Surge Outperforming Bitcoin Post Sec Grayscale Etf Filing Recognition

May 08, 2025 -

Understanding The Secs Xrp Classification A Comprehensive Guide

May 08, 2025

Understanding The Secs Xrp Classification A Comprehensive Guide

May 08, 2025