BigBear.ai (BBAI): A Deep Dive Into The Recent Stock Market Decline

Table of Contents

Macroeconomic Factors and Market Sentiment

The BigBear.ai (BBAI) stock decline isn't occurring in a vacuum. Broader macroeconomic conditions significantly impact the performance of tech stocks, especially those, like BBAI, reliant on growth and future projections. The current market environment is characterized by several factors contributing to the overall downturn.

-

Rising Interest Rates: Increased interest rates make borrowing more expensive, impacting companies' expansion plans and reducing the attractiveness of growth stocks like BBAI. Higher rates generally lead to lower valuations for companies with high growth potential but limited current profitability.

-

General Market Correction: The technology sector, as a whole, has experienced a significant correction in recent months. Investor concerns about inflation, recessionary risks, and overall market uncertainty have led to widespread selling across the tech landscape. BBAI, as a relatively young company in a competitive field, has felt this pressure acutely.

-

Shifting Investor Sentiment towards AI Stocks: While Artificial Intelligence remains a hot sector, investor enthusiasm has cooled slightly in recent months due to concerns about profitability and the long-term viability of certain AI ventures. This shift in sentiment impacts even promising AI companies like BigBear.ai.

Company-Specific Factors Affecting BBAI Stock Performance

Beyond the macroeconomic headwinds, several company-specific factors have contributed to the BBAI stock price drop. A thorough examination of these issues is crucial for understanding the full picture.

-

Recent Financial Performance: Investors carefully scrutinize a company's financial health. Any significant missteps in revenue projections, earnings reports, or growth forecasts can trigger negative market reactions. A detailed analysis of BigBear.ai's recent financial reports is needed to identify potential weaknesses.

-

Negative News and Announcements: Any negative news, such as delays in securing government contracts, unexpected legal challenges, or management changes, can immediately impact investor confidence and lead to a sell-off. Keeping abreast of all announcements regarding BBAI is essential.

-

Competitive Landscape: BigBear.ai operates in a highly competitive market for AI solutions, particularly in the government contracting space. Strong competition can pressure profit margins and market share, making the company more vulnerable to negative market sentiment. Understanding BigBear.ai’s competitive positioning is crucial.

-

Long-Term Growth Strategy: Investors are also evaluating the long-term viability of BigBear.ai's business model and growth strategy. Any perceived weaknesses or uncertainties in their long-term plans can lead to a decline in investor confidence.

