Best Personal Loans With No Credit Check: Up To $5000

Table of Contents

Understanding Personal Loans with No Credit Check

Personal loans with no credit check offer a seemingly quick solution for those with damaged credit scores or limited credit history. These loans bypass the traditional credit check process, making them accessible to a wider range of borrowers. However, it's crucial to understand the implications. Because lenders assume a higher risk, these loans typically come with significantly higher interest rates compared to traditional personal loans. This means you'll pay more in interest over the life of the loan.

Responsible borrowing and diligent repayment are paramount when considering a no-credit-check loan. Failing to repay on time can lead to further financial difficulties, including damaging your credit score even further (despite the initial lack of credit check).

- Higher interest rates are common: Expect to pay a premium for the convenience of a no-credit-check loan.

- Shorter repayment terms are often available: While convenient for some, shorter repayment terms can lead to higher monthly payments.

- Careful budgeting is crucial for repayment: Before applying, create a realistic budget to ensure you can comfortably afford the monthly payments.

- Consider the total cost of borrowing: Don't just focus on the initial loan amount; calculate the total interest paid over the loan's lifetime.

Types of Lenders Offering No Credit Check Personal Loans

Several types of lenders offer personal loans without a traditional credit check. However, it's vital to understand the differences and potential risks involved before committing.

Online Lenders

Online lenders have become increasingly popular, offering speed and convenience. You can often complete the entire application process online, receiving a decision within minutes or hours. However, online lenders often charge higher fees and interest rates than traditional banks or credit unions. Always check reviews and compare multiple online lenders before making a decision.

- Quick application process: Apply for a loan from the comfort of your home, often with quick approval times.

- Potentially higher interest rates: Be prepared for higher interest rates compared to traditional lenders.

- Variety of loan amounts: Online lenders often offer a range of loan amounts to suit various needs.

- Check reviews before choosing a lender: Thoroughly research the lender's reputation before submitting your application.

Payday Loan Providers

Payday loans are short-term, high-interest loans designed to be repaid on your next payday. These loans are often marketed as a quick solution to immediate financial needs but come with extremely high interest rates and short repayment periods, easily leading to a debt trap. Payday loans should only be considered as a last resort.

- Very high interest rates: Payday loans carry significantly higher interest rates than other loan types.

- Short repayment terms: The loan is typically due on your next payday, often within two weeks.

- Potential for debt traps: The high interest rates and short repayment periods can easily lead to a cycle of debt.

- Use only as a last resort: Consider all other options before resorting to a payday loan.

Credit Unions

Some credit unions may offer loans with less stringent credit checks than traditional banks. While not strictly "no credit check" loans, they may be more lenient with borrowers who have less-than-perfect credit. Credit unions often prioritize community members and may offer more favorable terms than other lenders.

- Potentially lower interest rates than payday loans: Credit union loans often have lower interest rates than payday loans.

- Membership requirements may apply: You'll usually need to become a member of the credit union to qualify for a loan.

- Focus on building credit with responsible repayment: Responsible repayment of a credit union loan can help improve your credit score.

Factors to Consider When Choosing a No Credit Check Personal Loan

Choosing a no credit check personal loan requires careful consideration of several factors. Rushing into a decision without proper research can lead to unfavorable terms and long-term financial difficulties.

Interest Rates and Fees

Interest rates and fees significantly impact the overall cost of the loan. Compare interest rates and fees across different lenders to find the most affordable option. Pay close attention to the Annual Percentage Rate (APR), which reflects the total cost of borrowing.

Repayment Terms

Choosing a repayment term that fits your budget is critical. Shorter terms mean higher monthly payments but less interest paid overall. Longer terms mean lower monthly payments but higher overall interest. Carefully assess your financial situation before selecting a repayment period.

Loan Amount

Only borrow what you absolutely need. Avoid borrowing more than you can comfortably repay, even with the higher interest rates associated with no-credit-check loans.

Lender Reputation

Research the reputation of the lender thoroughly. Check online reviews and compare different lenders before committing to a loan to ensure you're dealing with a reputable and trustworthy financial institution.

- Compare interest rates and fees: Look for the lowest APR possible.

- Choose a manageable repayment term: Select a term you can comfortably afford.

- Borrow only what's necessary: Avoid unnecessary debt.

- Check lender reviews and ratings: Ensure you're working with a trustworthy lender.

Alternatives to No Credit Check Personal Loans

While no credit check personal loans offer immediate access to funds, they often come at a high cost. Exploring alternative options may be more beneficial in the long run, even if they take longer to secure.

- Secured loans (using collateral): If you own valuable assets, a secured loan might offer better interest rates.

- Credit builder loans: These loans are specifically designed to help build your credit score.

- Seeking loans from family or friends: Borrowing from trusted individuals can offer more flexible terms.

- Improving credit score before applying for a traditional loan: This will significantly improve your chances of securing a loan with lower interest rates in the future.

Conclusion: Making Informed Decisions with No Credit Check Personal Loans

Securing a personal loan with no credit check can provide immediate relief, but it's crucial to approach the process responsibly. Understanding the higher interest rates, shorter repayment terms, and the importance of comparing lenders is vital. By carefully weighing the risks and benefits, and considering alternatives, you can make an informed decision that minimizes long-term financial burdens. Find the best personal loan with no credit check for your needs today by carefully comparing lenders and understanding the terms. Remember, responsible borrowing is key to achieving long-term financial stability.

Featured Posts

-

Baseball Book Review A Timely Column For Opening Day

May 28, 2025

Baseball Book Review A Timely Column For Opening Day

May 28, 2025 -

Discovery Of 13th Century Structures In Binnenhof Redevelopment

May 28, 2025

Discovery Of 13th Century Structures In Binnenhof Redevelopment

May 28, 2025 -

Rome Champ Continued Success No Room For Complacency

May 28, 2025

Rome Champ Continued Success No Room For Complacency

May 28, 2025 -

Hailee Steinfelds Professional Look On Good Morning America

May 28, 2025

Hailee Steinfelds Professional Look On Good Morning America

May 28, 2025 -

Ajax Six Points Behind After Controversial Referee Decision Against Az

May 28, 2025

Ajax Six Points Behind After Controversial Referee Decision Against Az

May 28, 2025

Latest Posts

-

Data Center Security Breach Deutsche Bank Contractor And Unauthorized Access

May 30, 2025

Data Center Security Breach Deutsche Bank Contractor And Unauthorized Access

May 30, 2025 -

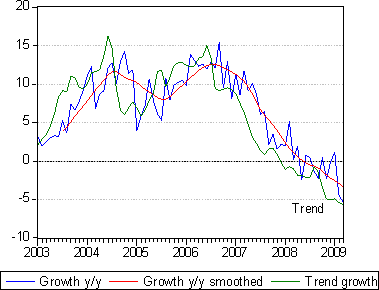

Corporate Earnings The Solid Present And Uncertain Future

May 30, 2025

Corporate Earnings The Solid Present And Uncertain Future

May 30, 2025 -

Finance Minister Holds Talks With Senior Deutsche Bank Officials

May 30, 2025

Finance Minister Holds Talks With Senior Deutsche Bank Officials

May 30, 2025 -

Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025

Deutsche Bank Depositary Receipts Virtual Investor Conference May 15 2025

May 30, 2025 -

Sudden Departure Deutsche Banks Distressed Sales Head Joins Morgan Stanley

May 30, 2025

Sudden Departure Deutsche Banks Distressed Sales Head Joins Morgan Stanley

May 30, 2025