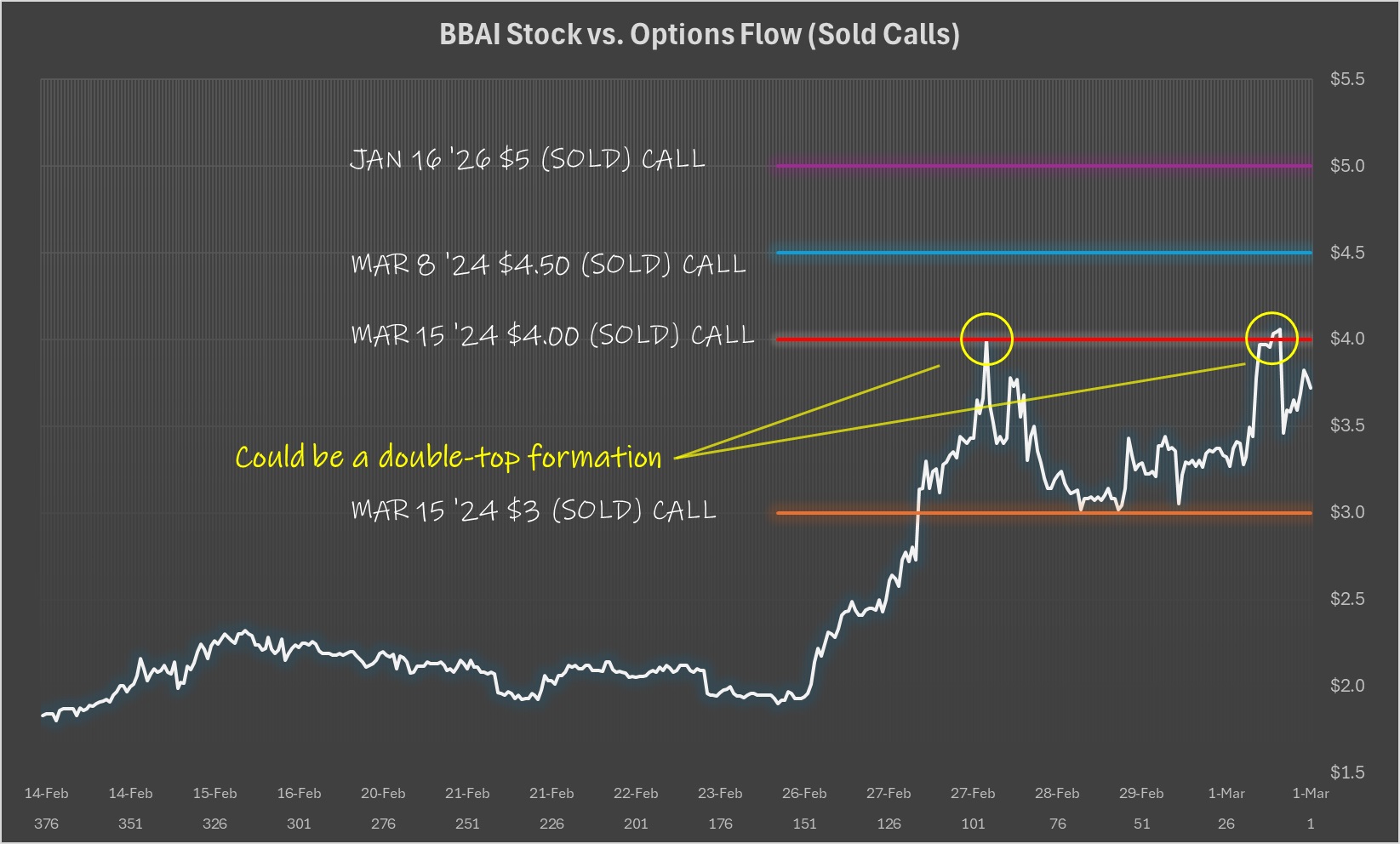

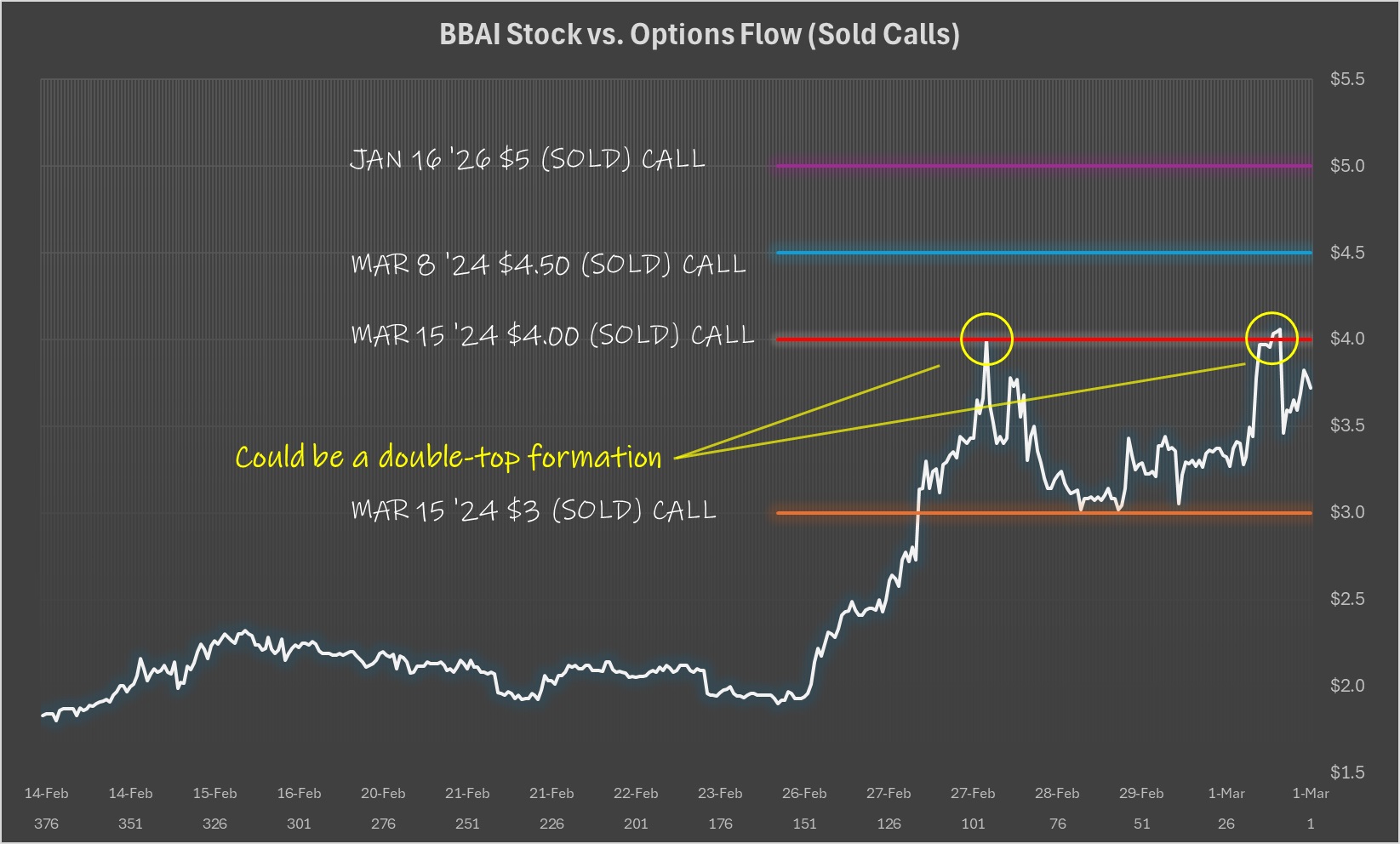

Technical Analysis of the BBAI Stock Chart

While fundamental analysis is crucial, technical analysis can provide further insights into the BBAI stock decline. (Disclaimer: This analysis is for informational purposes only and should not be considered financial advice.)

-

Support and Resistance Levels: Identifying key support and resistance levels on the BBAI stock chart can help understand potential price reversal points. Breaks below support levels often trigger further downward pressure.

-

Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, can help illustrate short-term and long-term trends. Crossovers of these averages can often signal potential shifts in momentum.

-

Trading Volume: Monitoring trading volume can provide insights into the strength of the price movements. High volume during a decline often suggests stronger selling pressure, while low volume might indicate a less significant trend. (Disclaimer: This is not financial advice.)

Conclusion: Understanding the Future of BigBear.ai (BBAI) Stock

The recent BigBear.ai (BBAI) stock decline is a complex issue stemming from a confluence of macroeconomic factors, company-specific events, and technical indicators. While the current situation presents challenges, it's important to maintain a balanced perspective. The future trajectory of BBAI's stock price depends on various factors, including improvements in its financial performance, successful execution of its growth strategy, and overall market sentiment towards AI stocks and the broader technology sector.

Conduct your own due diligence before investing in BBAI. Stay informed on the BigBear.ai (BBAI) stock market movements and learn more about the factors influencing BBAI stock prices. Remember, informed decision-making is crucial when considering investments in volatile stocks like BigBear.ai (BBAI). Investing in the stock market involves inherent risks, and losses are possible.

Featured Posts

-

Top Gbr News Grocery Staples To Buy Now A 2 000 Quarter And The Doge Poll

May 21, 2025

Top Gbr News Grocery Staples To Buy Now A 2 000 Quarter And The Doge Poll

May 21, 2025 -

Hout Bay Fcs Success The Klopp Connection

May 21, 2025

Hout Bay Fcs Success The Klopp Connection

May 21, 2025 -

Avis Le Matin Auto Sur L Alfa Romeo Junior 1 2 Turbo Speciale

May 21, 2025

Avis Le Matin Auto Sur L Alfa Romeo Junior 1 2 Turbo Speciale

May 21, 2025 -

Fastest Australian Crossing Man Completes Epic Foot Race

May 21, 2025

Fastest Australian Crossing Man Completes Epic Foot Race

May 21, 2025 -

Double Tragedy Murders Of Colombian Model And Mexican Influencer Highlight Urgent Need To Combat Femicide

May 21, 2025

Double Tragedy Murders Of Colombian Model And Mexican Influencer Highlight Urgent Need To Combat Femicide

May 21, 2025